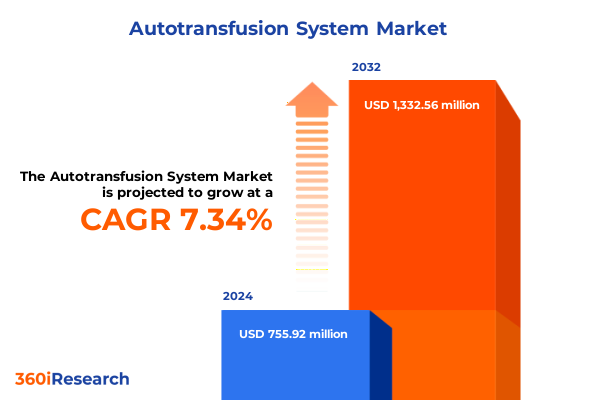

The Autotransfusion System Market size was estimated at USD 809.36 million in 2025 and expected to reach USD 867.23 million in 2026, at a CAGR of 7.38% to reach USD 1,332.56 million by 2032.

Unveiling How Autotransfusion Systems Revolutionize Surgical Blood Conservation, Enhance Patient Outcomes, and Elevate Efficiency Across Healthcare Settings

The integration of autotransfusion systems into contemporary surgical practice marks a pivotal evolution in blood management, transforming the way clinicians conserve and reutilize a patient’s own blood during operative procedures. By capturing, filtering, and reinfusing shed blood in real time, these devices mitigate the demand for allogeneic transfusions, thereby reducing exposure to infectious risks, immunological complications, and the logistical burden of donor blood inventory. As health systems face mounting pressures to enhance patient safety while containing costs, autotransfusion has emerged as a critical component of comprehensive blood conservation protocols.

Across cardiac, orthopedic, and trauma surgeries, growing clinical evidence underscores the capacity of autotransfusion systems to improve postoperative outcomes by minimizing transfusion-related morbidity. The convergence of stringent regulatory expectations for patient-centered care and the imperative to optimize resource utilization has accelerated the adoption of these technologies. Furthermore, payers increasingly recognize the long-term cost benefits associated with reduced complications and length of stay, reinforcing the strategic value of integrating autotransfusion solutions across a broad spectrum of procedural settings.

Driving Innovations and Rapidly Evolving Practices: Key Technological and Operational Shifts Shaping the Future of Autotransfusion Systems in Clinical Environments

In recent years, the autotransfusion landscape has undergone profound shifts driven by both technological breakthroughs and evolving clinical paradigms. The emergence of fully automatic systems equipped with advanced sensors and closed-loop controls has elevated the precision of blood processing, enabling surgical teams to achieve higher purity levels with minimal manual intervention. Simultaneously, semi-automatic platforms remain indispensable in resource-constrained settings, offering a balance between operator control and process reliability. These innovations have expanded the utility of autotransfusion beyond traditional cardiac suites to include orthopedic, transplant, and vascular surgery, where efficient blood recovery can significantly impact patient recovery trajectories.

At the same time, the introduction of next-generation leukocyte depletion filters and reservoir sets has enhanced biocompatibility and reduced the immunogenic load of reinfused blood. Filtration-based technologies, incorporating membrane materials with superior hemocompatibility, are now rivaling centrifugal approaches in both throughput and cell preservation. This cross-pollination of technological strengths has catalyzed new clinical protocols that prioritize tailored blood management strategies, ultimately fostering greater surgeon confidence and driving broader acceptance. Together, these operational and technological shifts are reshaping the competitive landscape and setting the stage for the next wave of innovation in autotransfusion.

Assessing the Broad-scale Effects of 2025 U.S. Tariff Measures on Autotransfusion System Supply Chains, Cost Structures, and Industry Resilience

The series of tariff measures enacted by the United States in 2025 has introduced significant complexity into the supply chain dynamics for autotransfusion system components. A 10 percent import duty on medical devices originating from China, coupled with paused tariffs on neighboring markets, has precipitated cost pressures for manufacturers reliant on global sourcing. As a result, several leading providers have reported notable profit margin contractions and have initiated strategies to localize production or adjust pricing structures to preserve financial stability and customer accessibility. These adjustments have reverberated through procurement channels, compelling hospitals and clinics to reassess capital expenditure timelines and supply agreements to mitigate budgetary impacts.

Moreover, trade tensions have prompted industry associations to lobby aggressively for exemptions, highlighting the potential for elevated patient costs and supply bottlenecks if tariffs remain in place. In response, companies like Philips have foreshadowed net profit impacts ranging from €250 million to €300 million, leading to a reallocation of manufacturing footprints and strategic hedging initiatives to offset the burden of duties. Despite these headwinds, some market participants anticipate that the temporary nature of certain levies, combined with long-term supply chain diversification and potential tariff relief negotiations, will ultimately preserve the integrity of the autotransfusion ecosystem. Nonetheless, the cumulative effect of sustained import duties underscores the importance of resilient sourcing strategies and agile cost-management frameworks going forward.

Uncovering Critical Segmentation Perspectives Across Product Types, Technologies, Patient Profiles, Surgical Applications, and End-User Settings

The autotransfusion market encompasses a diverse array of system configurations and consumable formats tailored to specific clinical requirements, with consoles split between fully automatic units offering closed-loop automation and semi-automatic platforms balancing manual flexibility and precision. Consumable segmentation includes advanced leukocyte depletion filters designed to minimize immunogenic risk and reservoir sets optimized for cell integrity and throughput. Underpinning these product distinctions are centrifugal and filtration technologies, each branching into gravity-driven designs, pump-assisted systems, leukocyte reduction membranes, and novel membrane filtration approaches, thereby accommodating varied procedural workflows and volume demands.

Patient demographics further refine market dynamics, as adult cohorts-spanning both general adult and elderly segments-present different hemodynamic profiles and circuit requirements than pediatric groups, which subdivide into neonatal and children categories, each with unique volume constraints and safety protocols. The application spectrum ranges from high-volume cardiac procedures like coronary artery bypass grafting and valve replacements to orthopedic interventions in joint replacement and spine surgery, in addition to critical use cases in trauma, transplant, and vascular surgeries. Finally, end-user channels-comprising ambulatory surgery centers, community and tertiary hospitals, and specialty clinics-drive adoption based on procedural volume, reimbursement frameworks, and investment capacity. Collectively, these segmentation axes illuminate targeted growth opportunities and operational imperatives for industry stakeholders.

This comprehensive research report categorizes the Autotransfusion System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Operation

- Application

- Patient Type

- End-User

Key Market Dynamics Driven by Regional Variations in Adoption, Regulatory Frameworks, and Healthcare Infrastructure Across Global Markets

Regional variations in healthcare infrastructure, regulatory landscapes, and reimbursement models exert a profound influence on autotransfusion uptake across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, robust hospital networks and well-established blood conservation guidelines have driven early adoption, particularly in the United States and Canada, where favorable reimbursement incentives and high surgical volumes catalyze system procurement. Nonetheless, concerns around supply chain resilience and tariff-induced cost variability are prompting North American providers to explore on-shore manufacturing collaborations and regional distribution hubs.

Meanwhile, in Europe, Middle East & Africa, heterogeneous regulatory requirements and variable budgetary constraints shape a patchwork of market responsiveness. Western European nations, underpinned by stringent patient safety regulations and value-based purchasing frameworks, maintain steady demand for premium autotransfusion solutions, whereas emerging markets in the Middle East and Africa demonstrate opportunistic growth, contingent on infrastructure investments and localized training initiatives. In Asia-Pacific, the confluence of expanding surgical capacity, particularly in China and India, and government initiatives to bolster domestic medical device industries is driving a rapid uptick in system installations. However, disparities in hospital procurement budgets and reimbursement rates necessitate diversified product portfolios and flexible financing models to capture the full spectrum of regional potential.

This comprehensive research report examines key regions that drive the evolution of the Autotransfusion System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Moves and Innovations by Leading Autotransfusion System Providers Driving Competitive Advantage and Market Differentiation

Leading autotransfusion system providers are deploying multifaceted strategies to fortify their competitive positions and capture emerging market segments. Major players have accelerated innovation pipelines, unveiling next-generation consoles with integrated analytics platforms that deliver real-time performance insights and facilitate remote diagnostics. Strategic acquisitions and partnerships with specialty consumable manufacturers have broadened product portfolios and strengthened vertical integration, enabling bundled solutions that appeal to capital-constrained customers seeking total workflow efficiencies.

Concurrently, companies are leveraging predictive maintenance algorithms and digital service offerings to enhance product uptime and customer satisfaction. These digital modules not only anticipate component wear and optimize consumable usage but also create recurring revenue streams through subscription-based support models. As smaller, regional vendors emerge-often focusing on niche consumables or cost-effective platforms-market leaders are responding by introducing tiered offerings and modular upgrade paths to protect base installations while unlocking new growth areas. This competitive interplay underscores a dynamic market where technological leadership, service excellence, and strategic flexibility define long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Autotransfusion System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- B. Braun SE

- Barkey GmbH & Co. KG

- Becton, Dickinson and Company

- Beijing ZKSK Technology Co., Ltd.

- Braile Biomédica

- Carolina Autotransfusion, Inc.

- Fresenius Medical Care AG & Co. KGaA

- Gen World Medical Devices

- Getinge AB

- Global Blood Resources, LLC

- Grifols, S.A.

- Haemonetics Corporation

- HemoClear B.V

- i-SEP

- Livanova PLC

- Medtronic PLC

- ProCell Surgical Inc.

- Redax S.p.A.

- Sarstedt AG & Co. KG

- Sisu Global Health

- SpecialtyCare

- Teleflex Incorporated

- Terumo Corporation

Actionable Strategies for Industry Leaders to Enhance Autotransfusion System Adoption, Supply Chain Resilience, and Operational Excellence

Industry leaders poised to capitalize on the evolving autotransfusion landscape should prioritize a balanced approach encompassing supply chain resilience, customer-centric innovation, and strategic partnerships. Strengthening local manufacturing capabilities and establishing multi-tiered distribution networks will mitigate exposure to import tariffs and logistic disruptions, while proactive engagement with regulatory bodies can expedite approvals for novel device enhancements. In parallel, investing in next-generation consumables research-particularly in advanced filtration materials-can solidify technological differentiation and address the growing demand for biocompatible, high-efficiency products.

Moreover, fostering collaborative relationships with clinical centers of excellence and professional societies will accelerate protocol development and reinforce evidence-based adoption. Embedding digital monitoring tools within devices can generate valuable real-world data, facilitating continuous improvement and enabling outcome-driven value propositions to payers. Finally, cultivating comprehensive training programs and technical support services will enhance end-user confidence and drive loyalty across diverse facility types. By aligning operational excellence with targeted innovation, industry participants can capture both established and nascent opportunities in this high-growth segment.

Rigorous Methodological Approach Integrating Primary and Secondary Research for Robust Autotransfusion System Market Analysis

This analysis synthesizes insights derived through a comprehensive, multi-phase research methodology integrating both primary and secondary data sources. Extensive secondary research involved the review of peer-reviewed clinical studies, regulatory filings, patent databases, and company disclosures to map technological evolutions and market dynamics. Primary research encompassed in-depth interviews with key opinion leaders-comprising perfusionists, surgical directors, procurement managers, and regulatory experts-as well as telesurveys of device end users to capture real-world usage patterns and unmet clinical needs.

Data triangulation techniques were applied to validate findings, ensuring consistency across disparate information streams. Market intelligence was further enriched through participation in industry conferences and workshops, providing first-hand exposure to emerging product launches and stakeholder perspectives. Quantitative data analytics, including trend extrapolation and competitive positioning models, underpinned the interpretation of qualitative feedback, resulting in a robust strategic framework that accurately reflects the current autotransfusion ecosystem. This methodological rigor guarantees the reliability and actionability of the recommendations and insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Autotransfusion System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Autotransfusion System Market, by Product Type

- Autotransfusion System Market, by Operation

- Autotransfusion System Market, by Application

- Autotransfusion System Market, by Patient Type

- Autotransfusion System Market, by End-User

- Autotransfusion System Market, by Region

- Autotransfusion System Market, by Group

- Autotransfusion System Market, by Country

- United States Autotransfusion System Market

- China Autotransfusion System Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesis of Insights Emphasizing the Evolutionary Trajectory and Strategic Imperatives Shaping the Autotransfusion System Landscape

The convergence of technological innovation, evolving clinical protocols, and shifting geopolitical factors has positioned autotransfusion systems at the forefront of surgical blood management strategies. Advances in automation, digital integration, and consumable design have enhanced performance and expanded the breadth of clinical applications, while emerging cost pressures-exacerbated by import tariffs-underscore the importance of resilient supply chains and strategic localization. Segmentation analyses reveal targeted growth pockets across diverse product, technology, patient, application, and end-user dimensions, and regional insights highlight the differentiated pathways by which adoption will unfold across the Americas, Europe, Middle East & Africa, and Asia-Pacific.

As leading providers refine their competitive positioning through innovation pipelines, strategic alliances, and digital service models, industry participants must remain agile to navigate regulatory complexities and capitalize on evolving reimbursement frameworks. The collective imperative for surgical teams and device manufacturers is clear: to collaboratively advance blood conservation protocols, optimize patient outcomes, and deliver sustainable value in an increasingly cost-conscious healthcare environment. The strategic imperatives outlined in this report serve as a roadmap for stakeholders seeking to harness the full potential of autotransfusion technology.

Immediate Next Steps to Acquire Comprehensive Autotransfusion System Market Insights with Ketan Rohom’s Expert Guidance and Support

To take the next step toward unlocking in-depth analysis and strategic insights in the autotransfusion system market, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. His expertise in healthcare technology research ensures a personalized consultation to align the report’s findings with your organizational objectives. Engaging with Ketan will enable you to explore tailored licensing options, gain clarifications on methodologies, and discuss custom deliverables that address your specific business challenges. With his guidance, you can accelerate decision-making, optimize investment strategies, and secure a competitive advantage. Don’t miss the opportunity to harness comprehensive market intelligence; connect now to propel your initiatives forward.

- How big is the Autotransfusion System Market?

- What is the Autotransfusion System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?