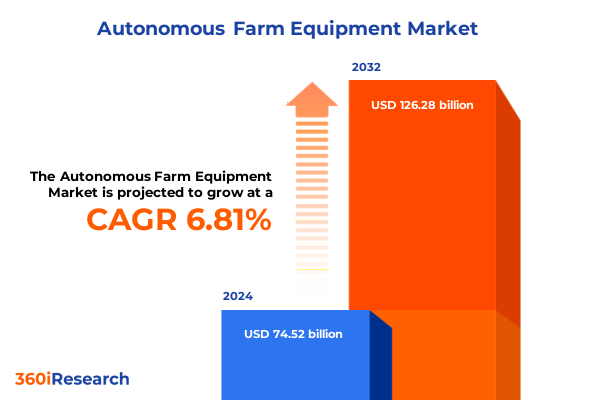

The Autonomous Farm Equipment Market size was estimated at USD 78.73 billion in 2025 and expected to reach USD 83.19 billion in 2026, at a CAGR of 6.98% to reach USD 126.28 billion by 2032.

Exploring the Emergence of Autonomous Farm Equipment as a Cornerstone for Enhancing Efficiency, Sustainability, and Productivity in Modern Agriculture

In recent years, agriculture has witnessed a paradigm shift as autonomous farm equipment moved from experimental prototypes to commercial-ready solutions. Farm operations historically reliant on manual labor and conventional machinery are now incorporating driverless tractors, robotic harvesters, and AI-enabled sprayers that can work safely around human operators. This transformation is not only driven by persistent labor shortages but also by the imperative to enhance productivity and sustainability in response to growing food demand and environmental concerns.

The advent of advanced sensors, machine learning algorithms, and high-precision navigation systems has accelerated the timeline for widespread autonomous adoption. Modern guidance systems integrate GNSS corrections and radar or lidar inputs to enable centimeter-level accuracy in field operations. As a result, planting and seeding tasks once susceptible to human error can be executed with unparalleled consistency, reducing input waste and optimizing yields. Meanwhile, embedded teleoperation platforms allow remote experts to oversee multiple units from centralized control centers, marking a shift toward digitalized farm management.

This report opens with an introduction to the technological, operational, and economic forces propelling autonomous machinery uptake. It lays the foundation for understanding how transforming consumer expectations, government incentives, and digital agriculture platforms converge to redefine efficiency and resilience in modern farming practices.

Analyzing the Key Technological, Operational, and Economic Shifts Driving the Rapid Evolution of Autonomous Machinery Across Farming Landscapes

Agricultural landscapes are undergoing transformative shifts driven by breakthroughs in artificial intelligence, connectivity, and supply chain integration. The fusion of machine vision and GPS-based navigation has enabled a new generation of harvesters and sprayers capable of recognizing crop patterns, detecting obstacles, and adjusting pathways in real time. These capabilities have not only lowered the technical barrier for precision farming but have also facilitated autonomous fertilization and pest control operations that adapt dynamically to field conditions.

Beyond pure technological advancements, the rise of modular controllers and powertrain architectures has made retrofitting existing tractors with autonomy kits both feasible and cost-effective. Mid- and large-scale farms are capitalizing on these innovations to extend the lifecycle of legacy equipment while simultaneously embracing diesel-electric hybrid propulsion for reduced fuel consumption and lower emissions. Data-driven agronomy platforms further amplify these gains, leveraging sensor-derived insights to fine-tune seeding rates and irrigation schedules, thereby promoting sustainable water usage.

Economic forces and policy landscapes are reinforcing these technological trends. Public subsidies and collaborative research programs are incentivizing manufacturers to accelerate autonomous equipment commercialization. Simultaneously, enhanced connectivity standards, including V2X communication protocols, are laying the groundwork for precision fleet management. Collectively, these shifts demonstrate how integrated ecosystems of hardware, software, and services are coalescing to redefine the future of farming operations.

Evaluating the Ripple Effects of New United States Tariffs Implemented in 2025 on the Adoption and Distribution of Autonomous Agricultural Machinery

The introduction of new United States tariffs in 2025 has created a complex environment for supply chains and cost structures within the autonomous agricultural machinery sector. Tariffs levied on critical components such as navigation systems and powertrain modules have elevated import costs, compelling manufacturers to reevaluate sourcing strategies and accelerate domestic production partnerships. Furthermore, increased levies on electronic sensors and advanced AI software licenses have prompted original equipment makers to reconsider cross-border licensing agreements.

These fiscal measures have exerted pressure on pricing models, with import-dependent players facing narrower margins on heavy-duty autonomous harvesters and large-scale planters. In response, some manufacturers have opted to localize assembly lines and qualify a broader array of tier-one domestic suppliers for controllers and guidance sensors. This pivot has not only mitigated immediate tariff impacts but also fostered innovation through closer collaboration between component specialists and machinery integrators.

Moreover, the redistribution of production footprints has reshaped distribution channels, compelling dealers and aftermarket service providers to invest in local technical training programs and spare parts inventories. While certain regions have experienced short-term cost inflation and supply bottlenecks, the resulting structural adjustments are poised to yield long-term resilience through diversified supply ecosystems and enhanced regional manufacturing capabilities.

Uncovering Holistic Segmentation Perspectives to Illuminate Type Component Operation Technology Propulsion and Farm Size Dynamics in Autonomous Equipment

Understanding the autonomous farm equipment landscape requires a multifaceted segmentation lens that captures variations in machine types, component architectures, operational workflows, technological enablers, propulsion systems, and farm scale dynamics. When analyzing the market based on type, attention centers on the contrasting use cases for balers versus high-capacity harvesters, precision mowers tailored for turf management compared to multi-row planters, and the role of seeders, sprayers, and tractors in integrated field operations. Examining the component side reveals divergent adoption rates for controllers, guidance systems, and navigation modules alongside the critical importance of powertrain innovations and sensor fusion units.

Delving into operational segmentation, autonomous fertilization platforms are disrupting traditional chemical application methods, while automated field preparation technologies are redefining soil tillage processes. Harvesting robotics equipped with machine vision are gaining traction in high-value crop scenarios, and autonomous irrigation solutions leverage radar and lidar insights to optimize water distribution. Seed planting and pest control functions are similarly benefitting from teleoperation and obstacle-detection software enhancements, culminating in end-to-end field management suites.

Technology categorization highlights the ascendancy of AI-driven software stacks that coordinate obstacle detection, path planning, and remote teleoperation. GPS-based positioning remains a foundational capability, yet machine vision systems and radar/lidar arrays are progressively enabling real-time obstacle avoidance and terrain mapping. V2X communications facilitate vehicle-to-vehicle and vehicle-to-infrastructure data exchanges, accelerating precision fleet orchestration.

Propulsion segmentation draws a clear delineation between traditional diesel engines and emerging electric solutions. Within electric powertrains, battery-electric systems coexist with nascent fuel cell-electric options, while parallel and series hybrid configurations straddle the performance-energy efficiency trade-off. Finally, farm size analysis demonstrates differential adoption patterns: large-scale operations are typically first movers for capital-intensive autonomous platforms, medium-sized enterprises focus on modular retrofit solutions, and small farms prioritize compact, cost-effective units to maximize return on investment.

This comprehensive research report categorizes the Autonomous Farm Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Technology

- Propulsion

- Farm Size

- Operation

Highlighting Regional Nuances and Growth Drivers Shaping the Americas Europe Middle East Africa and Asia Pacific Autonomous Farming Equipment Ecosystems

Regional landscapes present distinct trajectories for autonomous farming equipment deployment. In the Americas, expansive acreages and progressive agricultural policies have accelerated acceptance of driverless tractors and large-scale planters. North American producers, facing persistent labor constraints, are early adopters of fully autonomous sprayers and harvesters powered by hybrid drivetrains. South American growth, meanwhile, is driven by precision irrigation projects and energy-efficient machine vision solutions tailored to resource-scarce environments.

Europe, the Middle East, and Africa exhibit a varied mosaic of demand signals. Western European operators benefit from dense aftermarket service networks and supportive regulatory frameworks for low-emission farming, fostering investment in electric and hybrid autonomous equipment. In contrast, emerging markets across the Middle East and North Africa show growing interest in teleoperated seeding and pest control platforms designed for arid and semi-arid conditions. Sub-Saharan Africa is witnessing pilot programs that leverage low-cost sensor solutions integrated into conventional tractors, marking the first steps toward scalable autonomy.

Asia-Pacific adoption spans Japan’s high-tech robotics and GPS-guided rice transplanters to Australia’s autonomous balers designed for large rangelands. China’s robust R&D investments have catalyzed domestic production of AI & software suites for path planning and remote teleoperation, while Southeast Asian growers are experimenting with compact autonomous mowers and sprayers for smallholder plots. In each sub-region, local infrastructure maturity, labor dynamics, and environmental regulations shape the unique innovation pathways for automated agriculture.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Farm Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovation Pathways of Leading Manufacturers and Technology Providers in Autonomous Farm Machinery Industry

Leading equipment manufacturers and technology providers are redefining competitive dynamics through strategic alliances and differentiated innovation. A prominent tractor producer has forged collaborations with a satellite navigation firm to embed high-precision guidance systems into its product lineup, while a major implement supplier has acquired a machine vision startup to bolster its obstacle-detection and crop-specific harvesting capabilities. Simultaneously, industrial robotics specialists are partnering with legacy OEMs to retrofit traditional machinery with modular autonomy kits that can be deployed at scale across diverse crop types.

Technology-forward companies are also leveraging data-driven service models, offering subscription-based agronomic platforms that integrate teleoperation dashboards, real-time sensor analytics, and cloud-based maintenance forecasting. These providers are extending their value proposition beyond hardware sales, cultivating recurring revenue streams through software licensing and remote monitoring services. Meanwhile, aftermarket service networks are investing in technician training programs to ensure field teams can install, calibrate, and troubleshoot complex navigation and powertrain systems.

New entrants and regional players are carving niches through cost-optimized electric propulsion solutions and localized component sourcing strategies. They often focus on rapid prototyping cycles that address specific crop and terrain challenges, enabling them to compete against incumbent global giants. This competitive tapestry underscores the importance of both technological depth and regional agility for firms seeking to lead the next wave of autonomous farm equipment adoption.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Farm Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AG Leader Technology, Inc.

- Ag Xeed

- AGCO Corporation

- American Robotics

- Autonomous Solutions Inc.

- Bobcat Company by Doosan Group

- CLAAS KGaA mbH

- Clearpath Robotics

- CNH Industrial N.V.

- Deere & Company

- Deutz-Fahr

- Energid Technologies by Universal Robots

- Farmdroid by OPICO Limited

- Hexagon AB

- Iseki & Co., Ltd.

- J C Bamford Excavators Ltd.

- Kubota Corporation

- KUHN SAS

- Mahindra & Mahindra Ltd.

- Mahindra & Mahindra Limited

- Monarch Tractor

- Naio Technologies

- Precision Hawk

- Robert Bosch GmbH

- SZ DJI Technology Co., Ltd.

- Topcon Corporation

- Trimble Inc.

- Yanmar Holdings Co., Ltd.

Delivering Strategic and Tactical Recommendations to Empower Industry Leaders to Capitalize on Autonomous Farm Equipment Advancements and Market Opportunities

To maintain a competitive edge, industry leaders should prioritize forging cross-industry partnerships that accelerate integration between AI software developers, navigation sensor manufacturers, and teleoperation service providers. By co-developing scalable autonomy kits with standardized interfaces, organizations can reduce deployment complexity and deliver seamless upgrades to end-users. Moreover, investing in localized manufacturing and component assembly facilities can shield companies from tariff volatility and strengthen relationships with regional dealers and agricultural cooperatives.

In parallel, firms must enhance after-sales support ecosystems by establishing field training academies and remote diagnostics capabilities. Enabling technicians and operators with intuitive diagnostic tools and virtual reality–based maintenance guides will minimize downtime and amplify customer satisfaction. Executives should also explore tiered subscription models that align with farm size and operational requirements, offering modular service packages that cater to the distinct needs of large, medium, and small operations.

Finally, decision makers should champion interoperability standards and open data-sharing frameworks that unlock the full potential of V2X communication networks. Encouraging transparent data exchange among different equipment brands and agronomic platforms will catalyze new applications of predictive analytics, ultimately driving greater operational resilience and environmental stewardship.

Outlining the Rigorous Research Framework and Data Collection Approaches Underpinning Comprehensive Analysis of Autonomous Farm Equipment Landscape

This study employed a rigorous mixed-method research framework, combining in-depth primary interviews with farm operators, OEM executives, and component suppliers, with extensive secondary research across academic journals, technical white papers, and industry publications. Structured interviews and workshops facilitated qualitative insights into adoption barriers, operational challenges, and user preferences, while survey-based questionnaires captured quantitative data on technology utilization and investment priorities.

Data triangulation techniques validated key findings by cross-referencing insights from government policy documents, trade associations, and patent filings. Detailed case studies of early adopter farms provided longitudinal perspectives on performance outcomes and return on investment considerations. Furthermore, segmentation analyses were underpinned by proprietary databases tracking equipment deployments by type, component architecture, operational function, and propulsion system, as well as farm size profiles across major agricultural regions.

The research methodology also integrated scenario planning exercises to assess the impacts of evolving tariff structures, regulatory changes, and technological breakthroughs. Continuous validation sessions with an advisory panel of agronomy experts and field technicians ensured that the reported insights remained aligned with real-world operational realities and emerging innovation trajectories.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Farm Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Farm Equipment Market, by Type

- Autonomous Farm Equipment Market, by Component

- Autonomous Farm Equipment Market, by Technology

- Autonomous Farm Equipment Market, by Propulsion

- Autonomous Farm Equipment Market, by Farm Size

- Autonomous Farm Equipment Market, by Operation

- Autonomous Farm Equipment Market, by Region

- Autonomous Farm Equipment Market, by Group

- Autonomous Farm Equipment Market, by Country

- United States Autonomous Farm Equipment Market

- China Autonomous Farm Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Drawing Together Core Insights and Implications to Frame the Future Outlook of Autonomous Farm Equipment Deployment and Industry Transformation

The synthesis of technological, economic, and regional dynamics paints a compelling picture of a sector in rapid flux. As autonomy platforms mature, the convergence of AI-driven software, precision positioning systems, and advanced propulsion architectures is redefining how farmers approach core tasks such as planting, fertilization, and harvesting. The cumulative effect of 2025 tariff adjustments has imposed short-term headwinds, yet simultaneously spurred greater supply chain diversification and local innovation.

Segmentation insights reveal that the most successful offerings deliver modular, interoperable solutions tailored to specific farm scales and operational workflows. At the same time, regional heterogeneity underscores the importance of adaptive strategies that reflect local regulatory landscapes and infrastructure capabilities. Competitive analysis highlights a shift from hardware-centric models to integrated service ecosystems that blend equipment, analytics, and support offerings.

Looking ahead, the industry’s trajectory will hinge on collaborative frameworks that unlock shared data resources, common communication protocols, and open innovation networks. By embracing these principles, stakeholders can navigate policy complexities, optimize cost structures, and ultimately drive sustainable productivity gains across diverse agricultural contexts.

Engage with Ketan Rohom Associate Director Sales and Marketing to Secure Exclusive Research Insights and Accelerate Your Autonomous Farm Equipment Strategy

If you’re ready to transform operational efficiencies and position your organization at the forefront of agricultural innovation, reach out to Associate Director of Sales and Marketing Ketan Rohom to discuss how our comprehensive autonomous farm equipment intelligence can empower your decision making and accelerate your competitive edge

- How big is the Autonomous Farm Equipment Market?

- What is the Autonomous Farm Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?