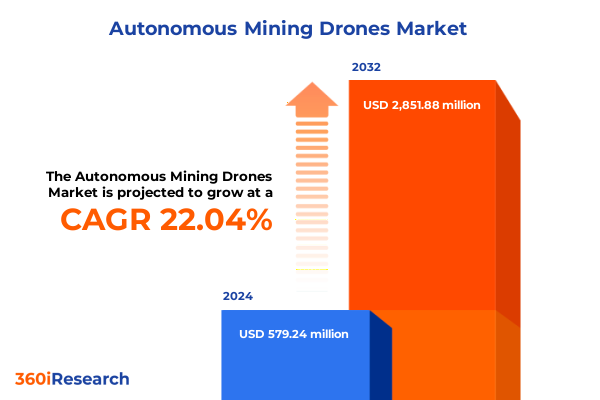

The Autonomous Mining Drones Market size was estimated at USD 700.19 million in 2025 and expected to reach USD 859.04 million in 2026, at a CAGR of 22.21% to reach USD 2,851.88 million by 2032.

Unlocking the Future of Mining Operations Through Autonomous Drone Technologies Revolutionizing Efficiency, Safety, and Data-Driven Decision Making in Real Time

The mining industry is entering a pivotal era defined by the integration of unmanned aerial and ground drone systems that are transforming traditional practices. What was once fringe experimentation in remote site surveying and hazard detection has rapidly evolved into core operational frameworks for leading mining enterprises worldwide. Today’s autonomous drones are not mere novelties but indispensable tools delivering high-resolution mapping, real-time environmental monitoring, and logistic support in environments too hazardous or remote for conventional methods.

Technological advancements in sensor miniaturization, battery life extension, and artificial intelligence–driven navigation have converged to enhance drone reliability and versatility in challenging mining contexts. Ground platforms equipped with robust environmental sensors now traverse open-pit expanses to gather geotechnical data, while hybrid aerial vehicles execute beyond-visual-line-of-sight (BVLOS) missions to perform volume calculations and detect structural anomalies. As capital projects demand deeper data insights and more stringent safety protocols, these autonomous systems offer a powerful fusion of operational agility and precision.

Moreover, regulatory bodies are adopting more nuanced frameworks to support safe drone deployment, enabling companies to scale beyond pilot projects into integrated fleet management models. As a result, mining operators are recalibrating their value chains, embedding drone-enabled data streams into decision support systems that optimize resource allocation, reduce downtime, and mitigate on-site risks. This evolutionary shift underscores the industry’s commitment to leveraging cutting-edge unmanned technologies to address both productivity imperatives and environmental stewardship responsibilities.

Emerging Technologies and Operational Paradigm Shifts Are Reshaping Mining Through Widespread Adoption of Autonomous Aerial and Ground Drone Systems

The transformative landscape of mining is being reshaped by unprecedented technological and operational paradigm shifts, as organizations embrace the synergistic potential of aerial and ground-based autonomous drone systems. Operators are now automating tasks from geotechnical surveys to material handling inspections, enabling continuous data acquisition without exposing personnel to hazardous conditions. Such innovations are redefining productivity benchmarks and establishing new standards for site safety.

Artificial intelligence and machine learning algorithms have become integral to drone autonomy, empowering systems to adapt flight paths in real time based on terrain analysis and sensor feedback. For example, autonomous docks that facilitate scheduled takeoffs, landings, and battery exchanges now support uninterrupted missions at scale, logging thousands of flights per dock annually-demonstrating utilization rates previously unimaginable in manual operations. Concurrently, advanced ground drones outfitted with LiDAR and multispectral sensors traverse vast haul roads to identify structural stress points and ground stability issues, producing actionable geospatial models with centimeter-level accuracy.

As these technologies mature, the ecosystem is witnessing a consolidation of hardware and software providers into end-to-end solution vendors. Companies that once focused solely on drone manufacturing are expanding into cloud-based analytics and integrated data platforms, creating seamless pipelines from raw aerial imagery to predictive maintenance insights. This convergence is catalyzing a shift from point solutions to fully integrated digital systems where unmanned platforms serve as the sensory and mobility backbone of modern mining operations.

Assessing the Far-Reaching Economic and Operational Impacts of New 2025 U.S. Tariff Policies on Imported Drone Systems and Mining Equipment Supply Chains

The introduction of cumulative tariff measures by the U.S. government in 2025 has exerted significant pressure on the cost structure of imported drone platforms and components critical to mining applications. Drones, specifically those manufactured in China, were excluded from the sweeping tariff exemptions granted to many other electronic devices. As a result, unmanned aircraft and related kits now face a combined duty rate of 170 percent, reflecting multiple successive tariff actions spanning several administrations and legislative directives.

This elevated tariff burden has material implications for procurement strategies across the mining sector. Equipment that previously benefitted from global supply chain efficiencies now carries a substantially higher landed cost, prompting procurement teams to revisit sourcing decisions. Companies relying on popular fixed-wing and rotary-wing models must evaluate the trade-offs between absorbing added duties internally or transferring cost increases down the value chain to end users. At the same time, accessory components such as high-resolution cameras and advanced sensors-integral to geospatial and environmental monitoring applications-have become notably more expensive to import under this reinforced tariff framework.

Beyond immediate price escalations, the tariff landscape has accelerated considerations for supply chain resilience. Many operators are exploring nearshoring or reshoring opportunities for drone assembly and sensor fabrication to mitigate exposure to punitive import duties. Others are investing in partnerships with domestic technology firms to develop indigenous capabilities, thereby avoiding tariff impacts while fostering local innovation ecosystems. This strategic pivot underscores a broader industry response to evolving trade policy, highlighting the interplay between geopolitics, cost containment, and technological adoption.

Unveiling Market Segmentation Insights That Illuminate Diverse Drone Types Models Payloads Autonomy Levels Applications and End-Use Dynamics Driving Growth

Unveiling market segmentation insights reveals a mosaic of drone configurations and capabilities that serve specialized mining tasks. When considering drone type, operators distinguish between aerial units for volumetric mapping and ground vehicles for in-pit inspections, each category offering distinct operational trade-offs in mobility, payload capacity, and deployment logistics. At the model level, fixed-wing platforms excel at long-duration flight missions covering extensive survey areas, while rotary-wing craft provide hover stability for detailed inspections, and hybrid variants bridge endurance with maneuverability.

Payload differentiation further deepens the segmentation narrative, encompassing everything from high-resolution optical cameras and LiDAR scanners for topographic analysis to environmental sensors that monitor dust levels and gas detection units for safety compliance. In parallel, the advent of ground penetrating radar (GPR) and advanced GPS navigation systems has enabled subsurface mapping and precise vehicular positioning in dynamic mining environments. Autonomy levels bifurcate solutions into fully autonomous fleets capable of unsupervised missions and semi-autonomous setups that require operator intervention for critical maneuvers or decision points.

Application-specific segmentations span across drilling support systems that integrate seamlessly with blast planning workflows to environmental and safety monitoring networks that continuously track air quality and structural integrity. Geological and exploration surveying tasks benefit from specialized photogrammetry packages, while material handling and site transportation scenarios leverage heavier payload drones for rapid cargo lifts. From a market perspective, end-use segmentation highlights cross-industry adoption in construction and oil and gas sectors, but mining remains a leading vertical where operators aggressively pursue unmanned solutions to optimize extraction processes and maintain regulatory compliance.

This comprehensive research report categorizes the Autonomous Mining Drones market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Drone Type

- Drone Model

- Payload Type

- Autonomy Level

- Application

- End-Use

Mapping Regional Dynamics in the Autonomous Mining Drone Market to Reveal Strategic Opportunities Across Americas Europe Middle East & Africa and Asia-Pacific

Regional analysis of autonomous mining drone deployments reveals distinct growth drivers and market dynamics. In the Americas, North and South American operators lead the charge with large-scale open-pit implementations that harness beyond-visual-line-of-sight (BVLOS) frameworks to conduct daily volumetric and perimeter surveys. A notable example is the systematic application of dock-based aerial systems at a major copper operation in Peru, where automated inspection cycles have improved data refresh rates from monthly to daily intervals.

Across Europe, Middle East & Africa, regulatory harmonization and strategic mining initiatives have catalyzed adoption, particularly in regions where environmental monitoring and community safety are tightly regulated. European OEMs have partnered with utility firms and construction companies to integrate LiDAR-equipped UAVs for tailings-dam assessments, while African mining conglomerates deploy drones for wildlife boundary surveillance and artisanal mining curtailment, reflecting a blend of sustainability and security motivations.

In Asia-Pacific, aggressive infrastructure investments and supportive policy frameworks have created fertile ground for autonomous drone innovation. Australia’s iron-ore giants have rolled out surveybot fleets capable of logging hundreds of missions per month, supported by robust Starlink connectivity and remote command centers. Furthermore, pilot programs in Southeast Asia leverage hybrid drones to navigate dense terrain for exploration and geological mapping, underscoring the region’s appetite for scalable aerial data solutions in both surface and underground operations.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Mining Drones market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading OEMs Service Providers and Mining Giants Driving the Development and Deployment of Autonomous Drone Solutions in the Mining Sector

A cohort of pioneering companies is shaping the trajectory of autonomous mining drone solutions. Skycatch, originally known for its aerial cloud-service model, has matured into a comprehensive offering for surface mining applications, pairing robust quadcopter designs with AI-driven analytics for volumetric calculations and hazard detection. Their collaborations with top miners exemplify how turnkey data pipelines can accelerate site planning cycles and safety audits.

Meanwhile, Brisbane-based Australian Droid and Robot has advanced ground-oriented robotic platforms capable of thriving in arduous underground and open-pit conditions. Their recent investment round underscores market confidence in ground-based sensors and measurement bots, which operate continuously to capture geotechnical metrics without halting production schedules. On the aerial front, European firms like Delair complement fixed-wing flight capabilities with enterprise-grade software stacks, enabling multi-disciplinary use cases ranging from pipeline inspections to environmental surveys, supported by a global office footprint.

Service-based innovators such as RocketDNA have demonstrated the feasibility of unmanned “drone-in-a-box” systems in live mining scenarios, logging thousands of autonomous missions within months of deployment and validating the concept of truly unattended operations. At the same time, sensor-specialist companies are collaborating with platform providers to integrate cutting-edge GPR, multispectral, and gas detection modules, creating adaptable payload suites that address evolving regulatory requirements and operational objectives.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Mining Drones market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AgEagle Aerial Systems Inc.

- Airobotics Inc.

- Delair S.A.

- DroneDeploy Inc.

- Epiroc AB

- Exyn Technologies

- Hexagon AB

- Luleå University of Technology

- Nelson Brothers Inc.

- Ondas Holdings Inc.

- Parrot SA

- Percepto Inc.

- Sandvik AB

- Skycatch Inc.

- Skydio Inc.

- SPH Engineering

- SZ DJI Technology Co., Ltd.

- Terra Drone

- Topcon Corporation

- Trimble Inc.

- Vision Aerial, Inc.

Actionable Recommendations to Empower Mining Executives to Leverage Autonomous Drone Technologies Optimize Safety Elevate Productivity and Streamline Operations

Executives should prioritize building interoperable data infrastructures that accommodate aerial and ground drone inputs within existing digital ecosystems. This means investing in centralized command platforms capable of ingesting photogrammetry outputs, LiDAR models, and environmental sensor feeds in real time, facilitating cross-functional teams to act on unified insights. By standardizing data formats and establishing API-driven integrations, mining operators can reduce informational silos and accelerate decision cycles.

Operational leaders must also consider the total cost of ownership when integrating unmanned systems. Beyond procurement, budgets should account for maintenance of charging docks, sensor calibration schedules, and software subscription fees. Engaging in joint development agreements with technology vendors can yield customized solutions that align with specific site topographies and process workflows. Such partnerships often unlock preferential pricing and enhanced post-deployment support.

Additionally, organizations must adopt comprehensive training programs that extend beyond piloting skills. Safety protocols for automated operations, drone traffic management processes, and anomaly response procedures require multidisciplinary competency development. Embedding unmanned system best practices into corporate governance frameworks ensures operational continuity and risk mitigation as fleets scale across multiple sites.

Detailing Rigorous Research Methodology Incorporating Primary Interviews Secondary Data Analysis and Advanced Modeling to Provide Actionable Market Intelligence

This research project integrated a multi-phase approach combining both qualitative and quantitative methodologies to ensure robust market intelligence. Primary data collection involved in-depth interviews with C-level mining executives, drone solution architects, and regulatory authorities to capture firsthand insights on deployment challenges, technology preferences, and adoption roadmaps. Interviews were conducted under confidentiality agreements, ensuring candid discourse on operational imperatives and strategic priorities.

Secondary research encompassed a thorough review of technical white papers, industry publications, and patent filings to map evolving technological capabilities and competitive landscapes. Trade journals and public statements by leading OEMs provided a foundation for identifying hardware advancements and software integration trends.

The data synthesis phase employed advanced modeling techniques, including scenario analysis and readiness maturity assessments, to evaluate vendor solution sets against defined operational criteria. Validation workshops with subject-matter experts further refined the findings, resulting in a comprehensive report that balances empirical evidence with actionable market perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Mining Drones market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Mining Drones Market, by Drone Type

- Autonomous Mining Drones Market, by Drone Model

- Autonomous Mining Drones Market, by Payload Type

- Autonomous Mining Drones Market, by Autonomy Level

- Autonomous Mining Drones Market, by Application

- Autonomous Mining Drones Market, by End-Use

- Autonomous Mining Drones Market, by Region

- Autonomous Mining Drones Market, by Group

- Autonomous Mining Drones Market, by Country

- United States Autonomous Mining Drones Market

- China Autonomous Mining Drones Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Summarizing Key Insights on the Adoption and Impact of Autonomous Drone Solutions in Mining While Underscoring Their Strategic Value for Industry Stakeholders

The convergence of aerial and ground autonomous systems is redefining how mining companies approach site surveying, environmental monitoring, and operational safety. High-precision mapping, enabled by LiDAR and multispectral payloads, offers granular insights that were previously unattainable through conventional means. When coupled with ground robots equipped for geotechnical and logistical tasks, the result is a harmonious ecosystem that elevates both productivity and risk management.

Tariff dynamics in 2025 have reshaped procurement strategies, driving a shift toward supply chain localization and strategic vendor partnerships. At the same time, regional market differences underscore the need for tailored deployment frameworks-what succeeds in the Americas may require adaptation to regulatory and infrastructural realities in EMEA or Asia-Pacific.

As the ecosystem matures, industry stakeholders who invest in scalable data architectures, foster cross-sector collaborations, and cultivate workforce competencies will be best positioned to harness the full potential of autonomous drone technologies. This strategic alignment of technology, policy, and talent will ultimately dictate competitive leadership in the evolving landscape of unmanned mining solutions.

Engage Directly with Our Sales and Marketing Associate Director to Secure Access to the Comprehensive Autonomous Mining Drone Market Research Report

For tailored guidance on how these insights apply directly to your organization, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure a personalized walkthrough of the report’s most impactful findings and recommendations. Engaging directly with this senior member of our commercial team ensures you receive a comprehensive understanding of how autonomous drone innovations can drive measurable improvements in productivity, safety, and cost efficiency at your mining operations. Act now to obtain the full market research report and position your company at the forefront of mining industry transformation through advanced unmanned aerial and ground systems.

- How big is the Autonomous Mining Drones Market?

- What is the Autonomous Mining Drones Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?