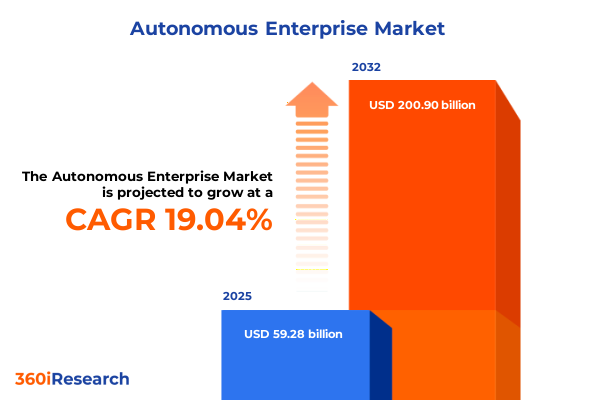

The Autonomous Enterprise Market size was estimated at USD 59.28 billion in 2025 and expected to reach USD 70.01 billion in 2026, at a CAGR of 19.04% to reach USD 200.90 billion by 2032.

Introducing the Autonomous Enterprise Revolution That Is Redefining Operational Efficiency, Strategic Agility, and Competitive Advantage on a Global Scale

Introducing this executive summary, we embark on a journey through the dynamic world of autonomous enterprise - a landscape where artificial intelligence, automation, and digital technologies converge to redefine how businesses operate. The autonomous enterprise model represents a paradigm shift, moving beyond isolated automation initiatives to an integrated ecosystem that can self-optimize, self-secure, and self-adapt across functions. This evolution stems from decades of technological innovation and the relentless pursuit of operational agility in an environment of growing complexity and global competition.

In recent years, generative AI and advanced analytics have accelerated organizations’ ability to derive real-time insights, while autonomous agents and networks reduce manual intervention and human error. These advancements promise to unlock new levels of efficiency, resilience, and innovation. At the same time, they compel leaders to rethink traditional operating models, talent strategies, and governance frameworks. Throughout this summary, we will explore how enterprises can navigate this unfolding transformation, harness emerging technologies, and adopt best practices that drive sustainable value creation in the autonomous age.

Uncovering the Fundamental Transformative Shifts Driving Autonomous Enterprise Adoption Amid Digital Disruption and Organizational Evolution

Across industries, organizations are experiencing transformative shifts that underpin the journey toward autonomous operations. The convergence of cloud-native architectures, pervasive connectivity, and AI-driven decision-making is dismantling functional silos, enabling seamless data flows and end-to-end process orchestration. These shifts are catalyzed by the transition from batch-driven workflows to continuous, event-driven models that respond in real time to evolving market conditions and customer demands.

Moreover, organizations are embracing composable business architectures where modular services and micro-applications can be rapidly assembled, tested, and scaled. This composability aligns with the growing need for adaptive systems that can iterate and self-govern based on dynamic performance metrics. Simultaneously, the expansion of autonomous networks powered by software-defined infrastructure is laying the groundwork for digitally native operating environments that optimize resource utilization and deliver unparalleled reliability. As a result, businesses are shifting from static, calendar-based planning cycles to continuous improvement loops that leverage AI for predictive insights and prescriptive recommendations, empowering leaders to act with confidence.

Analyzing the Far-Reaching Cumulative Impacts of United States 2025 Tariff Policies on Global Supply Chains, Cost Structures, and Technology Investments

In parallel with technological evolution, trade policy has emerged as a critical factor shaping autonomous enterprise strategies. Throughout 2025, the United States has implemented a series of tariffs aimed at balancing domestic manufacturing priorities with global supply chain considerations. These measures have imposed increased duties on key hardware components, semiconductors, and industrial automation systems, triggering a cumulative impact on procurement costs and vendor negotiations.

As tariffs raise the landed cost of imported technology, many organizations are reassessing supplier portfolios and accelerating nearshoring initiatives to mitigate exposure. This realignment is fostering partnerships with regional vendors and incentivizing investment in domestic production capacity for robotics, edge compute devices, and next-generation networking equipment. The resulting shift not only enhances supply chain resilience but also stimulates local ecosystems of component manufacturers and integration partners.

However, these benefits come with trade-offs. Organizations must navigate higher initial capital expenditures, potential shortages of specialized components, and the complexity of dual sourcing strategies. To maintain momentum toward autonomy, enterprises are optimizing technology roadmaps, leveraging hybrid deployment models, and exploring tariff engineering techniques such as redesigning product specifications to qualify for duty exemptions. Through proactive policy monitoring and strategic supplier engagement, leaders can turn tariff-related challenges into avenues for innovation and localized growth.

Revealing Key Segmentation Insights That Illuminate Market Dynamics Across Offerings, Autonomy Levels, Technologies, Organization Sizes, Deployment Models, Applications, and Industry Verticals

The autonomous enterprise is not a monolith but a layered ecosystem defined by multiple dimensions. From an offering perspective, the market encompasses both services and solutions, where managed services such as monitoring and support, and operations management play a vital role in operational continuity, while professional services including consulting, implementation, and integration drive tailored transformation. Solution-centric segments span accounts automation, autonomous agents, networks, robotic process automation, and security automation, each addressing distinct organizational imperatives.

Delving into levels of autonomy, the spectrum extends from manual enterprises to fully autonomous organizations. Many enterprises currently operate with assisted functions, leveraging AI-enhanced decision support, while a growing subset is deploying semi-autonomous capabilities across discrete processes. Advances in autonomous functions pave the way for fully self-governing systems that can sense, decide, and act without human intervention.

The technological foundation of this evolution is equally varied, spanning AI, big data analytics, blockchain, cloud computing, the Internet of Things, and robotics. Likewise, organizational scale influences adoption journeys: large enterprises often pilot expansive cross-functional initiatives, while small to mid-sized organizations prioritize rapid time to value through targeted automation. Deployment models oscillate between cloud and on-premise environments based on regulatory requirements, latency constraints, and security imperatives.

When it comes to applications, autonomous capabilities are permeating credit evaluation, customer and employee management, order management, predictive maintenance, and end-to-end process automation. Industry verticals such as BFSI, healthcare, manufacturing, retail, technology, telecommunications, and transportation are each charting unique paths, reflecting sector-specific demands and regulatory landscapes. Recognizing these segmentation dimensions is critical for stakeholders to craft solutions that resonate with distinct organizational needs and strategic objectives.

This comprehensive research report categorizes the Autonomous Enterprise market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Level of Autonomy

- Technology

- Organization Size

- Deployment Model

- Application

- Industry Vertical

Charting Key Regional Insights That Highlight Autonomous Enterprise Trends and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Markets

Regional dynamics profoundly shape the trajectory of autonomous enterprise adoption. Within the Americas, strong investment in digital infrastructure, a robust technology vendor ecosystem, and progressive regulatory frameworks are fueling pilot programs and full-scale deployments. Organizations in this region are leveraging mature cloud platforms, AI services, and automation tools to streamline operations and enhance customer experiences.

Across Europe, the Middle East, and Africa, enterprises are balancing ambitious digital initiatives with stringent data privacy regulations and sustainability goals. Energy and utilities companies are pioneering network-wide automation to support decarbonization targets, while financial institutions are integrating AI-driven compliance monitoring. This region’s diversity necessitates customized approaches, often blending local system integrators with global solution providers.

In the Asia-Pacific, rapid economic growth, favorable government incentives, and a competitive manufacturing base are accelerating autonomous enterprise strategies. From advanced robotics in industrial parks to autonomous networks supporting smart cities, organizations are exploring end-to-end automation at scale. The combination of high mobile penetration, pervasive IoT deployments, and national digital transformation agendas creates fertile ground for innovation and cross-border collaboration.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Enterprise market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Companies Shaping the Autonomous Enterprise Ecosystem Through Strategic Innovations, Partnerships, and Market-Driving Solutions

Leading organizations are staking their claims in the autonomous enterprise arena through strategic investments, partnerships, and product innovations. Global cloud providers continue to expand AI-as-a-service offerings, integrating autonomous orchestration capabilities that lower the barrier to entry for enterprise customers. Simultaneously, established automation vendors are embedding cognitive agents and advanced analytics into core platforms, enabling seamless interoperability with existing enterprise resource planning and customer relationship management systems.

Innovation-driven startups are carving out niche positions by specializing in security automation, autonomous network management, and vertical-specific robotic process automation. Their agility in developing targeted solutions is attracting partnerships with larger firms seeking to augment comprehensive portfolios. Meanwhile, system integrators and consultancies are evolving from advisory roles to outcome-oriented service partners, delivering managed services that include continuous improvement cycles, AI model retraining, and proactive incident management.

In addition, hardware manufacturers are collaborating with software developers to create turnkey solutions that integrate edge computing, sensors, and intelligent control systems. These end-to-end offerings simplify deployment and accelerate time to autonomy, particularly in industries with stringent latency or reliability requirements. By orchestrating ecosystems of technology providers, service partners, and industry consortia, leading companies are defining best practices and ecosystem standards that will shape the autonomous enterprise landscape for years to come.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Enterprise market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Amazon Web Services

- BMC Software, Inc.

- Capgemini SE

- Cloudera, Inc.

- Deloitte Touche Tohmatsu Limited

- Emagia

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Mindbox S.A.

- NTT DATA

- Oracle Corporation

- Pegasystems Inc.

- Rockwell Automation, Inc.

- Rossum

- SAP SE

- ScienceLogic

- SS&C Blue Prism

- Tangentia Inc.

- Tata Consultancy Services

- Tredence

- Uipath Inc.

- Wipro Limited

Delivering Actionable Recommendations to Guide Industry Leaders in Navigating the Autonomous Enterprise Landscape with Confidence and Strategic Foresight

To successfully navigate the shift toward autonomic operations, industry leaders must adopt a multi-dimensional strategy that balances technological ambition with pragmatic governance. First, prioritizing pilot initiatives aligned to high-impact use cases enables organizations to validate assumptions, refine AI models, and demonstrate demonstrable ROI. By leveraging iterative development cycles, teams can identify and remediate risks early while building organizational buy-in.

Second, cultivating an adaptive culture is paramount. This involves upskilling and reskilling talent to collaborate effectively with digital agents, fostering cross-functional teams that blend domain expertise with data science proficiency. Incorporating a federated governance model ensures centralized oversight of data quality, model ethics, and security protocols, while empowering business units to innovate at the edge.

Third, strategic partnerships with technology providers, system integrators, and industry consortia accelerate time to value. By tapping into shared best practices, standardized frameworks, and interoperable platforms, enterprises can avoid vendor lock-in and scale successful pilots across geographies and functions. Finally, establishing a continuous monitoring and measurement framework allows leaders to track performance against evolving benchmarks, ensuring that autonomous systems remain aligned to strategic objectives and deliver sustained operational excellence.

Outlining the Rigorous Research Methodology and Data Collection Approaches Underpinning the Analysis of the Global Autonomous Enterprise Landscape

This analysis rests on a comprehensive research methodology designed to ensure rigor, relevance, and reliability. Our approach combined extensive secondary research with primary data collection, including in-depth interviews with C-level executives, IT directors, and operational leaders across multiple industries. Secondary sources encompassed peer-reviewed journals, industry white papers, vendor publications, and trade association reports to capture emerging trends and technology roadmaps.

Qualitative insights were triangulated with quantitative data gathered from proprietary surveys and validated through cross-industry benchmarking exercises. Segmentation frameworks were developed to reflect real-world deployment patterns, and scenario analysis was conducted to assess potential impacts of geopolitical factors, regulatory changes, and macroeconomic dynamics. Throughout the process, iterative consultations with subject-matter experts verified assumptions and refined hypotheses.

Data analysis leveraged advanced analytic tools and statistical techniques to identify correlations, causations, and growth drivers. The resulting findings were peer-reviewed by an advisory panel to ensure the highest standards of accuracy and objectivity. This rigorous methodology underpins the insights presented, equipping decision-makers with a trustworthy foundation for strategic planning in the autonomous enterprise domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Enterprise market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Enterprise Market, by Offering

- Autonomous Enterprise Market, by Level of Autonomy

- Autonomous Enterprise Market, by Technology

- Autonomous Enterprise Market, by Organization Size

- Autonomous Enterprise Market, by Deployment Model

- Autonomous Enterprise Market, by Application

- Autonomous Enterprise Market, by Industry Vertical

- Autonomous Enterprise Market, by Region

- Autonomous Enterprise Market, by Group

- Autonomous Enterprise Market, by Country

- United States Autonomous Enterprise Market

- China Autonomous Enterprise Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Concluding Insights That Synthesize Core Findings and Highlight Strategic Imperatives for Organizations on the Path to Full Autonomy

In conclusion, the autonomous enterprise represents a transformative vision where technology, data, and human ingenuity converge to drive unparalleled efficiency, agility, and innovation. The journey to autonomy is neither linear nor uniform; it unfolds across a spectrum of maturity levels, technology stacks, and organizational priorities. By understanding the underpinning shifts, segmentation nuances, regional dynamics, and leading company strategies, decision-makers can chart a clear path forward.

Strategic imperatives include embracing composable architectures, fostering adaptive cultures, and forging ecosystem partnerships that amplify collective expertise. Organizations that proactively address evolving trade policies, supply chain complexities, and governance requirements will secure robust, scalable autonomous capabilities. Ultimately, the enterprises that succeed will view autonomy not merely as a technology deployment but as an enduring, practice-driven transformation that redefines how value is created and sustained.

Unlock Exclusive Autonomous Enterprise Insights and Connect with Ketan Rohom to Transform Your Strategic Vision into Tangible Market Success

Are you ready to unlock deep insights into the autonomous enterprise landscape and position your organization at the forefront of innovation? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to discover how our comprehensive market research report can empower your strategic decision making. Engage with Ketan to explore tailored research packages, gain exclusive access to detailed analysis, and accelerate your journey toward autonomous excellence. Contact Ketan today to transform insights into action and secure a competitive edge with the definitive autonomous enterprise market study.

- How big is the Autonomous Enterprise Market?

- What is the Autonomous Enterprise Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?