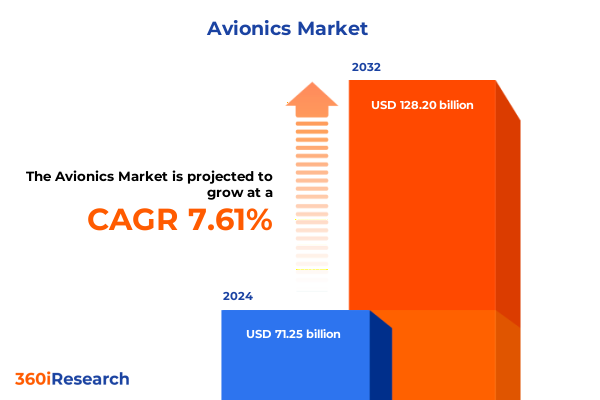

The Avionics Market size was estimated at USD 76.59 billion in 2025 and expected to reach USD 81.88 billion in 2026, at a CAGR of 7.63% to reach USD 128.20 billion by 2032.

Setting the Stage for an Unprecedented Era in Avionics Innovation and Market Dynamics Amid Rapid Technological Disruption and Regulatory Change

The avionics sector is undergoing a period of unprecedented transformation as converging forces of digital innovation, geopolitical realignment, and regulatory evolution reshape the future of flight. Emerging technologies such as artificial intelligence, machine learning, and software-defined radios are redefining traditional electronic architectures and enabling advanced functionalities that were once considered the domain of science fiction. Against this backdrop, industry stakeholders face the dual challenge of integrating next-generation capabilities while ensuring safety, reliability, and compliance within rigorous certification frameworks. By examining the latest technological, trade, and regulatory developments, this executive summary provides a concise yet thorough foundation for decision-makers aiming to harness the full potential of modern avionics.

Unveiling the Transformative Technological and Strategic Shifts Redefining Avionics Systems from AI Integration to Modular Architectures

Over the past two years, the avionics landscape has witnessed a series of transformative shifts driven by the deeper integration of digital systems and the emergence of more modular, interoperable architectures. Artificial intelligence has evolved from a niche research endeavor to a mainstream enabler of predictive maintenance and autonomous decision support, allowing airlines and militaries to optimize operations, minimize unscheduled downtime, and enhance mission readiness. Cloud-based analytics and high-speed data links are facilitating real-time situational awareness, enabling flight crews and ground operators to make informed choices based on instantaneous data streams.

Simultaneously, the advent of open architecture standards is dismantling proprietary silos, accelerating technology refresh cycles and reducing integration costs. Firms are embracing wireless avionics intra-connect (WAIC) solutions, which reduce wiring complexity and aircraft weight while delivering greater flexibility for future upgrades. The collective impact of these shifts is a material redefinition of avionics value propositions, with system providers and OEMs reconfiguring supply chains, forging strategic alliances, and prioritizing software-centric development pathways to maintain competitive advantage across commercial, business, and defense markets.

Analyzing the Cumulative Impact of 2025 United States Tariff Actions on Avionics Supply Chains, Component Costs, and Competitive Dynamics

In 2025, the United States implemented a series of trade actions that have cumulatively affected the avionics value chain, driving shifts in sourcing strategies and component costs. The Department of Commerce initiated a Section 232 national security investigation into imported commercial aircraft and parts, which imposes a 10% duty on affected imports, with public comment and potential rate adjustments under review. Alongside this, Section 301 measures targeting semiconductor products, including those used in flight control systems, navigation modules, and advanced sensors, saw tariff rates rise to 50% beginning January 1, 2025, creating significant cost pressures for avionics integrators yet stimulating some domestic capacity expansion.

These combined measures have driven industry participants to reassess global supply chain footprints, accelerate qualification of alternate suppliers in allied markets, and explore tariff mitigation through product reclassification or tariff exclusion requests. While some high-volume semiconductors and display components have experienced production on-shoring initiatives to offset incremental duties, the overall impact has been a reassessment of total landed costs, encouraging long-term supply agreements and collaborative R&D arrangements aimed at reducing dependency on single-source foreign suppliers.

Decoding Market Complexities through a Multi-Dimensional Segmentation Lens Product, Aircraft, Connectivity, Installation, and Distribution Dynamics

A nuanced understanding of the avionics market emerges when viewed through the prism of the five key segmentation dimensions, each illuminating distinct value pools and growth vectors. Product-type segmentation highlights the critical role of Communication Systems-ranging from intercoms to satellite terminals-in enabling in-flight connectivity and secure military communications, while Flight Control Systems, including autopilot and FMS solutions, are central to automation trends and in-service upgrades. Display Systems and Navigation Systems continue to evolve with high-definition, synthetic vision and GNSS-augmented capabilities, whereas Flight Data Recording and Surveillance & Monitoring Systems integrate resilient data capture and collision avoidance technologies.

Differentiating by Aircraft Type exposes varying adoption rates and lifecycle strategies: Business and General Aviation segments often pursue rapid retrofit cycles, while Commercial Aircraft operators balance OEM-led new installations with aftermarket modernization programs. Military platforms demand specialized, ruggedized avionics with bespoke certification requirements, and the surging Unmanned Aerial Vehicle market is catalyzing demand for lightweight, low-power modules. Connectivity segmentation underscores the accelerating shift from wired to wireless avionics systems, driven by weight reduction and maintenance efficiency, whereas Installation Type segmentation distinguishes between green-field aircraft platforms and retrofit & upgrade opportunities. Finally, Distribution Channel segmentation delineates the dynamic interplay between OEMs offering turnkey suites and Aftermarket Service Providers focused on lifecycle support and system enhancements.

This comprehensive research report categorizes the Avionics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Aircraft Type

- Connectivity

- Installation Type

- Distribution Channel

Navigating Regional Nuances in the Global Avionics Landscape Comparative Dynamics across the Americas, EMEA, and Asia-Pacific

Regional considerations play a pivotal role in shaping strategic priorities and competitive positioning across the global avionics ecosystem. In the Americas, robust commercial fleet expansion, combined with significant defense modernization budgets, underscores North America’s dual focus on efficiency gains through NextGen air traffic initiatives and the rapid deployment of advanced cockpit and mission systems. Latin American carriers and military forces similarly prioritize cost-effective retrofit programs while progressively adopting satellite-based communication and navigation upgrades.

Within Europe, Middle East & Africa, regulatory harmonization efforts-such as Single European Sky and SESAR projects-are driving interoperability standards and incentivizing CNS modernization across NATO airspaces and Gulf Cooperation Council states. At the same time, emerging African markets present nascent growth potential for basic retrofit and communications upgrades. In Asia-Pacific, soaring passenger traffic, deepening defense budgets, and dynamic UAV applications in civil and military contexts have propelled investments in high-throughput SATCOM, GNSS enhancements, and indigenous avionics production initiatives, reflecting a strategic emphasis on self-sufficiency and regional supply chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Avionics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Avionics Players Driving Innovation, Consolidation, and Strategic Partnerships in a Competitive Global Market

Industry leadership within avionics is characterized by a diverse portfolio of multinational conglomerates, specialized OEMs, and agile system integrators forging distinct strategic paths. Major players such as Honeywell International and Collins Aerospace are leveraging comprehensive R&D investments to advance open architecture platforms, AI-enabled flight management solutions, and integrated avionics suites that span commercial, business, and defense segments. Raytheon Technologies and Thales Group maintain a focus on secure communication networks, radar surveillance systems, and next-generation cockpit displays, often partnering with aerospace primes to co-develop bespoke mission avionics.

Simultaneously, niche innovators including Garmin and Teledyne Technologies are driving demand in cockpit modernization for general aviation and retrofit markets, emphasizing ease of integration and cost efficiency. The competitive landscape is further shaped by ongoing M&A activity as larger firms acquire specialized technology providers to bolster software capabilities, accelerate broadband connectivity solutions, and strengthen cybersecurity offerings, thereby optimizing value chains in anticipation of evolving air traffic management requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Avionics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Appareo Systems, LLC

- Aspen Avionics, Inc.

- Avidyne Corporation

- BAE Systems plc

- Curtiss-Wright Corporation

- ForeFlight, LLC

- FreeFlight Systems

- Garmin Ltd.

- General Electric Company

- Genesys Aerosystems

- Honeywell International Inc.

- L3Harris Technologies, Inc.

- Meggitt PLC

- Raytheon Technologies Corporation

- Safran SA

- Teledyne Technologies Incorporated

- Thales Group

- uAvionix Corporation

- Universal Avionics Systems Corporation

- Viasat, Inc.

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Avionics Market Opportunities and Mitigate Emerging Risks

To capitalize on the transformative shifts redefining avionics systems, industry leaders should pursue a series of strategic imperatives. First, embracing open avionics architectures and modular design principles will reduce integration timelines and support continuous technology refresh in response to emerging regulatory and operational requirements. Second, augmenting supply chain resilience through diversified sourcing strategies-balancing domestic production incentives with allied-country partnerships-will mitigate tariff-related volatility and safeguard critical component availability.

Moreover, embedding cybersecurity protocols at the hardware and software levels will become a non-negotiable requirement as software-defined radios and wireless data links proliferate. Market participants should also prioritize collaborative R&D initiatives targeting AI-driven predictive maintenance algorithms and spectrum-efficient communication channels. Finally, aligning regional market strategies with localized retrofit demand and regulatory frameworks will enable targeted value propositions, whether responding to NextGen upgrade programs in North America, SESAR-driven mandates in Europe, or defense-centered avionics initiatives in the Asia-Pacific theater.

Comprehensive Research Methodology Combining Primary Expert Interviews, Regulatory Analysis, and Secondary Data to Ensure Robust Market Insights

This analysis is underpinned by a rigorous research framework that integrates both primary and secondary methodologies. Primary insights were gathered through structured interviews and workshops involving avionics engineers, program executives at OEMs, regulatory officials, and supply chain managers from defense and commercial sectors. These engagements provided qualitative perspectives on technology adoption challenges, procurement priorities, and compliance strategies.

Secondary research synthesized publicly available trade data, tariff notices, regulatory filings, and industry publications to quantify shifts in trade actions, technology deployments, and regional investment patterns. External validation was achieved through cross-referencing findings with authoritative sources such as the USTR tariff announcements, Section 232 investigation documents, and sector-specific reports from credible outlets including Aviation Today and Reuters. This comprehensive approach ensures a robust and actionable set of insights aligned with current industry realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Avionics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Avionics Market, by Product Type

- Avionics Market, by Aircraft Type

- Avionics Market, by Connectivity

- Avionics Market, by Installation Type

- Avionics Market, by Distribution Channel

- Avionics Market, by Region

- Avionics Market, by Group

- Avionics Market, by Country

- United States Avionics Market

- China Avionics Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Findings to Illuminate the Future Trajectory of Avionics amidst Technological Advancements and Geopolitical Headwinds

The trajectory of the avionics market is defined by the confluence of accelerating technological innovation, evolving trade policies, and regionally differentiated regulatory frameworks. Key shifts in AI integration, open architectures, and wireless connectivity are challenging traditional supply chain models while unlocking new capabilities in safety, efficiency, and mission adaptability. Tariff actions introduced in 2025 underscore the need for proactive supply chain management, yet also present opportunities for domestic production and allied partnerships. Segmentation insights reveal distinct value pools across product types, aircraft categories, and installation models, while regional dynamics highlight divergent growth drivers and compliance considerations.

As industry leaders navigate these complexities, a strategic focus on modular design, cybersecurity, and collaborative R&D will position organizations to lead the next wave of avionics innovation. The recommendations outlined herein provide a clear roadmap for capitalizing on emerging trends and mitigating risks, ensuring that stakeholders are equipped to thrive in a rapidly evolving marketplace.

Unlock Deeper Avionics Market Insights and Drive Strategic Decisions by Engaging with Ketan Rohom to Access the Full Research Report

Ready to transform your strategic approach with comprehensive avionics market intelligence? Engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the full, in-depth research report. Gain access to exclusive data, expert analysis, and actionable insights that will equip your organization to navigate the rapidly evolving avionics landscape with confidence and precision. Reach out to Ketan Rohom today and take the first step toward driving innovation, optimizing supply chains, and capitalizing on emerging market opportunities that will define the future of aerospace technology

- How big is the Avionics Market?

- What is the Avionics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?