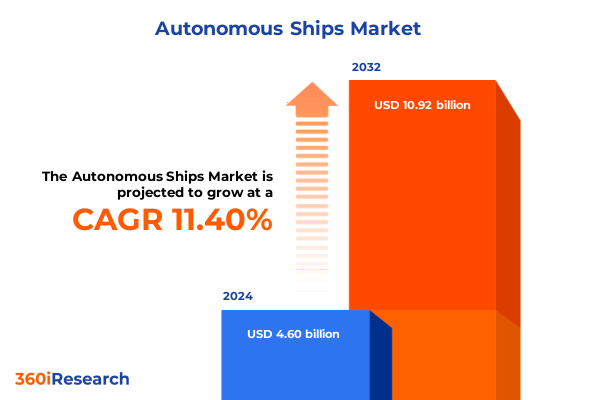

The Autonomous Ships Market size was estimated at USD 5.10 billion in 2025 and expected to reach USD 5.66 billion in 2026, at a CAGR of 11.48% to reach USD 10.92 billion by 2032.

Setting Sail on Autonomous Shipping: Understanding the Core Concepts Driving Transformation in Maritime Operations and Strategic Implications

Autonomous shipping represents a paradigm shift in maritime operations, reshaping how vessels navigate, communicate, and execute mission-critical tasks. Driven by advances in artificial intelligence, sensor networks, and connectivity protocols, these vessels are redefining the boundaries of efficiency, safety, and economic viability on the world’s oceans. As traditional seafaring models confront labor shortages and escalating operational costs, autonomous capabilities offer a compelling alternative that can streamline decision making, reduce human error, and enhance real-time responsiveness to dynamic environmental conditions.

Beyond the technological allure, driven vessels embody strategic implications for stakeholders across the maritime value chain. Shipowners and operators must recalibrate asset management strategies to integrate remote monitoring and predictive maintenance within established frameworks. Regulators are adapting to address cybersecurity vulnerabilities and liability questions arising from reduced onboard crews. Investors and insurers are evaluating novel risk profiles tied to unmanned navigation systems and data-driven performance analytics. This introductory overview establishes the foundation for understanding both the promise and the challenges that underpin the autonomous shipping revolution.

Charting Unprecedented Shifts in Autonomous Maritime Landscape Fueled by Technological Innovation and Regulatory Evolution Across Global Shipping

The autonomous shipping landscape is undergoing a radical transformation driven by a convergence of technological breakthroughs and evolving regulatory frameworks. Artificial intelligence algorithms now enable vessels to interpret complex oceanographic and meteorological data streams, facilitating adaptive routing that optimizes fuel consumption and shortens transit times. Simultaneously, edge-computing architectures provide real-time decision support for collision avoidance systems, allowing ships to respond autonomously to unexpected obstacles without compromising safety. These technical advances are complemented by a maturing ecosystem of digital twins, which allow operators to simulate mission scenarios, forecast performance metrics, and identify bottlenecks before deploying vessels at scale.

Regulatory bodies and classification societies are playing a pivotal role in steering these shifts toward operational readiness. Standards for autonomous functionality, data security, and system redundancies are emerging across major flag states, reducing certification barriers and fostering cross-border interoperability. Furthermore, industry consortia are collaborating on best practices for remote diagnostics and crew augmentation models that blend human oversight with autonomous controls. Taken together, the intersection of innovation and regulation is charting a new course for maritime operations that balances agility with accountability.

Decoding the Layered Consequences of United States Tariff Strategies on Autonomous Vessel Technologies and Supply Chains in 2025 Trading Environments

Changes to United States tariff policies in 2025 are reshaping the cost structures and supply chain dynamics for autonomous ship components and systems. Elevated duties on imported steel, semiconductors, and specialized sensor modules are increasing the landed cost of hardware elements such as navigation radars and hull-integrated sensors. These adjustments are prompting procurement teams to explore domestic manufacturing partnerships or nearshoring arrangements to contain production expenses and maintain lead times. In parallel, higher tax rates on foreign software licenses and consulting services are influencing the total cost of ownership for autonomy software platforms and fleet management solutions.

In response to these tariff-driven pressures, industry participants are recalibrating sourcing strategies and conducting detailed cost-benefit assessments of vertical integration versus external supply relationships. Some technology providers are localizing assembly operations in key U.S. shipyard hubs to mitigate duties while ensuring rapid service response. Meanwhile, logistics managers are optimizing distribution networks to navigate customs complexities and reduce demurrage risks. These cumulative impacts underscore the importance of a resilient procurement framework that can absorb policy volatility without compromising vessel performance or project timelines.

Unlocking Market Dynamics Through Multidimensional Segmentation Spanning Operation Modes Ship Types Systems Applications Vessel Sizes and Propulsion

A nuanced understanding of market segmentation provides clarity on where autonomous shipping solutions deliver the greatest value and how vendors can tailor offerings to specific operational scenarios. When differentiated by operation mode, fully autonomous configurations offer maximal efficiency gains in predictable open-ocean routes, whereas semi-autonomous setups balance human oversight with automated navigation for complex coastal or port maneuvers. Ship type segmentation highlights that dry bulk carriers and ore carriers benefit from cost-optimization algorithms that minimize ballast operations, while reefers and standard container vessels leverage temperature-controlled sensor integration and route optimization to preserve cargo integrity.

Examining the system-level breakdown reveals that communication systems and navigation equipment underpin secure data exchanges and precision positioning, while advanced sensors enable situational awareness in challenging conditions. Consulting services and training programs ensure crew and shore-based teams adopt best practices for remote monitoring, whereas autonomy and fleet management software create holistic control fabrics that synchronize vessel operations. Application-focused insights show that cargo transport drives initial adoption curves, defense and security projects catalyze high-reliability standards, and survey vessels benefit from precision mapping capabilities. Vessel size and propulsion segmentation indicate that large diesel-powered ships prioritize fuel efficiency optimization, medium electric-hybrid platforms focus on harbor emissions regulations, and small vessels integrate modular autonomy packs for coastal patrol duties.

This comprehensive research report categorizes the Autonomous Ships market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Operation Mode

- Ship Type

- System

- Application

- Vessel Size

- Propulsion

Navigating Regional Divergence in Autonomous Shipping Adoption and Growth Trajectories Across Americas Europe Middle East Africa and Asia Pacific

Regional dynamics play a critical role in autonomous shipping adoption, with adoption curves and infrastructure readiness diverging across the Americas, Europe Middle East and Africa, and Asia Pacific. In the Americas, proactive policy incentives and private sector pilots are accelerating trials in coastal trade corridors and inland waterway routes. Several North American ports have upgraded their digital infrastructure to support autonomous berthing trials, fostering collaboration between technology vendors and local port authorities. Latin American nations are exploring similar use cases for mineral and agricultural exports, leveraging semi-autonomous convoy models to navigate long-haul supply chains.

In Europe Middle East and Africa regions, stringent decarbonization targets and safety regulations are catalyzing demand for zero-emission vessel prototypes and advanced navigation redundancies. Port clusters in Northern Europe have emerged as testing grounds for fully autonomous transits, while consortium-driven projects in the Middle East are focusing on autonomous patrol vessels for security and offshore oilfield support. Asia Pacific continues to lead in scale, with major shipyards in East Asia integrating autonomy modules into new builds and retrofit programs. Collaboration between regional classification societies and technology consortia is fostering standardized frameworks that expedite market entry and enable interregional deployment.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Ships market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Strategic Postures and Competitive Profiles of Leading Stakeholders Shaping the Autonomous Shipping Ecosystem with Pioneering Solutions

Leading stakeholders within the autonomous shipping ecosystem are deploying distinct strategies to capture emerging opportunities. Engineering-focused incumbents are expanding research partnerships with academic institutions to enhance sensor accuracy and machine learning models. Technology integrators are investing in end-to-end platforms that unify hardware, software, and service components, positioning themselves as single-source providers for complex retrofits and newbuild projects. Collaborative alliances between electronics providers and maritime service firms are fostering co-development efforts, enabling seamless integration of navigation suites with fleet management dashboards.

Some pioneering shipping lines have established internal autonomy centers of excellence to spearhead pilot programs, gather operational data, and iteratively refine system performance. Meanwhile, defense contractors are adapting military-grade autonomy solutions for commercial survey and offshore support applications, driving cross-sector innovation. These diverse corporate initiatives reflect a broader trend toward ecosystem orchestration, where success increasingly depends on forging multi-stakeholder partnerships, sharing interoperable standards, and co-investing in joint testing facilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Ships market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- BAE Systems plc

- Buffalo Automation

- Damen Shipyards Group N.V.

- DNV AS

- Fugro N.V.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- MARSS Group, Inc.

- Mitsubishi Heavy Industries, Ltd.

- Mitsui E&S Shipbuilding Co., Ltd.

- Orca AI

- QinetiQ plc

- Rolls-Royce plc

- Saab AB

- Saildrone, Inc.

- Samsung Heavy Industries Co., Ltd.

- Sea Machines Robotics, Inc.

- Teledyne Technologies Incorporated

- Wärtsilä Corporation

Empowering Industry Leadership with Targeted Strategies to Capitalize on Autonomous Maritime Advancements and Drive Sustainable Competitive Advantage

To capitalize on the transformative potential of autonomous maritime technologies, industry leaders should prioritize partnerships that integrate domain expertise with advanced R&D capabilities. Establishing strategic alliances with sensor manufacturers and autonomy software developers enables accelerated deployment of scalable solutions while mitigating integration risks. Organizations should invest in digital twin environments that replicate real-world operational conditions, allowing for continuous performance validation and rapid iteration of control algorithms under diverse scenarios.

Furthermore, embedding cybersecurity protocols at the design stage and conducting regular vulnerability assessments will safeguard remote operations against evolving threats. Executives should also engage proactively with regulatory authorities to shape pragmatic certification pathways and ensure alignment with international conventions. Embracing modular hardware architectures and open API frameworks will future-proof investments, enabling seamless upgrades as new capabilities emerge. This actionable roadmap empowers decision makers to drive sustainable innovation, reduce time to market, and maintain a competitive edge in the next generation of maritime transport.

Methodological Framework Underpinning Robust Autonomous Shipping Analysis Through Rigorous Primary Research Secondary Validation and Expert Synthesis

The insights presented are grounded in a rigorous research methodology that blends qualitative and quantitative approaches to deliver robust analysis. Primary interviews with vessel operators, technology providers, and regulatory authorities provided firsthand perspectives on operational challenges, deployment barriers, and success factors. These insights were complemented by secondary research encompassing industry publications, patent filings, whitepapers, and standards documentation to capture the full spectrum of technological progress and policy developments.

Data triangulation was employed to validate trends across multiple sources, ensuring coherence between empirical observations and documented evidence. Expert workshops facilitated synthesis of core themes, while case study analyses highlighted best practices and innovative applications. The methodology prioritized transparency and replicability, with clearly defined data collection protocols, interview guides, and validation checklists underpinning each phase of the study. This comprehensive framework ensures confidence in the findings and supports informed decision making across stakeholder groups.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Ships market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Ships Market, by Operation Mode

- Autonomous Ships Market, by Ship Type

- Autonomous Ships Market, by System

- Autonomous Ships Market, by Application

- Autonomous Ships Market, by Vessel Size

- Autonomous Ships Market, by Propulsion

- Autonomous Ships Market, by Region

- Autonomous Ships Market, by Group

- Autonomous Ships Market, by Country

- United States Autonomous Ships Market

- China Autonomous Ships Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Converging Insights on Autonomous Maritime Transformation Emphasizing Strategic Priorities and Critical Imperatives for Future-Ready Shipping Ventures

The advent of autonomous shipping heralds a new era in maritime operations, with transformative implications for efficiency, safety, and environmental performance. By integrating advanced autonomy systems, industry participants can unlock unprecedented operational resilience, optimize resource utilization, and navigate complex regulatory landscapes with enhanced agility. The cumulative effects of technological innovation, policy evolution, and evolving stakeholder collaborations underscore the necessity for proactive strategic planning and dynamic capability development.

As momentum builds, organizations that align their investment priorities with the shifts identified herein will be best positioned to harness the full potential of unmanned and crew-reduced vessels. Whether through targeted R&D partnerships, regulatory engagement, or modular technology adoption, the path forward demands a holistic approach that balances innovation with risk management. Embracing these critical imperatives will enable maritime leaders to chart a course toward sustainable growth and enduring competitive advantage in the autonomous shipping domain.

Engage Directly with Associate Director Sales and Marketing to Secure Comprehensive Autonomous Shipping Market Intelligence for Strategic Decision Making

To access the definitive analysis that will guide your organization through the complexity of autonomous maritime innovation, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He will provide personalized guidance on how this detailed research report can support your strategic planning, operational optimization, and competitive positioning. Engage now to leverage expert insights, customized data interpretations, and tailored recommendations that empower you to navigate regulatory landscapes, capitalize on emerging technologies, and accelerate your journey toward fully autonomous maritime operations. Establish direct collaboration to secure the comprehensive intelligence essential for informed decision making and sustained market leadership.

- How big is the Autonomous Ships Market?

- What is the Autonomous Ships Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?