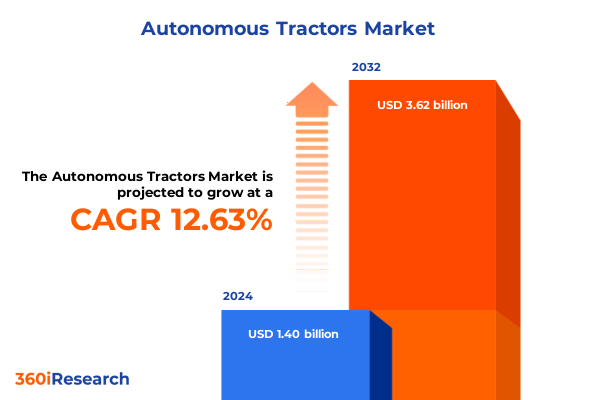

The Autonomous Tractors Market size was estimated at USD 1.57 billion in 2025 and expected to reach USD 1.74 billion in 2026, at a CAGR of 12.66% to reach USD 3.62 billion by 2032.

Discover How Autonomous Tractors Are Revolutionizing Modern Agriculture by Integrating Cutting Edge Robotics with Precision Farming to Boost Efficiency

Discover how autonomous tractors are revolutionizing modern agriculture by integrating cutting edge robotics with precision farming to boost efficiency. Autonomous tractors, equipped with sophisticated sensor arrays and AI-driven control systems, are enabling farmers to perform complex field operations without direct human guidance. This technological shift not only streamlines routine tasks but also enhances accuracy, leading to significant reductions in input waste and labor costs.

As the agricultural sector grapples with labor shortages and the imperative for sustainable practices, the deployment of self-driving tractors emerges as a critical solution. By leveraging machine learning algorithms and real-time data analytics, these machines optimize routes, monitor soil health, and adjust field treatments dynamically. This convergence of automation and situational awareness empowers decision-makers to allocate resources more effectively and respond rapidly to environmental variables, ultimately driving yields upward.

Industry adoption is further propelled by the alignment of agricultural policy incentives and the growing availability of digital infrastructure across rural landscapes. With increasing connectivity and the maturation of telematics platforms, stakeholders gain unprecedented visibility into fleet performance, enabling continuous improvement and iterative refinement of autonomous functionalities.

Unveiling the Key Transformative Shifts in Autonomous Tractor Technology Shaping the Future of Agriculture Through Digitalization and Real Time Data Insights

Unveiling the key transformative shifts in autonomous tractor technology reveals a panorama of innovation that is reshaping every facet of agricultural operations. Advances in sensor fusion and computer vision now allow machines to differentiate between crops and obstacles with remarkable granularity, ensuring precision intervention even in complex terrains. Concurrently, the integration of edge computing capabilities reduces reliance on constant connectivity, enabling autonomous units to execute time-sensitive decisions locally without latency constraints.

The migration from hydraulic to electrified powertrains further underscores the sector’s commitment to sustainability. Electric propulsion not only cuts greenhouse gas emissions but also offers quieter operation and lower maintenance requirements, factors that enhance field safety and operational continuity. In parallel, modular software architectures-underpinned by open APIs-are facilitating interoperability among diverse equipment fleets, unlocking new avenues for collaborative systems and third-party innovation.

Moreover, enhanced telematics and remote monitoring solutions have ushered in an era of predictive maintenance, wherein real-time diagnostics anticipate component degradation before failures occur. This proactivity reduces downtime and service costs, solidifying the trust of end users as autonomous platforms evolve from conceptual prototypes to reliable workhorses in the field.

Analyzing the Cumulative Impact of Recent US Tariffs on Autonomous Tractor Supply Chains and Cost Structures Affecting Technology Adoption and Innovation

Analyzing the cumulative impact of recent US tariffs on autonomous tractor supply chains and cost structures reveals several critical dynamics. Tariffs imposed on steel and aluminum have elevated raw material expenses for chassis and frame components, prompting original equipment manufacturers to reevaluate sourcing strategies. Concurrently, ongoing Section 301 duties on electronic subsystems imported from key trading partners have increased the cost of advanced sensors, guidance modules, and computing units, resulting in tighter price negotiations and stretched development budgets.

These fiscal pressures have accelerated a shift toward domestic supplier ecosystems. Manufacturers are forging partnerships with local steel producers and electronics assemblers, aiming to mitigate tariff exposure and reduce lead times. This realignment, however, brings its own challenges: ramping up domestic manufacturing capacity requires capital investment and workforce training, often extending project timelines and affecting margins.

In response, several industry leaders have adopted a dual sourcing approach, balancing cost-effective imports with in-country production to maintain flexibility. Additionally, strategic design modifications-such as the use of alternative alloys and simplified electronics architectures-are being employed to offset higher tariff burdens. The net effect of this multifaceted strategy is a complex interplay between cost containment and innovation advancement, influencing the pace at which autonomous tractors penetrate mainstream markets.

Revealing Key Segmentation Insights That Illuminate Mobility Application and End User Dimensions Driving Strategic Decisions in Autonomous Tractor Markets

Revealing key segmentation insights that illuminate mobility application and end user dimensions driving strategic decisions in autonomous tractor markets highlights the nuanced demands shaping product development. In the mobility dimension, tracked platforms deliver superior traction and soil preservation on uneven fields, with crawler designs excelling in heavy tillage while rubber tracks offer a balance of flotation and speed. Conversely, wheeled solutions can be optimized for either four wheel drive to tackle demanding topographies or two wheel drive for lighter operations, catering to diverse operational requirements.

When considering applications, the ability to harvest both fruit and vegetables alongside grain underscores the versatility of modern autonomous harvesters. Crop protection functions such as fertilizer application demand precision metering systems, whereas pest management benefits from targeted spraying technologies. Weed management operations, increasingly supported by machine vision, reflect the industry’s pivot toward chemical minimization. In the realm of soil preparation, primary tillage applications leverage robust traction systems, while secondary tillage tools prioritize fine seedbed conditioning and residue management.

End user segmentation further refines market approaches, as agricultural contractors seek flexible fleets that can service multiple clients, and government research institutions prioritize modular platforms for experimental trials. Among commercial farms, large scale operations favor high throughput capabilities, medium scale enterprises require adaptability across shifting crop calendars, and small scale growers look for cost efficient, easy to maintain solutions.

This comprehensive research report categorizes the Autonomous Tractors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mobility

- Application

- End User

Exploring Key Regional Insights Uncovering Unique Opportunities Challenges and Growth Drivers Across Americas Europe Middle East Africa and Asia Pacific

Exploring key regional insights uncovers unique opportunities, challenges, and growth drivers across the Americas, Europe Middle East Africa, and Asia Pacific, emphasizing the geographic diversity of autonomous tractor adoption. In the Americas, widespread consolidation of large scale farms and supportive regulatory frameworks for precision agriculture have fostered substantial investment in automation, with corn and soybean producers leading the charge toward self driving machinery.

Within Europe, Middle East, and Africa, fragmented landholdings and stringent environmental directives are accelerating interest in compact autonomous units for viticulture and specialty crops, complemented by government subsidies aimed at digital agriculture. Meanwhile, emerging markets in the region grapple with infrastructure gaps but exhibit strong research collaborations through public-private partnerships that pilot autonomous systems in controlled environments.

Across the Asia Pacific, acute labor shortages combined with rapidly aging agricultural workforces have precipitated a surge in mechanization, particularly in rice and horticulture segments. Local manufacturers are customizing robotic platforms to address small terraced fields, while multinationals establish regional research centers to adapt navigation algorithms to monsoon conditions and varying soil textures.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Tractors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Delving into Key Company Strategies and Dynamics Illustrating How Leading Equipment Manufacturers and Tech Innovators Propel Autonomous Tractor Innovation

Delving into key company strategies and dynamics illustrates how leading equipment manufacturers and tech innovators propel autonomous tractor innovation through alliances and product differentiation. Established agricultural machinery producers have integrated robotics divisions to complement their legacy portfolios, often acquiring specialized startups to accelerate software development and machine learning capabilities. This trend underscores a strategic pivot toward end to end solutions that combine hardware reliability with advanced analytics.

Simultaneously, sensor and guidance system providers are partnering with original equipment manufacturers to offer modular kits that can retrofit traditional tractors, expanding total addressable markets and facilitating gradual adoption. Collaborative ecosystems are emerging, wherein data sharing agreements enable multi brand interoperability on telematics platforms, fostering a more cohesive digital agriculture landscape.

Furthermore, a growing number of pure play technology firms are entering the sector with AI fueled platforms for tasks such as precision weeding and automated seeding. Their nimble development cycles and venture capital backing pressure incumbents to innovate rapidly, catalyzing a wave of feature enhancements and new service offerings that collectively push the industry forward.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Tractors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGCO Corporation

- Autonomous Solutions Inc

- Autonomous Tractor Corporation

- Bluewhite

- CLAAS KGaA mbH

- CNH Industrial N.V.

- Deere & Company

- FarmDroid

- Iseki & Co., Ltd.

- Kinze Manufacturing Inc

- Kubota Corporation

- Mahindra & Mahindra Ltd.

- Monarch Tractor

- Raven Industries Inc

- SDF Group

- Sonalika International

- Topcon Positioning Systems Inc

- Trimble Inc

- TYM Corporation

- Yanmar Holdings Co., Ltd.

Empowering Industry Leaders with Actionable Recommendations to Navigate Regulatory Shifts Technological Complexities and Market Evolution in Automated Farming

Empowering industry leaders with actionable recommendations to navigate regulatory shifts, technological complexities, and market evolution in automated farming involves a multifaceted approach. First, forging strategic partnerships between OEMs, technology vendors, and academic institutions accelerates R&D efforts while sharing risk. Such collaborations should focus on co developing modular architectures that enable rapid feature updates and cross compatibility across machinery brands.

Second, prioritizing an agile regulatory engagement strategy ensures early alignment with government agencies on safety standards, data privacy, and environmental guidelines. Proactively participating in pilot programs and consortiums can secure influence over evolving policies and reduce time to market.

Third, investing in a robust after sales service network addresses operator concerns around reliability and maintenance. Structured training programs for agronomic advisors and equipment technicians will reinforce trust and streamline fleet integration. Lastly, exploring innovative business models-such as equipment leasing paired with performance based service agreements-lowers entry barriers for end users and creates recurring revenue streams, positioning companies to capitalize on the next wave of autonomous tractor deployment.

Outlining a Rigorous Multi Method Research Framework Combining Primary Interviews Secondary Analysis and Data Triangulation for Autonomous Tractor Insights

Outlining a rigorous multi method research framework combining primary interviews, secondary analysis, and data triangulation for autonomous tractor insights ensures credibility and depth. The research commenced with in depth interviews of OEM executives, agribusiness consultants, and early adopter farm operators to gather firsthand perspectives on technology readiness, operational challenges, and investment priorities.

Secondary research encompassed a comprehensive review of peer reviewed journals, agricultural trade publications, patent filings, and regulatory documents to contextualize market drivers and identify emerging innovation clusters. This was complemented by technical evaluations of existing autonomous platforms and comparative analyses of sensor and powertrain configurations.

Data triangulation validated findings through cross referencing qualitative insights with quantitative observations from field trials and pilot programs. The methodology also incorporated scenario planning to assess the impact of external factors such as tariff changes, policy shifts, and weather variability. This structured approach provides a holistic view of the autonomous tractor ecosystem, ensuring actionable and reliable intelligence for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Tractors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Tractors Market, by Mobility

- Autonomous Tractors Market, by Application

- Autonomous Tractors Market, by End User

- Autonomous Tractors Market, by Region

- Autonomous Tractors Market, by Group

- Autonomous Tractors Market, by Country

- United States Autonomous Tractors Market

- China Autonomous Tractors Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Summarizing the Critical Findings of Autonomous Tractor Advancements and Underscoring Strategic Imperatives to Seize Emerging Opportunities in Agriculture

Summarizing the critical findings of autonomous tractor advancements and underscoring strategic imperatives to seize emerging opportunities in agriculture reveals an industry at a pivotal inflection point. The convergence of advanced sensor technologies, AI enabled navigation, and electrified powertrains is delivering unprecedented operational efficiencies, transforming labor models, and promoting sustainability across diverse crop and soil contexts.

While tariff driven cost pressures and regulatory complexities present notable hurdles, proactive strategic alignment and supplier diversification can mitigate these headwinds. The nuanced segmentation by mobility, application, and end user underscores the importance of tailored solutions that address specific field conditions, operational scales, and service models.

Ultimately, stakeholders who adopt an integrated approach-combining technological innovation with collaborative partnerships and agile business models-will be best positioned to lead the next wave of automated farming. The insights outlined herein offer a roadmap for navigating the dynamic landscape, fostering resilient growth and unlocking the full potential of autonomous tractor solutions.

Engage Directly with Ketan Rohom Associate Director Sales Marketing to Access Research Empowering Strategic Decisions in Autonomous Tractor Solutions

Engage directly with Ketan Rohom, Associate Director of Sales and Marketing, to access research empowering strategic decisions in autonomous tractor solutions. Uncover exclusive insights tailored to your organization’s unique challenges and priorities. By partnering with our team, you gain a comprehensive perspective on evolving technologies, regulatory developments, and regional dynamics that shape the trajectory of automated farming.

Our collaboration model prioritizes personalized consultations, whereby Ketan Rohom will guide you through key findings, discuss specific application scenarios, and align research outcomes with your operational objectives. This engagement ensures you receive targeted recommendations, customized data analyses, and timely updates on emerging trends. Secure your competitive edge by leveraging this premium research offering that transforms market intelligence into actionable strategies.

- How big is the Autonomous Tractors Market?

- What is the Autonomous Tractors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?