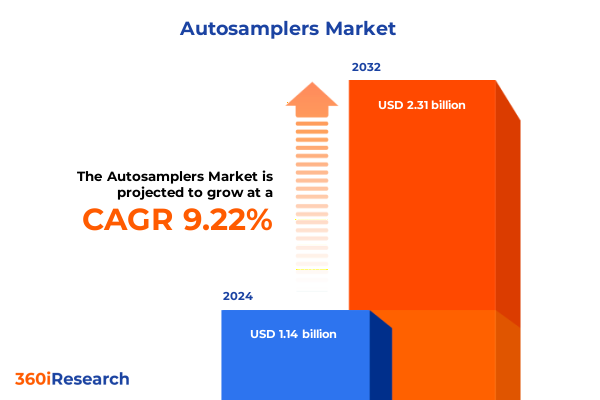

The Autosamplers Market size was estimated at USD 1.22 billion in 2025 and expected to reach USD 1.32 billion in 2026, at a CAGR of 9.50% to reach USD 2.31 billion by 2032.

Anchoring Analytical Excellence with Advanced Autosamplers by Unveiling Foundational Drivers and Emerging Trends Shaping Laboratory Workflows

Evaluation of autosampler instruments reveals their foundational importance in enhancing laboratory efficiency, precision, and data consistency across diverse analytical applications. As laboratories face mounting pressures to increase throughput and maintain stringent quality standards, automated sampling solutions have emerged as essential enablers of reproducible workflows. By minimizing manual intervention, autosamplers deliver consistent injection volumes, reduce human error, and streamline operate-to-operate variability, which is critical for sectors ranging from pharmaceutical development to environmental monitoring.

Over recent years, competitive dynamics within the autosampler landscape have intensified. Manufacturers have transitioned from purely mechanical designs to platforms that emphasize modularity, software integration, and enhanced user experience. Consequently, laboratory professionals now expect autosamplers to interface seamlessly with chromatography systems, laboratory information management systems, and cloud-based analytics environments. Furthermore, the increasing focus on compliance with regulatory frameworks has prompted vendors to implement robust audit trails and secure data handling protocols.

The interplay of technological sophistication and evolving end-user requirements underscores the need for a clear overview of the market drivers and challenges shaping autosampler adoption. This introduction sets the stage for examining the transformative shifts, regulatory implications, and segmentation paradigms that define current and future industry trajectories.

Transcending Conventional Sampling Practices as Technological Innovations and Sustainability Imperatives Reshape the Autosampler Ecosystem

The autosampler market is undergoing a fundamental transformation driven by rapid advances in digital connectivity and data science. Laboratories are now adopting autosamplers embedded with Internet of Things capabilities, enabling real-time performance monitoring and predictive maintenance. Additionally, the integration of artificial intelligence for intelligent sample prioritization and anomaly detection is elevating throughput while preserving analytical integrity. As instrument ecosystems become more interconnected, the role of autosamplers has expanded beyond mere sample delivery to become central coordination hubs within analytical workflows.

Simultaneously, sustainability imperatives and green chemistry principles are influencing autosampler design. Manufacturers are introducing components that reduce solvent consumption through optimized wash protocols and recyclable materials. Furthermore, there is growing demand for compact autosampler footprints to align with the increasing miniaturization trends in laboratory instrumentation. These shifts reflect a broader industry focus on operational efficiency, cost reduction, and environmental stewardship.

Overall, the convergence of digital intelligence, sustainability priorities, and ergonomic innovation is reshaping the autosampler landscape. This transformative phase offers industry stakeholders opportunities to differentiate product offerings, enhance user experience, and respond agilely to dynamic regulatory and market demands.

Assessing the Realized and Cumulative Effects of 2025 United States Tariff Adjustments on Autosampler Supply Chains and Import Dynamics

Recent adjustments to United States import tariffs have exerted tangible impacts on autosampler supply chains and procurement strategies. In early 2025, most laboratory instrument imports, including autosampler components manufactured in China, became subject to a composite duty rate that can exceed fifty percent when factoring in base reciprocal tariffs coupled with additional Section 301 charges. This levy has significantly elevated landed costs for systems and accessories originating from targeted regions, prompting procurement teams to reassess sourcing strategies, negotiate exclusion filings, and explore alternative fulfillment models.

In parallel, the Office of the United States Trade Representative has maintained duty-free status for numerous chromatographic parts and accessories, including septa, vials, and syringes, under extended Section 301 exclusions through August 31, 2025. Such exemptions offer temporary relief for key consumables and sample injector components, yet the uncertainty around future extension cycles has underscored the importance of strategic inventory management and proactive customs compliance.

Meanwhile, steel and aluminum content within certain autosampler subassemblies has triggered Section 232 tariffs of up to fifty percent, further complicating cost calculations for raw material-intensive modules. Collectively, these policy measures have catalyzed a shift toward domestic manufacturing partnerships, accelerated investment in near-shoring capabilities, and stimulated demand for refurbished instrumentation. This cumulative tariff environment continues to redefine value chains and compel industry participants to innovate around supply chain resilience.

Deriving Actionable Market Intelligence from Core Autosampler Segmentation Dimensions Across Product, Component, Sample, and Application Spectrums

Examination of autosampler market segmentation reveals distinct dynamics across a multifaceted product spectrum. Product segmentation differentiates between essential accessories-such as septa, syringes and needles, and vials-and integrated systems comprising gas chromatography and liquid chromatography autosamplers. While accessory offerings compete on consumable lifespan and material compatibility, system vendors prioritize precision drive mechanisms and advanced injection technologies. Component analysis further distinguishes between sample compartments engineered for accurate temperature control and sample injectors designed to optimize volume delivery and cycle times.

Sample type segmentation underscores the versatility of autosamplers in processing diverse matrices. Systems tailored for blood and biological specimens demand rigorous contamination control and biocompatibility, whereas chemical compound applications emphasize solvent resistance and inert surface treatments. Environmental sampling introduces variables such as particulate filtration and high-throughput batch processing, necessitating specialized sample injector configurations. Solvent type-driven research highlights the importance of carrier solvent stability, diluent compatibility for matrix effects mitigation, and wash solvent efficacy in minimizing cross-contamination, all of which inform instrument calibration and method development.

Distribution channel insights reveal the continued primacy of offline sales supported by field service networks, alongside growing adoption of online platforms offering rapid configurator tools and remote diagnostics. Application-centric segmentation shows clinical diagnostics and environmental testing leading early adoption curves, followed by high-throughput screening, quality assurance labs, and research and development departments seeking customizable workflows. End-user segmentation covers environmental agencies requiring standardized protocols, food and beverage firms ensuring safety compliance, laboratories managing diverse workload demands, petrochemical enterprises handling complex sample chemistries, and pharmaceutical companies enforcing Good Laboratory Practices. Each segment exhibits specific performance criteria and support expectations, guiding product roadmap decisions and service investments.

This comprehensive research report categorizes the Autosamplers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product

- Component

- Sample Type

- Solvent Type

- Distribution Channel

- Application

- End-User

Deciphering Region-Specific Demand Patterns and Strategic Advantages in Americas, Europe Middle East & Africa, and Asia-Pacific Laboratory Markets

Within the Americas region, strong government funding for pharmaceutical and biotechnology research has sustained robust demand for autosampler systems, while advanced industrial laboratories in the United States and Canada continue to invest in instrumentation upgrades. Additionally, Latin American environmental agencies have increased monitoring activities, spurring interest in portable and easily deployable autosampler accessories that can withstand challenging field conditions.

In Europe, Middle East, and Africa, stringent regulatory frameworks and harmonized standards have elevated expectations for autosampler accuracy and data traceability. Laboratories across Germany, the United Kingdom, and the Middle Eastern markets are prioritizing instruments with comprehensive audit trail capabilities and compliance-focused software. Concurrently, emerging laboratories in Africa are expanding capacity through cost-effective instrument leasing and regional service partnerships to address growing testing requirements.

Asia-Pacific laboratories exhibit an accelerating focus on capacity expansion driven by government initiatives in China, India, and Southeast Asian nations. These investments target environmental testing and pharmaceutical quality control, favoring suppliers that offer local manufacturing support and customizable training programs. Moreover, the rise of e-commerce channels in the region has made online configurators and digital after-sales services increasingly influential in purchase decisions, prompting vendors to refine regional distribution strategies and partner ecosystems.

This comprehensive research report examines key regions that drive the evolution of the Autosamplers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Strategic Collaborations and Innovation Pathways Driving Leadership Performance Among Major Autosampler Manufacturers

Several leading instrumentation companies are actively shaping the autosampler market through strategic collaborations, product line expansions, and technology licensing agreements. Major multinational laboratories equipment manufacturers have integrated autosampler platforms into broader analytical suites, enabling cross-platform compatibility with chromatography, mass spectrometry, and bioanalyzer workflows. Concurrently, specialized vendors have forged partnerships with software firms to deliver real-time data analytics and remote diagnostics services, enhancing uptime and driving predictive maintenance models.

In pursuit of differentiation, market frontrunners have accelerated investments in research and development to introduce advanced injection mechanisms, low-dead-volume designs, and fully enclosed sampling chambers that reduce contamination risk. Companies focusing on aftermarket services have expanded global support networks, offering rapid replacement kits and preventive maintenance contracts. As competition intensifies, joint ventures between equipment OEMs and academic research centers have emerged, facilitating early adoption of novel sampling methodologies and co-development of next-generation autosampler technologies.

The cumulative effect of these strategic moves is a market landscape where collaboration, product innovation, and service excellence converge to define leadership. Organizations that balance core instrumentation expertise with digital services and regional support are best positioned to capture growth opportunities and sustain competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autosamplers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies, Inc.

- Analytik Jena GmbH by Endress+Hauser Group

- Anton Paar GmbH

- Bio-Rad Laboratories, Inc.

- C. Gerhardt GmbH & Co. KG

- Cytiva Bioscience Holding Ltd.

- Dopak, Inc.

- FIAlab Instruments, Inc.

- Gilson, Inc.

- Hamilton Company

- JASCO, Incorporated

- LECO Corporation

- Merck KGaA

- METTLER TOLEDO GmbH

- PCE Instruments UK Ltd.

- PerkinElmer, Inc.

- Picarro, Inc.

- SEAL Analytical Limited

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- VWR International, LLC

- Waters Corporation

- Xylem Inc.

Formulating Impact-Driven Strategic Actions for Industry Leaders to Navigate Technological Complexities and Competitive Imperatives in Autosampler Markets

Industry leaders should prioritize the development of modular autosampler architectures to accommodate evolving method requirements and simplify field upgrades. By embracing plug-and-play accessory interfaces, organizations can reduce time to market for new method integrations and optimize inventory management for consumable components. Additionally, forging strategic alliances with software developers will enable the deployment of artificial intelligence functionalities that streamline sample scheduling, detect injection anomalies, and predict maintenance needs, thereby maximizing operational uptime.

To mitigate supply chain risks associated with tariff volatility, stakeholders must diversify supplier networks across multiple geographies and explore near-shoring opportunities for critical components. Establishing strategic stock buffers for high-turnover accessories and negotiating long-term exclusion extensions can further stabilize procurement costs. Concurrently, investing in sustainable design practices-such as solvent recycling modules and energy-efficient drives-will align product portfolios with corporate environmental, social, and governance commitments while reducing total cost of ownership.

Finally, cultivating comprehensive training programs and digital support platforms will enhance end-user proficiency and ensure consistent instrument performance. By leveraging e-learning modules, virtual commissioning tools, and regional service hubs, manufacturers can strengthen customer relationships, accelerate adoption cycles, and capture valuable usage insights for continuous product refinement.

Outlining Robust Qualitative and Quantitative Research Frameworks Ensuring Comprehensive Analysis and Validation of Autosampler Market Insights

This research employed a mixed-methods approach combining qualitative and quantitative analyses to ensure a comprehensive understanding of the autosampler market dynamics. Primary data was gathered through in-depth interviews with laboratory directors, procurement specialists, and instrumentation technicians across pharmaceutical, environmental, and academic institutions. These interviews were supplemented by structured surveys capturing purchase drivers, service expectations, and technology adoption timelines, providing rich insights into end-user requirements.

Secondary research comprised a detailed review of public filings, patent databases, and scholarly publications to map innovation trajectories and identify emerging technical advancements. Trade association reports and regulatory guidance documents were analyzed to understand compliance imperatives and standardization trends that influence autosampler specifications. Market dialogues at industry conferences and webinars provided real-time perspectives on challenges facing instrument developers and end users.

Data triangulation and expert validation sessions with instrumentation engineers and market analysts enhanced the credibility of our findings. Key performance indicators such as system throughput, injection precision, and maintenance cycle frequency were benchmarked to develop action-oriented conclusions. Throughout the research process, strict adherence to data integrity protocols and confidentiality agreements ensured the reliability and ethical handling of proprietary information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autosamplers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autosamplers Market, by Product

- Autosamplers Market, by Component

- Autosamplers Market, by Sample Type

- Autosamplers Market, by Solvent Type

- Autosamplers Market, by Distribution Channel

- Autosamplers Market, by Application

- Autosamplers Market, by End-User

- Autosamplers Market, by Region

- Autosamplers Market, by Group

- Autosamplers Market, by Country

- United States Autosamplers Market

- China Autosamplers Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1590 ]

Concluding Perspectives on Market Dynamics, Competitive Landscapes, and Strategic Pillars Guiding the Future of Autosampler Technologies

The evolving landscape of autosampler technology reflects a convergence of digital innovation, environmental stewardship, and regulatory rigor. Market participants are adapting to tariff-driven supply chain disruptions by sourcing components regionally and optimizing inventory strategies, while simultaneously embracing modular and sustainable design principles. Segmentation analysis highlights the nuanced requirements across product, component, sample type, solvent type, distribution channel, application, and end-user categories, underscoring the importance of targeted solution development.

Regionally, the Americas continue to leverage strong research funding, Europe, Middle East, and Africa are guided by strict compliance frameworks, and Asia-Pacific benefits from government-led capacity expansion and digital adoption. Leading companies differentiate through strategic partnerships, service excellence, and continuous innovation in sampling mechanics and software integration. The actionable recommendations outlined herein provide a strategic blueprint for stakeholders to enhance resilience, drive efficiency, and capitalize on growth avenues.

Moving forward, ongoing collaboration between vendors, regulators, and end users will be critical to navigating the complexities of analytical workflows and maintaining market momentum. By applying the insights and methodologies detailed in this report, organizations can position themselves at the forefront of autosampler advancements and deliver superior analytical outcomes.

Engaging Directly with Ketan Rohom to Unlock Comprehensive Autosampler Market Research and Fuel Data-Driven Strategic Decision Making

We invite you to connect with Ketan Rohom, Associate Director of Sales and Marketing, to explore how this detailed autosampler market report can support your strategic objectives and amplify your competitive edge. You will gain personalized guidance on the data sets most relevant to your business priorities along with insights on implementation roadmaps. By engaging directly with an expert in laboratory instrumentation markets, you can ensure timely access to the latest research findings, customized consultancy, and priority delivery options tailored to your organizational needs.

A brief conversation with Ketan Rohom will allow us to understand your specific focus areas-whether you are optimizing procurement strategies, expanding service portfolios, or planning capital investment. You will receive clarity on report structure, deliverables, and any value-added services, including bespoke data visualizations or executive briefings. Don’t miss the opportunity to leverage our comprehensive analysis to accelerate decision-making, mitigate risks, and capitalize on emerging autosampler trends.

Contact Ketan Rohom today to arrange a consultation and secure your copy of the market research report. Advance your market intelligence and position your organization for growth with the definitive resource on autosampler technologies and their evolving industry landscape.

- How big is the Autosamplers Market?

- What is the Autosamplers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?