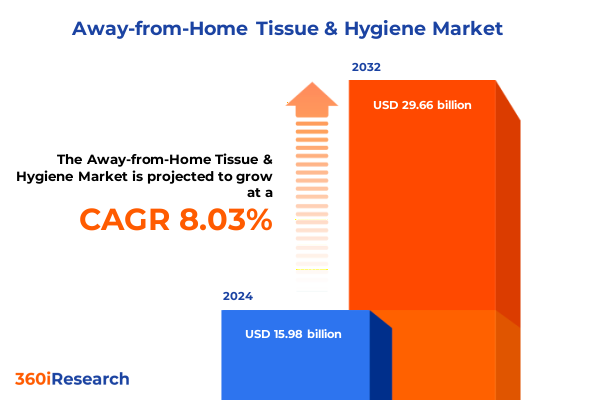

The Away-from-Home Tissue & Hygiene Market size was estimated at USD 17.25 billion in 2025 and expected to reach USD 18.63 billion in 2026, at a CAGR of 8.04% to reach USD 29.66 billion by 2032.

Unveiling the Critical Role of Away-From-Home Tissue and Hygiene Solutions in Shaping Public Health, Consumer Experience, and Operational Excellence

The away-from-home tissue and hygiene sector has become a foundational pillar in safeguarding public health and enhancing customer satisfaction across diverse environments. Over recent years, end-user expectations have shifted dramatically, with heightened awareness of cleanliness, safety, and quality driving demand for more innovative and reliable solutions. This evolving dynamic requires service providers, facility managers, and brand owners to reevaluate traditional procurement strategies and embrace new models of supply chain management and product development.

As organizations grapple with the twin imperatives of cost containment and operational efficiency, the significance of premium tissue, wipes, and hygiene consumables cannot be overstated. These products not only fulfill functional requirements but also serve as crucial touchpoints for reinforcing brand values and fostering trust. In this introduction, we establish the context for an in-depth exploration of transformative trends, regulatory influences, and strategic imperatives that define the current and future state of the away-from-home tissue and hygiene market.

Analyzing How Sustainability Imperatives and Digital Innovations Have Redefined Operational Standards and User Expectations in the Industry

A series of groundbreaking shifts has redefined the away-from-home tissue and hygiene landscape, starting with the accelerated embrace of sustainability. Stakeholders have invested heavily in developing biodegradable materials and closed-loop recycling programs to meet stringent environmental standards. Consequently, manufacturers are now exploring alternative fibers such as bamboo and post-consumer recycled pulp to reduce ecological footprints while preserving product performance and aesthetics.

Parallel to sustainability initiatives, digital transformation has streamlined procurement processes and improved usage monitoring. Internet-enabled dispensers and data analytics platforms offer real-time insights into consumption patterns, enabling facility managers to optimize inventory levels and minimize waste. Coupled with rising regulatory scrutiny and pandemic-driven hygiene protocols, these technological advancements have elevated expectations around product consistency, antimicrobial efficacy, and allergen control. Looking ahead, continuous innovation in formulation and dispenser design will be pivotal in maintaining service quality and cost efficiency.

Evaluating the Multi-Tiered Consequences of 2025 Tariff Adjustments on Raw Materials Sourcing, Production Costs, and Distribution Dynamics

In early 2025, the United States government implemented revised tariff frameworks on imported pulp and finished tissue products, marking one of the most consequential regulatory actions in recent memory. The cumulative effects of these tariffs have permeated every segment of the supply chain, from raw material procurement to end-user pricing models. Domestic manufacturers have faced increased incentives to source local raw fibers, but capacity constraints and elevated production costs have tempered the pace of on-shore expansion.

Simultaneously, downstream channels have navigated volatile pricing structures and supply uncertainties. Service providers have resorted to multi-sourcing strategies, forging contracts with domestic producers while maintaining limited imports under preferential quotas. This approach has softened the immediate cost shocks but has also amplified complexity in logistics and inventory management. As a result, stakeholders are now channeling investments into demand-sensing technologies and collaborative planning platforms to bolster resilience and forecast procurement needs more accurately.

Dissecting the Interplay Between Product Categories, End-User Requirements, Distribution Networks, and Material Choices Shaping Sector Dynamics

Deep segmentation analysis reveals a nuanced tapestry of product applications, user environments, distribution networks, and material preferences. When examining product typologies, facial tissues and paper towels continue to dominate high-volume usage scenarios, whereas specialized wipes for baby care, disinfectant tasks, and industrial cleaning offer tailored solutions for critical sanitation requirements. Within napkins and toilet paper, subcategories address specific consumption occasions and sustainability concerns, ranging from cocktail napkins at upscale venues to recycled pulp varieties in institutional settings.

Turning to end-user contexts, the foodservice industry-spanning cafeterias, full-service, and quick-service restaurants-demands rapid replenishment and cost efficiency. Healthcare facilities require stringent quality controls and hypoallergenic formulations to protect vulnerable populations. Hospitality venues balance luxury experiences with operational practicality, while industrial and corporate settings emphasize bulk procurement and robust dispenser systems. Distribution channels further diversify reach, with direct sales and onsite vendors serving large accounts, while distributors, online marketplaces, and retail outlets cater to decentralized purchasing patterns. Finally, material preferences such as virgin pulp, bamboo, and post-consumer recycled fibers underscore the sector’s commitment to balancing performance, sustainability, and cost considerations.

This comprehensive research report categorizes the Away-from-Home Tissue & Hygiene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- End User

- Distribution Channel

Exploring How Regional Regulations, Infrastructure Capabilities, and Consumer Behaviors Drive Distinct Growth Paths in Major Global Markets

Regional variations in regulatory frameworks and consumption behaviors have led to markedly different market trajectories across the Americas, EMEA, and Asia-Pacific. In the Americas, stringent environmental legislation alongside strong consumer demand for hygienic standards has accelerated adoption of recycled and bamboo-based products. North American suppliers benefit from established pulp production infrastructure but must continuously innovate to meet evolving sustainability mandates.

Within EMEA, the convergence of rigorous single-use plastic directives and robust waste-management systems has fostered innovation in water-efficient dispensers and compostable materials. European nations, in particular, have implemented comprehensive labeling requirements that influence purchasing decisions at the institutional and retail levels. Meanwhile, the Asia-Pacific region combines rapid urbanization and expanding hospitality sectors, creating high demand for multi-functional tissue and wipe solutions. However, infrastructure gaps in wastewater treatment and recycling logistics pose challenges that market participants address through strategic partnerships and localized manufacturing initiatives.

This comprehensive research report examines key regions that drive the evolution of the Away-from-Home Tissue & Hygiene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Initiatives, Collaborations, and Innovation Pipelines That Define Competitive Leadership Across the Industry

Major industry players have embarked on a range of strategic initiatives to fortify market positions and differentiate their offerings. Leading manufacturers have increased capital allocation for research in advanced fiber processing and antimicrobial treatments, seeking to offer premium products that command higher margins. Several companies have also pursued acquisitions of regional producers to extend distribution footprints while leveraging local expertise to refine product portfolios.

Collaborative ventures between pulp suppliers and dispenser technology innovators have further introduced integrated hygiene systems that monitor usage patterns and automate replenishment cycles. Meanwhile, some organizations have piloted closed-loop recycling programs in partnership with waste management firms, showcasing their commitment to circular economy principles. Competitive dynamics are intensifying as entrants and incumbents alike seek patent protections on novel formulations and dispenser designs, underscoring the importance of sustained innovation in maintaining leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Away-from-Home Tissue & Hygiene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Asia Pulp & Paper

- Cascades Inc.

- Clearwater Paper Corporation

- Empresas CMPC

- Essity AB

- First Quality Enterprises, Inc.

- Georgia-Pacific LLC

- Hengan International Group Company Limited

- Kimberly-Clark Corporation

- Kruger Products L.P.

- Metsä Tissue

- Oji Holdings Corporation

- Procter & Gamble

- Sofidel Group

- WEPA Group

Advancing Sustainability Partnerships and Digital Ecosystem Deployment to Enhance Supply Chain Resilience and User Experience

In response to shifting market imperatives, industry leaders should prioritize investments in sustainable materials sourcing and circular-economy collaborations. By forging alliances with forestry management organizations and waste-recovery firms, companies can secure stable fiber supplies and reduce environmental footprints. Furthermore, adopting advanced manufacturing techniques such as enzymatic bleaching and waterless processing will lower energy consumption and reinforce compliance with emerging regulations.

Another critical recommendation involves the expansion of digital hygiene ecosystems. Integrating sensor-enabled dispensers with cloud-based analytics not only optimizes inventory flows but also provides actionable insights into consumption trends at the site level. Complementing this, executing targeted pilot programs within key end-user verticals can validate new product formulations under real-world conditions, enabling rapid iteration and market introduction. Lastly, embedding sustainability metrics into customer reporting frameworks will demonstrate accountability and enhance brand equity in the eyes of corporates, governments, and end consumers.

Outlining the Multi-Pronged Research Framework That Combines Expert Interviews, Data Analytics, and Segmentation Models to Ensure Comprehensive Market Insights

The foundation of this analysis rests on a hybrid research methodology that integrates both primary and secondary data sources. Expert interviews were conducted with senior executives, procurement managers, and hygiene specialists across multiple geographies to capture first-hand insights on regulatory impacts, operational challenges, and evolving end-user preferences. These qualitative inputs were triangulated with trade association publications, technical whitepapers, and patent filings to validate emerging technologies and competitive strategies.

Quantitative analysis was underpinned by a comprehensive review of shipment records, trade flows, and tariff schedules, while adherence to strict data integrity protocols ensured consistency across segments. Segmentation models were developed through cluster analysis and stakeholder workshops, allowing for a robust mapping of product types, end-user contexts, distribution channels, and material specifications. This multi-pronged approach ensures that the findings presented herein reflect a balanced and accurate portrayal of market realities and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Away-from-Home Tissue & Hygiene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Away-from-Home Tissue & Hygiene Market, by Product Type

- Away-from-Home Tissue & Hygiene Market, by Material Type

- Away-from-Home Tissue & Hygiene Market, by End User

- Away-from-Home Tissue & Hygiene Market, by Distribution Channel

- Away-from-Home Tissue & Hygiene Market, by Region

- Away-from-Home Tissue & Hygiene Market, by Group

- Away-from-Home Tissue & Hygiene Market, by Country

- United States Away-from-Home Tissue & Hygiene Market

- China Away-from-Home Tissue & Hygiene Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Summarizing Critical Insights and Strategic Imperatives to Empower Stakeholders in Navigating a Complex and Evolving Industry Landscape

This executive summary has illuminated the pivotal forces shaping the away-from-home tissue and hygiene market, from sustainability mandates and technological innovations to tariff realignments and regional variations. A clear understanding of product and end-user segment dynamics, combined with insights into material sourcing and distribution strategies, equips stakeholders to navigate an increasingly competitive and regulated environment.

As market conditions continue to evolve, organizations that proactively integrate advanced analytics, circular economy principles, and strategic partnerships will be best positioned to capture emerging opportunities. The strategic recommendations outlined here serve as a roadmap for leaders aiming to bolster operational agility and drive differentiated value. With a solid methodological foundation supporting these insights, industry participants can confidently chart a course toward sustainable growth and market leadership.

Secure Your Competitive Edge in the Away-From-Home Tissue and Hygiene Industry with Expert Insights from Ketan Rohom

Don’t miss the opportunity to leverage the most comprehensive away-from-home tissue and hygiene market research available. Contact Ketan Rohom, Associate Director, Sales & Marketing, to gain exclusive insights that will empower your strategic planning, product innovation, and competitive positioning. With a deep understanding of emerging trends, regional nuances, and regulatory impacts, this report is designed to provide the actionable intelligence needed to drive growth and resilience in a rapidly evolving landscape.

Reach out to Ketan Rohom today to secure your copy and start translating data into decisive advantage. Equip your organization with the clarity to navigate complex tariffs, capitalize on segmentation opportunities, and implement sustainability initiatives that distinguish your brand. Seize this chance to stay ahead of competitors and align your offerings with the future of the away-from-home tissue and hygiene sector.

- How big is the Away-from-Home Tissue & Hygiene Market?

- What is the Away-from-Home Tissue & Hygiene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?