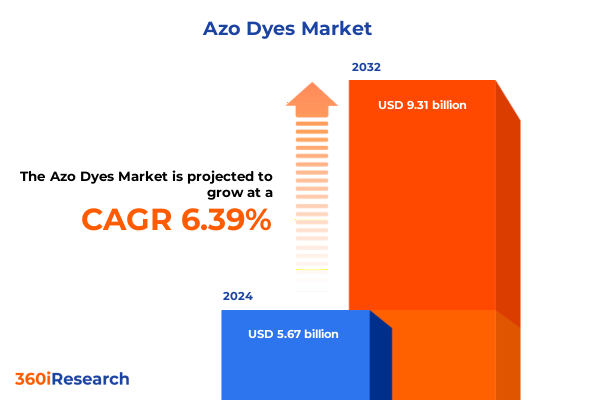

The Azo Dyes Market size was estimated at USD 6.03 billion in 2025 and expected to reach USD 6.39 billion in 2026, at a CAGR of 6.37% to reach USD 9.31 billion by 2032.

Setting the Stage for Azo Dye Market Dynamics: Unveiling Core Trends, Drivers, and Strategic Imperatives Facing Stakeholders in a Rapidly Evolving Landscape

The azo dye segment represents one of the most versatile and widely utilized classes of synthetic colorants, spanning applications from textiles to printing inks, and from food packaging to specialty coatings. Its unique chemical structures, characterized by one or more azo linkages between aromatic groups, confer vibrant hues and enhanced fastness properties sought by manufacturers around the globe. In recent years, shifting consumer preferences towards sustainability, coupled with evolving regulatory landscapes, have underscored the need for innovation in both dye formulation and processing techniques. This executive summary provides a succinct yet comprehensive overview of the forces reshaping the azo dye industry, offering stakeholders a clear view of prevailing trends and critical considerations.

Through an analytical lens, this report synthesizes the key market drivers including environmental regulations, raw material supply constraints, and emerging end-use demands. It also highlights transformative shifts such as the rise of eco-friendly chemistries and digital printing technologies. By examining the cumulative impact of recent United States tariffs, dissecting segmentation insights by application, type, form, and distribution channels, and presenting a nuanced regional overview, this document equips decision-makers with the strategic perspectives needed to navigate complexities and capture growth opportunities effectively.

Navigating Monumental Shifts Reshaping the Azo Dye Ecosystem Through Sustainability Innovations, Digital Transformations, and Emerging Regulatory Milestones

The azo dye landscape is experiencing unprecedented transformation driven by regulatory interventions aimed at reducing hazardous chemical residues and by technological advancements focused on process efficiencies. Stricter emission controls and tighter restrictions on certain aromatic amines have prompted suppliers to reformulate products, favoring safer intermediates and adopting advanced wastewater treatment processes. Concurrently, digital textile printing has emerged as a disruptive force, enabling on-demand coloration with minimal water usage. This digital shift accelerates production flexibility while diminishing the environmental footprint of traditional dyeing methods.

Moreover, sustainability has become a strategic imperative for industry participants, inspiring investments in bio-based dyes and closed-loop manufacturing systems. Developments in enzymatic pretreatment and renewable feedstocks reflect a broader circular economy approach, where waste valorization and energy recovery are prioritized. These innovations not only address environmental concerns but also unlock cost efficiencies over the long term. As a result, incumbent players and new entrants alike are forming partnerships to leverage shared expertise, driving a wave of co-innovation in specialty dye technologies.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Raw Materials, Supply Chains, Cost Structures, and Competitiveness in Azo Dye Markets

In 2025, the implementation of United States tariffs on key dye intermediates has reverberated across global supply chains, compelling manufacturers to reassess sourcing strategies and evaluate domestic production alternatives. Raw material costs have surged, affecting profit margins and intensifying competition among suppliers. In response, some players have renegotiated contracts with regional partners or secured backward integration into critical feedstock production. This realignment not only diversifies supply risk but also fosters greater control over cost structures and lead times.

Furthermore, the higher import duties have incentivized end users to optimize dye usage through precision dosing and improved fixation techniques. These efficiency gains partially offset cost pressures while enhancing product quality. At the same time, downstream formulator margins have tightened, spurring innovation in high-value, performance-oriented dyes that justify premium pricing. As tariffs persist, ongoing dialogues between industry associations and policymakers seek exemptions or adjustments to mitigate unintended consequences for domestic manufacturers and consumers alike.

Uncovering Critical Segmentation Dimensions That Drive Demand Patterns Across Application, Type, Form, and Distribution Channels in the Azo Dye Industry

A granular examination of market segmentation reveals that application diversity remains a cornerstone of azo dye demand. The cosmetics sector continues to prioritize mild formulations and regulatory compliance, while the food and beverage industry seeks approved, food-grade colorants with enhanced stability. In leather treatment, fastness and durability are nonnegotiable, driving adoption of specialized acid and basic dye classes. Paper applications bifurcate into coated and uncoated substrates, each demanding tailored pigment dispersions. Within plastics, polyethylene terephthalate (PET) dominates packaging uses, whereas polypropylene (PP), polystyrene (PS), and polyvinyl chloride (PVC) serve various industrial needs. The printing ink domain is similarly varied, encompassing digital inkjet systems, flexographic, gravure, and offset processes, each requiring unique dye carrier properties. Textile manufacturing spans natural fibers such as cotton and wool, alongside synthetic options like nylon and polyester, with reactive and disperse chemistries ensuring optimal color yield and wash fastness.

Type-based insights highlight the enduring relevance of acid dyes, subdivided into leveling and milling grades, and direct dyes available in standard and high-performance variants. Disperse dyes bifurcate into carrier and non-carrier technologies, while mordant classes differentiate between post- and pre-metalized formulations. Reactive dye innovation has progressed across bifunctional and monofunctional species, offering superior fixation. Sulfur dyes, prized for cost-effectiveness in dark shades, continue to find utility where environmental constraints permit. Form considerations further differentiate market needs: coarse and fine granular products cater to batching processes, solvent-based and water-based liquids support continuous dyeing, and micro or standard powders facilitate precise dosing. Finally, distribution channels range from direct sales via OEM and aftermarket services to networks of local and major distributors, complemented by both B2B and B2C e-commerce platforms that streamline procurement and enable rapid replenishment.

This comprehensive research report categorizes the Azo Dyes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Type

- Form

- Distribution Channel

Examining Regional Dynamics in the Americas, Europe Middle East Africa, and Asia Pacific That Shape Demand Trajectories and Investment Flows for Azo Dyes

Regional dynamics play a pivotal role in shaping azo dye market trajectories. In the Americas, robust demand in textiles and packaging, combined with progressive regulatory frameworks, drives innovation in low-impact dye systems. Manufacturers in North America are increasingly investing in localized specialty dye production to circumvent import tariffs and reduce lead times, while sustainable manufacturing credentials gain prominence in procurement decisions. Latin American markets exhibit potential growth in leather and food packaging dyes, although infrastructure constraints and fluctuating currency rates present challenges.

Across Europe, the Middle East, and Africa, stringent environmental standards in the European Union continue to catalyze the adoption of eco-friendly alternatives, including enzyme-assisted and bio-based dye solutions. Middle Eastern industrial hubs leverage petrochemical feedstock availability to produce economy-grade dyes for export, whereas African markets focus on meeting rising domestic demand in textiles and leather through cost-effective sulfur and basic dyes. In the Asia-Pacific region, rapid urbanization and rising disposable incomes propel expansion in fashion textiles and cosmetics. Regional dye manufacturers favor scalable water-based formulations to address water scarcity concerns, and digital ink developments are accelerating the shift from analog printing methods.

This comprehensive research report examines key regions that drive the evolution of the Azo Dyes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Chemical Innovators and Strategic Alliances Driving Technological Advances, Portfolio Expansions, and Competitive Positioning in the Azo Dye Sector

Leading chemical innovators are positioning themselves to capitalize on evolving market needs through strategic portfolio expansions and alliances. Multifaceted players are integrating specialty dye operations with advanced intermediate synthesis, thereby capturing greater value across the supply chain. Joint ventures between pigment producers and textile finishers exemplify collaborative models that accelerate product development and market penetration. Additionally, several enterprises have broadened their offerings to include turnkey color management systems, combining software analytics with dye formulations to optimize resource utilization.

Innovation pipelines reflect a focus on high-performance reactive and disperse dye chemistries capable of meeting fastness demands in durable sportswear and technical textiles. Simultaneously, digital ink manufacturers are introducing bespoke pigment dispersions tailored for high-resolution inkjet printers, facilitating on-demand customization. Industry alliances also extend to academic partnerships, where joint research on enzymatic and microbial dye synthesis is unlocking sustainable production routes. These collaborative approaches not only share risk but also fast-track commercialization, ensuring that first-to-market advantages are realized in an increasingly competitive environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Azo Dyes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Aarti Industries Ltd

- Archroma

- Asahi Songwon Colors Ltd

- Atul Ltd

- BASF SE

- Bodal Chemicals Ltd

- Clariant AG

- Colourtex Industries Limited

- DIC Corporation

- DyStar Group

- Everlight Chemical Industrial Co., Ltd.

- Heubach GmbH

- Huntsman Corporation

- Kiri Industries Ltd

- Kyung-In Synthetic Corporation

- LANXESS AG

- Nippon Kayaku Co., Ltd.

- Osaka Godo Co., Ltd.

- Shandong Rainbow Chemical Co., Ltd.

- Sudarshan Chemical Industries Limited

- Sumitomo Chemical Company, Limited

- Sun Chemical

- Trust Chem Co. Ltd.

- Vidhi Specialty Food Ingredients Ltd

- Vipul Organics Ltd

Implementing Strategic Roadmaps That Enhance Resilience, Foster Innovation, and Leverage Partnerships to Secure Long-Term Growth in the Azo Dye Industry

To navigate the evolving landscape, industry leaders should prioritize investments in green chemistry and digital platforms that offer both environmental and operational dividends. By implementing closed-loop water treatment systems, manufacturers can significantly reduce effluent discharge and comply with tightening effluent norms, while simultaneously recovering valuable process resources. Moreover, embracing advanced analytics and automation across production lines enables real-time quality control, minimizing waste and ensuring batch consistency.

Fostering strategic partnerships with technology providers and academic institutions will accelerate the development of bio-based dyes and enzymatic processes, conferring a competitive edge in sustainability credentials. Diversifying supply chains through regional manufacturing hubs mitigates tariff exposure and safeguards against geopolitical disruptions. Leaders are also encouraged to engage proactively with regulatory bodies to shape pragmatic standards that balance environmental goals with practical implementation. Finally, upskilling the workforce through targeted training programs in digital dyeing technologies will ensure that organizations remain agile and ready to capitalize on emerging opportunities.

Detailing Research Methodologies Integrating Primary Interviews, Secondary Analysis, and Validation Protocols Upholding Integrity of Azo Dye Market Findings

This research employs a multi-tiered methodology to ensure the highest level of rigor and credibility. Primary insights were gathered through in-depth interviews with C-level executives, R&D leaders, and regulatory experts across key geographic regions. These qualitative findings were triangulated with secondary data, including peer-reviewed journals, technical white papers, and public regulatory filings, to validate emerging trends and corroborate market dynamics.

Data analysis involved thematic coding of qualitative interviews, enabling the identification of recurring industry drivers and pain points. Quantitative validation was performed through cross-referencing global trade statistics, production volume reports, and end-use sector consumption patterns. A final round of expert panel reviews-including industry veterans and academic researchers-ensured that interpretations were robust and free from bias. This integrated approach guarantees that the insights presented reflect a comprehensive and reliable assessment of the azo dye landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Azo Dyes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Azo Dyes Market, by Application

- Azo Dyes Market, by Type

- Azo Dyes Market, by Form

- Azo Dyes Market, by Distribution Channel

- Azo Dyes Market, by Region

- Azo Dyes Market, by Group

- Azo Dyes Market, by Country

- United States Azo Dyes Market

- China Azo Dyes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Critical Insights and Strategic Imperatives to Guide Future Decision-Making and Strengthen Competitive Advantage in the Azo Dye Sector

This executive summary has synthesized the multifaceted forces influencing the azo dye industry, from stringent environmental regulations and tariff-driven supply adjustments to the accelerating adoption of sustainable chemistries and digital printing technologies. Segmentation analysis has underscored the importance of tailored solutions across diverse applications, dye types, forms, and distribution pathways. Regional insights further revealed that localized innovation and regulatory variations will continue to shape market trajectories.

As the industry advances, stakeholders who embrace collaborative innovation, optimize supply chain resilience, and invest in green manufacturing will be best positioned to capture emerging opportunities. By leveraging cutting-edge research methodologies and expert validation, decision-makers can confidently navigate uncertainties and formulate strategies that align with both commercial and sustainability objectives. Ultimately, a forward-looking approach that balances technological progress with pragmatic regulation will define market leadership in the coming years.

Engage with Ketan Rohom to Unlock Comprehensive Azo Dye Market Research Insights That Empower Strategic Initiatives and Drive Informed Investment Decisions

To delve deeper into these comprehensive insights and translate them into actionable strategies, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Through a personalized consultation, gain access to the full market research report that offers exhaustive detail on emerging technologies, regulatory frameworks, and supply chain dynamics. Engaging with Ketan will enable your organization to secure tailored intelligence that aligns with your unique objectives and supports robust decision-making. Connect today to unlock the knowledge and strategic perspective required to drive growth and maintain a competitive edge in the azo dye market

- How big is the Azo Dyes Market?

- What is the Azo Dyes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?