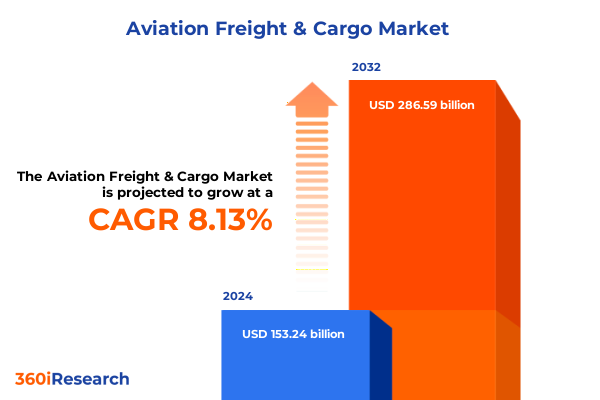

The Aviation Freight & Cargo Market size was estimated at USD 165.50 billion in 2025 and expected to reach USD 178.40 billion in 2026, at a CAGR of 8.15% to reach USD 286.59 billion by 2032.

Discovering the Foundations of the Aviation Freight and Cargo Marketplace Through Comprehensive Strategic and Operational Insights

The aviation freight and cargo industry serves as the lifeblood of global commerce, seamlessly bridging manufacturers, distributors, and end-consumers across continents. In today’s interconnected landscape, the ability to transport goods rapidly and reliably by air has never been more critical. Businesses rely on this sector not only to maintain just-in-time supply chains but also to capitalize on emergent market opportunities in high-value, perishable, and mission-critical cargo segments. As global trade volumes escalate and customer expectations evolve, the air freight network must continually adapt its operational, technological, and strategic frameworks to uphold service excellence and cost efficiency.

Against this backdrop, carriers, logistics providers, and end-users confront a dynamic set of drivers and constraints. Technological innovation is reshaping how shipments are tracked, managed, and optimized, while regulatory developments around sustainability and security are imposing new compliance requirements. Simultaneously, an expanding palette of service offerings-from economy solutions catering to price-sensitive shippers to express networks tailored for urgent deliveries-is fragmenting demand and intensifying competitive pressures. This confluence of factors underscores the need for an integrated perspective that captures both macro trends and granular operational realities.

This executive summary offers a structured synopsis of the current market environment, key transformative forces, tariff implications, segmentation insights, and regional differentials. It also highlights the strategic positioning of leading players, actionable recommendations for industry leaders, and the rigorous research methodology underpinning these findings. Designed to guide senior executives and strategic planners, these insights aim to foster informed decision-making and chart a resilient course forward in an era of unprecedented change.

Navigating the New Paradigm of Technological, Regulatory, and Consumer-Driven Transformations Shaping the Aviation Freight and Cargo Ecosystem

The aviation freight and cargo sector is undergoing a profound metamorphosis driven by a confluence of technological advances, regulatory mandates, and shifting customer expectations. Digitization initiatives, such as the integration of IoT sensors and blockchain-enabled ledgers, are revolutionizing transparency and traceability across the supply chain. These innovations enable real-time monitoring of environmental conditions for perishable and high-value shipments, while predictive analytics optimize routing and load balancing to maximize fleet utilization.

Simultaneously, regulatory frameworks are tightening around carbon emissions, noise pollution, and cargo security, compelling carriers to adopt sustainable fuels, retrofit existing fleets, and invest in airport infrastructure enhancements. The push for environmental responsibility is reshaping procurement strategies as shippers increasingly prioritize partners with credible decarbonization roadmaps. In parallel, evolving security protocols emphasize advanced screening technologies and digital documentation to mitigate risks associated with dangerous goods and cross-border shipments.

Consumer behavior is also exerting powerful influence, as the exponential growth of e-commerce demands faster delivery windows and more flexible service choices. Logistics providers are responding by launching tailored express corridors, leveraging digital platforms for seamless booking and tracking, and exploring last-mile integration with air-sea multimodal solutions. The amalgamation of these forces is establishing a new operational paradigm in which agility, transparency, and sustainability are not optional but fundamental prerequisites for competitive differentiation.

Assessing the Comprehensive Consequences of 2025 United States Tariff Adjustments on Aviation Freight and Cargo International Flows

In 2025, the United States implemented a series of tariff adjustments affecting a broad spectrum of imported goods, with significant repercussions for the aviation freight and cargo industry. Tariffs on key commodities such as certain metals, electronics components, and advanced machinery have led to recalibrated cost structures throughout the global logistics network. Carriers and forwarders have been compelled to reassess routing decisions, often opting for indirect paths or transshipment hubs to mitigate duties and preserve margin integrity.

These tariff shifts have precipitated a notable reconfiguration of trade lanes, with importers and exporters seeking to diversify sourcing strategies beyond traditional partners. While some shippers have absorbed incremental duties in exchange for faster transit times, others have transitioned to over-the-border movements via Canada and Mexico, leveraging free trade agreements to circumvent higher U.S. levies. Such maneuvers have introduced complexity into capacity planning and forecasting, as unpredictable surges in cross-border traffic strain existing infrastructure.

The net effect of these policy changes extends beyond immediate cost pressures, influencing long-term network design and contractual frameworks. Stakeholders are increasingly negotiating flexible rate structures and surge capacity clauses to accommodate tariff-driven volume fluctuations. Moreover, carriers are accelerating investments in digital customs clearance solutions and tariff optimization tools, recognizing that agility in regulatory response has become a critical capability for sustaining reliable service and competitive pricing in a post-tariff environment.

Delving into In-Depth Segmentation Perspectives That Illuminate Mode, Service, Size, Cargo Classification, and Industry Usage Patterns

Deep insights emerge when scrutinizing the market through multiple segmentation lenses, from the vehicles that carry cargo to the industries that consume it. By mode of transport, the landscape is divided between dedicated freighter operations and the utilization of belly cargo capacity in passenger aircraft. Each mode offers unique advantages: dedicated fleets provide flexibility for large-scale shipments while belly space leverages existing passenger routes to deliver cost-effective service. Transitioning between these options requires nuanced planning, as demand patterns dictate the optimal blend of capacity and speed.

Service tiers further delineate the market into express, standard, and economy offerings. Providers tailor their networks to balance delivery speed against price considerations, often layering regional express corridors atop broader standard air freight services. At the same time, economy solutions cater to shippers with extended lead times, leveraging backhaul opportunities and lower-cost routings to drive efficiency. This multi-tiered service architecture reflects evolving shipper priorities and underscores the importance of modular network design.

Shipment size segmentation reveals distinct operational drivers for small, medium, and large consignments. Small parcels demand acceleration of digital booking and tracking capabilities, while medium-sized shipments are optimized through volumetric consolidation and standardized handling processes. Large freight, including outsized or heavy-lift loads, necessitates specialized equipment and custom routing, often engaging project cargo experts to coordinate multimodal transfers.

Cargo type introduces further complexity, as the industry handles everything from general packaged goods and machinery & equipment to high-value electronics and precious metals, as well as dangerous chemicals, explosives, live animals, and various perishable commodities. Each category imposes specific storage, handling, and regulatory requirements, compelling providers to maintain specialized facilities, certifications, and training programs.

Finally, the end-user industry segmentation-spanning aerospace & defense, automotive, e-commerce & retail, electronics & technology, food & beverages, and pharmaceuticals & healthcare-shapes demand profiles and service attributes. Aerospace logistics prioritize traceability and high-security protocols, automotive supply chains emphasize just-in-time consistency, and the pharmaceutical segment demands validated cold-chain solutions. Understanding these layered segmentation dynamics is pivotal for stakeholders to align network investments with targeted market pockets and unlock differentiated value propositions.

This comprehensive research report categorizes the Aviation Freight & Cargo market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode Of Transport

- Type Of Service

- Shipment Size

- Cargo Type

- End-User Industry

Exploring Distinct Regional Dynamics and Strategic Opportunities Across the Americas, EMEA, and Asia-Pacific Freight Corridors

Regional characteristics exert a profound influence on how aviation freight and cargo networks evolve and perform. In the Americas, robust intra-regional trade corridors underpin a mature network of major hub airports and efficient cross-border trucking connections. The prevalence of large-scale manufacturing and distribution centers in North America dovetails with high-capacity dedicated freighter services, while Latin American markets continue to lean on belly cargo allocations due to constrained freighter infrastructure.

Across Europe, the Middle East & Africa, a tapestry of regulatory environments and infrastructural maturity levels shapes service offerings. Western European nations benefit from dense airport clusters and harmonized customs regimes, fostering swift standard and express air freight solutions. The Middle East serves as a strategic intercontinental connecting point, with top-tier carriers investing heavily in next-generation freighter fleets and digital trade facilitation hubs. In contrast, segments of Africa are still developing core airport capacities and cold-chain capabilities, generating pockets of high growth potential for specialized perishable and pharmaceutical logistics.

The Asia-Pacific region stands out for its dual role as both production powerhouse and burgeoning consumer market. Peak e-commerce demand in major East Asian economies is driving unprecedented volumes into express flight lanes, while Southeast Asian manufacturing growth is bolstering standard and economy service tiers. Investments in greenfield airports and bonded logistics parks are raising the bar for service reliability, and partnerships between domestic carriers and global integrators are enabling seamless end-to-end offerings across diverse regulatory landscapes. Collectively, these regional nuances underscore the importance of sculpting network strategies that resonate with localized market demands and growth trajectories.

This comprehensive research report examines key regions that drive the evolution of the Aviation Freight & Cargo market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Uncovering the Strategic Positioning and Innovation Initiatives of Leading Global Aviation Freight and Cargo Service Providers

Leading service providers are deploying an array of strategies to assert dominance in an increasingly competitive environment. Global integrators have doubled down on proprietary digital platforms that blend air, ground, and sea modalities, offering seamless booking and real-time visibility across touchpoints. At the same time, pure-play air freight carriers are investing in next-generation freighter aircraft outfitted with fuel-efficient engines and smart loading systems to reduce per-flight costs and emissions.

Strategic alliances and joint ventures are proliferating as carriers seek to broaden their network footprints without incurring the full overhead of new gateways. Collaboration agreements facilitate capacity sharing on high-traffic lanes, while code-share arrangements enhance service density in emerging markets. This cooperative model contrasts with traditional consolidation-focused approaches, reflecting a shift toward more agile, asset-light expansions.

In the innovation space, providers are piloting autonomous cargo drones for last-mile deliveries, particularly in regions where ground infrastructure remains limited. Trials of hybrid electric aircraft for short-haul routes are also gaining momentum, signaling the industry’s commitment to decarbonization. On the customer engagement front, AI-driven chatbots and advanced data analytics are enhancing responsiveness, enabling predictive problem resolution and personalized service recommendations.

Companies are also refining their value-added services portfolio, catalyzing growth in segments such as temperature-controlled pharma lanes and secure high-value corridors. By aligning these specialized offerings with end-user industry requirements and digital platform capabilities, leading players are reinforcing customer loyalty, expanding wallet share, and fortifying their competitive moats.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation Freight & Cargo market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A.P. Møller - Mærsk A/S

- Airbus SE

- ATR Aircraft

- Cargolux Airlines International S.A.

- CMA CGM S.A.

- Dassault Aviation SA

- Deutsche Post AG

- Embraer S.A.

- Expeditors International of Washington, Inc.

- FedEx Corporation

- GEODIS S.A.

- Israel Aerospace Industries Ltd.

- Kuehne + Nagel International AG

- Lockheed Martin Corporation

- Nippon Express Co., Ltd.

- Textron Aviation Inc.

- The Boeing Company

- United Parcel Service, Inc.

- Viking Air Ltd.

- XPO Logistics, Inc.

Actionable Strategies and Tactical Roadmaps to Enhance Resilience Profitability and Sustainability in Aviation Freight and Cargo

To navigate mounting complexity and accelerate performance improvement, industry leaders should prioritize integrated technology adoption and data-centric decision frameworks. Establishing unified control towers that consolidate real-time operational data, tariff schedules, and capacity forecasts under a single pane of glass can drastically improve agility and drive down disruption costs. As these environments mature, predictive algorithms will facilitate proactive capacity reallocation and dynamic pricing adjustments, optimizing both service quality and profitability.

Sustainability must be elevated from compliance checkbox to strategic differentiator. Industry participants can gain a competitive edge by embedding carbon accounting tools into rate quotations, enabling customers to make emissions-informed logistics choices. Concurrently, forging partnerships with sustainable aviation fuel producers and exploring electrification pathways for feeder aircraft can substantively reduce environmental footprints and resonate with increasingly eco-sensitive stakeholders.

Enhancing end-user centricity through tailored product bundles can unlock incremental revenue and deepen customer loyalty. By co-developing specialized solutions with key vertical partners-such as cold-chain pillars for pharmaceuticals or secure high-touch services for aerospace components-providers can create stickier engagements and defend against price erosion. These customized offerings, delivered via scalable digital channels, will also support higher margins and recurring revenue streams.

Finally, fostering a culture of continuous innovation is imperative. Leadership teams should allocate resources for rapid prototyping of emerging concepts such as autonomous urban air cargo and peer-to-peer logistics marketplaces. Institutionalizing cross-functional innovation labs and executing periodic strategy sprints will ensure the organization remains at the forefront of industry disruption and is well-positioned to capitalize on emerging growth vectors.

Outlining a Robust Multi-Phase Research Methodology Combining Qualitative and Quantitative Approaches With Industry Benchmarks

The insights presented in this analysis are grounded in a multi-phase research methodology that blends qualitative depth with quantitative rigor. Initial desk research aggregated publicly available industry publications, regulatory filings, company annual reports, and trade association data to establish a comprehensive baseline of market structure and historical trends. This secondary research phase was supplemented by proprietary news archives and policy announcements to capture recent developments and tariff changes.

To enrich this foundation, primary interviews were conducted with a cross-section of stakeholders, including senior executives from major carriers, logistics managers at leading manufacturing and retail firms, regulatory authorities, and industry consultants. These interviews provided nuanced perspectives on operational challenges, investment priorities, and emerging opportunities, ensuring that the analysis reflects both strategic intent and practical execution considerations.

Quantitative data points derived from industry surveys and financial disclosures were triangulated against shipment volume indices, airport throughput statistics, and trade flow metrics. This triangulation process served to validate narrative findings and highlight areas of divergence or emerging inflection points. Additionally, benchmarking exercises compared carrier performance across key service attributes, including on-time delivery rates, network coverage, and digital innovation maturity.

Throughout the methodology, data integrity and ethical guidelines were upheld, with all proprietary sources anonymized to protect confidentiality. The resulting framework ensures that conclusions and recommendations are both credible and actionable, offering decision makers a reliable compass for strategic planning in the aviation freight and cargo domain.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation Freight & Cargo market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation Freight & Cargo Market, by Mode Of Transport

- Aviation Freight & Cargo Market, by Type Of Service

- Aviation Freight & Cargo Market, by Shipment Size

- Aviation Freight & Cargo Market, by Cargo Type

- Aviation Freight & Cargo Market, by End-User Industry

- Aviation Freight & Cargo Market, by Region

- Aviation Freight & Cargo Market, by Group

- Aviation Freight & Cargo Market, by Country

- United States Aviation Freight & Cargo Market

- China Aviation Freight & Cargo Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Critical Insights and Forward-Thinking Imperatives to Articulate the Future Outlook of Aviation Freight and Cargo

By synthesizing cross-sector perspectives and rigorous data analysis, this executive summary illuminates the imperatives driving the future of aviation freight and cargo. From the relentless pace of digital transformation and shifting regulatory landscapes to the nuances of global trade policy, stakeholders must navigate a mosaic of forces that is reshaping service portfolios, network geographies, and cost structures. In this evolving ecosystem, agility, collaboration, and innovation stand out as critical success factors.

Looking ahead, the integration of advanced analytics, autonomous systems, and sustainable aviation fuels will redefine operational models and environmental stewardship. Carriers that proactively embrace these technologies and forge strategic alliances across modalities will secure a competitive edge in both established and emerging markets. Equally important will be the ability to tailor solutions to the specific demands of diverse end-user industries, whether through specialized cold-chain corridors for pharmaceuticals or secure high-value lanes for electronics.

Ultimately, the organizations that excel will be those that treat transformation as a continuous journey rather than a one-off initiative. Embedding a culture of experimentation, backed by adaptive governance structures and customer-centric metrics, will empower industry participants to anticipate disruptions and pivot swiftly. By aligning strategic vision with operational excellence, the aviation freight and cargo sector can chart a path toward sustainable growth, operational resilience, and enduring competitive advantage.

Empowering Decision Makers With Expert Guidance to Secure Comprehensive Market Insights by Connecting With Ketan Rohom

To explore the intricate dynamics of the aviation freight and cargo market and unlock tailored insights that drive strategic growth, we invite you to connect with Ketan Rohom (Associate Director, Sales & Marketing). Engaging directly will enable decision makers to acquire a comprehensive market research report designed to illuminate industry trends, competitive landscapes, and forward-looking opportunities. By initiating a conversation with Ketan, you will gain personalized guidance on how the report can address your specific business challenges, support informed investment decisions, and reinforce operational resilience. Reach out today to secure your copy and empower your organization with the data-driven intelligence it needs to thrive in a rapidly evolving global marketplace

- How big is the Aviation Freight & Cargo Market?

- What is the Aviation Freight & Cargo Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?