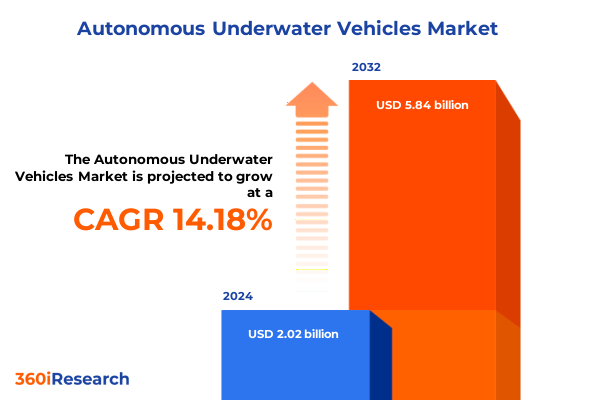

The Autonomous Underwater Vehicles Market size was estimated at USD 2.29 billion in 2025 and expected to reach USD 2.59 billion in 2026, at a CAGR of 14.31% to reach USD 5.84 billion by 2032.

Embarking on a New Depth of Innovation with Autonomous Underwater Vehicles Transforming Marine Operations Across Industries

Autonomous underwater vehicles (AUVs) represent a transformative leap in marine technology, blending robotics, sensor innovation, and advanced data analytics to explore and monitor subsea environments without direct human intervention. These unmanned platforms navigate complex underwater terrains to perform tasks ranging from high-resolution seabed mapping to infrastructure inspection and scientific research. Over the past decade, AUVs have evolved from experimental prototypes to mission-critical assets employed by navies, research institutions, and commercial enterprises worldwide.

As global demand for situational awareness beneath the waves intensifies, AUVs have become indispensable for ensuring maritime security, enabling environmental monitoring, and supporting offshore energy operations. Advancements in propulsion efficiency, power storage, and miniaturized electronics have extended mission durations and depths of operation, facilitating continuous data collection in areas previously deemed inaccessible or prohibitively risky. Moreover, real-time communication enhancements now allow operators to adjust mission parameters on the fly, optimizing survey outcomes and reducing operational costs.

Looking ahead, the convergence of artificial intelligence, machine learning, and underwater swarm capabilities promises to unlock new dimensions of autonomy, collaboration, and adaptability. By integrating predictive analytics and adaptive control systems, next-generation AUVs will navigate dynamic currents, obstacle-laden passages, and evolving mission objectives with minimal human oversight. This strategic introduction sets the stage for a deeper exploration of the forces reshaping the AUV landscape, from geopolitical shifts to technological breakthroughs, offering a comprehensive lens into an industry at the vanguard of marine innovation.

Navigating Tides of Technological Revolution: Transformative Shifts Driving the Future of Underwater Robotics in Marine Missions

In recent years, the underwater robotics sector has witnessed seismic technological shifts that are redefining mission capabilities and operational paradigms. One of the most notable developments is the integration of sophisticated artificial intelligence engines, which empower AUVs to autonomously detect, classify, and respond to acoustic and visual stimuli in real time. This leap was exemplified by a European defense start-up unveiling mini submersibles capable of patrolling for months while autonomously identifying subtle acoustic signatures at scale to safeguard critical undersea infrastructure.

Concurrently, major naval forces are adopting iterative, test-driven approaches modeled after space industry pioneers to accelerate AUV development cycles. By deploying early-stage prototypes alongside conventional vessels in diverse environments, militaries can rapidly incorporate user feedback, refine hardware configurations, and deploy software updates. This agile methodology mirrors the ethos of commercial spacecraft development and has been credited with shortening iteration timelines, increasing system resilience, and expanding mission envelopes for tasks such as intelligence collection and mine countermeasures.

Moreover, breakthroughs in materials science and battery chemistry are enabling long-endurance missions at greater depths. Combined with modular sensor architectures, these advancements allow operators to tailor vehicle payloads to mission objectives-whether conducting deep-sea biodiversity studies or executing covert surveillance. These transformative shifts underscore a broader trajectory toward more adaptive, high-throughput underwater operations that will drive future market evolution and strategic investment.

Assessing the Cumulative Effects of 2025 United States Tariffs on Global Supply Chains and the Autonomous Underwater Vehicle Sector

In 2025, the imposition of new U.S. tariffs on components and finished imports crucial to autonomous underwater vehicle production has introduced notable complexities to global supply chains. These measures, intended to protect domestic manufacturing, have led to increased costs for pressure-resistant sensors and specialized electronics typically sourced from European suppliers. Consequently, vehicle manufacturers have confronted material shortages and price escalations that ripple across design, production, and deployment phases.

As companies adjust sourcing strategies to mitigate tariff impacts, some have relocated critical subsystems procurement to allied markets, while others have accelerated in-house component development to reduce foreign dependency. While these efforts foster greater supply chain resilience, they often entail elevated research and engineering expenditures, which may inflate capital requirements for both established firms and emerging entrants. This environment has fueled consolidation trends as market participants seek economies of scale and integrated vertical capabilities to offset added costs.

Furthermore, reciprocal trade measures enacted by affected exporting nations have introduced uncertainty into international collaborations, compelling stakeholders to renegotiate long-term contracts and explore alternative partnership models. In turn, these dynamics have influenced program schedules for defense and research agencies, prompting a renewed focus on optimizing lifecycle support and strengthening domestic industrial bases. In sum, the cumulative effects of the 2025 tariff landscape are reshaping competitive positioning and necessitating strategic adaptations across the AUV ecosystem.

Unlocking Market Potential through Product Type, Technology, End User, and Application-Based Segmentation Insights

A comprehensive examination of the autonomous underwater vehicle market through multiple segmentation lenses reveals nuanced insights that can inform strategic decisions. When evaluating platforms by size, large vehicles are increasingly coveted for deep-sea exploration and heavy-payload missions, medium platforms strike a balance between endurance and deployability for coastal and mid-depth tasks, while shallow AUVs serve agile operations such as port security and nearshore environmental surveys.

From a technology standpoint, advancements in collision avoidance modules, communication arrays, imaging suites, navigation packages, and propulsion components are collectively enhancing mission intelligence and reliability. Acoustic and satellite communications now enable broader command ranges, while LED lighting, multibeam echo sounders, side-scan sonars, and sub-bottom profilers generate unparalleled seabed mappings. Navigation frameworks have evolved to integrate acoustic, dead reckoning, geophysical, and inertial systems, delivering precision routing in complex terrains. Meanwhile, propulsion architectures-spanning battery modules to fin actuators and pump motors-are fine-tuned to extend operational duration and maneuverability.

End-user segmentation highlights the divergent priorities of commercial enterprises, defense agencies, public institutions, and research bodies. Oil and gas firms emphasize subsea inspection and maintenance, renewable energy developers focus on site surveys, and telecommunications operators safeguard undersea cable networks. Military stakeholders prioritize anti-submarine warfare, mine countermeasures, and covert surveillance, whereas environmental agencies and marine institutes leverage AUVs for biodiversity assessments and pollution tracking. Research organizations across government and academia exploit these platforms for oceanographic and geophysical studies.

Application-driven classifications further underscore mission diversity, spanning archaeology, environmental monitoring, defense, oceanography, oil and gas exploration, and search-and-recovery tasks. Each use case imposes distinct payload, endurance, and navigation requirements, driving specialization in both vehicle design and operational protocols. By synthesizing these segmentation facets, decision-makers can target investments, tailor product roadmaps, and align service offerings with evolving market demands.

This comprehensive research report categorizes the Autonomous Underwater Vehicles market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- End User

- Application

Regional Dynamics Shaping the Autonomous Underwater Vehicle Landscape in the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional nuances significantly shape the trajectory of autonomous underwater vehicle adoption and innovation. In the Americas, the convergence of defense modernization initiatives and robust offshore energy activities has catalyzed demand for advanced AUV platforms. North American navies and coast guards have integrated unmanned systems into routine patrols and mine-clearance operations, while private-sector operators continue to expand capabilities for subsea inspections and geotechnical surveys.

Across Europe, the Middle East, and Africa, a blend of environmental regulation, infrastructure protection, and strategic deterrence is fueling diverse AUV deployments. European research consortia collaborate on deep-ocean mapping and climate science, whereas Gulf Cooperation Council states invest in undersea pipeline monitoring to safeguard critical energy corridors. Meanwhile, African coastal nations explore AUVs for marine habitat conservation and fisheries management, balancing ecological preservation with economic development.

In the Asia-Pacific region, rapid naval fleet expansions and ambitious deep-sea mineral prospecting have driven a surge in demand for high-endurance, deep-diving vehicles. Governments are establishing dedicated test ranges and fostering public-private partnerships to accelerate technology transfers. Furthermore, industrial players in East Asia are forging alliances to develop indigenous sensor technologies and propulsion solutions, aiming to reduce import dependencies and capture growing export markets.

These regional insights underscore disparate growth drivers, regulatory frameworks, and collaborative models. By understanding these geographic distinctions, stakeholders can prioritize market entry strategies, localize product features, and engage with regional research networks and defense procurement bodies to maximize impact.

This comprehensive research report examines key regions that drive the evolution of the Autonomous Underwater Vehicles market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Strategic Partnerships Influencing the Autonomous Underwater Vehicle Ecosystem

The competitive arena of autonomous underwater vehicles is defined by a blend of established defense contractors, specialized marine technology firms, and agile start-ups. Leading corporations have leveraged extensive R&D resources to deliver integrated systems, often bundling vehicles with comprehensive mission support services. These entities focus on turnkey solutions for subsea survey, surveillance, and maintenance, leveraging global service networks to ensure rapid deployment and in-theater support.

Simultaneously, niche innovators are driving breakthroughs in battery chemistry, sensor miniaturization, and open architecture software platforms. By collaborating with academic institutions and research consortia, these companies accelerate the validation of new propulsion techniques and machine learning algorithms, enhancing AUV autonomy and adaptability. Partnerships between defense departments and technology firms have also yielded high-profile demonstration programs, showcasing the application of swarm tactics and multi-vehicle coordination for complex missions.

Additionally, consolidation trends have emerged as larger players acquire specialized system integrators to fill portfolio gaps, particularly in areas such as underwater acoustics and geophysical navigation. These strategic acquisitions enable rapid scaling of in-house competencies and consolidation of supply chains, enhancing operational resilience in a tariff-impacted environment. At the same time, joint ventures spanning continents are facilitating co-development of regionally tailored AUV variants, capitalizing on local manufacturing incentives and regulatory incentives.

Ultimately, companies that balance deep technical expertise with agile commercialization models are best positioned to lead the next wave of AUV adoption across defense, commercial, and scientific applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autonomous Underwater Vehicles market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anduril Industries, Inc.

- ASELSAN A.Ş.

- Boston Engineering Corporation

- Exail SAS

- Fugro N.V.

- General Dynamics Mission Systems, Inc.

- Huntington Ingalls Industries, Inc.

- IHI Corporation

- International Submarine Engineering Ltd.

- Klein Marine Systems, Inc.

- Kongsberg Gruppen ASA

- L3Harris Technologies, Inc.

- Lockheed Martin Corporation

- Naval Group

- Ocean Aero, Inc.

- Oceaneering International, Inc.

- RUAG International Holding Ltd.

- Saab AB

- Teledyne Technologies Incorporated

- Terradepth, Inc.

- Thales Group

- The Boeing Company

Actionable Strategies for Industry Leaders to Capitalize on Emerging Opportunities in the Autonomous Underwater Vehicle Market

To thrive in the evolving autonomous underwater vehicle domain, industry leaders should pursue a multi-pronged strategy that emphasizes technology differentiation, supply chain resilience, and collaborative ecosystems. First, prioritizing investment in modular, open-architecture platforms will enable rapid integration of emerging sensor and propulsion advances, reducing time to market and supporting diverse mission requirements. Establishing pilot programs with end users can accelerate feedback loops, ensuring iterative improvements align with operational realities.

Simultaneously, companies must diversify component sourcing to mitigate tariff-induced disruptions. Developing in-house competencies for critical subsystems-such as pressure-resistant housings and high-fidelity navigation modules-can reduce dependency on single-country suppliers and enhance negotiating leverage. Forming strategic supply alliances with regional manufacturers may unlock preferential access to emerging markets and provide buffer against regulatory volatility.

Moreover, forging cross-sector partnerships between defense agencies, energy firms, and environmental institutions can catalyze shared mission deployments, spreading R&D costs and validating new capabilities across multiple use cases. Collaborative investment in dedicated test facilities and digital twin environments will underpin these joint initiatives, enabling data-driven optimization of vehicle performance and mission planning.

Finally, aligning product roadmaps with evolving regulatory standards and ethical frameworks will foster trust and facilitate market acceptance. Engaging proactively with international maritime bodies and environmental oversight agencies can streamline approvals for commercial operations and reinforce corporate responsibility commitments. By executing these actionable recommendations, industry participants can secure sustainable growth and reinforce their leadership in the underwater robotics arena.

Detailed Research Methodology Employed to Ensure Rigorous and Reliable Analysis of the Autonomous Underwater Vehicle Market

The research methodology underpinning this executive summary combines a blend of primary and secondary data collection techniques to ensure robust, objective insights. Primary outreach included structured interviews with industry executives, subject-matter workshops, and targeted surveys of defense procurement officers, subsea engineering managers, and marine scientists. These engagements provided first-hand perspectives on technology adoption, operational pain points, and evolving mission requirements.

Secondary research encompassed a systematic review of reputable technical journals, defense white papers, and industry news sources published within the last 12 months. This review captured recent demonstration projects, regulatory updates, and technological breakthroughs from leading academic and corporate laboratories. Publications from naval research entities, environmental monitoring agencies, and energy sector consortia were analyzed to gauge cross-domain innovation trajectories.

Quantitative validation employed triangulation of supply chain analyses, contract award announcements, and patent filings to verify growth patterns and competitive dynamics. Regional deployment statistics, drawn from publicly disclosed fleet compositions and governmental procurement documents, were cross-referenced with private-sector investment trends to ensure consistency.

This multi-layered approach-blending stakeholder insights, independent research, and data triangulation-ensures the findings presented herein are both current and reflective of real-world operational constraints, market drivers, and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autonomous Underwater Vehicles market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autonomous Underwater Vehicles Market, by Product Type

- Autonomous Underwater Vehicles Market, by Technology

- Autonomous Underwater Vehicles Market, by End User

- Autonomous Underwater Vehicles Market, by Application

- Autonomous Underwater Vehicles Market, by Region

- Autonomous Underwater Vehicles Market, by Group

- Autonomous Underwater Vehicles Market, by Country

- United States Autonomous Underwater Vehicles Market

- China Autonomous Underwater Vehicles Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Concluding Reflections on the Evolution, Opportunities, and Challenges Facing the Autonomous Underwater Vehicle Industry

The autonomous underwater vehicle industry stands at a pivotal juncture, characterized by rapid technological convergence, evolving geopolitical dynamics, and expanding commercial applications. The synthesis of enhanced AI-driven autonomy, modular sensor systems, and resilient propulsion networks has elevated mission capabilities while reducing operational risk. Concurrently, tariff policies and supply chain realignments are reshaping cost structures, compelling stakeholders to adopt agile sourcing and vertical integration strategies.

Regional growth trajectories underscore the importance of localized innovation hubs and collaborative frameworks that align public and private objectives. From North American defense missions to Asia-Pacific deep-sea exploration and EMEA environmental monitoring initiatives, AUVs are increasingly central to both security and sustainability agendas. The interplay of regulation, investment incentives, and technological partnerships will determine competitive positioning in the coming years.

Looking forward, success will hinge on a company’s ability to harmonize advanced R&D with pragmatic deployment considerations, embracing open standards and interoperable architectures. As the industry evolves toward integrated mission ecosystems-where multiple unmanned systems operate in concert-the capacity to deliver seamless command and control, data fusion, and lifecycle support will emerge as key differentiators.

In conclusion, the AUV landscape offers a wealth of opportunities for those who can navigate technological shifts, policy nuances, and market demands with foresight and strategic agility. The insights distilled here provide a roadmap for stakeholders seeking to lead in this dynamic domain.

Secure Your Competitive Edge Today with a Comprehensive Autonomous Underwater Vehicle Market Report from Ketan Rohom

To secure a decisive advantage in harnessing the potential of autonomous underwater vehicles, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to access the full-depth market research report tailored to your strategic needs. This comprehensive package includes in-depth analysis, proprietary data models, and expert interpretations designed to inform procurement, development, and investment decisions. By leveraging these insights, you will be equipped to navigate regulatory environments, optimize R&D roadmaps, and align with emerging application demands across military, commercial, and environmental domains. Reach out to engage in a personalized briefing, explore customized packages, and embark on an informed path toward unlocking growth opportunities beneath the waves.

- How big is the Autonomous Underwater Vehicles Market?

- What is the Autonomous Underwater Vehicles Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?