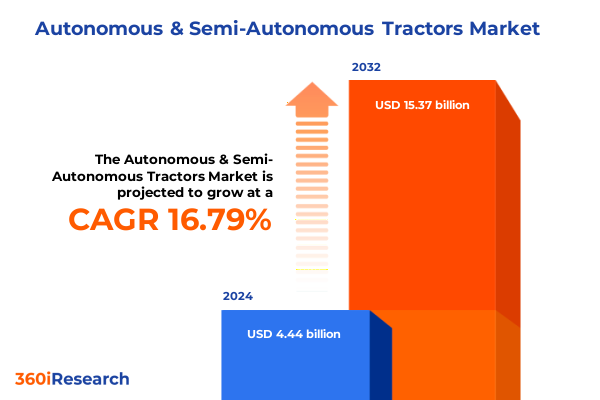

The Autonomous & Semi-Autonomous Tractors Market size was estimated at USD 2.52 billion in 2025 and expected to reach USD 2.77 billion in 2026, at a CAGR of 9.94% to reach USD 4.91 billion by 2032.

Exploring the Emergence of Autonomous and Semi-Autonomous Tractors Revolutionizing Modern Agriculture Through Innovative Robotics and AI Integration

Autonomous and semi-autonomous tractors represent a watershed moment in the evolution of agricultural machinery, heralding a new era characterized by precision, scalability, and efficiency. With the integration of advanced robotics, artificial intelligence, and sensor-based navigation systems, these tractors are not merely incremental upgrades but foundational shifts that redefine traditional farming paradigms. As global demands for sustainable food production intensify, the ability to optimize resource allocation, streamline operations, and minimize waste becomes pivotal. Autonomous solutions address these challenges head-on by delivering consistent, high-quality field operations while reducing reliance on manual labor and mitigating human error.

Emerging from years of research and iterative innovation, semi-autonomous tractors bridge the gap between conventional machinery and fully robotic operations. They offer customizable automation levels, empowering operators to retain manual control during complex tasks or delegate routine activities to onboard systems. This flexibility facilitates smoother technology adoption by allowing stakeholders to align automation strategies with existing workflows and workforce capabilities. Consequently, the tractor market is transitioning from a cost-driven investment model to a value-based approach, where the focus lies on long-term productivity gains, environmental stewardship, and adaptability in the face of evolving agronomic demands.

Examining the Pivotal Technological and Operational Shifts Driving the Rapid Evolution of Autonomous Tractor Ecosystems Across Farming Operations

Recent years have witnessed a surge of transformative shifts within the agricultural equipment landscape, propelled by advances in computer vision, machine learning, and connectivity. These technological breakthroughs enable tractors to perform GPS-guided path planning, real-time obstacle detection, and adaptive decision-making under varying soil and weather conditions. Additionally, the advent of edge computing and 5G networks allows for seamless data exchange between machines, central command units, and cloud-based analytics platforms, creating a cohesive digital ecosystem.

Meanwhile, operational models are evolving to accommodate these innovations, with service-based frameworks emerging alongside traditional equipment sales. This transition underscores a broader move toward outcome-focused engagements, in which manufacturers, technology providers, and end users collaborate on subscription or leasing arrangements. Flexibility in deployment has been complemented by an uptick in collaborative research initiatives involving universities, agricultural cooperatives, and private R&D centers. Such partnerships are catalyzing faster iteration cycles and more robust validation protocols, thereby de-risking investments and accelerating time-to-value for end users. Taken together, these shifts are converging to create a more resilient, intelligent, and data-driven agricultural machinery sector.

Analyzing the Collective Impact of 2025 United States Tariffs on Autonomous Tractor Supply Chains, Cost Structures, and Competitive Dynamics in Agriculture

In 2025, a series of adjustments to United States import tariffs imposed on precision robotics and advanced electronics have triggered a cascade of supply chain realignments in the autonomous tractor segment. Manufacturers reliant on high-precision sensors, LIDAR units, and specialized chipsets have faced heightened procurement costs, prompting strategic reassessments of overseas component sourcing. To offset these burdens, several organizations have initiated nearshoring initiatives, relocating critical manufacturing tasks to North America or forging new partnerships with domestic suppliers.

These shifts have not only affected unit economics but have also reshaped competitive dynamics. Companies with vertically integrated operations have gained an edge in cost control and quality assurance, while those dependent on fragmented global supply chains have encountered tighter margins and longer lead times. Simultaneously, the tariff-driven impetus has spurred innovation in alternative sensor technologies and open-architecture control systems, as industry players seek resilient solutions that mitigate exposure to fluctuating trade policies. Ultimately, the 2025 tariff adjustments have acted as both a catalyst and a constraint, accelerating strategic consolidation while underscoring the importance of supply chain agility in a geopolitically complex environment.

Uncovering Segmentation Insights Revealing How Autonomy Levels, Tractor Types, Power Outputs, Fuel Technologies, and Applications Shape Market Trajectories

A nuanced understanding of market segmentation is essential to navigate the multifaceted autonomous tractor landscape. Based on the level of autonomy, offerings span from semi-autonomous models to fully autonomous systems; within the fully autonomous category, distinctions between full automation and high automation capabilities reveal varying degrees of operational independence. Another axis of differentiation lies in tractor type, where the choice between tracked and wheeled tractors influences adaptability to diverse terrain and soil conditions. Power output segmentation-ranging from up to 100 HP to the 100–200 HP bracket, and above 200 HP-dictates the scale and intensity of viable agricultural tasks, signaling where certain solutions may be more applicable.

Fuel type further underscores technology variations: diesel platforms continue to dominate core applications, while electric drivetrains, subdivided into lithium-ion and emerging solid-state battery systems, promise quieter, emission-free operation. Hybrid architectures, encompassing diesel-electric and hydrogen-based configurations, are gaining traction as transitional solutions, balancing range, refueling infrastructure, and environmental considerations. Finally, application-based segmentation highlights how tractors are optimized for harvesting tasks such as combine and forage harvesting, planting activities including seed drilling and transplanting, spraying operations covering fertilizer and pesticide dispersion, and tillage functions encompassing both primary and secondary soil cultivation. Each segment conveys distinct value propositions tied to productivity, sustainability, and cost efficiency, illuminating where adopters can maximize return on investment and where vendors can tailor their go-to-market strategies.

This comprehensive research report categorizes the Autonomous & Semi-Autonomous Tractors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Tractor Type

- Component

- Autonomy Level

- Power Output

- Propulsion Type

- Application

- End User

Highlighting Regional Dynamics Across the Americas, Europe Middle East & Africa, and Asia-Pacific That Drive Adoption of Autonomous and Semi-Autonomous Tractors

Regional dynamics play an instrumental role in shaping the trajectory of autonomous and semi-autonomous tractor adoption. In the Americas, large-scale commercial farms and crop-intensive operations are benchmarking precision agriculture use cases, leveraging government incentives and well-established logistics networks to facilitate deployments. A mature aftermarket and service infrastructure in North and South America further underpins end-user confidence, enabling scale-up strategies and continuous performance optimization through data-driven maintenance programs.

Across Europe, the Middle East, and Africa, regulatory frameworks emphasizing carbon neutrality and water conservation are catalyzing interest in low-emission, high-efficiency machinery. Western European markets are early adopters of stringent sustainability requirements, while emerging economies in the Middle East and North Africa are piloting automation investments to address labor shortages and water scarcity. In sub-Saharan regions, smaller farm sizes and fragmented land holdings present challenges, but localized leasing models and cooperative ownership structures are unlocking pathways for technology diffusion.

In the Asia-Pacific region, rapid modernization of agricultural practices in China, India, and Southeast Asia is fueling demand for flexible automation solutions. Varying land parcel structures, seasonal labor availability, and rising digital infrastructure investments differentiate adoption curves. Collaborative agreements between local OEMs and international technology providers are accelerating product localization, ensuring that hardware and software platforms resonate with region-specific agronomic and operational requirements.

This comprehensive research report examines key regions that drive the evolution of the Autonomous & Semi-Autonomous Tractors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players Shaping the Future of Autonomous Tractor Technologies Through Strategic Innovations and Partnerships

The competitive landscape of autonomous tractor technology is defined by a convergence of traditional agricultural machinery OEMs and specialized technology firms. Established manufacturers have extended their R&D portfolios to incorporate AI-enabled guidance systems and partnerships with autonomous system start-ups, leveraging decades of engineering expertise and dealer networks. Conversely, technology-centric companies offer modular retrofit kits and open-architecture software platforms, empowering retrofit integration on legacy equipment and fostering an ecosystem of third-party developers.

Strategic alliances have become a common modus operandi: cross-sector collaborations with sensor manufacturers, communication service providers, and cloud analytics vendors accelerate time-to-market and enhance system interoperability. Leading enterprises are investing in data management frameworks that integrate telematics, environmental monitoring, and agronomic insights to deliver prescriptive recommendations and predictive maintenance alerts. As manufacturing fundamentals interact with software-defined value chains, the industry is witnessing a shift toward outcome-based service agreements, in which performance benchmarks replace unit-for-unit sales metrics as the primary measure of success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous & Semi-Autonomous Tractors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Deere & Company

- Kubota Corporation

- CNH Industrial N.V.

- Mahindra & Mahindra Ltd.

- Yanmar Holdings Co., Ltd.

- Hexagon AB

- Sabi Agri

- Zimeno Inc.

- TYM Corporation

- SDF S.p.A.

- AGCO Corporation

- Amos Power, Inc.

- Antonio Carraro S.p.A.

- Daedong Corporation

- EOX Tractors B.V.

- ISEKI & CO., LTD.

- LS Mtron Ltd.

- Weichai Lovol Intelligent Agricultural Technology CO., LTD

- Zoomlion Agriculture Machinery Co., Ltd.

- Ztractor Inc.

Actionable Recommendations for Industry Leaders to Accelerate Adoption, Drive Operational Excellence, and Foster Sustainable Growth in Autonomous Farming

To navigate the complexities and capitalize on the promise of autonomous tractor technologies, industry leaders should consider a structured roadmap. Prioritizing research partnerships and pilot programs can accelerate validation cycles while demonstrating proof of concept within representative farm environments. This stage should include rigorous safety assessments, operator training modules, and integration with existing farm management systems to ensure seamless adoption.

Next, stakeholders are advised to invest in scalable data architectures that underpin continuous improvement through real-time performance feedback loops. Embracing cloud-native platforms and edge analytics will reduce latency and facilitate localized decision-making. Simultaneously, engaging with policy makers and regulatory bodies can shape future standards and secure incentives for automated equipment deployment. Lastly, fostering cross-functional teams that blend agronomy expertise, robotics engineering, and business strategy will enable organizations to pivot as market conditions evolve. By adopting a holistic approach-spanning technology validation, data infrastructure, regulatory alignment, and organizational capability building-leaders can unlock sustainable growth and reinforce their position at the vanguard of precision agriculture.

Defining Rigorous Research Methodology Embracing Quantitative Data Analysis, Qualitative Expert Insights, and Advanced Validation Techniques for Robust Findings

This study employed a comprehensive research methodology combining primary and secondary approaches to ensure robust, unbiased findings. Primary research involved in-depth interviews with equipment manufacturers, technology providers, agricultural producers, and sector analysts, yielding qualitative insights into operational challenges, adoption drivers, and innovation roadblocks. Complementing these dialogues, expert panels and workshops validated preliminary hypotheses and stress-tested emerging trends under diverse agronomic and economic scenarios.

Secondary research encompassed a systematic review of industry white papers, peer-reviewed journals, government publications, and patent filings to capture macroeconomic factors, technological benchmarks, and evolving regulatory frameworks. Data triangulation techniques were applied to reconcile divergent data points and enhance the integrity of thematic conclusions. Throughout the process, advanced validation protocols-such as cross-referencing vendor claims with third-party performance evaluations and conducting site visits-reinforced the credibility of the final analysis. This multi-method approach underpins the actionable insights and strategic recommendations presented herein, ensuring they are grounded in both empirical evidence and real-world applicability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous & Semi-Autonomous Tractors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous & Semi-Autonomous Tractors Market, by Offering

- Autonomous & Semi-Autonomous Tractors Market, by Tractor Type

- Autonomous & Semi-Autonomous Tractors Market, by Component

- Autonomous & Semi-Autonomous Tractors Market, by Autonomy Level

- Autonomous & Semi-Autonomous Tractors Market, by Power Output

- Autonomous & Semi-Autonomous Tractors Market, by Propulsion Type

- Autonomous & Semi-Autonomous Tractors Market, by Application

- Autonomous & Semi-Autonomous Tractors Market, by End User

- Autonomous & Semi-Autonomous Tractors Market, by Region

- Autonomous & Semi-Autonomous Tractors Market, by Group

- Autonomous & Semi-Autonomous Tractors Market, by Country

- United States Autonomous & Semi-Autonomous Tractors Market

- China Autonomous & Semi-Autonomous Tractors Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Summarizing Key Insights and Strategic Imperatives That Underscore the Transformative Potential of Autonomous and Semi-Autonomous Tractors

The evolution of autonomous and semi-autonomous tractors is reshaping the agricultural equipment landscape, offering unparalleled opportunities to enhance productivity, sustainability, and operational resilience. Technological advancements in robotics, artificial intelligence, and connectivity have unlocked a spectrum of automation levels that can be tailored to diverse farm sizes, crop types, and geographic conditions. At the same time, the 2025 United States tariff adjustments have reinforced the imperative for supply chain flexibility and component diversification, spurring both nearshoring and innovation in alternative system architectures.

Through a nuanced segmentation lens that encompasses autonomy level, tractor design, power output, fuel system, and application focus, stakeholders can precisely target investments and partnerships to align with strategic priorities. Regional insights further reveal how geographies vary in readiness and regulatory drivers, underscoring the need for localized go-to-market approaches. By combining these layers of analysis with a clear action roadmap and rigorous methodology, industry leaders are positioned to harness the transformative potential of autonomous tractors. Ultimately, embracing these innovations will not only optimize farm operations but also contribute to global food security, resource conservation, and economic development in agricultural communities.

Connect with Ketan Rohom, Associate Director Sales & Marketing, to Secure In-Depth Autonomous Tractor Market Intelligence and Propel Your Strategic Growth

To explore crucial insights and harness the full potential of autonomous tractor innovations, connect directly with Ketan Rohom, an established Associate Director focusing on Sales and Marketing. Engage in a detailed conversation about how in-depth market intelligence and comprehensive data on technology adoption, regulatory impacts, and competitive positioning can empower your organization to make informed strategic moves. This tailored engagement will outline bespoke research options aligned with your specific operational challenges, risk tolerance, and growth objectives. Take proactive steps today to ensure your teams have access to the latest autonomous and semi-autonomous tractor analyses, driving efficiency, reducing costs, and fostering sustainable agricultural practices. Reach out to secure an exclusive briefing and customized proposal that will equip you with the insights necessary to outperform in an increasingly automated agricultural landscape.

- How big is the Autonomous & Semi-Autonomous Tractors Market?

- What is the Autonomous & Semi-Autonomous Tractors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?