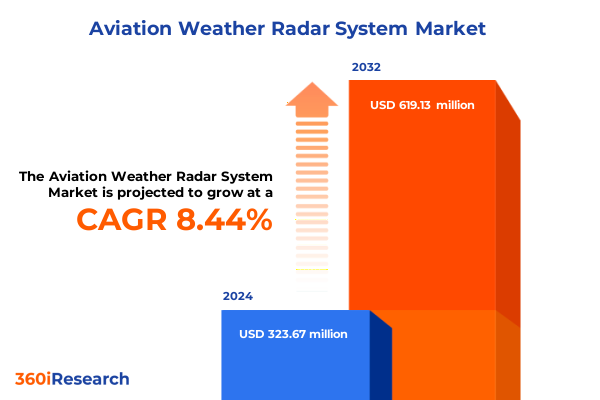

The Aviation Weather Radar System Market size was estimated at USD 349.85 million in 2025 and expected to reach USD 378.40 million in 2026, at a CAGR of 8.49% to reach USD 619.13 million by 2032.

Understanding the Critical Role of Aviation Weather Radar Systems in Enhancing Flight Safety, Operational Efficiency, and Navigational Precision Globally

The aviation weather radar market stands as a critical pillar in modern air transportation, playing an indispensable role in safeguarding flight operations and enabling real-time meteorological awareness. By continuously detecting precipitation, turbulence, and wind shear, these systems significantly reduce in-flight risks and support route optimization, ultimately elevating both safety and efficiency across commercial and military aviation sectors.

This executive summary distills the core dynamics shaping the aviation weather radar landscape, providing decision-makers with a clear understanding of technological evolution, regulatory influences, and market forces. Drawing on rigorous research and expert insights, it lays the groundwork for strategic planning and investment, guiding stakeholders toward informed choices that align with both near-term imperatives and long-term growth trajectories.

Exploring the Major Technological and Operational Transformations Shaping the Aviation Weather Radar Ecosystem Amid Rapid Digitalization and Innovation

The aviation weather radar ecosystem is undergoing profound technological and operational transformation as industry participants embrace digitalization, automation, and advanced sensing capabilities. Transition from legacy magnetron-based systems to solid-state radar architectures has accelerated, driven by the need for higher reliability, lower maintenance burdens, and enhanced signal resolution. Concurrently, the integration of artificial intelligence and machine learning into radar data processing enables predictive analytics, facilitating proactive weather avoidance and more precise flight path adjustments.

In parallel, the convergence of satellite data, ground-based networked sensors, and airborne radar systems is forging a cohesive atmospheric intelligence framework. This interconnected approach empowers airlines and air traffic management authorities to seamlessly share real-time weather insights, optimize airspace utilization, and mitigate disruptions. Furthermore, miniaturization and modular design principles are expanding the deployment of weather radar capabilities into smaller aircraft platforms and unmanned aerial systems, extending comprehensive meteorological coverage to previously underserved segments.

Analyzing the Aggregate Effects of Recent United States Tariffs on Aviation Weather Radar Supply Chains, Production Costs, and Market Dynamics in 2025

The cumulative impact of United States trade measures enacted in early 2025 has introduced significant cost pressures and strategic recalibrations across aviation weather radar supply chains. Tariffs of 25 percent on steel and aluminum imports, alongside increased duties on key electronic components sourced from China and North America, have amplified production expenses and prompted manufacturers to reassess sourcing strategies to maintain margins. Temporary exemptions under the United States–Mexico–Canada Agreement offered short-lived relief for Canadian and Mexican-origin goods until April 2, 2025, yet uncertainty surrounding further policy shifts continues to challenge planning cycles.

Major system integrators and component suppliers have responded by diversifying their manufacturing footprints, exploring nearshoring options, and investing in in-country value addition. These initiatives aim to mitigate tariff liabilities and safeguard critical supply lines. Airlines and defense operators are likewise evaluating life-cycle costs of radar-equipped platforms more rigorously, negotiating contracts that account for potential tariff revisions, and seeking collaborative pathways to absorb cost escalations through long-term service agreements.

Unveiling the Deep-Dive Market Segmentation of Aviation Weather Radars Across Type, Component, Range, Frequency, Distribution Channels, and Applications

An in-depth examination of the aviation weather radar market segmentation reveals distinct demand patterns and innovation drivers across multiple dimensions. The delineation between airborne radar and ground radar underscores divergent application requirements: airborne systems prioritize weight, compactness, and power efficiency, whereas ground-based installations emphasize long-range detection and continuous operation. Component-level analysis further uncovers the critical roles of antennas, duplexers, processors, receivers, and transmitters, each undergoing rapid technological enhancement to meet evolving performance expectations.

The classification by radar range-spanning long, medium, and short-range capabilities-reflects usage scenarios from en-route weather surveillance to terminal area guidance and localized hazard monitoring. Frequency band segmentation into C Band and X Band highlights the trade-offs between penetration capacity, resolution, and atmospheric attenuation, influencing system selection based on regional precipitation profiles and airspace density. Distribution channels, whether offline retail through specialized avionics distributors or online retail platforms offering direct-to-user procurement, illustrate shifting procurement models. Application segmentation distinguishes between civil aviation uses-including cargo airliners, commercial carriers, and private aircraft-and military aviation deployments, each segment demanding tailored system attributes, certification pathways, and support frameworks.

This comprehensive research report categorizes the Aviation Weather Radar System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Radar Range

- Frequency Band

- Distribution Channel

- Application

Comparative Analysis of Regional Market Dynamics Showcasing Growth Drivers and Challenges Across the Americas, EMEA, and Asia-Pacific in Aviation Weather Radar Adoption

Regional market dynamics for aviation weather radar systems are shaped by unique regulatory environments, infrastructure development trajectories, and air traffic growth patterns. In the Americas, robust defense budgets and comprehensive air traffic management modernization initiatives are driving demand for both ground and airborne radar upgrades. Collaborative programs between government agencies and private manufacturers are prioritizing interoperable networks to support cross-border flights and cargo operations, while emerging business aviation operators seek compact, high-performance solutions for remote-route operations.

Within Europe, the Middle East, and Africa, stringent regulatory frameworks and advanced certification protocols underpin strong adoption of next-generation weather radar technologies. Europe’s Single European Sky initiative and the Middle East’s airport expansion projects offer significant opportunities for system integrators. Conversely, Africa presents nascent but accelerating potential, where investments in air traffic safety and emerging low-cost carrier operations are gradually fueling demand. Meanwhile, the Asia-Pacific region stands out for its rapid traffic growth in China and India, extensive airport modernization, and strategic initiatives to bolster regional air defense capabilities. These factors collectively position the Asia-Pacific as a high-growth frontier for weather radar deployments across civil and military domains.

This comprehensive research report examines key regions that drive the evolution of the Aviation Weather Radar System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Positioning and Competitive Profiles of Leading Global Corporations in the Aviation Weather Radar Market Landscape

Leading original equipment manufacturers and system integrators maintain competitive differentiation through a blend of technological leadership, strategic partnerships, and global service networks. Prominent players leverage advanced R&D capabilities to introduce radar arrays with enhanced scanning speeds, improved clutter rejection, and seamless integration with digital weather overlays. Collaboration with specialized component suppliers facilitates rapid prototyping of next-generation antenna designs and solid-state transmit modules, further accelerating product development cycles.

Simultaneously, companies are forging alliances with software analytics firms to embed advanced visualization and predictive modeling directly into radar consoles. Such initiatives extend value beyond hardware sales by offering subscription-based data services that deliver actionable weather intelligence. Expansion of maintenance, repair, and overhaul (MRO) networks across key aviation hubs underscores the criticality of after-sales support, with major suppliers investing in regional training centers and remote diagnostics capabilities to minimize downtime and maximize radar system availability.

This comprehensive research report delivers an in-depth overview of the principal market players in the Aviation Weather Radar System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aerodata AG

- Airbus SE

- BAE Systems PLC

- Baron Weather, Inc.

- Elbit Systems Ltd.

- Enterprise Electronics Corporation

- EWR Radar Systems, Inc.

- GAMIC GmbH

- General Dynamics Corp.

- Hensoldt AG

- Honeywell International Inc.

- Israel Aerospace Industries Ltd.

- Kratos Defense & Security Solutions, Inc.

- L3Harris Technologies Inc.

- Leonardo S.p.A

- Lockheed Martin Corporation

- Northrop Grumman Corp.

- Raytheon Technologies Corp.

- Saab AB

- Teledyne FLIR LLC

- Terma A/S

- Thales Group

- The Boeing Company

- Toshiba Infrastructure Systems & Solutions Corporation

- Vaisala Oyj

Strategic Imperatives and Practical Measures for Industry Stakeholders to Capitalize on Emerging Trends and Overcome Imminent Challenges

Industry stakeholders must prioritize investment in digital architectures that accommodate modular upgrades, ensuring systems remain agile in the face of regulatory shifts and evolving performance benchmarks. Establishing diversified supply chains-blending domestic manufacturing with carefully vetted international partners-will help buffer against future trade disruptions and maintain cost competitiveness. Advancements in software-defined radar platforms should be leveraged to deliver continuous feature enhancements without requiring extensive hardware retrofits, thereby preserving investment value and enabling rapid feature rollouts.

Proactive engagement with regulatory authorities and standard-setting bodies is essential to shape certification guidelines that align with emerging solid-state and networked radar paradigms. Partnerships between manufacturers, airlines, and research institutions can foster shared risk models for technology validation, accelerating time-to-market for innovative solutions. Finally, focusing on data analytics capabilities and subscription-based service offerings will create recurring revenue streams, enhance customer loyalty, and cement leadership positions in a market where real-time weather intelligence is increasingly valued.

Overview of the Rigorous Research Framework, Data Collection Approaches, and Analytical Techniques Underpinning the Aviation Weather Radar Market Study

This study harnessed a multi-layered research framework combining primary and secondary data sources to deliver a robust market analysis. Primary research included in-depth interviews with senior executives, system architects, and end users across civil and defense segments to capture firsthand insights into technological adoption, procurement drivers, and pain points. Secondary research encompassed a thorough review of industry publications, regulatory filings, technical specifications, and publicly available company disclosures to validate market dynamics and benchmark competitive positioning.

Quantitative analysis employed triangulation techniques, aligning data from supply chain statistics, trade tariff records, and air traffic activity reports to underpin trend assessment and segmentation analysis. Geospatial mapping tools were utilized to visualize regional adoption patterns, while advanced statistical modeling informed scenario planning and risk assessment. Rigorous data validation procedures, including cross-referencing multiple independent sources and expert panel reviews, ensured the integrity and reliability of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Aviation Weather Radar System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Aviation Weather Radar System Market, by Type

- Aviation Weather Radar System Market, by Component

- Aviation Weather Radar System Market, by Radar Range

- Aviation Weather Radar System Market, by Frequency Band

- Aviation Weather Radar System Market, by Distribution Channel

- Aviation Weather Radar System Market, by Application

- Aviation Weather Radar System Market, by Region

- Aviation Weather Radar System Market, by Group

- Aviation Weather Radar System Market, by Country

- United States Aviation Weather Radar System Market

- China Aviation Weather Radar System Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Synthesis of Key Findings and Forward-Looking Perspectives on the Future Trajectory of the Aviation Weather Radar Market

In synthesis, the aviation weather radar market is at an inflection point where technological innovation and geopolitical forces converge. Solid-state advancements, AI-driven analytics, and networked sensor ecosystems are redefining system capabilities, while tariffs and trade policies introduce new cost and strategic considerations. The multidimensional segmentation and regional analyses highlight nuanced growth pockets, underscoring the imperative for tailored strategies that address diverse end-user requirements.

Looking ahead, stakeholders who embrace modular digital designs, diversify supply frameworks, and expand value-added services will be best positioned to navigate uncertainties and capture emerging opportunities. This report equips decision-makers with the insights needed to chart a forward-thinking path, balancing immediate operational imperatives with long-term innovation goals to secure sustained growth in the dynamic aviation weather radar landscape.

Engage Directly with Ketan Rohom for Exclusive Access to Transformative Aviation Weather Radar Market Intelligence

Unlock unparalleled strategic foresight by engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, to acquire the full market research report tailored to aviation weather radar systems. His expertise in articulating the nuanced insights and actionable recommendations will ensure you receive a comprehensive overview that drives your organization’s competitive advantage.

Reach out to schedule a personalized consultation and explore flexible licensing options designed to meet your strategic objectives. Secure your copy today and empower your decision-making with data-driven intelligence that transforms challenges into opportunities.

- How big is the Aviation Weather Radar System Market?

- What is the Aviation Weather Radar System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?