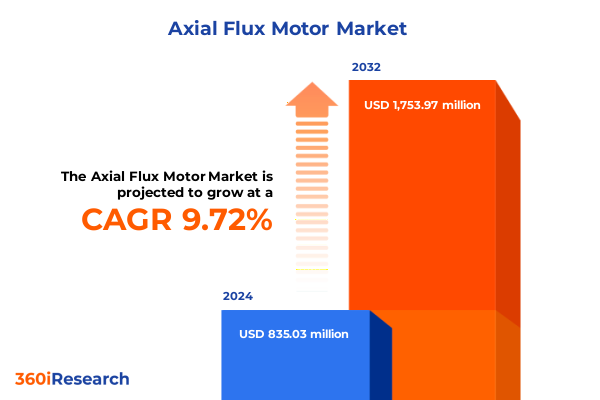

The Axial Flux Motor Market size was estimated at USD 835.03 million in 2024 and expected to reach USD 912.44 million in 2025, at a CAGR of 9.72% to reach USD 1,753.97 million by 2032.

A concise orientation to axial flux motor technology that balances transformative engineering advantages with practical manufacturing and sourcing realities

Axial flux electric motor technology is shifting from niche demonstration projects into pragmatic system-level choices for designers and OEMs across multiple industries. This introduction frames axial flux motors in terms of their defining engineering attributes-high torque and power density, compact axial geometry, and improved surface-area-for-cooling-while also setting expectations about manufacturability, materials dependencies, and supply chain risk. The purpose here is to orient leadership and technical teams to why axial flux matters now, which use-cases are maturing fastest, and how near-term policy and sourcing dynamics will shape adoption timelines.

Across passenger and commercial automotive platforms, aerospace propulsion concepts including eVTOL and drones, and specialized marine and industrial drives, axial flux architectures are emerging as a compelling alternative to radial flux drives when volume, weight, and package constraints are decisive. However, translating prototype performance into cost-competitive high-volume production requires parallel advances in automated winding, rotor-stator assembly, cooling integration, and magnet supply. This introduction therefore balances the technology’s clear performance upside with the operational and sourcing realities that decision-makers must address as they consider product roadmaps or supplier partnerships.

An integrated view of technological breakthroughs, supply chain realignments, and policy shifts that are reshaping axial flux motor adoption across high-performance and industrial sectors

The landscape for axial flux motors is undergoing several converging transformations that are accelerating commercial relevance while also raising new strategic trade-offs. First, breakthroughs in packaging and cooling have enabled continuous power figures closer to peak ratings, which makes axial flux attractive for high-duty applications such as performance electrified drivetrains and propulsion for eVTOL concepts. Early production commitments and pilot programs with leading OEMs demonstrate that the topology’s promise is now crossing the valley of death from prototype to limited production, prompting intensified supplier investment in automated processes and integrated motor-controller assemblies. Evidence of this evolution is visible in the industry’s movement from bespoke, low-volume implementations to announcements of scaling plans and factory builds.

Second, materials and supply-chain dynamics are reshaping the cost and risk profile of axial flux adoption. The motors’ reliance on permanent magnets intensifies sensitivity to rare-earth magnet availability and pricing, while their compact form factor concentrates value in a smaller number of strategically significant components. Consequently, projects that once competed on peak torque or power density must increasingly incorporate magnet recycling design, alternative magnet chemistries, and dual-sourcing strategies into early-stage engineering. Third, regulatory and trade developments are complicating supplier selection and procurement strategies. Tariff adjustments, export controls, and geopolitical negotiations have introduced episodic shocks that influence near-term sourcing choices and longer-term decisions about onshore capacity and vertical integration. Collectively, these shifts are driving a more holistic approach to motor selection where performance, cost, resilience, and geopolitical exposure are evaluated in parallel.

How 2025 tariff adjustments and export restrictions have altered procurement, materials resilience, and onshore production decisions for magnet-dependent axial flux motor supply chains

The cumulative effect of United States tariff policy and reciprocal trade responses in 2025 has introduced measurable friction into axial flux motor supply chains, particularly for magnet-intensive designs and imported subassemblies. Policy actions and diplomatic agreements earlier in the year produced a complex picture: temporary tariff adjustments reduced headline duties on certain magnet imports during a trade truce, while at the same time export controls and licensing regimes implemented by trading partners continued to constrain the movement of select rare earth elements and finished magnets. These simultaneous dynamics mean that procurement teams face a mixture of higher effective landed costs, intermittent supply interruptions, and greater uncertainty about lead times for critical inputs.

Operationally, manufacturers and OEMs responded by accelerating onshore sourcing and by participating in regional consortia and recycling initiatives to improve magnet resilience. Evidence from high-profile automakers shows an increased emphasis on local production to mitigate tariff exposure and preserve margin, with strategic investments and plant expansions announced in response to tariff-driven import cost pressure. At the same time, export restrictions on a subset of rare earths have prompted industry actors to prioritize design-for-recycling and alternative magnet chemistries to reduce reliance on single-source suppliers. Taken together, the tariff and export control environment in 2025 has not rendered axial flux motors commercially infeasible, but it has raised the operational bar: firms must now incorporate trade scenario planning into sourcing, adjust supplier qualification timelines, and accelerate materials circularity initiatives to maintain predictable supply and competitive costing.

Nuanced segmentation-driven implications showing how topology, power bands, cooling strategies, electrical phase, structural staging, application demands, and distribution pathways shape product and commercial choices

Segmentation analysis reveals differentiated value propositions and implementation timelines across the topology, power bands, thermal strategies, electrical architectures, mechanical structures, applications, and distribution pathways. When the topology axis is considered, double-stator axial flux motors typically deliver higher torque density for the same frame envelope relative to single-stator variants; designers therefore prefer double-stator architectures where compact high-torque traction or propulsion is required, while single-stator variants appear wherever simplicity and reduced assembly steps are prioritized. Within the power-rating dimension, motors below 50 kW are frequently targeted at drones, small UAVs, and supplementary auxiliary drives where low mass and rapid responsiveness are paramount, while the 50–200 kW band captures the most active crossover where automotive traction and light aerospace propulsion validate axial flux advantages. Above 200 kW applications are concentrated in heavier propulsion tasks and marine or industrial drives where stacking and multi-module integration mitigate single-unit manufacturing constraints.

Cooling strategy also differentiates design choices; air-cooled variants excel in low-mass platforms and simplify maintenance, whereas liquid-cooled machines are favored when sustained continuous power is required and thermal management directly affects duty-cycle performance. Phase choices-single phase versus three phase-map to control complexity and intended integration: single phase use-cases are rare and typically confined to generator-style or niche applications, while three phase systems dominate traction and industrial deployments because of their compatibility with modern inverters and established control stacks. Structural configuration matters as well; single-stage designs offer manufacturing simplicity for lower power ranges, whereas multi-stage structures provide the scalability and torque multiplication needed for high-power marine and aerospace installations. Application segmentation underscores distinct product requirements: aerospace deployments emphasize weight, certification pathways, and redundancy; electric vehicle programs balance torque density, cost-effectiveness, and manufacturability across battery electric and hybrid electric powertrains; industrial customers prioritize continuous-duty thermal solutions for manufacturing and robotics applications; marine applications require corrosion-resistant mechanical interfaces and integration into electric-boat or submarine propulsion architectures. Distribution channels manifest distinct go-to-market strategies; the aftermarket prioritizes retrofitability, serviceability, and standardized mounts, while original equipment manufacturers focus on co-development, integration engineering, and qualification protocols.

This comprehensive research report categorizes the Axial Flux Motor market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Topology

- Cooling Method

- Phase

- Excitation Type

- Power Rating

- Application

- Distribution Channel

Comparative regional dynamics showing how Americas, Europe-Middle East-Africa, and Asia-Pacific market structures, policies, and supply ecosystems influence axial flux deployment strategies

Regional dynamics are central to strategic planning because supply chains, regulation, end-user demand, and industrial policies vary meaningfully across global markets. In the Americas, automotive OEMs and Tier 1 suppliers are responding to trade policy and incentives by expanding local assembly and by qualifying suppliers with North American footprint or reliable multi-regional logistics. This regional focus favors axial flux designs that can be industrialized with predictable component flows and supports partnerships where lead-time reduction and co-located testing facilities matter.

In Europe, Middle East and Africa, policy initiatives and EU-funded programs are accelerating projects to strengthen domestic magnet recycling and processing capabilities, which aligns with the region’s broader emphasis on strategic autonomy for critical materials. European aerospace and high-performance automotive segments are early adopters of axial flux layouts because of stringent packaging and performance requirements, and regional projects are increasingly emphasizing circularity and second-life magnet recovery. Asia-Pacific continues to be pivotal for component manufacturing and magnet supply, with sophisticated production ecosystems and established rare-earth processing capacity. For global firms, APAC’s manufacturing scale and supplier depth make it indispensable, but geopolitical tensions and export controls have prompted multinational firms to diversify production footprints and to explore regional redundancy to protect against localized trade shocks.

This comprehensive research report examines key regions that drive the evolution of the Axial Flux Motor market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic company archetypes and partner selection criteria emphasizing in-house integration, specialist motor developers, and materials-focused collaborators

Industry participants coalescing around axial flux technology fall into several strategic archetypes: vertically integrated OEMs embedding proprietary axial flux modules into platforms, specialized motor developers focused on high-performance or aerospace niches, and materials and supply-chain innovators addressing magnet resilience and manufacturing scale. Recent demonstrations and announced factory investments by premium automotive OEMs illustrate a push to internalize axial flux capabilities and to use this topology as a performance differentiator. Specialist suppliers are pursuing modular, scalable product families that target stackability and thermal management innovations to address the continuous-power shortfall that historically constrained axial flux for heavy-duty applications.

Concurrent with these hardware advances, materials-focused initiatives are mobilizing to build resilient magnet supply chains and to establish recycling loops that reduce exposure to trade fluctuations. Companies active in closed-loop magnet recovery and regional magnet-processing consortia are positioning themselves as strategic partners to motor manufacturers seeking to de-risk inputs. For decision-makers evaluating potential partners, technical credibility (including validated power density, repeatable thermal performance, and manufacturability), a clear pathway to upscaling, and upstream engagement on magnet sourcing and recycling are the most important selection criteria for long-term supplier relationships.

This comprehensive research report delivers an in-depth overview of the principal market players in the Axial Flux Motor market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Ltd.

- ADATA Technology Co., Ltd.

- Allient, Inc.

- BEYOND MOTORS d.o.o.

- Biotage AB

- Conifer Technologies

- Emrax d.o.o

- Evolito Ltd.

- Faststream Technologies

- High Power Media Limited

- Infinitum Electric, Inc.

- Lucchi R. S.r.l.

- Magnax BV

- Matris d.o.o.

- Miba AG

- Mirmex Motor SA

- Nidec Corporation

- Phi-Power AG

- Regal Rexnord Corporation

- Saietta by EXEDY Corporation

- Schaeffler AG

- SEMOTOR Co., Ltd

- Siemens AG

- siliXcon s.r.o.

- Sumitomo Electric Industries, Ltd.

- Torus Robotics Pvt Ltd

- Turntide Technologies Inc.

- WEG S.A.

- Whylot Electromechanical Solutions

- YASA Limited by Mercedes-Benz Group AG.

- Zhejiang Pangu Power Technology Co., Ltd

Actionable operational and strategic measures for leadership to reduce materials exposure, accelerate manufacturability, and stage commercialization to validate axial flux investments

Industry leaders should adopt a set of pragmatic actions that align product decisions with supply-chain resilience and commercialization timelines. First, link motor architecture choices directly to availability and sourcing scenarios for magnet materials; where single-source exposure exists, prioritize design-for-recycling, reduced magnet mass options, and validated alternatives to aggressive rare-earth chemistries so that product launches are not contingent on a single supply route. Second, invest in scalable manufacturing processes early: automation of winding, stacking, and rotor assembly reduces unit cost growth curves and shortens the path from prototype to series production. Third, structure supplier relationships to balance cost with resilience; that means qualifying dual-sourced magnet and core suppliers, leveraging regional processing partnerships, and embedding contractual options for risk-sharing in the event of trade disruptions.

Finally, adopt a staged deployment plan for applications. Begin with lower-risk, high-margin programs where axial flux advantages are material-such as performance sub-systems, aerospace auxiliary propulsion, or premium marine drives-then use those programs to validate production processes and to finance scale-up into larger-volume automotive or industrial segments. Complement this product staging with scenario-based trade and tariff modeling to support procurement decisions and capital allocation, and ensure R&D roadmaps include magnet-recovery and alternative-chemistry pathways to preserve optionality over the next five years.

A mixed-methods approach combining primary technical interviews, validation of manufacturer test claims, and scenario-based trade sensitivity analysis to produce decision-focused conclusions

The research underpinning this summary combined primary technical validation with a multi-layer review of secondary industry evidence, trade policy notices, and company disclosures. Primary inputs included structured interviews with engineers and procurement leads from automotive, aerospace, and marine programs, alongside direct evaluation of technical datasheets and integration briefs from leading axial flux suppliers. Secondary sources comprised peer-reviewed engineering analyses, manufacturer technical statements, policy and trade notices, and reputable industry reporting that documents recent production announcements, tariff developments, and materials initiatives.

Analysis methods emphasized cross-validation: technical claims were reconciled against independent bench test reports or company dyno results where available, and supply-chain assertions were cross-checked with public trade actions, industry consortium statements, and announced regional funding programs for magnet processing or recycling. Where policy and trade actions remain fluid, scenario analysis was applied to describe plausible procurement outcomes through a combination of sensitivity testing of landed costs and qualitative assessment of lead-time risk. The approach balances technical rigor with practical, decision-focused synthesis to support executives and product leaders in aligning engineering choices with resilient commercial strategies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Axial Flux Motor market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Axial Flux Motor Market, by Topology

- Axial Flux Motor Market, by Cooling Method

- Axial Flux Motor Market, by Phase

- Axial Flux Motor Market, by Excitation Type

- Axial Flux Motor Market, by Power Rating

- Axial Flux Motor Market, by Application

- Axial Flux Motor Market, by Distribution Channel

- Axial Flux Motor Market, by Region

- Axial Flux Motor Market, by Group

- Axial Flux Motor Market, by Country

- United States Axial Flux Motor Market

- China Axial Flux Motor Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1749 ]

A pragmatic concluding synthesis that ties technical promise to supply-chain imperatives and executable commercialization pathways

Axial flux motor technology is transitioning from a performance curiosity to a practical choice for programs where torque density, packaging efficiency, and thermal management materially affect system outcomes. This transition is being accelerated by focused investments in manufacturability, by OEM commitments to pilot and limited production runs, and by materials- and policy-driven responses that emphasize diversification and circularity. Nevertheless, success at scale will hinge on the industry’s ability to tackle magnet resilience, to standardize production methods that reduce cost and variability, and to integrate trade-aware sourcing strategies into early engineering cycles.

For executives and technical leaders, the imperative is clear: treat axial flux not simply as a superior topology on paper, but as a systems decision that connects design, supplier strategy, policy analysis, and manufacturing readiness. When these dimensions are aligned, axial flux motors offer a pathway to differentiated products and new architectures; when they are not, the same performance advantages can be undermined by supply interruptions and cost volatility.

Direct procurement pathway and tailored briefing options with the Associate Director to secure the axial flux motor market research report and executive deliverables

To acquire the full market research report and unlock strategic implementations tailored to your commercial objectives, please reach out to Ketan Rohom, Associate Director, Sales & Marketing. Ketan can provide a customized briefing that aligns the report’s insights with your product roadmaps, procurement timelines, and go-to-market ambitions. Engaging directly will enable a rapid procurement cycle, expedited access to appendices, and bespoke licensing options that support technical due diligence, supplier mapping, or competitive positioning exercises.

Contacting Ketan will also permit arrangement of a private walkthrough of the report’s methodology, a live Q&A on tariff sensitivities and sourcing alternatives, and access to executive summaries for stakeholder distribution. Prospective buyers will benefit from an initial scoping call to define which data modules and regional deep dives are most relevant, thereby ensuring the purchased deliverable aligns tightly with short-term tactical needs and longer-term strategic planning horizons.

- How big is the Axial Flux Motor Market?

- What is the Axial Flux Motor Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?