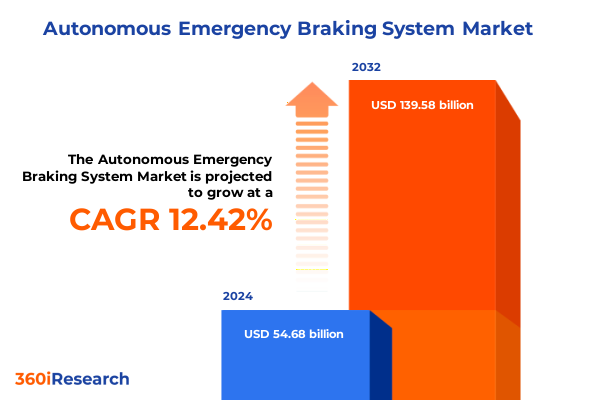

The Autonomous Emergency Braking System Market size was estimated at USD 60.48 billion in 2025 and expected to reach USD 66.90 billion in 2026, at a CAGR of 12.69% to reach USD 139.58 billion by 2032.

Establishing the Critical Context and Strategic Value of Autonomous Emergency Braking Systems in Modern Vehicle Safety Ecosystems

Autonomous Emergency Braking (AEB) systems have rapidly evolved from novel concept to indispensable safety feature, reflecting a profound shift in automotive priorities toward collision avoidance and occupant protection. As advanced sensor arrays, machine learning algorithms, and real-time data processing capabilities have matured, AEB has transitioned from optional add-on to a critical requirement in both commercial and passenger vehicles. This progression underscores a broader movement toward active safety measures, where systems detect and respond to imminent hazards without driver intervention.

Industry stakeholders have recognized that AEB’s influence extends beyond reducing crash severity; it fundamentally transforms vehicle design, liability frameworks, and consumer expectations. Original equipment manufacturers invest heavily in refining sensor fusion and software architectures, while regulatory bodies worldwide introduce stringent testing protocols and mandatory installation standards. Meanwhile, fleet operators and individual car buyers increasingly prioritize vehicles equipped with autonomous braking, perceiving them as not merely features but essential elements of modern mobility solutions.

In the competitive landscape, AEB’s adoption rate serves as a barometer for technological leadership and brand reputation. Vehicle makers collaborate with semiconductor vendors, software developers, and actuator manufacturers to optimize system responsiveness, reliability, and cost-effectiveness. This intricate ecosystem demands a clear understanding of current capabilities and future directions. Our analysis dives into the foundational aspects of AEB, providing executives with a concise yet comprehensive overview of the technological, regulatory, and market forces propelling its widespread integration.

Navigating the Transformative Technological Developments Regulatory Milestones and Consumer Expectations Reshaping the Global AEB Market Dynamics

The Autonomous Emergency Braking market has witnessed several transformative shifts driven by breakthroughs in sensor technologies, regulatory pressures, and evolving consumer demands. Millimeter-wave radar modules and LiDAR units have advanced dramatically in resolution and reliability, enabling systems to detect pedestrians, cyclists, and small obstacles under diverse environmental conditions. Simultaneously, the integration of digital signal processors and high-performance microcontrollers has reduced latency, ensuring that braking decisions occur within milliseconds of hazard detection.

On the regulatory front, numerous jurisdictions have introduced phased mandates requiring AEB as a standard safety feature in new vehicle models. These regulatory milestones have pressured manufacturers to accelerate development cycles and achieve higher performance benchmarks, spurring innovation in control software and predictive algorithms. Moreover, collaborative frameworks such as public–private research consortia and harmonized safety assessment protocols have fostered knowledge sharing and facilitated market harmonization.

Consumer expectations have shifted from viewing AEB as a luxury option to considering it an indispensable safeguard. Studies reveal that buyers now factor AEB performance into purchase decisions, often willing to pay a premium for systems that deliver robust pedestrian detection and multi-scenario functionality. As the market matures, the emphasis is transitioning from basic collision avoidance to sophisticated predictive software that anticipates complex traffic patterns and adapts to driver behavior. Together, these technological, regulatory, and consumer-driven forces are reshaping the AEB landscape, setting a new standard for vehicle safety performance.

Analyzing How the 2025 U.S. Tariff Adjustments on Automotive Safety Components Reshaped Supply Chains and Cost Structures in AEB Systems

In 2025, the United States implemented new tariff measures on automotive safety components, significantly affecting the Autonomous Emergency Braking supply chain. Components categorized under harmonized tariff codes for sensors, actuators, and processors experienced increased import duties. As a result, manufacturers relying on overseas suppliers had to contend with heightened input costs, prompting reevaluation of sourcing strategies and contract terms. The aggregated effect of these tariffs reverberated through the AEB ecosystem, from raw material procurement to final assembly.

Domestic producers of electric actuators and hydraulic actuators found themselves in a paradoxical position. While higher duties made imported actuators more expensive, U.S.-based actuator manufacturers were unable to immediately scale production to meet the surge in demand. This imbalance created interim supply shortages, requiring automakers to adjust production schedules and consider inventory buffering. Likewise, global suppliers of digital signal processors and microcontrollers grappled with shifting cost structures, some seeking tariff exclusion petitions or strategic joint ventures with U.S. counterparts to mitigate financial impact.

On the software front, control software and advanced prediction software faced indirect consequences as development teams contended with delayed hardware deliveries and cost overruns. Original equipment manufacturers recalibrated their project budgets, allocating additional resources to offset tariff-driven expenditure. Over time, these adjustments have encouraged increased domestic investment in component manufacturing and software development, fostering a more resilient and localized AEB value chain.

Uncovering Intricate Multilayered Component Vehicle Type and Sales Channel Segmentation Nuances Shaping AEB Market Strategies

Component complexities have become a focal point in understanding AEB market dynamics. Actuators, processors, and software form the technological backbone, yet each segment presents its own stratified landscape. Within the actuator domain, the emergence of electric actuator variants alongside established hydraulic actuator designs has spurred innovation in packaging, durability, and power efficiency. Processors are likewise bifurcated between digital signal processors optimized for real-time data acquisition and microcontrollers tuned for system control and redundancy. Software differentiation further intensifies competition as control software matures in stability and failsafe mechanisms while prediction software advances through improved modeling of pedestrian and vehicle trajectories.

Vehicle type segmentation underscores divergent requirements for commercial vehicles and passenger cars. Commercial platforms demand robust solutions to accommodate heavier loads, higher duty cycles, and integration with fleet management systems. Conversely, passenger car configurations prioritize compact sensor modules and seamless infotainment integration for an unobtrusive user experience. This dichotomy has propelled tier-one suppliers to customize AEB suites, ensuring that braking calibration, sensor positioning, and human–machine interface align with the end use scenario.

Sales channel dynamics vary significantly between aftermarket and original equipment manufacturing pathways. In the aftermarket sphere, retrofit kits incorporating modular packages of processors and electric actuators must balance ease of installation with certifiable performance. OEM channels, in contrast, focus on embedded architectures, leveraging factory integration to optimize wiring harnesses and sensor placement. Understanding these nuanced segmentation layers empowers stakeholders to tailor product road maps and distribution strategies to targeted industry segments.

This comprehensive research report categorizes the Autonomous Emergency Braking System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Vehicle Type

- Sales Channel

Evaluating Diverse Regional Adoption Patterns Regulatory Environments and Infrastructure Influences on AEB Deployment Across the Globe

Regional dynamics in the Autonomous Emergency Braking arena are influenced by economic maturity, regulatory frameworks, and infrastructure readiness across the Americas, Europe Middle East and Africa, and Asia-Pacific regions. In North and South America, federal and state safety mandates have accelerated system adoption among passenger vehicles, while commercial fleets leverage AEB to reduce operational risk and insurance liabilities. This has catalyzed partnerships between local component manufacturers and global software vendors to deliver regionally optimized solutions.

Across Europe, the Middle East, and Africa, diverse regulatory landscapes coexist alongside pan-European safety assessments and Middle Eastern pilot programs for connected vehicle ecosystems. European markets often lead in stringent type-approval processes and consumer testing protocols, prompting continuous refinement of sensor fusion algorithms. In contrast, emerging markets in the broader region prioritize cost-effective solutions and modular retrofit options to elevate basic safety standards in commercial transportation.

Asia-Pacific exhibits a dynamic interplay between high-volume production hubs and forward-looking safety initiatives. Advanced economies in East Asia advocate for harmonized AEB benchmarks, integrating systems into urban mobility frameworks and autonomous shuttle trials. Meanwhile, Southeast Asian and South Asian markets see a growing aftermarket demand, with retrofit solutions addressing infrastructure constraints and regulatory variances. Recognizing these region-specific trajectories enables manufacturers to optimize local partnerships, supply chain footprints, and product feature sets.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Emergency Braking System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Alliances Proprietary Technology Advances and Manufacturing Expansions Driving Leadership in AEB Systems

Key players in the Autonomous Emergency Braking domain are forging strategic alliances, advancing proprietary technologies, and expanding manufacturing footprints to secure competitive advantage. Semiconductor leaders consistently innovate digital signal processing architectures and low-power microcontroller platforms tailored to AEB demands, while actuator specialists invest in next-generation electric actuator modules that deliver precise braking control under high loads. Software firms differentiate through robust control algorithm libraries and sophisticated predictive analytics engines that enhance detection accuracy and system resilience.

Automotive OEMs actively collaborate with tier-one suppliers and technology partners to co-develop integrated AEB stacks. These partnerships often result in exclusive hardware–software bundles that streamline vehicle assembly and certification processes. Meanwhile, aftermarket retrofit specialists leverage open software frameworks and standardized hardware interfaces to offer modular upgrade kits, targeting fleets and regions where factory-fitted AEB is not yet mandated.

Investment patterns reveal a surge in cross-industry R&D consortiums focusing on multi-vendor interoperability, cybersecurity measures for connected vehicle networks, and advanced driver assistance system convergence. Simultaneously, some manufacturers pursue vertical integration strategies by acquiring specialized software houses or establishing in-house actuator production lines. These tactical moves underscore an industry-wide drive to control quality across the AEB value chain and accelerate time-to-market for next-generation safety solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Emergency Braking System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aisin Seiki Co., Ltd

- Aptiv PLC

- Autoliv, Inc.

- Continental AG

- DENSO Corporation

- HL Mando Corporation

- Hyundai Mobis Co., Ltd

- Knorr-Bremse AG

- Mobileye Global Inc

- Robert Bosch GmbH

- Valeo SA

- WABCO Holdings Inc.

- ZF Friedrichshafen AG

Advancing Proactive Collaboration Innovation Diversity and Regulatory Engagement to Secure Sustainable Leadership in AEB Market Growth

Industry leaders should prioritize diversification of their supply base by engaging both domestic and international component manufacturers to mitigate tariff and geopolitical risks. Establishing strategic partnerships with semiconductor designers and software developers can accelerate innovation cycles for digital signal processors, microcontrollers, and advanced prediction algorithms. Leaders also need to integrate flexible platform architectures that accommodate electric and hydraulic actuator variants, supporting rapid customization for commercial vehicles and passenger car models.

Strengthening collaboration with regulatory bodies and industry consortiums will ensure alignment with emerging safety mandates and certification requirements. Active participation in harmonization efforts facilitates early access to draft regulations, enabling product road maps to anticipate compliance timelines. Concurrently, investing in robust analytics and validation frameworks will enhance system performance documentation and streamline homologation processes.

Finally, stakeholders should explore value-added offerings in the aftermarket sphere by developing modular AEB upgrade packages that integrate seamlessly with legacy vehicle platforms. By coupling retrofit solutions with data-driven service models, companies can create recurring revenue streams and broaden market reach in regions where OEM adoption remains nascent. Such proactive measures will position industry leaders to adapt swiftly to landscape shifts and sustain long-term growth.

Detailing a Robust Multimodal Research Framework Integrating Secondary Analysis Expert Interviews and Quantitative Triangulation

Our research methodology encompasses a rigorous multistage process designed to ensure data integrity and comprehensive market understanding. We initiated with an extensive review of secondary sources, including peer-reviewed journals, patent filings, and regulatory documentation, to map the technological evolution of sensor modules, actuator designs, and software architectures. Publicly available safety test results and type-approval data provided additional validation of performance benchmarks across different vehicle classes.

In parallel, we conducted in-depth interviews with key stakeholders, spanning semiconductor engineers, actuator specialists, software architects, and safety regulators. These qualitative insights were instrumental in interpreting technical nuances and emerging trends. Furthermore, we solicited perspectives from fleet operators and aftermarket service providers to gauge practical deployment challenges and commercial adoption drivers.

Quantitative data was triangulated through cross-analysis of industry surveys, trade association reports, and corporate financial disclosures. We applied consistency checks, outlier analysis, and scenario modeling to address discrepancies and validate assumptions. This layered approach ensured a balanced synthesis of expert judgment and empirical evidence, culminating in a robust analytical framework that underpins our findings and strategic recommendations.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Emergency Braking System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Emergency Braking System Market, by Component

- Autonomous Emergency Braking System Market, by Vehicle Type

- Autonomous Emergency Braking System Market, by Sales Channel

- Autonomous Emergency Braking System Market, by Region

- Autonomous Emergency Braking System Market, by Group

- Autonomous Emergency Braking System Market, by Country

- United States Autonomous Emergency Braking System Market

- China Autonomous Emergency Braking System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Summarizing the Evolution Resilience and Strategic Priorities Underpinning the Future Trajectory of AEB Systems Worldwide

Autonomous Emergency Braking systems have transcended experimental novelty to become fundamental enablers of vehicle safety and operational efficiency. The convergence of advanced sensors, high-performance processors, and intelligent software positioning AEB as a core component of next-generation mobility solutions. This trajectory is further catalyzed by regulatory imperatives, consumer demand for enhanced protection, and a global push toward autonomous driving capabilities.

Despite temporary supply chain disruptions and tariff-induced cost pressures, the industry’s collective response underscores resilience and adaptability. Collaborative innovation between OEMs, technology providers, and aftermarket specialists is fostering a more localized and diversified value chain. As segmentation insights reveal distinct requirements across actuators, processors, and software, as well as vehicle types and sales channels, tailored strategies are emerging to address unique market needs.

Regional variation in regulatory landscape and infrastructure investment continues to shape adoption patterns, compelling stakeholders to refine product offerings for local markets. Leaders who embrace proactive supply management, dynamic R&D partnerships, and modular platform architectures will be well positioned to navigate future shifts. Ultimately, the sustained evolution of AEB systems will play a pivotal role in realizing safer roads, reducing accident severity, and advancing the broader vision of autonomous mobility.

Connect with Ketan Rohom to Secure Comprehensive Autonomous Emergency Braking Market Intelligence and Drive Strategic Innovation

For further insights into the transformative potential of Autonomous Emergency Braking systems and to explore the full breadth of market intelligence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of the comprehensive research report. An engaging discussion with Ketan will illuminate tailored opportunities for your strategic initiatives and ensure you harness the latest innovations in vehicle safety technology. Don’t miss the chance to position your organization at the forefront of AEB advancements and future mobility solutions by connecting today.

- How big is the Autonomous Emergency Braking System Market?

- What is the Autonomous Emergency Braking System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?