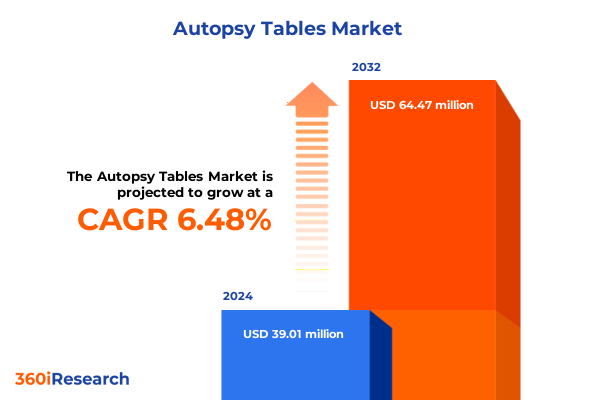

The Autopsy Tables Market size was estimated at USD 41.56 million in 2025 and expected to reach USD 50.45 million in 2026, at a CAGR of 6.47% to reach USD 64.47 million by 2032.

An In-Depth Introduction Emphasizing the Critical Role of Autopsy Tables in Enhancing Forensic Accuracy and Medical Examination Standards

The landscape of modern forensic science and clinical medicine is underpinned by the critical functionality of autopsy tables, which serve as the foundational workstations for postmortem examinations and pathological investigations. These specialized tables are engineered to uphold strict hygiene standards, facilitate precise dissection procedures, and integrate seamlessly with ancillary diagnostic technologies. Their role extends beyond mere support platforms, evolving into dynamic interfaces that can accommodate radiographic integration, temperature control, and fluid drainage systems. As such, the choice of autopsy table directly influences the accuracy of forensic findings and the efficiency of laboratory workflows.

In recent years, heightened awareness around medico-legal accountability and regulatory compliance has amplified the demand for autopsy tables designed to meet stringent quality benchmarks. Medical examiners, forensic pathologists, and research scientists alike depend on these tables to uphold chain-of-custody protocols and ensure the integrity of evidence. Simultaneously, hospitals and medical colleges are recognizing the pedagogical value of ergonomically optimized tables that improve both user comfort and procedural visibility. This dual focus on precision and practicality marks a pivotal juncture for manufacturers seeking to differentiate their offerings through innovation.

Against this backdrop, our executive summary delves into the structural and operational parameters that define leading autopsy table solutions. By examining design trends, material selections, and emerging functionalities, this introduction sets the stage for a detailed exploration of the forces reshaping the market. It offers a clear-eyed view of the foundational elements that will inform subsequent analysis, equipping stakeholders with the contextual understanding necessary to navigate an evolving competitive terrain.

Revolutionary Advancements and Shifting Dynamics Defining the Evolving Autopsy Table Landscape Through Technology Integration and Ergonomic Innovation

The autopsy table industry is undergoing a period of profound transformation driven by technological convergence and shifting end-user expectations. Manufacturers are increasingly integrating radiographic imaging capabilities directly into table surfaces, enabling forensic investigators to capture high-resolution imagery in situ and expedite case processing. Simultaneously, innovations in hydraulic systems are offering smoother height adjustments and load capacities, catering to diverse specimen sizes and reducing physical strain on operators. Ergonomic design principles now extend beyond support surfaces, incorporating adjustable footrests, arm supports, and modular flange attachments that accommodate a spectrum of investigative tools.

Moreover, digital connectivity features such as touchscreen controls, IoT-enabled condition monitoring, and wireless data transfer are redefining the concept of a passive workstation. These functionalities not only streamline workflow management but also contribute to predictive maintenance models, minimizing downtime and extending service life. Material science breakthroughs have also contributed to surfaces with superior chemical resistance and antimicrobial properties, meeting the dual imperatives of sterility and durability.

As demand for multi-functional autopsy tables intensifies, strategic partnerships between software developers and equipment manufacturers are emerging, setting a new standard for integrated forensic solutions. This amalgamation of hardware and digital ecosystems underscores the broader trend of smart laboratory environments, where interconnected devices collaborate to deliver comprehensive diagnostic insights. Ultimately, these transformative shifts are reshaping procurement criteria, elevating expectations for customizable, technology-rich platforms that address the nuanced requirements of forensic laboratories, hospital morgues, and academic research facilities.

Analyzing the Comprehensive Impact of the 2025 United States Tariffs on Autopsy Table Production Costs, Supply Chains, and Manufacturer Strategies

In 2025, the United States implemented a series of tariff adjustments targeting key steel and aluminum imports, exerting significant pressure on autopsy table manufacturers reliant on these raw materials. Stainless steel and carbon steel, essential for fabricating robust, corrosion-resistant table surfaces and frames, saw incremental cost increases that reverberated across the supply chain. The tariffs prompted domestic producers to reevaluate sourcing strategies, shifting certain procurement volumes toward local suppliers while selectively maintaining overseas partnerships for radiographic components not widely manufactured domestically.

These policy shifts triggered a cascade of operational recalibrations, as manufacturers navigated the trade-off between material cost optimization and product performance requirements. The reallocation of bulk purchases to North American steel mills mitigated some tariff impacts but introduced lead-time variability due to capacity constraints. Concurrently, the elevated price of aluminum challenged producers of lighter, portable table models, compelling them to refine alloy compositions or explore hybrid material constructs that preserve weight advantages without compromising structural integrity.

Trade tensions also influenced inventory management practices, with several firms adopting just-in-time delivery frameworks to reduce holding costs while maintaining production continuity. In response to tariff-induced cost pressures, competitive pricing strategies emerged that balanced margin preservation with value-added service packages, such as extended warranties and modular upgrade options. These adaptive measures underscore how regulatory interventions have reshaped financial planning, supplier collaboration, and innovation prioritization within the autopsy table sector throughout 2025.

Uncovering Key Insights Through Comprehensive Segmentation of Autopsy Tables by Type, End User, Application, Material Composition, and Pricing Tiers

A nuanced examination of the autopsy table market reveals critical insights when dissecting demand through multiple segmentation lenses. Product type segmentation-encompassing hydraulic, manual, and radiographic tables-uncovers how each mechanism aligns with distinct operational priorities. Hydraulic systems deliver automated height adjustability and heavy-load handling, manual tables offer cost-effective simplicity and easier maintenance, while radiographic tables integrate imaging platforms that enhance on-site diagnostic workflows. These variations underscore the importance of aligning table selection with laboratory throughput and technological integration requirements.

Parallel analysis of end user segmentation across forensic laboratories, hospitals, and medical colleges illuminates disparate procurement drivers. Government and private forensic labs prioritize chain-of-custody compliance and rapid case turnover, influencing design features such as integrated evidence tracking and chemical-resistant coatings. In both public and private hospitals, the emphasis shifts toward multi-disciplinary functionality, supporting pathology departments with adjustable surfaces that facilitate diverse procedural applications. Government and private medical colleges value educational versatility, selecting tables that support hands-on student training alongside research activities.

Application-based segmentation further distinguishes requirements: forensic investigative units demand heavy-duty platforms capable of accommodating larger specimens, pathology applications benefit from modular accessories to support delicate tissue examination, and research environments leverage precision-engineered tables for experimental reproducibility. Material composition also plays a pivotal role, with aluminum offering portability for mobile forensic units, carbon steel providing unmatched durability for high-throughput labs, and stainless steel delivering superior corrosion resistance critical for hygiene and sterilization. The delineation of economy, standard, and premium price tiers reflects this confluence of functional features, build quality, and after-sales service levels. Together, these intersecting segmentation dimensions form an actionable framework for tailoring product development strategies and targeting market niches with differentiated value propositions.

This comprehensive research report categorizes the Autopsy Tables market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Price Range

- End User

- Application

Examining Regional Market Dynamics Across Americas, Europe Middle East & Africa, and Asia-Pacific Driving Adoption and Growth in Autopsy Table Demand

Regional dynamics in the autopsy table market illuminate diverse growth patterns and procurement philosophies. In the Americas, a strong emphasis on compliance with stringent forensic accreditation standards has fueled demand for high-precision, stainless steel tables supplemented by digital integration features. Government agencies and private forensic service providers here invest in tables that support rapid case processing and evidence integrity, driving innovation in fluid management systems and built-in decontamination protocols.

Europe, the Middle East, and Africa (EMEA) present a mosaic of regulatory and budgetary contexts. Developed European markets prioritize antimicrobial surfaces and eco-friendly material sourcing in alignment with sustainability mandates. The Middle East invests in rapid infrastructure expansion, requiring portable and modular tables capable of deployment in emerging forensic and pathology centers. African markets, characterized by variable healthcare funding, favor robust, low-maintenance manual tables and cost-effective hydraulic models that withstand challenging environmental conditions.

Asia-Pacific exhibits robust growth propelled by increasing healthcare modernization initiatives and expanding research institutions. Markets such as China, Japan, and Australia emphasize radiographic table designs that integrate high-resolution imaging capabilities to support forensic and clinical pathology workflows. Fast-growing Southeast Asian nations demonstrate a preference for versatile pricing tiers, balancing economy models for budget-conscious public facilities with premium offerings that deliver enhanced durability and digital functionality to private laboratories.

These regional distinctions underscore the importance of customizing product portfolios to align with localized regulatory frameworks, infrastructure maturity, and procurement budgets, thereby unlocking targeted growth pathways across the global autopsy table landscape.

This comprehensive research report examines key regions that drive the evolution of the Autopsy Tables market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Innovations and Competitive Profiles of Leading Manufacturers Shaping the Autopsy Table Industry Landscape with Differentiated Offerings

Leading manufacturers in the autopsy table sector distinguish themselves through strategic investments in product innovation, service support, and global footprint expansion. Several established firms have introduced modular platforms that enable customers to configure tables with interchangeable components-such as radiographic cassettes, cooling systems, and evidence collection drawers-tailoring functionality to specific institutional requirements. These configurable offerings underscore a shift from one-size-fits-all solutions toward bespoke configurations that enhance operational efficiency.

Competitive differentiation also emerges through extended service networks and digital support infrastructure. Top-tier companies leverage IoT-enabled monitoring to proactively schedule maintenance and minimize unplanned downtime, strengthening customer loyalty. In parallel, firms are forging partnerships with software developers to integrate data analytics dashboards, enabling forensic directors to track utilization metrics and optimize asset deployment across multiple sites.

Strategic geographic expansion further amplifies competitive positioning. Several key players have established regional manufacturing facilities in North America, Europe, and Asia-Pacific, reducing lead times and mitigating tariff impacts on raw materials. By localizing production of core steel components while maintaining centralized design and R&D hubs, these companies balance cost efficiencies with innovation agility. Moreover, alliances with regional distributors in emerging markets have extended end-user reach, facilitating faster adoption of advanced table technologies.

Through this combination of modular product design, proactive service models, and strategic regional presence, leading autopsy table manufacturers are shaping the competitive landscape and setting new benchmarks for performance, reliability, and customer engagement.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autopsy Tables market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AFOS Medical

- Angelantoni Life Science

- Barber Medical

- Ceabis Srl

- EIHF Isofroid

- Ferno‑Washington, Inc.

- Fiocchetti

- Flexmort

- Funeralia

- Getinge AB

- Guangzhou Yueshen Medical Equipment Co., Ltd.

- Hygeco International Products

- JAPSON

- Kugel Medical GmbH & Co. KG

- Labconco Corporation

- LEEC Limited

- MEDIS Medical Technology GmbH

- Meiko Maschinenbau GmbH & Co. KG

- Miele & Cie. KG

- Mopec, Inc.

- Mortech Manufacturing Company, Inc.

- Mortuary Supply Company, LLC

- NaugraLabEquipments

- SP Industries, Inc.

- Steelco S.p.A.

- Steriflow Systems Private Limited

- STERIS plc

- Thermo Fisher Scientific Inc.

- Western Electric & Scientific Works

Implementing Actionable Strategies and Best Practices for Industry Leaders to Navigate Supply Challenges and Accelerate Innovation in Autopsy Table Production

Industry leaders must adopt a multi-pronged approach to sustain growth and mitigate operational disruptions in the autopsy table market. First, diversifying supply chains by qualifying alternate domestic and international steel and aluminum vendors will reduce vulnerability to tariff fluctuations and lead-time bottlenecks. Establishing strategic partnerships with secondary suppliers can provide buffer inventories while preserving production continuity.

Second, investing in research and development focused on lightweight composite materials and antimicrobial surface coatings can unlock new product categories that address evolving healthcare hygiene standards. By collaborating with material science institutes, manufacturers can pioneer tables that meet or exceed emerging infection-control regulations while enhancing portability for mobile forensic applications.

Third, adopting a tiered customer engagement model that bundles premium maintenance plans, remote diagnostics, and training services can reinforce value propositions and foster longer-term contracts. Embedding IoT-based condition monitoring in table designs will enable predictive maintenance and support data-driven service offerings, elevating customer satisfaction and retention.

Finally, tailoring distribution strategies to regional market maturity-by combining direct sales in high-growth Asia-Pacific hubs with distributor partnerships in EMEA and structured government procurement channels in the Americas-will optimize market coverage. These actionable strategies will empower industry leaders to navigate trade uncertainties, accelerate product innovation, and capture emerging opportunities in both established and frontier markets.

Detailing the Rigorous Research Methodology Involving Primary Interviews, Secondary Data Analysis, and Triangulation Techniques Employed for Report Accuracy

This report synthesizes insights through a blended research methodology that emphasizes both primary and secondary data sources. Primary research involved structured interviews with forensic pathologists, laboratory directors, hospital procurement officers, and academic faculty across major markets. These qualitative discussions provided firsthand perspectives on operational priorities, performance expectations, and purchasing considerations related to autopsy table solutions.

Secondary research complemented these insights through a comprehensive review of regulatory filings, procurement tenders, technical product specifications, and industry white papers. Supplementary data points were cross-verified against international standards published by forensic accreditation bodies and healthcare safety agencies to validate compliance benchmarks and material performance criteria.

Quantitative analysis incorporated a segmentation framework informed by product type, end user, application, material composition, and price tier. These categories were mapped against regional demand profiles and competitive inventories to identify adoption trends and potential market gaps. Triangulation techniques were applied to reconcile disparate data sets, ensuring consistency in thematic findings and eliminating anomalies.

Finally, internal validation workshops with subject-matter experts refined the report’s conclusions and recommendations. By integrating practitioner feedback and iterative review cycles, the research methodology upheld rigorous standards of accuracy, relevance, and strategic applicability, resulting in a report that delivers actionable intelligence grounded in empirical evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autopsy Tables market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autopsy Tables Market, by Product Type

- Autopsy Tables Market, by Material

- Autopsy Tables Market, by Price Range

- Autopsy Tables Market, by End User

- Autopsy Tables Market, by Application

- Autopsy Tables Market, by Region

- Autopsy Tables Market, by Group

- Autopsy Tables Market, by Country

- United States Autopsy Tables Market

- China Autopsy Tables Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing Critical Findings and Implications for Stakeholders to Leverage Autopsy Table Market Trends and Address Emerging Opportunities with Confidence

In summary, the autopsy table market is at a strategic inflection point where technological innovation, regulatory dynamics, and supply chain complexities converge to reshape procurement and product development trajectories. The integration of radiographic imaging, hydraulic automation, and ergonomic design features reflects manufacturers’ drive to meet heightened user demands for precision, efficiency, and compliance.

Cumulative tariff impacts have prompted supply chain diversification and cost-management strategies, while segmentation analysis underscores the need for tailored offerings across hydraulic, manual, and radiographic models, distinct end-user cohorts, and material preferences ranging from aluminum to stainless steel. Regional insights reveal that market drivers vary considerably between the Americas, EMEA, and Asia-Pacific, necessitating localized go-to-market approaches and flexible pricing structures.

Leading companies are differentiating through modular product architectures, IoT-enabled service models, and strategic manufacturing footprints, thereby setting new competitive benchmarks. Industry leaders seeking to capitalize on emerging opportunities must prioritize supply chain resilience, invest in advanced materials research, and implement value-add service offerings to strengthen customer relationships.

Ultimately, stakeholders equipped with a clear understanding of these critical trends and actionable recommendations will be well positioned to navigate uncertainty, accelerate innovation, and achieve sustained growth in the evolving autopsy table market.

Discover How to Access the In-Depth Autopsy Table Market Research Report by Connecting with Ketan Rohom for Customized Insights and Purchase Guidance

To explore the full breadth of this comprehensive research, reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to gain personalized guidance on report access, customization options, and licensing arrangements tailored to your strategic priorities. Engage with him today to secure detailed insights, answer any specific queries, and establish the optimal path for leveraging this market intelligence within your organization’s decision-making framework. Unlock the complete report’s in-depth analyses, expert commentary, and actionable data sets by connecting with Ketan Rohom for seamless purchasing support and bespoke consultation services designed to accelerate your autopsy table market strategies.

- How big is the Autopsy Tables Market?

- What is the Autopsy Tables Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?