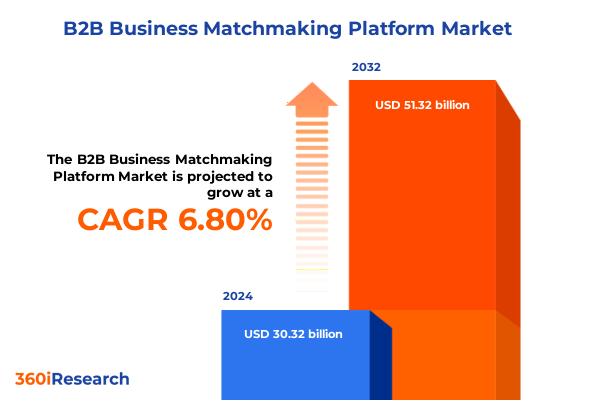

The B2B Business Matchmaking Platform Market size was estimated at USD 32.23 billion in 2025 and expected to reach USD 34.47 billion in 2026, at a CAGR of 6.87% to reach USD 51.32 billion by 2032.

Unlocking Growth in a Hyperconnected Era Where B2B Matchmaking Meets AI-Driven Digital Marketplaces to Foster Strategic Partnerships and Operational Agility

The landscape of B2B matchmaking is undergoing a powerful transformation, driven by the convergence of digital marketplaces, artificial intelligence, and evolving buyer expectations. What once relied heavily on traditional trade shows and manual introductions is now shifting toward platforms capable of delivering precise connections at scale. As enterprises increasingly embrace data-driven procurement and sales processes, they expect seamless experiences that mirror the immediacy and personalization found in B2C environments. This shift is forcing businesses to reconsider how they source partners, identify suppliers, and cultivate long-term relationships with a heightened focus on efficiency and transparency.

Amid this evolution, digital marketplaces have emerged as the epicenter for B2B interactions. According to recent industry analysis, marketplaces now account for nearly two-thirds of global online sales, growing six times faster than conventional e-commerce channels. Concurrently, businesses are directing a substantial portion of their investment toward AI-driven tools, with 79% of organizations planning to increase AI budgets to automate workflows and enhance matchmaking precision. These trends underscore a stark reality: organizations that fail to integrate innovative matchmaking technologies risk falling behind in an increasingly competitive environment.

Looking ahead, B2B matchmaking platforms that combine advanced analytics, machine learning, and user-centric design will lead the charge in facilitating meaningful connections. As decision-makers demand greater visibility into partner profiles and deeper insights into potential collaborations, the ability to deliver real-time intelligence and predictive recommendations will become a critical differentiator. This report opens a window into these developments, offering a comprehensive overview of the strategic imperatives shaping the next generation of B2B matchmaking.

Embracing Seamless Collaboration Through AI, Blockchain, and Omnichannel Ecosystems That Redefine the Future of B2B Networking Experiences

The trajectory of B2B matchmaking is being redefined by a series of converging technological and operational shifts that promise to reshape traditional engagement models. At the forefront of this change is the integration of artificial intelligence, which has moved beyond isolated pilot projects to become an integral component of enterprise architectures. Leading organizations are harnessing AI not only to automate routine tasks but also to deliver hyper-personalized recommendations, dynamic pricing strategies, and predictive analytics that anticipate partner needs before they arise. By embedding AI into core workflows, businesses are unlocking new efficiencies and creating a foundation for sustained competitive advantage.

In tandem with AI adoption, blockchain technologies are gaining traction as a means to ensure transparency and trust across complex supply chains. By providing immutable transaction records and streamlined smart contracts, blockchain is eroding longstanding barriers related to provenance verification and compliance. Enterprises in sectors such as pharmaceuticals and manufacturing have already begun piloting blockchain-enabled networks to reduce fraud and accelerate cross-border transactions, heralding a new era of secure and auditable partnership ecosystems.

Furthermore, the shift toward omnichannel engagement is compelling B2B platforms to offer unified experiences across digital, in-person, and hybrid interactions. Buyers now demand seamless transitions between web portals, mobile applications, and face-to-face networking opportunities, with real-time data synchronization paramount for maintaining consistency. Organizations are responding by adopting composable architectures and cloud-native integration hubs, enabling rapid deployment of new matchmaking features and real-time analytics pipelines that support on-the-spot decision-making. Together, these transformative shifts are setting the stage for a more connected, insightful, and responsive B2B matchmaking environment.

Navigating the Far-Reaching Ripple Effects of 2025 U.S. Tariff Measures on Supply Chains, Cost Structures, and International Trade Dynamics

The cumulative impact of the United States’ 2025 tariff measures on global supply chains has introduced an unprecedented layer of complexity for companies relying on cross-border sourcing. Most notably, the expansion of Section 301 tariffs on Chinese imports-now reaching rates as high as 145% for certain categories-has compelled organizations to reassess supplier portfolios and absorb significant cost increases. Concurrently, Section 232 tariffs on steel and aluminum, implemented to bolster domestic production, continue to impose an additional 25% duty, further squeezing margins in industries such as automotive and heavy manufacturing.

Automotive manufacturers have felt the strain acutely; in the second quarter of 2025, major U.S. automakers reported over $1.4 billion in combined tariff-related expenses, with one leading firm noting that the cumulative impact could reach up to $5 billion by year-end if current duties persist. While some corporations have opted to absorb these costs in the short term to shield consumers from immediate price hikes, analysts warn that prolonged tariff pressures will inevitably translate into higher end-user pricing and altered procurement strategies.

Beyond the direct cost increases, these tariffs have triggered a wave of supply chain diversification efforts. More than half of surveyed manufacturing executives indicated plans to accelerate purchases ahead of anticipated duties, while others are exploring alternative sourcing from non-tariff-exposed regions or investing in domestic capacity expansion to mitigate future risks. As a result, the landscape for B2B matchmaking is evolving: platforms that can seamlessly connect buyers with tariff-compliant suppliers, provide real-time cost analytics, and facilitate rapid onboarding of alternative partners will be poised to capture greater market share in this era of heightened trade uncertainty.

Deciphering Diverse Market Segments Spanning Services, Solutions, Deployment Models, Enterprise Scales, and Industry Verticals for Targeted Engagement Strategies

Understanding the multifaceted dimensions of market opportunities requires a deep dive into both service-oriented and product-driven segments, each with their own nuances. Within the services domain, consulting engagements often revolve around strategic IT and digital transformation, while integration projects focus on weaving together disparate data sources and platforms to create cohesive workflows. Ongoing support and training services ensure that enterprises maximize their return on technology investments, particularly as AI modules and recommendation engines become embedded within core platforms. On the solutions side, analytics modules harvest vast datasets to power insights, customer relationship management integrations bridge sales and marketing efforts, and specialized AI engines deliver personalized matching recommendations to users.

Deployment considerations further shape platform selection, with cloud-based architectures offering scalability, agility, and lower upfront costs, whereas on-premises solutions continue to appeal to organizations seeking greater control over data sovereignty and custom integrations. Enterprise size also exerts influence: large corporations often require extensive customization, multi-tiered support, and robust security protocols; small and mid-sized enterprises typically prioritize ease of implementation, predictable pricing models, and preconfigured feature sets to accelerate time to value.

Vertical-specific dynamics play a pivotal role in dictating matchmaking priorities. Financial services institutions grapple with stringent regulatory requirements and demand platforms that enhance transparency and auditability. Software and telecommunications firms value seamless API integrations and real-time analytics to manage complex partner networks. Manufacturing entities prioritize supply chain resilience and traceability, retail and consumer goods companies focus on omnichannel consistency, and transportation and logistics providers seek optimized routing and compliance management. Within BFSI alone, banking, capital markets, and insurance each bring unique risk profiles and partner ecosystems, underscoring the importance of tailoring matchmaking capabilities to address distinct industry requirements.

This comprehensive research report categorizes the B2B Business Matchmaking Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Deployment

- Enterprise Size

- Vertical

Capitalizing on Regional Nuances Across the Americas, EMEA, and Asia-Pacific to Drive Localized Expertise and Cross-Border Strategic Connections

Regional nuances continue to exert a strong influence on how B2B matchmaking platforms are adopted and deployed. In the Americas, rapid digitalization across North and South America has fostered an environment where cloud-native solutions are widely embraced, supported by robust connectivity and a competitive vendor ecosystem that values innovation and agility. Latin America, in particular, has shown an appetite for mobile-first matchmaking features, reflecting the region’s high smartphone penetration and preference for on-the-go interactions.

Across Europe, the Middle East, and Africa, regulatory complexity and data privacy considerations take center stage. Platforms operating in these markets must provide stringent compliance frameworks, including advanced encryption and granular access controls, to meet GDPR and region-specific mandates. Emerging economies in Africa are leapfrogging traditional infrastructure constraints by adopting SaaS solutions, while mature European markets are driving demand for composable platforms that can integrate seamlessly with existing enterprise systems across multiple jurisdictions.

The Asia-Pacific region presents a tapestry of diverse market maturity levels and cultural dynamics. In high-growth markets like India and Southeast Asia, cost-effective matchmaking solutions that blend AI-driven discovery with multilingual support are in high demand. Meanwhile, markets such as Japan and Australia prioritize deep analytics capabilities, localized service offerings, and strategic partnerships with established industry players. Overall, platforms that can adapt to varying regulatory regimes, language requirements, and digital maturity profiles will succeed in capturing the vast opportunities across these three major regional blocks.

This comprehensive research report examines key regions that drive the evolution of the B2B Business Matchmaking Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Leading B2B Matchmaking Platforms and Emerging Innovators Driving Value, Network Effects, and Competitive Differentiation in 2025

The competitive landscape for B2B matchmaking platforms in 2025 encompasses both established global marketplaces and agile niche innovators. Major players such as Alibaba and eWorldTrade continue to leverage extensive supplier networks, advanced AI matching engines, and integrated logistics partnerships to deliver comprehensive sourcing experiences for millions of buyers worldwide. At the same time, event-focused solutions like Swapcard and Brella differentiate themselves through deep integration with in-person and hybrid event management tools, offering real-time networking apps that facilitate spontaneous encounters and follow-up analytics to measure engagement outcomes.

Innovators such as Hopin have expanded from virtual event origins to offer robust matchmaking capabilities for both online and face-to-face interactions, while platforms like b2match and Canapii provide highly customizable engines tailored to specific industry events and trade show formats. Meanwhile, emerging challengers are capitalizing on specialized use cases-such as IoT-enabled supply chain matchmaking or embedded CRM integrations-to carve out niche positioning. Across the board, successful companies are uniting advanced AI algorithms with seamless user experiences, ensuring that recommendations are accurate, contextually relevant, and delivered through intuitive interfaces.

Partnership strategies also distinguish leading operators. Integrations with CRM, ERP, and procurement systems are table stakes, but platforms that offer open APIs and developer ecosystems gain an edge by enabling customers to embed matchmaking capabilities into broader digital workflows. Additionally, alliances with logistics providers, payment processors, and compliance specialists help to reduce friction, enhance end-to-end visibility, and accelerate time to value for enterprise clients.

This comprehensive research report delivers an in-depth overview of the principal market players in the B2B Business Matchmaking Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AladdinB2B Inc.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- B2Match GmbH

- Bombora, Inc.

- Brella Oy

- Connect 1to1

- Connect Space Inc.

- Converve GmbH

- EC21 Co., Ltd.

- Europages SA

- Eventtia Inc.

- Global Sources Ltd.

- IndiaMART InterMesh Ltd.

- Kompass Group SA

- Meetmaps S.L.

- Symantra Ltd.

- Thomas Publishing Company

- TradeIndia Private Limited

- Zhejiang Focus Information Technology Co., Ltd.

Implementing Actionable Strategies to Enhance AI-Driven Matching, Supply Chain Resilience, and Partnership Ecosystem Development for Leadership Excellence

To excel in today’s dynamic B2B matchmaking landscape, industry leaders should prioritize strategic investments that align with both immediate operational needs and long-term growth objectives. First, implementing advanced AI-driven matching capabilities can substantially improve connection quality by leveraging comprehensive behavioral, transactional, and profile data to generate precise recommendations. This requires dedicating resources to data governance and AI model refinement to ensure accuracy and reduce bias.

Second, bolstering supply chain resilience is critical in light of persistent tariff uncertainties. Organizations can benefit from platforms that integrate real-time cost analytics, supplier risk scores, and alternative sourcing options. Establishing proactive monitoring tools to track tariff updates and regulatory changes will empower procurement and sourcing teams to pivot swiftly and maintain business continuity.

Third, fostering robust partnership ecosystems through open APIs and integration frameworks will enhance platform stickiness and drive customer satisfaction. By delivering turnkey connectors for CRM, ERP, and logistics partners, providers can minimize deployment friction and maximize the value clients derive from matchmaking capabilities. Equally important is investing in developer outreach programs and co-innovation initiatives that encourage customers and third-party vendors to extend platform functionalities.

Finally, cultivating localized expertise and compliance capabilities will differentiate offerings across regions. Whether it’s embedding GDPR-compliant features for EMEA customers or supporting multilingual interfaces for Asia-Pacific markets, tailoring the user experience to meet regional demands will unlock new revenue streams and deepen customer loyalty.

Outlining a Rigorous Mixed-Method Research Approach Combining Primary Interviews, Secondary Data, and Advanced Analytical Techniques for Market Clarity

This study employs a robust mixed-method research framework, beginning with extensive secondary research to map the competitive landscape, regulatory environment, and technological trends shaping B2B matchmaking. Data sources include industry journals, government publications, and authoritative white papers, ensuring a comprehensive understanding of tariff implications, AI adoption rates, and regional market dynamics.

Complementing the desktop analysis, primary research was conducted through in-depth interviews with over 30 senior executives from leading enterprises, technology vendors, and industry associations. These conversations provided firsthand insights into adoption challenges, desired platform capabilities, and emerging best practices. Survey data from more than 200 procurement and sales professionals further quantified sentiment around digital matchmaking preferences, budget allocations, and anticipated roadmap investments.

Quantitative findings were triangulated with proprietary analytics, leveraging advanced statistical techniques to identify significant correlations and forecast scenario impacts. Segmentation analyses were performed to disaggregate the market by component, deployment model, enterprise size, and vertical, while regional evaluations drew on localized market intelligence and expert validations. The resulting dataset was subjected to rigorous quality checks, ensuring that conclusions and recommendations are grounded in reliable and up-to-date information.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our B2B Business Matchmaking Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- B2B Business Matchmaking Platform Market, by Component

- B2B Business Matchmaking Platform Market, by Deployment

- B2B Business Matchmaking Platform Market, by Enterprise Size

- B2B Business Matchmaking Platform Market, by Vertical

- B2B Business Matchmaking Platform Market, by Region

- B2B Business Matchmaking Platform Market, by Group

- B2B Business Matchmaking Platform Market, by Country

- United States B2B Business Matchmaking Platform Market

- China B2B Business Matchmaking Platform Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Synthesizing Insights to Chart a Path Forward Where Digital Matchmaking and Strategic Alliances Converge for Sustainable B2B Growth in a Volatile Landscape

The convergence of digital innovation, geopolitical shifts, and evolving buyer expectations is fundamentally reshaping the B2B matchmaking landscape. Platforms that masterfully integrate AI-driven personalization, blockchain-enabled transparency, and seamless omnichannel experiences will stand out as strategic enablers of enterprise growth. At the same time, the ripple effects of escalating tariff measures underscore the necessity of resilient supply chain strategies and agile procurement frameworks.

Tailoring offerings to distinct market segments-spanning professional services, core technology modules, cloud versus on-premises deployments, and vertical-specific requirements-will be essential for delivering differentiated value. Moreover, capturing the unique characteristics of the Americas, EMEA, and Asia-Pacific regions through localized features, compliance protocols, and partnership networks will unlock new avenues for expansion.

Ultimately, the path forward lies in embracing a balanced approach that aligns technological innovation with pragmatic operational rigor. By leveraging comprehensive market insights, actionable recommendations, and specialized matchmaking capabilities, enterprises can transform how they discover, qualify, and engage with partners. This strategic realignment promises not just incremental improvements, but the potential to redefine the very nature of B2B collaboration in an increasingly interconnected world.

Connect with Ketan Rohom to Secure Exclusive Access to In-Depth Market Intelligence and Propel Your B2B Matchmaking Strategy Above the Competition

To explore a deeper dive into transformative market trends and tailored matchmaking strategies, reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to secure your copy of the full market research report. Engage directly to discuss your organization’s unique requirements and discover how this comprehensive analysis can empower your strategic decisions. By partnering with Ketan, you’ll gain priority access to expert insights, detailed segmentation analyses, and actionable recommendations that will accelerate your B2B matchmaking initiatives. Connect today to elevate your competitive advantage and position your enterprise at the forefront of global industry innovation.

- How big is the B2B Business Matchmaking Platform Market?

- What is the B2B Business Matchmaking Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?