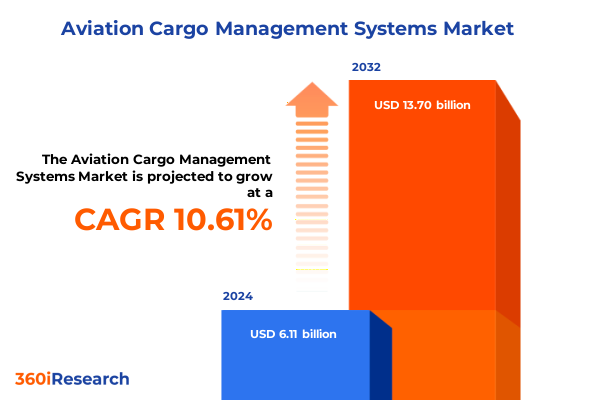

The Aviation Cargo Management Systems Market size was estimated at USD 6.75 billion in 2025 and expected to reach USD 7.45 billion in 2026, at a CAGR of 10.64% to reach USD 13.70 billion by 2032.

Setting the Stage for Innovation and Efficiency in Global Air Freight Management Through Next-Generation Cargo Solutions and Collaborative Workflows

The unprecedented acceleration of global trade, fueled by e-commerce penetration and just-in-time manufacturing, has placed intense demands on air cargo management systems. Adapting to this heightened velocity, shippers and carriers alike are seeking robust platforms that not only streamline operations but also ensure end-to-end visibility and resilience. Organizations must navigate a complex web of regulatory compliance, sustainability mandates, and security protocols while integrating rapidly evolving technologies such as artificial intelligence and the Internet of Things. As a result, modern cargo management solutions are transitioning from siloed transaction platforms to holistic orchestration engines that balance efficiency, cost containment, and customer expectations.

Within this dynamic milieu, stakeholders across airports, airlines, freight forwarders, and ground handlers are aligning around the common imperative to digitize legacy workflows. Reliance on manual processes and disparate systems is increasingly viewed as untenable in an environment characterized by fluctuating demand patterns and geopolitical uncertainties. The introduction of cloud-based architectures, coupled with advanced analytics and machine learning, is reshaping operational paradigms, enabling predictive decision-making and agile response mechanisms. In parallel, the emergence of collaborative ecosystems is fostering seamless data exchange among partners, laying the groundwork for more intelligent capacity planning, rapid exception management, and sustainable growth trajectories.

Navigating the Technological and Operational Paradigm Shifts Reshaping Cargo Management Ecosystems Worldwide

Over the past few years, the air cargo sector has experienced transformative technological disruptions that are redefining the concept of operational excellence. Automation of manual handling tasks through robotics and mechanized sorting has significantly reduced processing times and error rates, while cloud-native platforms have eliminated the constraints of on-premises hardware, facilitating real-time data access across geographically dispersed stakeholders. Concurrently, machine learning algorithms are enhancing demand forecasting capabilities, enabling carriers and logistics providers to reduce empty-leg flights and optimize load factors.

Moreover, the integration of Internet of Things sensors with tracking and tracing software is delivering unprecedented visibility into shipment condition and location, bolstering risk management and customer service. Blockchain pilots for air cargo documentation promise to eliminate paper-based bills of lading, streamline customs clearance, and improve auditability. Sustainability has also emerged as a focal point of innovation, driving the adoption of fuel-efficient flight planning tools and carbon offset integrations within cargo management suites. These advancements collectively signal a shift toward an ecosystem where data-driven collaboration, operational agility, and environmental stewardship converge to elevate the standards of air cargo management.

Evaluating the Widespread Consequences of Elevated United States Tariff Measures on Air Cargo Strategies and Supply Chains in 2025

In 2025, an escalation of United States tariff measures has reverberated through the global air cargo network, altering cost structures and routing strategies. Heightened duties on key import categories have prompted importers to reassess carrier contracts and surcharge allocations, with many seeking alternative gateways or multi-modal transport to mitigate landed costs. This phenomenon has been particularly pronounced for shipments originating from regions subject to Section 301 measures, where duty increases of up to 25 percent have driven cargo owners to explore transshipment hubs in free trade zones and to renegotiate freight-all-kinds rates.

These tariffs have also heightened scrutiny over customs brokerage processes, compelling freight forwarders and integrated service providers to invest in advanced compliance modules within their cargo management platforms. Automated tariff classification and dynamic duty calculation tools are now essential features to prevent clearance delays and avoid exposure to penalty provisions. Additionally, carriers have responded by refining their network strategies, collaborating with ground handlers to accelerate unloading operations in jurisdictionally favorable airports. The combined effect of these policy shifts is fostering a new operational ethos in which agility in response to regulatory volatility is as critical as the core capabilities of tracking, allocation, and resource planning.

Unlocking Deep Market Segmentation Insights Across Application, Component, Deployment, and Enterprise Scales

A nuanced understanding of application-based segmentation reveals that airports of all scales demand unified platforms capable of orchestrating curfews, slot allocations, and ramp operations in harmony with cargo airlines and commercial carriers. Freight forwarders, whether independent boutique operators or vertically integrated logistics conglomerates, require modular solutions that can adapt to their distinct control-tower requirements and network footprints. Ground handling providers, in turn, look for systems that tightly integrate real-time warehouse processes with on-dock transfer coordination and automated equipment scheduling.

From a component standpoint, consulting services have emerged as a critical enabler of digital transformation, guiding organizations through the strategic selection of software suites and deployment architectures. Support and maintenance offerings ensure system uptime and continuous feature rollouts, reducing the burden on internal IT teams. Tracking and tracing modules furnish granular visibility into shipment lifecycle events, while transportation management systems align route planning and capacity allocation with cost-optimization algorithms. Warehouse management suites extend this orchestration into storage and consolidation yards, automating inventory reconciliation and asset utilization.

When considering deployment preferences, cloud-native solutions are gaining momentum for their scalability, rapid provisioning, and seamless third-party integrations, whereas on-premises implementations remain relevant for entities with stringent data residency requirements or deeply embedded legacy infrastructures. Finally, large enterprises engage comprehensive end-to-end platforms capable of supporting multinational operations, complex network configurations, and advanced analytics, whereas small and medium-sized enterprises favor lightweight, intuitive interfaces that deliver quick time-to-value and lower total cost of ownership.

This comprehensive research report categorizes the Aviation Cargo Management Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Application

- Deployment Mode

- Organization Size

Illuminating the Strategic Regional Dynamics and Competitive Landscapes Spanning the Americas, EMEA, and Asia-Pacific

The Americas region continues to assert its dominance through significant investments in airport modernization and digital cargo corridors. North American carriers are enhancing their cargo management suites to support bespoke e-commerce shipping methods and temperature-controlled freight. In Latin America, burgeoning industrial clusters and new free trade agreements are driving demand for simplified compliance workflows and expedited customs processing functionality.

Across Europe, Middle East, and Africa, stakeholders are grappling with a heterogeneous regulatory landscape that demands configurable rule engines within cargo management systems. European Union directives on data protection and sustainable aviation fuel usage necessitate close collaboration among solution providers, carriers, and ground handlers to align system capabilities with compliance mandates. Meanwhile, the Middle East is emerging as a transshipment powerhouse, leveraging advanced hub airports to redistribute capacity throughout Africa, where infrastructure gaps have amplified the need for flexible, resilient cargo orchestration platforms.

In Asia-Pacific, the rapid expansion of manufacturing hubs in China and Southeast Asia, paired with government-led Belt and Road initiatives, has spurred exponential growth in air freight demand. Regional carriers are investing heavily in AI-driven demand forecasting and dynamic capacity management tools to navigate seasonal volatility and cross-border complexities. At the same time, emerging markets are accelerating cloud adoption to bypass cumbersome local infrastructure upgrades, enabling faster deployment of end-to-end cargo management capabilities.

This comprehensive research report examines key regions that drive the evolution of the Aviation Cargo Management Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Distilling Critical Competitive Intelligence from Leading Aviation Cargo Management Technology and Service Providers Worldwide

Leading providers within the aviation cargo management sphere are differentiating through strategic alliances, platform extensibility, and vertical integration. Technology innovators are partnering with global integrators to embed advanced machine learning engines within legacy transportation management modules, delivering predictive analytics as a core service offering. At the same time, specialized software vendors are expanding their footprints via M&A, incorporating warehouse management functionalities and real-time tracking features to compete across the stack.

Service leaders and consulting firms are carving out market share by coupling implementation expertise with proprietary industry accelerators, reducing deployment timelines and ensuring best-practice alignment. Several players have augmented their portfolios with carbon accounting modules, responding to rising pressure from carriers and shippers to meet net-zero objectives. In parallel, cloud hyperscalers are introducing managed cargo solutions that combine platform scalability with strict service level agreements, appealing to both global freight integrators and regional operators.

Competitive differentiation is increasingly defined by the depth of ecosystem connectivity. Providers offering open APIs, developer sandboxes, and partner marketplaces empower customers to tailor their cargo management landscapes with niche analytics tools, specialized compliance libraries, and last-mile delivery integrations. As cargo management evolves into a critical enabler of supply chain resilience, leading companies are those that can demonstrate both technological innovation and domain-specific expertise.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation Cargo Management Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accelya

- Accenture PLC

- ACL Airshop

- Aeologic Technologies

- AIA Cargo

- Awery Software FZ LLC

- Boltrics

- Champ Cargosystems SA

- ECS Group

- GALAXY International by Kale Logistics Solutions

- GoFreight

- Golden Support. s.r.o.

- Hermes Cargo

- Hexaware Technologies Limited

- InteliSys Aviation Systems

- Logitude World

- Magaya Corporation

- NIIT Technologies

- Riege Software International GmbH

- Sabre GLBL Inc.

- Shipthis

- Takeflite

- Travel Technology Interactive

- Wipro Ltd.

- WNS (Holdings) Ltd.

Actionable Strategic Imperatives for Industry Leaders to Enhance Agility and Operational Excellence in Air Cargo Management

Industry leaders should prioritize the acceleration of digital transformation initiatives by adopting modular, API-centric platforms that can seamlessly integrate predictive analytics and automation tools. Proactive investments in artificial intelligence will enhance demand forecasting accuracy and enable dynamic capacity allocation, ultimately reducing cost per shipment and improving service reliability. In parallel, establishing cross-functional centers of excellence will cultivate the internal capabilities required to drive continuous innovation and facilitate governance over evolving regulatory requirements.

To navigate tariff volatility and global trade uncertainties, executives should explore strategic alliances with customs brokerage specialists and leverage advanced compliance engines within their cargo management systems. This will mitigate clearance delays and safeguard against punitive fines. Concurrently, embedding sustainability metrics into core performance dashboards will provide transparency on carbon footprints, fuel consumption, and waste reduction, aligning operational objectives with emerging environmental standards.

Finally, fostering a culture of collaborative innovation across the extended supply chain will be critical. Engaging with solution partners, ground handlers, and last-mile carriers through integrated digital platforms can streamline exception management and accelerate decision-making. By proactively scaling capabilities, industry leaders can secure a competitive advantage in a landscape defined by rapid technological change and regulatory complexity.

Ensuring Robust Insights through Rigorous Data Collection, Multi-Source Validation, and Comprehensive Analytical Frameworks

Our research methodology combines extensive primary interviews with C-suite executives, operations managers, and technology architects across airlines, airports, freight forwarders, and ground handling companies to surface firsthand insights into evolving pain points and strategic priorities. Complementing these qualitative engagements, secondary research encompasses white papers, regulatory filings, and vendor product literature to validate emerging trends and benchmark solution capabilities against global best practices.

Data triangulation is achieved through the integration of third-party logistics performance indices, trade flow databases, and tariff schedules to contextualize market dynamics and policy impacts. Advanced analytical frameworks, including SWOT analyses and technology readiness assessments, are applied to distill the competitive positioning of leading vendors and to identify gaps in service portfolios. The segmentation framework is rigorously tested through scenario modeling and expert validation workshops, ensuring that application, component, deployment, and organization size dimensions accurately reflect real-world decision criteria.

Throughout the study, an advisory board of industry veterans provided ongoing feedback to refine research instruments and vet preliminary findings. This collaborative approach has ensured the robustness of insights and the reliability of strategic recommendations, delivering actionable intelligence to support both technology providers and cargo stakeholders in navigating the complexities of the modern air freight ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation Cargo Management Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation Cargo Management Systems Market, by Component

- Aviation Cargo Management Systems Market, by Application

- Aviation Cargo Management Systems Market, by Deployment Mode

- Aviation Cargo Management Systems Market, by Organization Size

- Aviation Cargo Management Systems Market, by Region

- Aviation Cargo Management Systems Market, by Group

- Aviation Cargo Management Systems Market, by Country

- United States Aviation Cargo Management Systems Market

- China Aviation Cargo Management Systems Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesis of Core Findings Highlighting the Nexus of Technology, Policy, and Competitive Forces Driving Cargo Management Evolution

The convergence of advanced digital solutions, shifting trade policies, and evolving regional priorities underscores a pivotal moment for air cargo management. Technological advancements such as AI-enabled forecasting, IoT-driven visibility, and blockchain-based documentation are redefining operational efficiencies. Simultaneously, the 2025 tariff landscape in the United States has compelled stakeholders to reimagine routing strategies, compliance processes, and cost-allocation mechanisms.

In dissecting market segmentation, it is clear that differentiated requirements across airports, airlines, forwarders, and ground handlers necessitate flexible, scalable platforms. The choice between cloud and on-premises deployment, alongside the distinct needs of large enterprises versus small and medium-sized businesses, continues to shape vendor roadmaps and buyer evaluations. Regionally, the Americas, EMEA, and Asia-Pacific each present unique growth drivers, regulatory challenges, and infrastructure investments that influence cargo management priorities.

Competitive analysis confirms that leading technology and service providers are advancing through strategic alliances, broadened service portfolios, and a focus on ecosystem connectivity. The actionable recommendations outlined herein offer a clear blueprint for executives to enhance agility, strengthen compliance resilience, and drive sustainable operations. As the air cargo industry navigates an era defined by rapid technological change and policy volatility, the insights and strategies encapsulated in this report will be instrumental for decision-makers committed to staying ahead of the curve.

Engage Directly with Ketan Rohom to Access In-Depth Market Intelligence and Empower Your Strategic Decision-Making in Cargo Systems

For tailored insights, strategic counsel, and exclusive access to the full Aviation Cargo Management Systems market research report, connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex data into actionable initiatives can help your organization identify growth opportunities and mitigate risks. Reach out to explore customized briefings, secure early-release findings, and leverage our comprehensive analysis to sharpen your competitive edge in the evolving air cargo landscape.

Don’t miss the opportunity to empower your strategic decision-making with definitive intelligence on regulatory shifts, technological innovations, and market segmentation dynamics. Partner with Ketan today to receive a detailed proposal, discuss bespoke advisory engagements, and accelerate your path to operational excellence and sustainable growth in global cargo management.

- How big is the Aviation Cargo Management Systems Market?

- What is the Aviation Cargo Management Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?