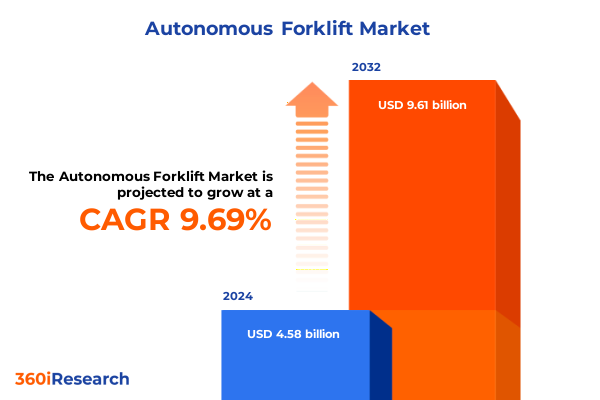

The Autonomous Forklift Market size was estimated at USD 5.00 billion in 2025 and expected to reach USD 5.45 billion in 2026, at a CAGR of 9.78% to reach USD 9.61 billion by 2032.

Discover How Autonomous Forklifts Are Redefining Industrial Material Handling Through AI, Robotics, and Seamless Connectivity Driving Operational Excellence

Industrial operations are undergoing a profound transformation as autonomous forklifts redefine the way materials are handled in modern warehouses. By integrating advanced robotics, sensor fusion, and real-time connectivity, these vehicles eliminate manual intervention, reduce workplace injuries, and deliver consistent throughput. Decision-makers across logistics, manufacturing, and retail sectors are recognizing the potential of these driverless platforms to streamline processes and support lean operations. The convergence of artificial intelligence, machine learning, and Internet of Things (IoT) frameworks has paved the way for autonomous forklifts to navigate dynamic environments, avoid obstacles, and execute complex tasks with precision.

Moreover, labor shortages and rising wage pressures have compelled companies to seek automation solutions that can operate around the clock without fatigue or error. As e-commerce growth accelerates consumer expectations for rapid order fulfillment, facilities increasingly depend on automated vehicles to maintain service levels and reduce reliance on temporary labor. At the same time, sustainability goals are encouraging the shift to electric and hydrogen fuel cell power sources, aligning material handling with corporate environmental objectives. Together, these factors are driving the adoption of autonomous forklifts as a cornerstone of Industry 4.0, reshaping conventional warehouses into smart, adaptive logistics hubs.

Uncover the Major Technological and Market Forces Propelling Autonomous Forklifts into the Future of Material Handling and Logistics Efficiency

The autonomous forklift landscape is characterized by rapid technological evolution that accelerates efficiency gains and operational safety. Cutting-edge sensor suites, including LiDAR, cameras, and ultrasonic detectors, work in concert with sophisticated navigation algorithms to enable precise path planning and dynamic obstacle avoidance. Edge computing capabilities allow these vehicles to process large volumes of data locally, minimizing latency and ensuring real-time responsiveness. Meanwhile, cloud-based fleet management platforms provide centralized monitoring, diagnostics, and predictive maintenance, empowering managers to optimize uptime and extend asset life cycles.

Significant market drivers are aligning to amplify the transformative impact of these innovations. The explosive growth of e-commerce has redefined logistics requirements, compelling distribution centers to handle higher SKU diversity and accelerated replenishment cycles. Concurrently, stringent safety regulations and zero-accident targets are compelling companies to adopt autonomous systems that minimize the risk of collisions and operator errors. Sustainability mandates are reinforcing demand for zero-emission vehicles, prompting a shift toward electric and hydrogen fuel cell forklifts that reduce carbon footprints and comply with evolving environmental standards.

In addition to technological advances, strategic partnerships between automotive manufacturers, semiconductor firms, and software integrators are fostering an ecosystem that accelerates product development and commercialization. Alliances between equipment OEMs and technology providers are creating modular, scalable platforms that can be customized for diverse operational scenarios. As these collaborative models mature, the autonomous forklift market is poised to benefit from accelerated innovation cycles and rapid adoption across industries.

Assessing the Broad Economic, Supply Chain, and Innovation Impacts of Renewed US Tariff Measures on the Autonomous Forklift Industry in 2025

An immediate consequence of renewed tariff measures is the slowdown in capital investment decisions across the warehouse automation sector. Industry discussions reveal that many end users are deferring large-scale deployments, uncertain about future duty rates and the potential for escalating equipment costs. Automation vendors report increasing hesitation among decision-makers, who fear that sudden policy shifts could undermine return on investment and disrupt long-term planning.

Tariffs on key raw materials, particularly a 25 percent duty on steel, are directly inflating the production costs of automated vehicles. Since steel constitutes the structural core of forklifts, this levy translates into significant price increases for both autonomous and manual models. Higher material costs are being passed through supply chains, compressing OEM margins and challenging manufacturers to absorb or offset these expenses without pricing end users out of the market.

In response to these pressures, leading equipment producers are reevaluating their global sourcing strategies. Companies are exploring alternative suppliers in regions subject to lower tariffs or considering nearshoring critical component production to North America. Meanwhile, logistics providers are negotiating new freight contracts to mitigate disrupted shipping schedules, and integrators are reassessing project timelines to account for potential delays in sensor and semiconductor deliveries.

Key Segmentation Dimensions Shaping Autonomous Forklift Markets Across Product Types, Load Capacities, Power Sources, Sales Channels, Applications, and Industries

Evaluation of autonomous forklift market segmentation reveals diverse dimensions that inform strategic decision-making by end users and equipment manufacturers alike. Product type distinctions encompass a spectrum from counterbalance forklifts that manage heavy pallet loads to pallet stackers offering space-efficient lift capabilities, as well as specialized reach trucks, straddle forklifts, and very narrow aisle vehicles engineered for high-density storage environments. Load capacity profiles range from low-capacity units suited for smaller operations to medium and high-capacity platforms capable of handling industrial-scale payloads with ease. Power source considerations further differentiate offerings, as electric drives deliver quiet, emission-free operation while hydrogen fuel cells provide extended runtime, and internal combustion engines maintain a presence in applications where refueling speed is critical.

Sales channels also play a pivotal role, with traditional offline models leveraging direct sales teams and distributor networks to ensure localized service and support, while digital platforms enable streamlined procurement processes and rapid quoting. Application-driven segmentation underscores the varied operational contexts in which autonomous forklifts operate, from temperature-controlled cold storage and intensive loading and unloading zones to material transport corridors, order picking aisles, and shelf replenishment systems. Finally, end-use industry analysis highlights adoption patterns across construction sites, logistics and warehousing hubs, retail distribution centers, and manufacturing facilities-subdivided into automotive production lines and food and beverage processing plants-demonstrating how sector-specific requirements shape equipment configurations and service models.

This comprehensive research report categorizes the Autonomous Forklift market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Load Capacity

- Power Source

- Sales Channel

- Application

- End-Use Industry

Unveiling Regional Dynamics That Influence Adoption and Growth of Autonomous Forklifts in the Americas, Europe, Middle East & Africa, and Asia-Pacific Markets

Regional dynamics exert a profound influence on autonomous forklift adoption, driven by economic priorities, infrastructure readiness, and regulatory frameworks. In the Americas, the United States maintains leadership through substantial investments in automated warehousing and a mature logistics ecosystem. Canada’s emphasis on nearshoring and robust distribution networks further underpins demand, while Brazil’s growing e-commerce and retail expansion are driving pilot programs in key logistics corridors. Across these markets, favorable tax incentives, public-private collaborations on infrastructure modernization, and the presence of major OEMs facilitate rapid integration of driverless material handling solutions.

In Europe, the Middle East, and Africa, equipment adoption reflects a balance between stringent safety and emissions regulations and the need for operational agility. Western Europe’s focus on sustainability accelerates the shift to electric and hydrogen boats, while Eastern European markets leverage cost-competitive manufacturing hubs to deploy automation in automotive and consumer goods sectors. In the Middle East, strategic logistics investments in free trade zones and mega-project developments in the Gulf Cooperation Council countries create compelling use cases for autonomous fleets. African markets, though nascent, are seeing initial forays into automation in high-value sectors such as pharmaceuticals and cold chain, driven by international logistics players.

Asia-Pacific exhibits some of the highest growth potential, as China, Japan, South Korea, and Southeast Asia embrace Industry 4.0 initiatives. China’s domestic robotics industry, backed by government subsidies, produces cost-competitive sensor packages and navigation systems, while Japan and South Korea’s deep expertise in semiconductor manufacturing ensures high-performance processing units. In Southeast Asian manufacturing and logistics hubs, companies are leveraging autonomous forklifts to address labor shortages and increase throughput in export-oriented operations. Across the region, digital infrastructure, 5G connectivity, and collaborative automation standards are laying the groundwork for widespread deployment.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Forklift market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Movers Shaping the Competitive Autonomous Forklift Industry Landscape with Breakthrough Products and Partnerships

A diverse array of players is competing to define the future of autonomous forklifts through product differentiation, strategic alliances, and service innovation. Established OEMs such as Toyota Industries Corporation, KION Group, and Jungheinrich AG continue to leverage their global manufacturing footprints and deep distribution networks to roll out increasingly intelligent lift trucks. These companies are investing heavily in R&D, incorporating advanced perception systems, telematics, and predictive maintenance tools into next-generation models.

Emerging entrants and technology specialists are also shaping the competitive landscape by focusing on modular automation kits, retrofittable systems for existing fleets, and open-architecture software that simplifies integration with warehouse management platforms. Strategic partnerships between robotics startups and logistics integrators are accelerating time to market and enabling customized solutions for complex facility layouts. Collaborations with semiconductor and sensor manufacturers are further driving down costs and improving performance, while joint ventures are enabling OEMs to access regional markets through localized production and service hubs.

In parallel, third-party service providers and system integrators are offering managed automation programs, bundling equipment, software, and maintenance under subscription models. This trend is democratizing access to autonomous forklifts, allowing small and mid-sized operations to adopt cutting-edge technology without prohibitive upfront investments. As the ecosystem matures, alliances across the value chain-from component suppliers to distribution partners-will be critical to delivering end-to-end automation solutions that scale with customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Forklift market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGILOX Services GmbH

- Anhui Heli Co., Ltd.

- BALYO SA

- CLARK Material Handling Company

- Crown Equipment Corporation

- Cyngn Inc.

- Daifuku Co., Ltd.

- E80 Group SPA

- Ek robotics GmbH

- Fox Robotics Inc.

- GIDEON BROTHERS

- Godrej & Boyce Manufacturing Company Limited

- HANGCHA Group

- Hyster-Yale, Inc.

- Hyundai Construction Equipment Co., Ltd.

- Jungheinrich AG

- KION GROUP AG

- Kollmorgen Corporation

- Konecranes Inc.

- MANITOU BF

- MITSUBISHI LOGISNEXT CO.,LTD

- Oceaneering International, Inc.

- Quantum Robotics

- Rockwell Automation, Inc.

- Seegrid Corporation

- Swisslog Holding AG

- Taixing Andylift Equipment Co.,Ltd.

- Teradyne Robotics, Inc.

- Toyota Industries Corporation

- Vecna Robotics, Inc.

- VisionNav Robotics

Formulating Actionable Strategies for Industry Leaders to Capitalize on Autonomous Forklift Innovation, Streamline Supply Chains, and Mitigate Geopolitical Risks

Industry leaders must adopt multifaceted strategies to navigate evolving trade policies while maximizing the potential of autonomous forklifts. First, companies should diversify their supply chains by identifying alternative component sources in lower-tariff jurisdictions and developing partnerships with regional suppliers. This approach mitigates the risk of cost fluctuations and delivery delays, ensuring continuity of operations. Next, organizations should accelerate investment in modular automation architectures that enable phased deployments and seamless integration with existing warehouse management systems, reducing disruption and enhancing ROI certainty.

To strengthen innovation pipelines, leaders are advised to establish collaborative R&D partnerships that combine the domain expertise of equipment OEMs with the advanced analytics capabilities of software firms and the manufacturing know-how of semiconductor providers. Such alliances can expedite the development of energy-efficient power sources, robust localization algorithms, and predictive maintenance platforms. Concurrently, companies should cultivate a skilled workforce through targeted training programs that upskill maintenance personnel and IT teams, ensuring the organization can support increasingly sophisticated automated fleets.

Finally, proactive engagement with policymakers and industry associations is essential to shape regulations that balance safety imperatives with innovation incentives. By contributing to the development of common standards for interoperability and data security, companies can reduce compliance burdens and accelerate technology adoption. This holistic approach-spanning supply chain resilience, modular innovation, workforce readiness, and regulatory advocacy-will position industry leaders to capitalize on the transformative potential of autonomous forklifts.

Outlining a Research Methodology Integrating Expert Interviews, Secondary Data Analysis, and Robust Analytical Frameworks for Market Evaluation

This report is underpinned by a rigorous research methodology that combines primary and secondary data sources to deliver a comprehensive market assessment. Primary insights were gathered through in-depth interviews with senior executives and technical specialists across leading OEMs, system integrators, end-user organizations, and trade associations. These discussions provided firsthand perspectives on technology roadmaps, procurement considerations, and operational challenges.

Secondary research involved systematic review of company websites, public filings, industry publications, and regulatory databases to validate product launches, partnership announcements, and policy developments. Proprietary databases and cross-industry benchmarks were used to triangulate qualitative findings and ensure consistency. Each segmentation dimension and regional market was further analyzed through scenario mapping, enabling identification of key growth drivers, adoption barriers, and emerging trends.

Quantitative data were synthesized using an analytical framework that emphasizes triangulation among data points from multiple sources. This approach enhances the accuracy of trend analysis without delving into specific market sizing. Finally, findings were peer-reviewed by subject matter experts to confirm methodological integrity and relevance, ensuring that conclusions reflect the latest industry dynamics and stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Forklift market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Forklift Market, by Product Type

- Autonomous Forklift Market, by Load Capacity

- Autonomous Forklift Market, by Power Source

- Autonomous Forklift Market, by Sales Channel

- Autonomous Forklift Market, by Application

- Autonomous Forklift Market, by End-Use Industry

- Autonomous Forklift Market, by Region

- Autonomous Forklift Market, by Group

- Autonomous Forklift Market, by Country

- United States Autonomous Forklift Market

- China Autonomous Forklift Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Findings to Illustrate How Autonomous Forklift Advancements, Policy Dynamics, and Market Segments Converge to Drive Future Industry Success

The convergence of advanced robotics, artificial intelligence, and digitized supply chains has marked autonomous forklifts as a cornerstone technology for modern material handling operations. Adoption is propelled by the need for safety, reliability, and efficiency, while sustainability goals align with the transition towards electric and hydrogen fuel sources. Regional variations underscore the importance of tailoring strategies to local infrastructure, regulatory environments, and industry priorities.

Trade policy uncertainty, particularly the reimposition of tariffs on critical materials and components, has introduced short-term cost pressures and project delays. However, these challenges are catalyzing strategic adjustments in supply chain architectures and prompting investment in modular, upgradeable automation platforms. Segmentation analysis highlights that diverse operational needs-ranging from high-capacity heavy lifting to narrow-aisle order picking-demand bespoke solutions, underscoring the value of flexible product portfolios and subscription-based service models.

Looking ahead, the autonomous forklift industry will continue to evolve through cross-industry partnerships, open-architecture software ecosystems, and advancements in energy storage. Leaders who proactively adapt their sourcing strategies, foster collaborative innovation, and engage with regulatory stakeholders will be best positioned to harness the full potential of driverless material handling. Through disciplined execution and continuous learning, organizations can achieve scalable automation that delivers sustained operational excellence.

Contact Ketan Rohom to Secure Your Comprehensive Autonomous Forklift Market Research Report and Gain Strategic Insights to Accelerate Growth Today

Unlock unparalleled market intelligence and seize a competitive edge by partnering with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to access the full autonomous forklift market research report. His expertise will guide you through the complexities of evolving trade policies, emerging technologies, and regional dynamics. By securing this comprehensive report, you gain strategic insights into segmentation nuances, regional growth drivers, and leading company strategies, empowering your organization to make informed investment decisions and optimize operational performance. Reach out to Ketan Rohom to obtain your copy and accelerate your pathway to innovation, cost efficiency, and market leadership within the autonomous forklift landscape.

- How big is the Autonomous Forklift Market?

- What is the Autonomous Forklift Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?