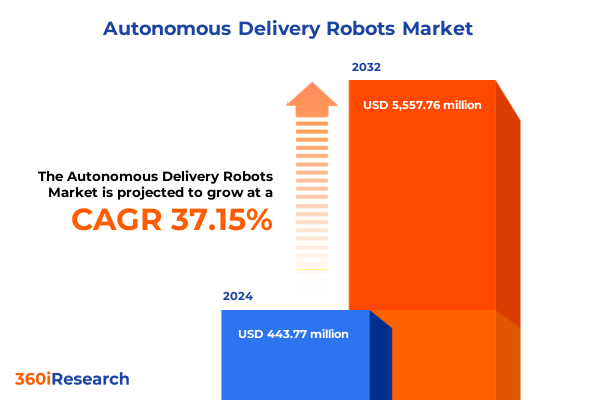

The Autonomous Delivery Robots Market size was estimated at USD 605.83 million in 2025 and expected to reach USD 818.06 million in 2026, at a CAGR of 37.24% to reach USD 5,557.76 million by 2032.

Exploring the Emergence and Significance of Autonomous Delivery Robots in Revolutionizing Last-Mile Logistics and Service Sectors

Autonomous delivery robots have transitioned from niche experimental platforms to essential components reshaping the last-mile logistics landscape. Driven by relentless advances in artificial intelligence, sensor miniaturization, and wireless connectivity, these mobile systems are now navigating sidewalks, campuses, and urban corridors with unprecedented reliability. Across industries ranging from foodservice to pharmaceuticals, organizations are recognizing that robots can deliver not only packages but also consistent customer experiences and significant cost efficiencies. This surge in adoption follows a convergence of factors: mounting labor shortages in traditional courier networks, heightened consumer expectations for rapid contactless delivery, and the maturation of regulatory frameworks that once impeded robot deployments. These elements, combined with escalating e-commerce penetration and growing environmental mandates, are compelling both startups and legacy players to accelerate their investments in autonomous delivery solutions.

In response to this dynamic environment, a diverse ecosystem of stakeholders has emerged. Robotics firms are forging partnerships with retailers, logistics providers, and municipalities to conduct large-scale pilots and commercial rollouts. Meanwhile, technology integrators are embedding advanced AI navigation stacks into new chassis designs, and venture investors are pouring capital into companies that demonstrate scalable operations. As you delve into this executive summary, you will gain clarity on the forces propelling the industry forward, the structural challenges that persist, and the strategic imperatives for achieving competitive advantage.

Unprecedented Technological and Operational Transitions Shaping the Future of Autonomous Delivery Robotics Across Key Industries

The autonomous delivery robotics industry is experiencing a paradigm shift as cutting-edge technologies converge to redefine what is possible in last-mile logistics. High-performance edge AI processors, such as Nvidia’s Jetson Orin and Qualcomm RB6, are now enabling sidewalk robots to process trillions of operations per second directly on-board, eliminating latency and connectivity constraints. Concurrently, the cost of critical sensing components has plummeted, with solid-state LiDAR units falling below $500 and RTK GNSS modules reaching sub-$50 price points. These hardware breakthroughs are complemented by software innovations in computer vision, deep reinforcement learning, and multi-robot coordination, allowing fleets to adapt in real time to pedestrian traffic, weather conditions, and dynamic urban environments.

Beyond hardware and software, transformative shifts in regulatory landscapes and public infrastructure are creating fertile ground for scaling deployments. American cities such as Miami and Los Angeles have launched sidewalk delivery pilot programs, while the Federal Aviation Administration’s expanded drone corridor initiatives are speeding up aerial deliveries. At the same time, consumer-facing trials by grocery chains and quick-service restaurants are gathering invaluable operational data on safety, efficiency, and customer satisfaction. These collective advances are not merely incremental-they represent a tipping point at which autonomous delivery robots cross the threshold from demonstration projects to mission-critical logistics assets.

Assessing the Wide-Ranging Effects of 2025 U.S. Tariffs on Cost Structures, Supply Chains, and Strategic Responses in Delivery Robotics

In early April 2025, the U.S. administration introduced a sweeping baseline tariff of 10% on virtually all imports under the “Liberation Day” proclamation, with higher, country-specific rates rolling out on April 9 for roughly 60 trading partners, including a significant expansion of duties on Chinese goods. These measures have elevated the cost of importing essential robotics components such as sensors, actuators, and semiconductors. For example, tariffs on Chinese-made actuators have surged to 34%, translating to cost increases exceeding 20%, while duties on Taiwanese semiconductors reached 32%, imposing up to a 15% premium on critical chips used in navigation and control modules.

The cumulative impact of these tariffs has reverberated across the supply chain. Robotics manufacturers reliant on international sourcing are confronting double-digit increases in their bills of materials, prompting many to reevaluate procurement strategies. Some firms have accelerated initiatives to nearshore or fully reshore component production, leveraging incentives from the CHIPS and Science Act to onshore semiconductor fabrication. Others are redesigning robots to be more modular and less reliant on high-tariff parts, while a subset of startups is pivoting toward service models where hardware is bundled with maintenance and software subscriptions to offset margin pressures. Ultimately, the tariffs are reshaping not only cost structures but also competitive dynamics, as companies with robust domestic supply chains gain a decisive advantage.

Deriving Strategic Insights from Diverse Segmentation Frameworks That Illuminate Market Opportunities and Challenges in Autonomous Delivery Robotics

Segment-level analysis reveals that the market’s evolution is deeply influenced by both end-user requirements and underlying technological characteristics. In healthcare settings such as hospitals, robots must adhere to strict sanitation protocols and navigate complex indoor layouts, whereas pharmacy applications prioritize secure, temperature-controlled compartments. Conversely, last-mile logistics deployments differentiate between suburban routes optimized for speed and urban corridors requiring robust obstacle avoidance. Within the restaurant sector, quick-service environments emphasize high-frequency, small-payload deliveries that demand swift turnover, while sit-down establishments focus on in-building navigation to guest tables. Brick-and-mortar retail applications integrate with store inventory systems for direct-to-consumer handoffs, whereas e-commerce use cases deploy robots for curbside pickup and coordinated parcel drop-offs.

Deep dives into robot typologies further sharpen strategic focus. Aerial platforms, whether multirotor UAVs or fixed-wing drones, excel at point-to-point rapid delivery where line-of-sight air corridors exist, while ground systems, spanning wheeled, tracked, and legged robots, offer versatility across terrains and grade profiles. Functionality-based segmentation underscores contrasts between controlled indoor deployments in warehouses and offices, last-mile services across urban streets, and remote rural use cases where connectivity and endurance become paramount. Likewise, the autonomy continuum-from fully autonomous vehicles capable of dynamic replanning to teleoperated platforms serving niche scenarios-dictates investment levels and regulatory compliance strategies. Payload capacity tiers, encompassing sub-5 kg courier bots to heavy-lift units above 20 kg, map directly to application areas in industrial, suburban, and urban settings. When these segmentation lenses are combined with propulsion preferences-electric, fuel cell, or hybrid-the result is a mosaic of pathways for innovation, partnerships, and market entry strategies.

This comprehensive research report categorizes the Autonomous Delivery Robots market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Robot Type

- Functionality

- Autonomy Level

- Propulsion System

- Payload Capacity

- Application Area

- End User

Unveiling Regional Dynamics That Drive Autonomous Delivery Robot Adoption and Innovation Across Americas, EMEA, and Asia-Pacific Markets

Regional distinctions are pronounced in the autonomous delivery robotics market, driven by varied infrastructure maturity, regulatory environments, and consumer expectations. In the Americas, strong investments in domestic production capacity, supportive municipal pilot programs, and acute labor shortages in logistics have accelerated adoption. North American cities have become global testbeds for ground-based robots and aerial drones alike, with major retailers and postal services integrating pilot projects into their core operations. Latin American markets, while still nascent, are demonstrating promising grassroots trials in densely populated urban centers where traffic congestion amplifies the appeal of sidewalk delivery solutions.

In Europe, Middle East & Africa, the push for decarbonization and stringent emissions regulations is fostering demand for electric and hybrid propulsion systems. European Union directives on autonomous systems, combined with funding for Smart City initiatives, are creating structured roadmaps for safe robot integration. Meanwhile, Gulf Cooperation Council nations are investing in drone corridors and automated logistics hubs to streamline last-mile services in sprawling metropolitan areas. Across sub-Saharan Africa, early-stage pilots leverage delayed regulatory frameworks to experiment with hybrid models, often pairing human oversight with autonomous technology for critical healthcare and essential goods delivery.

Asia-Pacific exhibits a bifurcated landscape. Markets like Japan, South Korea, and Singapore are at the forefront of in-building and campus deployments, leveraging advanced infrastructure and high consumer receptivity. In contrast, China’s rapid urbanization and government-backed smart city programs are driving scale, although tariffs and geopolitical dynamics are prompting domestic robotics champions to localize supply chains. Australia, despite slower regulatory progress, remains on the cusp of broader trials as federal frameworks for autonomous systems are slated for rollout by 2026.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Delivery Robots market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining the Strategic Positioning, Innovations, and Competitive Maneuvers of Leading Autonomous Delivery Robot Companies in 2025

Industry leaders and emerging challengers alike are shaping the competitive arena with distinctive strategies. Starship Technologies has solidified its presence through citywide sidewalk deployments in multiple U.S. and European markets, leveraging machine learning-driven fleet coordination to optimize route efficiency and battery management. Nuro continues to refine its vehicle autonomy stack for street-level delivery, doubling down on partnerships with grocery chains to pilot neighborhood-scale grocery drops. Amazon’s Scout program remains an exemplar of integrating robotics into existing delivery networks, with tens of thousands of couriers benefitting from hybrid human-robot workflows in suburban contexts.

Mid-cap innovators such as Serve Robotics and Coco Robotics have captured urban market share by designing compact, resilient wheeled platforms equipped with advanced lidar and computer vision systems, while Zipline and Wing are systematically expanding aerial delivery corridors under evolving FAA guidelines. Logistics specialists like Gatik have carved out differentiated positions in B2B short-haul routes, optimizing platooning algorithms to maximize payload and minimize energy consumption. At the same time, medical robotics companies are collaborating with hospital systems to validate temperature-controlled, compliance-ready robots for controlled facility environments. Across this spectrum, funding rounds, strategic alliances, and patent activity underscore intense jockeying for technological leadership and geographic expansion.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Delivery Robots market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aethon Inc.

- Amazon.com, Inc.

- Boston Dynamics, Inc.

- Clearpath Robotics Inc.

- Dispatch

- Eliport

- FedEx Corporation

- Kiwibot, Inc.

- Marble Robot, Inc.

- Nuro, Inc.

- Ottonomy Inc.

- Rocos Global Limited

- Rosen Robots, Inc.

- Savioke, Inc.

- Segway Robotics

- Serve Robotics, Inc.

- Starship Technologies OÜ

- Udelv, Inc.

- Zipline International Inc.

Offering Actionable Best Practices for Industry Leaders to Capitalize on Growth Opportunities and Navigate Challenges in Delivery Robotics

To secure a competitive edge, industry leaders should prioritize the resilience of their supply chains by diversifying component sourcing and advancing domestic partnerships, thereby mitigating tariff and geopolitical risks. Concurrently, investing in modular software architectures will enable rapid integration of emerging sensor technologies and AI capabilities, while also facilitating compliance with localized regulatory requirements. Collaborative engagements with municipalities and standards bodies can accelerate the establishment of clear operational guidelines, reducing trial durations and enhancing stakeholder confidence.

Strategic alliances between robotics developers and last-mile logistics operators will be essential for co-designing solutions that align with real-world operational workflows. Organizations should also explore innovative service models such as delivery-as-a-service subscriptions, which can spread capital expenditures over predictable recurring revenues and foster stickier customer relationships. In parallel, companies must cultivate end-user trust through rigorous safety validations and transparent data policies, ensuring that privacy and cybersecurity standards keep pace with technical advancements. Finally, embracing scenario-based planning-testing business models under varied tariff, regulatory, and technology adoption pathways-will prepare leadership teams for rapid pivots when external conditions shift.

Detailing a Robust Multi-Method Research Methodology Combining Primary, Secondary, and Analytical Approaches for Comprehensive Market Insights

This research employs a multi-faceted methodology that integrates primary, secondary, and analytical approaches to ensure robust, actionable insights. Primary research includes in-depth interviews with senior executives from leading robotics firms, logistics providers, regulatory agencies, and end-user organizations, capturing qualitative perspectives on adoption drivers, operational constraints, and emerging use cases. Secondary research draws from a wide array of publicly available sources, including technical whitepapers, government publications, industry conference proceedings, and reputable news outlets, to contextualize quantitative trends and validate qualitative observations.

Quantitative analysis leverages data triangulation techniques, cross-referencing shipment volumes, pilot project metrics, and component cost indices to build a comprehensive view of market dynamics without relying on proprietary forecasting data. Segmentation analyses apply logical breakdowns by end user, robot type, functionality, autonomy level, propulsion system, payload capacity, and application area, ensuring that strategic takeaways are grounded in real-world use-case differentiation. Finally, scenario planning exercises simulate the potential impacts of tariff changes, technological breakthroughs, and regulatory evolutions, equipping decision-makers with a spectrum of plausible futures and corresponding strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Delivery Robots market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Delivery Robots Market, by Robot Type

- Autonomous Delivery Robots Market, by Functionality

- Autonomous Delivery Robots Market, by Autonomy Level

- Autonomous Delivery Robots Market, by Propulsion System

- Autonomous Delivery Robots Market, by Payload Capacity

- Autonomous Delivery Robots Market, by Application Area

- Autonomous Delivery Robots Market, by End User

- Autonomous Delivery Robots Market, by Region

- Autonomous Delivery Robots Market, by Group

- Autonomous Delivery Robots Market, by Country

- United States Autonomous Delivery Robots Market

- China Autonomous Delivery Robots Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2703 ]

Concluding Reflections on the Strategic Imperatives, Technological Momentum, and Future Trajectory of the Autonomous Delivery Robotics Industry

The autonomous delivery robotics sector stands at an inflection point where technological maturity, shifting regulatory frameworks, and evolving customer expectations converge to create unprecedented opportunities. Organizations that move decisively to align their product roadmaps, supply chains, and go-to-market strategies with the realities of segmentation and regional dynamics will capture disproportionate value. Conversely, those that fail to anticipate the dual challenges of geopolitical trade tensions and rapid technology cycles risk being outpaced by more agile competitors.

Looking ahead, advances in edge AI, energy storage, and collaborative autonomy are poised to unlock new use cases, from on-campus medical logistics to urban micro-fulfillment networks. By embedding strategic flexibility and resilience into their core operations, market participants can not only navigate the complexities of today’s environment but also shape the industry’s trajectory toward greater automation, sustainability, and consumer-centricity. The path forward demands a balanced focus on innovation, partnerships, and pragmatic execution.

Engaging Directly with Our Associate Director to Secure Your Comprehensive Autonomous Delivery Robot Market Research Report Today

If you are ready to harness the transformative potential of autonomous delivery robotics and secure a comprehensive analysis tailored to your strategic needs, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. Ketan brings a deep understanding of both the technical and commercial dimensions of the autonomous robotics landscape and can guide your organization through the nuances of market entry, competitive positioning, and investment decisions. Engaging directly will provide you with unparalleled access to expert insights, bespoke data extracts, and personalized consulting that align with your priorities and timelines. Connect with Ketan today to explore how this market research report can empower your next strategic move in autonomous delivery robotics

- How big is the Autonomous Delivery Robots Market?

- What is the Autonomous Delivery Robots Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?