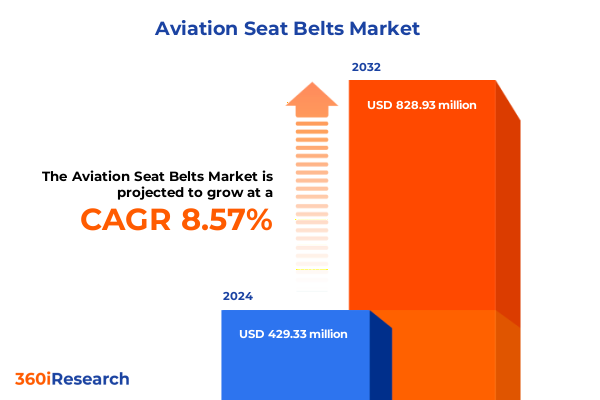

The Aviation Seat Belts Market size was estimated at USD 429.33 million in 2024 and expected to reach USD 463.85 million in 2025, at a CAGR of 8.57% to reach USD 828.93 million by 2032.

Crafting a Strategic Overview Illuminating Core Drivers Emerging Challenges and Intricate Market Dynamics Shaping the Evolution of Aviation Seat Belt Safety

The aviation landscape today is witnessing an unprecedented focus on passenger safety and operational reliability, with seat belt systems emerging as a critical component of in-flight risk management. As both regulatory bodies and aircraft manufacturers drive toward enhanced crashworthiness standards, the demand for sophisticated seat restraint solutions has intensified. In addition, the push toward lightweight materials and ergonomic designs has reshaped traditional paradigms, compelling stakeholders to reevaluate legacy systems and invest in next-generation technologies.

Moreover, evolving passenger expectations for comfort and convenience have driven innovations in retractable mechanisms and material science, marrying safety imperatives with weight optimization. In parallel, heightened awareness of supply chain vulnerabilities has accentuated the importance of tariff impacts, regional production strategies, and partnership models. Consequently, a holistic analysis of market drivers, challenges, and strategic pathways is essential for industry leaders seeking to capture emerging opportunities.

Furthermore, this executive summary distills the report’s core findings, offering a concise yet comprehensive overview of transformative shifts, geopolitical influences, segment-level insights, regional dynamics, and competitive positioning. By synthesizing these multifaceted dimensions, decision-makers will be equipped with the intelligence necessary to navigate complex market forces, align product roadmaps with regulatory timelines, and prioritize investments that yield sustainable returns.

Looking ahead, the interplay between innovation cycles and regulatory cadences will dictate the pace at which new restraint systems enter service. Collaboration among airlines, tier-one contractors, and accreditation bodies is critical to ensure that advanced prototypes meet both safety requirements and operational constraints. Strategic alignment of research portfolios with anticipated certification updates, coupled with agile manufacturing capabilities, will determine which players emerge as champions in an increasingly safety-driven market. Consequently, understanding these multifaceted dynamics is pivotal for executives seeking to chart a resilient growth trajectory in the evolving aviation seat belt domain.

Uncovering Pivotal Technological Regulatory and Customer-Centric Transformations Redefining the Aviation Seat Belt Market Landscape in 2025 and Beyond

The aviation seat belt industry is undergoing a period of rapid transformation fueled by technological breakthroughs, regulatory evolution, and shifting stakeholder priorities. Intelligent restraint systems featuring sensor integration now enable adaptive tightening mechanisms, enhancing occupant protection during turbulence and emergency maneuvers. In conjunction with these sensors, the integration of Internet of Things (IoT) platforms has introduced predictive maintenance capabilities, providing real-time diagnostics that preempt component failures and minimize downtime.

Simultaneously, regulatory frameworks worldwide have tightened crash injury criteria and mandated more rigorous testing protocols. New certification standards now require dynamic performance validation under extreme load scenarios, prompting manufacturers to adopt advanced simulation tools and material fatigue analyses. In addition, environmental sustainability has emerged as a key driver, with regulations incentivizing the use of recyclable polymers and bio-based fibers to reduce aircraft weight and carbon footprint.

Furthermore, passenger experience considerations have catalyzed ergonomic refinements, leading to slimmer profiles and enhanced comfort features that do not compromise structural integrity. These shifts have not only redefined product innovation roadmaps but also accelerated strategic collaborations between material science experts, avionics integrators, and regulatory bodies. Ultimately, the convergence of these forces is creating a more resilient, efficient, and passenger-centric aviation safety ecosystem.

In addition, the integration of digital supply chain platforms and advanced analytics has reshaped procurement and inventory management paradigms. By leveraging real-time visibility into component traceability and demand forecasting, manufacturers and MRO providers can optimize stock levels, reduce lead times, and improve serviceability metrics. As collaborative ecosystems expand to include software, hardware, and data service providers, the competitive landscape for seat belt innovations increasingly hinges on cross-sector partnerships and co-development models.

Analyzing the Impacts of 2025 U.S. Tariff Escalations on Import Economics Supply Chain Resilience and Strategic Sourcing in the Aviation Seat Belt Sector

The imposition of new tariff measures by the United States in early 2025 has introduced a complex set of challenges and strategic considerations for aviation seat belt manufacturers and suppliers. By increasing duties on key components and raw materials imported from select markets, these tariffs have exerted upward pressure on procurement costs, compelling companies to reassess global sourcing strategies. In response, some original equipment manufacturers have shifted toward near-shore partnerships to mitigate the financial impact of cross-border levies, thereby enhancing supply chain agility and cost predictability.

Moreover, the tariffs have triggered a ripple effect across the value chain, influencing lead times, inventory policies, and long-term contractual agreements. Suppliers are increasingly exploring consolidation of shipments to amortize fixed duty expenses, while logistics providers are optimizing routing to minimize tariff exposure. Concurrently, engineering teams are accelerating material substitution initiatives, evaluating alternative fiber composites and domestic alloys that comply with new trade regulations without sacrificing performance.

Financial strategies have also adapted in response to these tariff measures, with companies revisiting pricing models and contract structures to share cost burdens more equitably with airline customers. Long-term supplier agreements now often include tariff-adjustment clauses, enabling dynamic repricing mechanisms based on fluctuating duty rates. These contractual innovations, alongside proactive scenario planning, have become integral to maintaining profitability and ensuring continuity of supply amid shifting trade policies.

Furthermore, government incentives at the state and regional levels have begun to offset some of the tariff-related burdens, with localized tax rebates and manufacturing grants fostering onshore production capacity. As a result, a nuanced understanding of regulatory trends and proactive engagement with policy stakeholders have become essential tools for executives aiming to preserve margins, strengthen resilience, and maintain competitive positioning in the evolving tariff landscape.

Revealing Deep Insights into Market Segmentation by Belt Type Technology Material Composition Aircraft Class and Channel Distribution

Deep-dive segmentation analysis reveals the nuanced underpinnings of the aviation seat belt market, highlighting distinct preferences and performance requirements across product configurations. Based on seat belt type, the market spans five point belt systems that offer extensive restraint coverage, traditional lap belts favored for their simplicity and cost-effectiveness, lap shoulder belts which strike a balance between safety and comfort, and six point belts engineered for high-impact reliability in specialized applications. Each belt category caters to varying safety regulations and user demographics, informing differentiated product roadmaps.

From a technological perspective, the industry differentiates between non-retractable mechanisms that provide fixed anchoring and retractable solutions that integrate spring-loaded reels for enhanced stowage and load management. The choice between these technologies influences installation complexity and maintenance cycles, with retractable systems gaining traction in commercial passenger cabins for their ergonomic advantages.

Material-based segmentation underscores the importance of composite selection, spanning high-strength aramid fibers prized for their cut and abrasion resistance, nylon alternatives valued for cost efficiency and flexibility, and polyester options recognized for their tensile durability and resistance to environmental degradation. The strategic deployment of these materials reflects a trade-off between weight reduction goals and lifecycle performance metrics.

When examining aircraft type, segment analysis encompasses the rigorous demands of cargo aircraft applications, the unique configuration constraints of helicopter seating layouts, and the broad spectrum of passenger aircraft installations. Finally, distribution channel segmentation differentiates aftermarket procurement-driven by maintenance, repair, and overhaul cycles-from original equipment manufacturing pathways coordinated directly with airframe integrators. Together, these layered insights enable targeted go-to-market strategies and product differentiation across diverse end-user requirements.

This multidimensional segmentation framework not only delineates product attributes and distribution pathways but also informs cross-segment optimization strategies. For example, combining data on retractable technology adoption with material resilience metrics and regional preferences can reveal synergistic opportunities for targeted product enhancement. Such granular segmentation empowers stakeholders to prioritize R&D investments and client engagements that align closely with discrete market niches.

This comprehensive research report categorizes the Aviation Seat Belts market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Seat Belt Type

- Technology

- Material

- Aircraft Type

- Distribution Channel

Illuminating Nuanced Regional Variations and Strategic Growth Drivers across Americas Europe Middle East & Africa and Asia Pacific Aviation Seat Belt Markets

Regional dynamics play a pivotal role in shaping strategic priorities and investment patterns across the global aviation seat belt market. In the Americas, strong regulatory oversight by federal aviation agencies, coupled with sustained investment in fleet modernization by major carriers, has fueled demand for advanced restraint solutions. North American suppliers benefit from proximity to leading OEMs and robust infrastructure, while Latin American stakeholders are gradually increasing adoption rates as regional carriers upgrade aging fleets.

Conversely, Europe, Middle East & Africa present a heterogeneous landscape in which stringent European Union safety directives coexist with evolving certification standards in the Gulf and African nations. European manufacturers leverage established R&D ecosystems and collaborative consortia to refine high-performance materials, while Middle Eastern carriers emphasize passenger experience enhancements in flagship fleets. African markets, though nascent, are experiencing incremental growth driven by infrastructure development and regional connectivity initiatives.

Further east, the Asia-Pacific region stands out as a crucial growth frontier, with expanding commercial aviation networks in China, India, and Southeast Asia driving aftermarket and OEM demand. Local production hubs in Southeast Asia and increasing regulatory alignment with international safety norms have accelerated technology transfer and joint ventures. In addition, Asia-Pacific airlines’ focus on sustainability has spurred interest in eco-friendly material substitutes, positioning the region as both a manufacturing powerhouse and key consumer market for advanced seat belt systems.

Furthermore, regional trade agreements and bilateral safety protocols significantly influence market access and manufacturing decisions. In the Americas, the USMCA framework streamlines component exchange, while in Europe, the EASA and CEPA align certification standards across member states. Asia-Pacific nations are increasingly forging aviation safety pacts that encourage technology transfer and local content participation, thereby creating a ripple effect on OEM sourcing strategies and aftermarket support infrastructures.

This comprehensive research report examines key regions that drive the evolution of the Aviation Seat Belts market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders and Their Strategic Initiatives Partnerships and Technological Advancements Transforming the Aviation Seat Belt Landscape

Leading industry stakeholders have intensified strategic efforts to differentiate their offerings and capture market share within the aviation seat belt segment. One global avionics and aerospace supplier has expanded its portfolio through the integration of lightweight composite technologies and smart fastening systems, demonstrating a commitment to both safety innovation and operational efficiency. Another prominent manufacturer, known for its extensive aftermarket network, has strengthened partnerships with tier-one carriers to deliver rapid-response maintenance services and retrofit kits tailored to diverse airframe models.

In parallel, a major seating solutions enterprise has leveraged advanced polymer expertise to introduce next-generation webbing materials that deliver enhanced cut resistance and UV stability. This company’s collaborations with research institutes have yielded proprietary coatings that resist flame propagation while reducing friction during emergency evacuations. Meanwhile, an established engineering conglomerate has invested in modular restraint architectures compatible with both passenger cabins and specialized rotorcraft applications, streamlining certification processes across multiple regulatory jurisdictions.

Furthermore, emerging players specializing in sensor-enabled retractable mechanisms are gaining traction by aligning product roadmaps with predictive maintenance platforms and digital supply networks. These agile entrants are fostering collaborations with digital twins developers to simulate crash dynamics and optimize belt tension algorithms. Collectively, these strategic initiatives underscore an increasingly competitive environment characterized by technological convergence and collaborative ecosystems.

Looking ahead, merger and acquisition activity is expected to reshape the competitive landscape as large OEMs and component specialists seek to integrate complementary technologies. Startups focusing on novel belt tension algorithms and smart sensor arrays are drawing venture capital interest, positioning themselves as potential acquisition targets. Strategic investments in these emerging innovators may accelerate time-to-market for advanced restraint solutions and foster differentiation in an environment where safety margins and operational efficiency are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation Seat Belts market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ACM Aircraft Cabin Modification GmbH

- Aerocare International Limited

- AmSafe Inc.

- ANJOU AERONAUTIQUE

- Autoflug GmbH

- Autoliv Inc.

- Collins Aerospace

- Davis Aircraft Products Co, Inc.

- Leonardo S.p.A.

- Midwest Precision Products, Inc.

- RECARO Aircraft Seating GmbH & Co. KG

- SAFRAN group

- Salvex Group Inc.

- SCHROTH Safety Products GmbH

- Ssnake-Oyl Products, Inc.

- TRW Automotive Holdings Corp.

- ZF Friedrichshafen AG

Delivering Tactical and Strategic Recommendations to Enable Industry Leaders to Capitalize on Emerging Opportunities and Mitigate Aviation Seat Belt Market Challenges

To capitalize on the evolving aviation seat belt landscape, industry leaders should prioritize cross-functional collaboration that integrates design, regulatory, and supply chain teams from the earliest stages of product development. By adopting modular design principles, companies can accelerate certification timelines and reduce customization costs, enabling rapid adaptation to emerging regulations and customer specifications. In addition, establishing strategic alliances with material innovators will facilitate the adoption of advanced fiber composites and bio-based polymers, driving both performance enhancements and sustainability objectives.

Moreover, decision-makers must invest in digitalization initiatives, such as implementing sensor-based analytics for predictive maintenance and leveraging blockchain-enabled traceability throughout the component lifecycle. These technologies not only improve safety compliance but also enhance operational transparency and streamline aftermarket support. Complementarily, firms should explore near-shore manufacturing partnerships to mitigate tariff exposure and bolster supply chain resilience in response to geopolitical uncertainties.

Furthermore, a customer-centric approach that incorporates user experience testing and ergonomic validation will yield restraint systems that resonate with both commercial airlines and specialty operators. By integrating feedback loops and simulation-based prototyping, organizations can refine belt geometries and retractor mechanisms to align with evolving passenger expectations.

In parallel, companies should embed sustainability metrics into product roadmaps by aligning with international environmental standards and pursuing third-party ecolabel certifications. Establishing ongoing dialogues with certification authorities will smooth regulatory pathways and preempt compliance bottlenecks. Moreover, attracting and retaining engineering talent with expertise in material science, digital systems, and regulatory affairs will be essential to sustain innovation pipelines and accelerate go-to-market timelines. Ultimately, these actionable strategies will equip industry stakeholders to navigate complex market dynamics while delivering differentiated value propositions and sustaining competitive advantage.

Outlining a Robust Research Methodology Describing Data Collection Approaches Analytical Frameworks and Rigorous Validation for Aviation Seat Belt Insights

The research foundation is built upon a dual-pronged approach, combining comprehensive secondary data analysis with targeted primary engagements to ensure depth and accuracy. Secondary research encompassed an exhaustive review of regulatory filings, technical white papers, industry standards documentation, and safety certification reports. This phase provided critical context on evolving performance benchmarks and compliance requirements across key markets.

Subsequently, primary research activities involved structured interviews and quantitative surveys with senior engineers, procurement executives, and safety compliance officers within leading aerospace organizations. These interactions yielded nuanced perspectives on material selection criteria, technology integration challenges, and supplier evaluation processes. In addition, site visits and virtual walkthroughs of manufacturing facilities offered firsthand insights into production workflows, quality assurance protocols, and equipment capabilities.

To validate findings, a triangulation methodology was applied, cross-referencing interview data with historical case studies and simulation outputs. Statistical outliers were examined through follow-up consultations, while consensus models were employed to reconcile divergent expert opinions. All data points underwent rigorous quality checks and consistency assessments, ensuring that the final insights reflect both operational realities and strategic imperatives.

Complementary to primary and secondary sources, the methodology incorporated advanced data modeling and scenario analysis to explore potential market inflection points. Monte Carlo simulations and sensitivity testing examined key variables such as tariff volatility, raw material price fluctuations, and certification lead times. These quantitative techniques provided robust foresight into risk vectors and opportunity zones, ensuring that the conclusions drawn reflect a wide spectrum of plausible future states. This robust research architecture underpins the actionable intelligence presented throughout the summary.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation Seat Belts market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation Seat Belts Market, by Seat Belt Type

- Aviation Seat Belts Market, by Technology

- Aviation Seat Belts Market, by Material

- Aviation Seat Belts Market, by Aircraft Type

- Aviation Seat Belts Market, by Distribution Channel

- Aviation Seat Belts Market, by Region

- Aviation Seat Belts Market, by Group

- Aviation Seat Belts Market, by Country

- Competitive Landscape

- List of Figures [Total: 30]

- List of Tables [Total: 423 ]

Synthesizing Critical Findings and Defining the Path Forward for Stakeholders Navigating the Intricate Landscape of Aviation Seat Belt Safety Markets

This executive summary distills the intricate interplay of technological innovation, regulatory evolution, and market segmentation that defines the current and future trajectory of aviation seat belt systems. By synthesizing insights on advanced materials, sensor-enabled mechanisms, and regional dynamics, the analysis illuminates the pathways through which stakeholders can enhance safety, optimize costs, and achieve sustainable growth. In particular, the examination of U.S. tariff impacts underscores the strategic importance of supply chain agility and localized manufacturing partnerships.

Moreover, the segmentation analysis provides a granular understanding of how seat belt configurations, technological variants, material choices, aircraft types, and distribution channels collectively shape product development priorities. Coupled with regional perspectives on the Americas, Europe Middle East & Africa, and Asia Pacific markets, these findings enable targeted market entry and expansion strategies that align with localized regulatory and customer requirements.

Ultimately, the competitive landscape is characterized by collaborative ecosystems wherein established players and agile innovators coalesce around shared objectives of safety excellence and operational efficiency. As the sector continues to evolve, a disciplined focus on research-driven product roadmaps and strategic partnerships will be essential to navigate complexities and secure a leadership position in the aviation seat belt arena.

As next-generation trends emerge, the convergence of predictive analytics, avionics integration, and passenger-centered design will define the future of seat belt systems. Smarter restraint assemblies capable of communicating with flight control systems and passenger health monitoring platforms will offer unprecedented safety assurances. By remaining vigilant of these nascent trends and fostering a culture of innovation, stakeholders can sustain competitive advantage and lead the charge toward safer skies.

Connect Directly with Ketan Rohom to Secure Your Comprehensive Aviation Seat Belt Research Report and Drive Informed Strategic Decisions with Expert Guidance

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to access the full aviation seat belt market research report. Gain immediate visibility into the complete dataset, in-depth analysis, and expert recommendations that inform strategic decision making. This comprehensive resource provides stakeholders with the actionable insights required to optimize product portfolios, strengthen supply chains, and capitalize on emerging technological and regional trends. Reach out today to secure your exclusive report and partner with an expert dedicated to driving your organization’s success in the evolving aviation safety landscape.

Don’t miss the opportunity to collaborate with a specialized expert who understands the intricate demands of the aviation safety sector. Partnering with Ketan Rohom ensures direct access to customized insights, tailored briefings, and priority research updates that support critical decision-making processes. Act now to secure the strategic intelligence that will propel your organization ahead of the curve.

- How big is the Aviation Seat Belts Market?

- What is the Aviation Seat Belts Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?