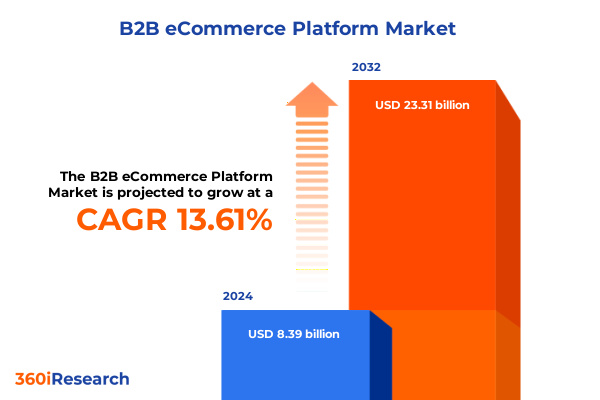

The B2B eCommerce Platform Market size was estimated at USD 9.46 billion in 2025 and expected to reach USD 10.69 billion in 2026, at a CAGR of 13.74% to reach USD 23.31 billion by 2032.

An authoritative framing of strategic imperatives and changing stakeholder expectations that drive platform modernization and commercial transformation in B2B commerce

The digital transformation of B2B commerce has evolved from tactical experimentation into a board-level priority that dictates customer engagement, operational resilience, and growth strategies across sectors. Companies are moving beyond basic catalog and transaction capabilities to design integrated platforms that unify procurement, sales, and supplier collaboration. This introduction sets the context for why platform selection, ecosystem partnerships, and technology architecture now determine not only commercial performance but also the agility to respond to external shocks and regulatory shifts.

In this environment, strategic stakeholders must reconcile legacy system dependencies with the need for modular, API-driven capabilities that support omnichannel selling, dynamic pricing, and advanced analytics. As buyer expectations converge with B2C convenience, enterprises face pressure to deliver sophisticated self-service experiences while preserving governance and compliance. This section outlines the imperatives that underpin subsequent analysis, emphasizing the operational, commercial, and technical trade-offs leaders must weigh when planning platform investments and transformation roadmaps.

A clear articulation of the fundamental shifts reshaping platform architectures, data-driven commerce, and go to market convergence that compel new investment priorities

The landscape of B2B eCommerce platforms is undergoing several transformative shifts that redefine how enterprises compete and collaborate. Market participants are increasingly prioritizing composable architectures, enabling modular deployment of microservices and API-led integrations to accelerate time to value. At the same time, advances in data analytics and AI are moving from pilot projects to embedded features, allowing sellers to personalize catalogs, optimize pricing, and automate order orchestration across complex supply chains.

Concurrently, channel strategies are converging; organizations are integrating digital self-service with direct sales, partner marketplaces, and embedded commerce to create seamless buying journeys. Security and compliance are no longer afterthoughts; they are built into platform roadmaps as first-order requirements driven by data sovereignty and industry-specific regulations. Finally, the economic cycle has increased emphasis on operational efficiency, prompting a wave of process automation, vendor consolidation, and renewed focus on measurable ROI from platform investments. These shifts demand a strategic approach that balances innovation with risk management and long-term extensibility.

An evidence-based evaluation of how 2025 tariff policy changes have influenced sourcing, pricing engines, and supply chain resilience for cross-border B2B operations

Policy developments in tariff schedules and trade enforcement during 2025 have created tangible operational headwinds for companies that rely on cross-border procurement and distributed manufacturing. The cumulative impact of United States tariffs in 2025 has rippled through sourcing strategies, supplier negotiations, and total landed cost calculations. Procurement teams report heightened emphasis on supplier diversification, nearshoring considerations, and contract renogiations to mitigate step changes in input costs and to preserve margin stability.

From a platform perspective, tariff volatility underscores the importance of transparent cost modeling and configurable pricing engines capable of incorporating duties, customs processing fees, and local tax implications at the line-item level. Supply chain control towers and integrated vendor portals are being leveraged to surface tariff exposure in procurement workflows and to accelerate change orders where necessary. In addition, enterprises are investing in scenario analysis capabilities and enhanced supplier performance monitoring to reduce single-source dependencies and to respond quickly to policy-driven disruptions that affect inventory planning and customer commitments.

Deep segmentation insights that map platform types, business models, technology stacks, deployment choices, vertical demands, and organizational scale to strategic priorities and capability needs

A nuanced understanding of market segmentation clarifies where investments deliver the greatest strategic value and which buyer and supplier cohorts demand different functional priorities. Based on Platform Type, market is studied across Custom-Built Platform, Integrated Platform, and Standalone Platform; each option presents trade-offs between customization, time to value, and total cost of ownership that influence adoption across industries. Based on Business Model, market is studied across Buyer-Oriented, Intermediary-Oriented, and Supplier-Oriented approaches, highlighting how network effects, monetization strategies, and partner governance vary when the platform centers on procurement hubs versus distributor ecosystems.

Based on Technology, market is studied across Open Source and Proprietary solutions, revealing divergent upgrade cycles, community-driven extensibility, and vendor dependency profiles. Based on Deployment Model, market is studied across Cloud Based and On Premise implementations, reflecting differing priorities in scalability, security control, and internal IT capability. Based on Industry Vertical, market is studied across Apparel & Fashion, Consumer Electronics, Healthcare, Manufacturing, Retail, and Wholesale & Distribution, each vertical imposing unique catalog complexity, regulatory requirements, and integration patterns. Based on Organization Size, market is studied across Large Enterprises and Small & Medium-Sized Enterprises, which shapes procurement rigor, customization appetite, and capital allocation for digital transformation. Taken together, these segmentation lenses enable leaders to map capability requirements to buyer personas, prioritize roadmap features, and select delivery models that align with cost, speed, and risk tolerance.

This comprehensive research report categorizes the B2B eCommerce Platform market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Platform Type

- Technology

- Business Model

- Deployment Model

- Industry Vertical

- Organization Size

Regional competitive and regulatory contrasts that determine platform localization requirements, partner strategies, and deployment models across major global markets

Regional dynamics continue to exert a strong influence on platform strategy, partner selection, and regulatory compliance for B2B commerce. In the Americas, digital procurement adoption is accelerated by mature enterprise IT landscapes and wide availability of cloud infrastructure, which favors rapid rollout of integrated platforms and advanced analytics capabilities. Conversely, Europe, Middle East & Africa presents a fragmented regulatory environment and varied maturity levels across markets, driving demand for configurable compliance controls, regional data residency options, and multi-currency commerce functionality. These differences encourage platform vendors and implementers to offer localized accelerators and compliance toolkits.

Across Asia-Pacific, rapid digital adoption and strong manufacturing linkages foster demand for scalable platforms that can accommodate high transaction volumes, complex multi-tier supplier networks, and real-time logistics integration. The region’s innovation ecosystems also produce a vigorous supplier market for specialized modules and integrations. Collectively, these geographic patterns suggest that regional go-to-market models should combine global platform capabilities with local delivery expertise, regulatory covered processes, and partnerships that reflect each region’s infrastructure and commercial norms. As a result, successful market entrants balance central product standards with regional customization and partner-led services.

This comprehensive research report examines key regions that drive the evolution of the B2B eCommerce Platform market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive differentiation among platform providers through modular architectures, partner ecosystems, and industry specialization that accelerate adoption and reduce implementation risk

Leading companies within the B2B eCommerce platform ecosystem are differentiating through a mix of product depth, partner networks, and vertical specialization. Some vendors focus on modular product suites that enable rapid integration with ERP, PIM, and logistics systems, while others emphasize turnkey solutions for specific industry verticals to accelerate time to value. Service-led firms differentiate by combining implementation expertise with managed services and change management offerings, recognizing that technical delivery alone does not guarantee end-user adoption or long-term ROI.

Strategic partnerships and an open integration posture have become decisive competitive levers; platform providers that offer robust APIs and established partner marketplaces enable richer ecosystems and faster innovation cycles. At the same time, customers value vendors that provide transparent roadmaps, clear SLAs, and community-driven knowledge resources. Enterprise procurement organizations are increasingly evaluating vendors on data governance practices, interoperability, and demonstrated success within similar regulatory and operational contexts. These competitive dynamics reward providers that can demonstrate measurable process improvements, integration maturity, and a consultative approach to scaling digital commerce operations.

This comprehensive research report delivers an in-depth overview of the principal market players in the B2B eCommerce Platform market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adobe Inc.

- Alibaba Group Holding Limited

- Amazon.com, Inc.

- BigCommerce Holdings, Inc.

- Cloudfy Ltd

- commercetools GmbH

- DHgate.com Inc..

- eBay Inc.

- Focus Technology (Shenzhen) Co., Ltd.

- Global Sources Limited

- IndiaMART InterMESH Limited

- Info Edge India Ltd.

- International Business Machines Corporation

- Intershop Communications AG

- JD.com, Inc.

- Oracle Corporation

- Oritur Technologies Private Limited

- Salesforce, Inc.

- Sana Commerce EMEA B.V.

- SAP SE

- Shopify Inc.

- Unite Network AG

- VTEX S.A.

- Xometry

- Znode LLC by Amla Commerce, Inc.

- ZOE Holding Company

- Zoho Corporation Pvt. Ltd.

Actionable, phased recommendations for executives to align stakeholders, prioritize modular architectures, and institutionalize change management for successful platform transformation

Leaders should adopt a clear, phased approach to platform selection and implementation that balances strategic ambition with operational execution. First, define outcome-based objectives and use-case prioritization to ensure investments directly support revenue enablement, cost reduction, or supply chain resilience. Next, align internal stakeholders across procurement, IT, sales, and legal to create a governance forum that expedites decisions and mitigates scope creep. This includes establishing measurable performance indicators tied to user adoption, process efficiency, and integration uptime.

In parallel, prioritize modularity and interoperability over monolithic customization to reduce technical debt and preserve upgrade paths. Build vendor evaluation criteria that weigh API maturity, integration accelerators, and partner ecosystems as heavily as feature checklists. Invest in change management, training, and internal champions to sustain adoption beyond go-live. Finally, incorporate scenario planning and tariff-sensitive cost modeling into procurement workflows to maintain agility in sourcing and pricing. By following these steps, organizations can reduce implementation risk, accelerate value capture, and maintain flexibility to adapt to regulatory or market shifts.

A transparent description of evidence sources, qualitative and quantitative validation steps, and triangulation methods used to ensure reliable, actionable insights for enterprise stakeholders

The research underpinning this executive summary combined multiple evidence streams to ensure robustness, reliability, and practical relevance. Primary data collection included interviews with procurement and commerce leaders, technical architects, and senior operations executives across industries to capture firsthand perspectives on platform requirements, integration challenges, and adoption barriers. Secondary research comprised a systematic review of vendor documentation, regulatory guidance, and publicly disclosed customer case studies to validate claims about capability sets and deployment patterns.

Findings were triangulated through cross-validation between qualitative interviews and documented evidence, with particular attention to recurring themes such as API readiness, deployment preferences, and tariff-related supply chain adjustments. Analytical methods included capability mapping, gap analysis, and scenario-based impact assessment to translate observed trends into actionable implications for buyers. Quality assurance measures included peer review by independent subject matter experts and reconciliation of conflicting inputs to ensure conclusions reflect consensus where present and clearly articulate areas of divergence where uncertainty remains.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our B2B eCommerce Platform market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- B2B eCommerce Platform Market, by Platform Type

- B2B eCommerce Platform Market, by Technology

- B2B eCommerce Platform Market, by Business Model

- B2B eCommerce Platform Market, by Deployment Model

- B2B eCommerce Platform Market, by Industry Vertical

- B2B eCommerce Platform Market, by Organization Size

- B2B eCommerce Platform Market, by Region

- B2B eCommerce Platform Market, by Group

- B2B eCommerce Platform Market, by Country

- United States B2B eCommerce Platform Market

- China B2B eCommerce Platform Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

A conclusive synthesis of strategic priorities, regional nuances, and tactical imperatives that guide resilient platform selection and transformation choices for B2B organizations

In conclusion, the B2B eCommerce platform landscape demands a pragmatic balance between innovation and operational discipline. Companies that prioritize composable architectures, invest in data-driven commerce features, and design for regulatory and regional variation are better positioned to capture long-term value. Tariff shifts and supply chain volatility in 2025 have reinforced the need for transparent cost modeling and supplier diversification, making platform capabilities that surface exposure and enable rapid reconfiguration increasingly essential.

Moreover, segmentation by platform type, business model, technology stack, deployment preference, industry vertical, and organization size provides a practical framework for matching vendor capabilities to enterprise priorities. Regional dynamics further emphasize the need for localized compliance and partner-led delivery. By combining disciplined vendor selection, modular implementation strategies, and strong change management, organizations can reduce risk, accelerate adoption, and create a more resilient digital commerce foundation that supports future growth.

Immediate contact guidance to secure the complete market research report with a personalized briefing and tailored procurement support for enterprise decision makers

To acquire the full market research report and unlock tailored insights for strategic decision-making, contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange a detailed briefing and purchase discussion.

A one-on-one consultation will ensure the report’s findings are aligned to your priorities, whether you require vendor selection support, deployment roadmaps, or supply chain resilience planning. During the briefing, reviewers can request targeted data extracts or scoped follow-up analysis to support procurement, IT, or commercial teams. Next steps include a demonstration of key dashboards, an overview of methodology and data sources, and confirmation of licensing terms for internal use and client presentations.

Engaging directly with the sales lead will enable expedited delivery and a tailored onboarding session for stakeholders. Reach out to schedule a confidential consultation to evaluate how the research supports your transformation agenda and to secure immediate access to proprietary insights and actionable recommendations.

- How big is the B2B eCommerce Platform Market?

- What is the B2B eCommerce Platform Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?