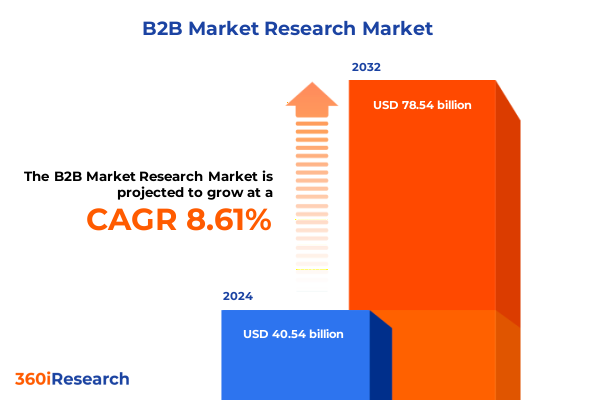

The B2B Market Research Market size was estimated at USD 43.90 billion in 2025 and expected to reach USD 47.58 billion in 2026, at a CAGR of 8.66% to reach USD 78.54 billion by 2032.

Providing a Strategic Overview of the B2B Market Research Landscape Highlighting Emerging Trends Challenges and Opportunities Shaping Industry Dynamics

The B2B market research ecosystem is undergoing profound evolution as organizations strive to remain agile in the face of rapidly shifting industry paradigms. In a landscape defined by digital acceleration and evolving buyer expectations, decision-makers are seeking differentiated, in-depth insights that illuminate invisible growth levers and emerging opportunities. Establishing a solid contextual foundation is critical: an informed introduction frames the discussion, unites stakeholders around shared objectives, and sets the stage for a data-driven exploration of market dynamics.

By articulating the study’s purpose and scope, this section lays out the strategic rationale behind a comprehensive exploration of offerings, methodologies, data types, and end-user segments. It emphasizes the importance of balancing qualitative narratives with quantitative rigor to deliver balanced perspectives on competitive positioning and emerging themes. In doing so, this introduction underscores how the rest of the executive summary builds upon a methodical approach to uncover key drivers, disruptive forces, and actionable intelligence that equip leaders with the insights needed to navigate both immediate challenges and long-term transformation.

Examining the Major Transformative Forces Reshaping B2B Market Research Through AI Digitalization Sustainability and Synthetic Data Innovations

Technological advancements are redefining the way B2B market research is conducted, delivered, and consumed. Artificial intelligence and data-driven platforms are enabling hyper-personalized insights, predictive analytics, and generative models that can simulate respondent behavior with unprecedented speed and scale. These innovations are not just incremental enhancements; they are fundamentally altering the value chain of research delivery, creating opportunities for faster turnarounds and deeper contextual understanding. IDC’s analysis highlights how AI-driven product configuration tools and generative capabilities are becoming integral to digital commerce strategies, transforming every interaction across the buying journey and reshaping traditional research methodologies.

At the same time, sustainability and ESG considerations have moved from peripheral compliance issues to core strategic priorities for B2B organizations. Driven by regulatory frameworks such as the EU’s Corporate Sustainability Reporting Directive and rising stakeholder expectations, companies are increasingly demanding data that not only measures environmental performance but also benchmarks social impacts and governance practices. Financial institutions and industrial players alike are focusing on transparent reporting mechanisms that can be integrated into decision-making processes, while consultancies specialized in sustainability advisory are experiencing surges in demand for expert guidance on material risk assessments.

Parallel to these developments, synthetic data is emerging as a transformative force in market research. By generating high-fidelity datasets that mimic real-world respondent behavior, synthetic data addresses key challenges such as privacy concerns, survey fatigue, and data scarcity. Industry feedback indicates a growing confidence in synthetic methodologies, with approximately 87% of research teams reporting satisfaction with the consistency and robustness of synthetic samples. This shift is enabling research teams to explore complex hypotheses and run stress tests on models without compromising respondent confidentiality.

Furthermore, Account-Based Marketing is evolving into a more sophisticated, end-to-end engagement model. ABM 2.0 leverages advanced analytics, multi-channel personalization, and AI-driven orchestration to maintain continuous dialogue with high-value accounts across buying stages. This evolution reflects a broader trend toward precision-targeted insights and cross-functional alignment between research, marketing, and sales teams, ensuring that intelligence is directly actionable and tightly integrated with growth objectives.

Analyzing the Extensive Cumulative Effects of 2025 Tariff Measures on US Industries Supply Chains and Corporate Strategic Responses

The cumulative impact of the 2025 tariff measures represents one of the most comprehensive overhauls of U.S. trade policy in recent decades. According to analysis by the Federal Reserve Bank of Richmond, average effective tariff rates could rise from roughly 2.3 percent in a 2024 baseline to over 22 percent when all announced measures are taken into account. This marked escalation stems from a sequence of announcements between February and April 2025 that expanded steel and aluminum tariffs, imposed universal and country-specific levies, and introduced broad reciprocal tariffs covering multiple trading partners.

Manufacturing and mining industries stand out as the most vulnerable under the new tariff regime. Finance officer surveys indicate that over half of manufacturing CFOs are actively diversifying supply chains, while nearly 40 percent accelerated procurement activities in anticipation of increased duties. These strategic adjustments underscore the material operational risks posed by tariff-related disruptions, especially for capital-intensive sectors subject to average tariff rates exceeding 18 percent.

In addition to sectoral ramifications, the tariffs have altered the competitive calculus of global supply chains. Increased costs on key inputs have prompted firms to explore alternative sourcing and consider regional production strategies to mitigate trade friction. Concurrently, ongoing negotiations with the European Union, Japan, and other partners have introduced an element of policy volatility, as prospective agreements could recalibrate duty levels-particularly for automotive and steel products-once pending deals are finalized.

Unveiling Key Segmentation Insights Across Offerings Research Types Data Modalities End Users and Sales Channels to Inform Market Strategies

A nuanced understanding of market segmentation offers clarity on where value is created and how resources can be optimally allocated. When viewed through the lens of offering types-spanning branding research, competitor analysis, customer feedback, and product evaluation-distinct requirements emerge in terms of the depth of qualitative storytelling versus the precision of quantitative metrics. These offering categories often overlap, yet each demands tailored methodologies and deliverables to meet client expectations.

From a research type perspective, primary research continues to deliver first-hand intelligence through interviews, surveys, and ethnographic studies, while secondary research provides foundational context and historical data that enriches strategic narratives. The interplay between qualitative and quantitative data modalities further underscores how narrative richness and statistical rigor combine to form comprehensive insights, enabling organizations to triangulate findings across different data streams.

End-user segments across aerospace and defense; automotive and transportation; banking, financial services, and insurance; consumer goods and retail; food and beverage; healthcare and life science; IT and telecommunication; and pharmaceuticals each exhibit unique pain points, regulatory dynamics, and innovation cycles. Recognizing these nuances is crucial for designing sector-specific research frameworks and benchmarking metrics.

Finally, the choice of sales channel-whether via direct engagement models or through indirect partner networks-shapes the distribution, communication, and ultimately the commercial impact of research outputs. Direct sales models often emphasize bespoke research programs and deeper client partnerships, while indirect channels can extend reach through alliances with consultancies and technology platform integrators.

This comprehensive research report categorizes the B2B Market Research market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Research Type

- Data Type

- End User

- Sales Channel

Highlighting Critical Regional Market Research Insights Spanning the Americas Europe Middle East Africa and Asia Pacific Dynamics

Geographic dynamics play an instrumental role in shaping market realities and competitive landscapes. In the Americas, robust demand for digitalization and sustainability solutions coexists with supply chain vulnerabilities that have been exacerbated by reshoring trends and tariff-induced cost pressures. Regional trade agreements and cross-border partnerships continue to evolve, compelling firms to reassess their North American footprint.

In Europe, Middle East, and Africa, the regulatory environment-particularly around data privacy, sustainability disclosure, and trade policy-remains the primary driver of investment in insight-driven decision-making. Organizations in these regions are increasingly leveraging research to navigate complex policy frameworks, foster resilience, and identify opportunities in emerging markets.

Asia-Pacific stands out for its rapid adoption of advanced analytics, generative AI, and digital commerce platforms. The region’s dynamic growth trajectories, fueled by technology incubation hubs and pro-innovation policies, have made it a testing ground for new research methodologies and market entry strategies.

This comprehensive research report examines key regions that drive the evolution of the B2B Market Research market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Entities Shaping the Competitive Market Research Landscape Through Innovation Collaboration and Technology Integration

Leading entities within the market research ecosystem are advancing the frontier of analytical rigor, platform versatility, and methodological innovation. These organizations excel at integrating artificial intelligence and machine learning capabilities into research pipelines, enabling self-service analytics and predictive modeling that deliver real-time insights. Others are distinguished by their ability to combine proprietary panel networks with synthetic data engines, addressing respondent scarcity while safeguarding data privacy.

Collaborative ventures between research consultancies and technology providers are fostering seamless integration of research outputs into enterprise resource planning systems, digital commerce platforms, and customer relationship management tools. These partnerships are facilitating the democratization of insights across organizational hierarchies, ensuring that C-suite executives, innovation teams, and frontline managers all benefit from a unified data narrative.

At the same time, specialized advisory firms are capitalizing on deep sector expertise, particularly in regulated industries such as healthcare, life sciences, and aerospace. Their domain-specific knowledge allows for rigorous interpretation of market trends, risk scenarios, and regulatory developments, providing clients with actionable intelligence that transcends standard questionnaires and dashboards.

This comprehensive research report delivers an in-depth overview of the principal market players in the B2B Market Research market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 360-iResearch Private Limited

- B2B International

- Bain & Company

- Borderless Access Pvt. Ltd.

- Boston Consulting Group

- Deloitte Touche Tohmatsu Limited

- Dialectica Limited

- Dynata, LLC

- Ernst & Young (EY) Parthenon

- FieldworkHub Ltd.

- Forrester Research, Inc.

- Gartner, Inc.

- Geo Strategy Partners

- GlobalData PLC

- Grand View Research, Inc.

- IMARC Services Private Limited

- Innovate MR, LLC

- INTAGE Inc.

- Ipsos Group

- IQVIA Inc.

- Kantar Group Limited

- Kudos Research

- MARKET PROBE INTERNATIONAL, INC.

- Marketsandmarkets Research Private Ltd.

- McKinsey & Company

- Ovation-Worldwide Holdings, LLC

- PricewaterhouseCoopers LLP

- PureSpectrum Inc.

- Roots Research

- S&P Global Inc.

- SIS International Research

- Statista, Inc.

- The Nielsen Company (US), LLC.

- TRU Group Inc.

- Westat, Inc.

Strategic Actionable Recommendations for Industry Leaders to Navigate Market Disruptions Enhance Insights and Drive Sustainable Competitive Advantage

Organizations must adopt a proactive posture to harness transformative trends and mitigate emerging risks. First, integrating advanced analytics and AI across the research life cycle is essential: establishing robust data governance frameworks, investing in machine learning capabilities, and upskilling teams will lay the foundation for scalable, predictive intelligence.

Second, embedding sustainability and ESG considerations into every research deliverable will ensure that insights align with evolving policy mandates and stakeholder expectations. This requires developing transparent measurement frameworks, leveraging third-party verification for credibility, and aligning research outputs with science-based targets.

Third, segment-specific strategies should be refined by combining qualitative depth with quantitative precision. Customizing research designs for each end-user vertical, and calibrating methodologies to reflect distinct regulatory and market dynamics, will drive relevance and impact. Likewise, dynamic segmentation models that integrate real-time data sources can uncover nascent opportunities faster.

Finally, forging strategic alliances across technology and consulting ecosystems will expand distribution channels and enhance solution breadth. Collaborations that integrate research insights directly into commercial platforms or advisory workflows can accelerate time to value, ensuring that strategic intelligence informs both high-level decision-making and operational execution.

Detailing the Rigorous Research Methodology Underpinning Data Collection Analysis and Validation Processes Employed in This Market Research Study

The study employs a hybrid research methodology that balances primary engagement with rigorous secondary analysis. Primary data collection includes in-depth interviews with senior executives across key industry verticals, ethnographic observation of buyer journeys, and structured surveys designed to capture both strategic priorities and operational challenges. These approaches ensure that qualitative nuances and lived experiences are incorporated into the insight hierarchy.

Secondary research provides the contextual framework, drawing on public filings, policy announcements, trade association publications, and curated news sources. This layer establishes baseline benchmarks, historical trends, and regulatory developments, enabling the synthesis of primary findings within a broader market narrative.

Data validation and triangulation are integral to the methodology. Findings from qualitative interviews are cross-checked against survey responses and secondary datasets, while statistical validation techniques-such as confidence interval analysis and variance testing-ensure the reliability of quantitative insights. Additionally, pilot studies and iterative feedback loops with select clients confirm the clarity and practical relevance of emerging themes.

Ethical considerations underpin every phase of the research process. Respondent confidentiality, compliance with data privacy regulations, and transparency of research protocols are maintained to uphold the integrity and credibility of the study.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our B2B Market Research market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- B2B Market Research Market, by Offering

- B2B Market Research Market, by Research Type

- B2B Market Research Market, by Data Type

- B2B Market Research Market, by End User

- B2B Market Research Market, by Sales Channel

- B2B Market Research Market, by Region

- B2B Market Research Market, by Group

- B2B Market Research Market, by Country

- United States B2B Market Research Market

- China B2B Market Research Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Summarizing the Comprehensive Findings and Strategic Implications of the Market Research Study to Guide Decision Making and Future Planning

This executive summary has distilled the critical dynamics shaping the B2B market research landscape in 2025. In scrutinizing technological breakthroughs, tariff implications, segment-specific imperatives, and regional intricacies, the study presents a cohesive narrative of transformation and adaptation. By profiling leading market intelligence providers and synthesizing actionable recommendations, this analysis equips industry leaders with a strategic roadmap for leveraging insights as a competitive asset.

Moving forward, organizations that embrace integrated analytics, prioritize sustainability metrics, and cultivate dynamic partnerships will be best positioned to capture emerging opportunities and navigate uncertainties. The confluence of AI, ESG, supply chain realignments, and regional trade policies demands a holistic approach-one that ensures insights are not only accurate but also deeply aligned with organizational goals.

Ultimately, the ability to translate market intelligence into strategic initiatives will determine success in an environment where speed, precision, and ethical governance converge. This study serves as a guide for decision-makers, providing both the intellectual framework and the pragmatic tools necessary to accelerate growth and sustain competitive advantage.

Engage with Associate Director Sales and Marketing to Acquire the Full Market Research Report and Empower Data Driven Strategic Decision Making

If you are ready to elevate your strategic path with data-driven clarity and unlock competitive differentiation, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging in a dialogue will provide you with detailed guidance on the research scope, methodology, and insights tailored to your organizational challenges. Secure access to proprietary analyses, customized deep dives, and actionable roadmaps designed to translate market intelligence into pragmatic strategies. Let our expertise guide you in harnessing critical market dynamics and emerging trends to achieve your business objectives.

- How big is the B2B Market Research Market?

- What is the B2B Market Research Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?