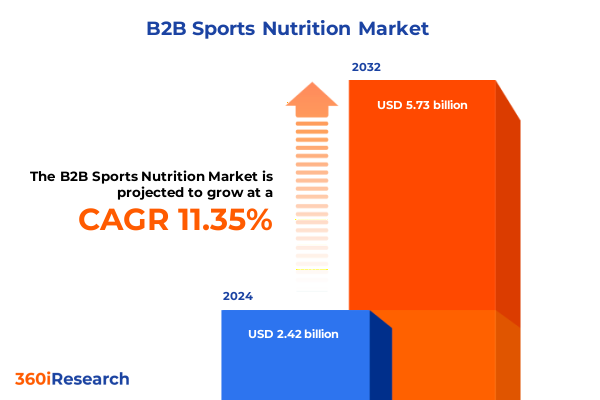

The B2B Sports Nutrition Market size was estimated at USD 9.87 billion in 2025 and expected to reach USD 10.58 billion in 2026, at a CAGR of 7.74% to reach USD 16.64 billion by 2032.

Exploring the Evolution of the B2B Sports Nutrition Landscape under Emerging Consumer Health Demands Technological Advances and Commercial Partnerships

The B2B sports nutrition sector is currently experiencing an unprecedented convergence of health consciousness, technological innovation, and evolving performance requirements among professional athletes, fitness centers, and healthcare institutions. As organizations seek to differentiate their offerings and optimize performance outcomes, there is a heightened demand for scientifically formulated supplements, fortified beverages, and evidence-based nutritional programs. This report opens by examining the foundational forces driving this shift, including the rising prevalence of personalized nutrition strategies, advancements in formulation science, and the critical role of data analytics in forecasting demand for specialized products.

Within this dynamic environment, stakeholders across distribution networks-from wholesale distributors to specialty retailers-are recalibrating their approaches to sourcing, inventory management, and customer engagement. The proliferation of digital channels is disrupting traditional sales models, enabling streamlined procurement processes and enhanced transparency across supply chains. Industry players are leveraging real-time insights to adapt quickly to consumer preferences, regulatory developments, and emerging ingredient trends, laying the groundwork for robust, resilient business strategies.

This introductory section frames the overarching objectives of the report: to identify transformative market shifts, understand the implications of recent policy changes, and uncover nuanced segmentation and regional patterns. By blending strategic analysis with forward-looking perspectives, it sets the stage for an in-depth exploration of the key themes that will define the next chapter of growth and innovation in B2B sports nutrition.

Identifying Transformative Market Shifts Shaping B2B Sports Nutrition through Digital Platforms Regulatory Changes and Evolving Performance Nutrition Requirements

Over the past several years, the B2B sports nutrition landscape has undergone a number of transformative shifts that are redefining how industry participants develop, market, and distribute their products. One of the most profound changes is the ascendancy of digital platforms as critical conduits for both product education and procurement. Companies are increasingly deploying e-commerce portals and proprietary digital ordering systems to streamline bulk purchases and to offer dynamic pricing models tailored to enterprise clients. Simultaneously, the integration of digital health solutions-such as mobile apps that track biometrics and deliver personalized supplement recommendations-has elevated the standard for what constitutes a competitive offering in this segment.

Regulatory changes around labeling and ingredient approvals have also reshaped product development roadmaps. Stricter guidelines regarding claims on creatine, plant-based proteins, and emerging performance ingredients have compelled manufacturers to invest heavily in clinical trials and transparent documentation. This trend dovetails with growing investor emphasis on traceability and supply chain integrity, as organizations seek to mitigate the risks associated with adulteration and counterfeiting.

In parallel, consumer preference shifts toward clean-label formulations, sustainably sourced raw materials, and eco-friendly packaging have prompted incumbents and new entrants alike to reevaluate their sourcing strategies. Partnerships between ingredient suppliers and contract manufacturers are becoming more collaborative and data-driven, ensuring that cost efficiencies are balanced with commitments to sustainability and regulatory compliance. Taken together, these catalysts are delivering a more agile, consumer-centric, and innovation-driven B2B sports nutrition ecosystem.

Analyzing the Far-reaching Effects of New 2025 United States Tariffs on B2B Sports Nutrition Supply Chains Costs and Competitive Positioning

In early 2025, the United States implemented a new set of tariffs targeting a range of imported raw materials and finished goods critical to sports nutrition manufacturing. These measures, aimed at supporting domestic agriculture and incentivizing local value addition, have had a cascading impact on input costs and sourcing decisions for enterprise buyers. Manufacturers reliant on foreign-sourced whey protein isolates, plant-based protein concentrates, and specialty amino acid derivatives have been compelled to reassess supplier agreements, with many accelerating plans to diversify or onshore production.

As a result, pricing pressures have emerged at multiple junctures across the supply chain. Ingredient suppliers have passed through higher duties to contract manufacturers, who in turn have negotiated cost-sharing arrangements with distributors and large-scale commercial buyers. Several leading sports nutrition producers have announced strategic partnerships with domestic dairy cooperatives and botanical extractors to establish localized supply hubs, thereby hedging against future policy volatility.

The tariff-induced realignment has also increased the attractiveness of vertically integrated models. Organizations capable of internalizing production of value-added ingredients-such as plant-derived proteins or fortified beverage bases-are gaining competitive advantages through improved margin control and supply reliability. At the same time, buyers are negotiating multi-year contracts with fixed-cost structures to lock in pricing stability. In aggregate, the 2025 tariff regime is catalyzing a reconfiguration of procurement strategies, fostering closer collaboration between buyers and suppliers, and driving a paradigm shift toward greater self-sufficiency within the B2B sports nutrition sector.

Revealing Deep Segmentation Insights into B2B Sports Nutrition Markets Based on Product Types Channels Forms Applications and End User Profiles

The B2B sports nutrition market can be dissected across multiple layers of segmentation, each providing critical insights into product development and go-to-market strategies. By product type, performance supplements remain at the forefront, particularly formulations such as BCAAs, creatine, nitric oxide boosters, and specialized pre-workout blends, which continue to see elevated demand from professional training facilities and athletic organizations. Protein supplements, encompassing casein, collagen, plant-based, and whey proteins, illustrate a parallel trajectory of growth driven by the convergence of recovery science and muscle synthesis research. Sports drinks, ranging from electrolyte solutions to energy and isotonic formulations, are increasingly tailored to enterprise clients seeking turnkey hydration programs. Meanwhile, vitamins and minerals-covering calcium, magnesium, multivitamins, and vitamin D-are being repositioned as foundational recovery aids in structured nutritional regimes, and weight management products, including appetite suppressants, fat burners, and meal replacement solutions, are finding traction within corporate wellness initiatives.

Channel segmentation reveals a bifurcated approach to distribution, with offline networks-comprising distributors, pharmacies, and specialty retailers-maintaining their importance for large-volume bulk orders and consultative service offerings. Yet online channels have gained significant momentum, as company websites and third-party e-commerce platforms facilitate seamless ordering workflows, dynamic inventory updates, and integrated data reporting for enterprise buyers. Form-based considerations further refine market strategies: bars, divided into energy and protein variants, serve as convenient on-the-go nutrition solutions; capsules and tablets deliver precision dosing through discrete formats; flavored and unflavored powders remain a staple due to their cost efficiency; and ready-to-drink products, offered in both multi-serve cans and single-serve bottles, bridge the convenience gap for end users.

Application-oriented segmentation underscores the diversity of performance use cases. Energy and endurance formulations cater to high-intensity training protocols, while muscle building blends leverage anabolic-support ingredients. Recovery-focused products combine synergistic components for post-activity repair, and weight management offerings incorporate thermogenic and satiety elements for holistic care. Finally, end-user segmentation highlights the distinct needs of distributors, e-commerce retailers, gyms and fitness centers, healthcare institutions, and specialty retailers. Understanding the interplay between product type, distribution channel, form factor, application, and end-user profile allows industry players to tailor offerings that align precisely with buyer requirements and consumption contexts.

This comprehensive research report categorizes the B2B Sports Nutrition market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Distribution Channel

- End User

Uncovering Regional Dynamics Influencing B2B Sports Nutrition Growth Patterns Across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics are shaping the competitive contours of the B2B sports nutrition market across three primary geographies: the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, the United States remains the dominant force, buoyed by a mature regulatory environment, robust sports science infrastructure, and high per-capita expenditure on health and fitness. Canada and Brazil are following suit with growing interest in plant-based proteins and sustainable ingredient sourcing, supported by regional trade agreements that facilitate ingredient flow between key agricultural markets.

Europe Middle East & Africa exhibits a mosaic of market maturity levels. Western European markets benefit from stringent labeling requirements and consumer demand for premium, clinically validated products, while Middle Eastern and African regions are emerging growth corridors, with local distributors forging partnerships to introduce turnkey hydration and recovery solutions. Regulatory harmonization efforts within the European Union provide stability for multinational suppliers, and recent investments in manufacturing capacity in North Africa are reducing lead times for markets in both regions.

Meanwhile, the Asia-Pacific arena is marked by rapid expansion in China, India, Japan, and Australia, driven by rising health awareness, expanding gym networks, and government-sponsored sports initiatives. Localization trends are particularly pronounced: formulations integrating regionally prevalent ingredients, such as rice protein or traditional herbal extracts, are resonating with enterprise consumers seeking culturally relevant offerings. Cross-border e-commerce is also catalyzing distribution, as buyers leverage digital platforms to access international brands. Taken together, these regional insights underscore the importance of adaptive market entry strategies and the value of aligning portfolios with diverse regulatory frameworks, consumption patterns, and supply chain infrastructures.

This comprehensive research report examines key regions that drive the evolution of the B2B Sports Nutrition market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Established Players Shaping the Competitive B2B Sports Nutrition Arena through Product Development Partnerships and Strategic Investments

Key companies in the B2B sports nutrition arena are distinguished by their investments in research and development, strategic partnerships, and global footprint expansions. Leading ingredient manufacturers are collaborating with contract fill-and-finish partners to co-develop next-generation formulations optimized for enterprise clients, while legacy beverage brands are entering performance hydration segments through white-label agreements and joint ventures. Agri-focused enterprises are looking to integrate upstream by offering proprietary protein isolates and botanical extracts, reinforcing supply chain traceability and cost efficiencies.

Mergers and acquisitions continue to play a central role, as larger conglomerates acquire niche specialized firms to broaden their product portfolios and capitalize on emerging trends such as plant-based proteins and cognitive performance supplements. Simultaneously, agile mid-market players are carving out differentiated positions through targeted innovation in areas like microbiome-supporting ingredients and sustainable packaging solutions. Collaborative initiatives between packaging experts and ingredient suppliers are yielding eco-friendly formats such as compostable sachets and recyclable multi-serve cans, addressing growing sustainability mandates among enterprise buyers.

International players are also forming geographic alliances to navigate local regulatory landscapes and optimize distribution networks. Cross-sector partnerships between sports nutrition companies and clinical research institutes are accelerating the clinical validation of new ingredient claims, bolstering product credibility among professional sports teams, fitness chains, and healthcare institutions. Collectively, these strategic moves underscore a competitive environment where agility, innovation, and integrated value chain control are paramount.

This comprehensive research report delivers an in-depth overview of the principal market players in the B2B Sports Nutrition market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Ajinomoto Co., Inc.

- Clif Bar & Company

- Glanbia Plc

- GNC Holdings, Inc.

- Herbalife International of America, Inc.

- Iovate Health Sciences International Inc.

- MusclePharm Corporation

- Nestlé S.A.

- Otsuka Pharmaceutical Co., Ltd.

- PepsiCo, Inc.

- Post Holdings, Inc.

- Science in Sport (SiS) plc

- The Coca-Cola Company

- The Hut Group

Formulating Actionable Recommendations for Industry Leaders to Navigate Regulatory Shifts Strengthen Supply Chains and Capitalize on Emerging Nutritional Demands Innovations

Industry leaders seeking to prosper in the dynamic B2B sports nutrition sector must prioritize a set of actionable strategies that align with market realities and emerging opportunities. First, investing in digital procurement platforms that deliver real-time pricing, inventory visibility, and seamless integration with enterprise resource planning systems will streamline ordering processes and strengthen client relationships. This foundation of digital excellence should be complemented by the deployment of data analytics tools capable of identifying evolving consumption patterns and forecasting demand for emerging ingredients.

Second, diversifying supply chains in response to the 2025 tariff landscape is critical for cost management and operational resilience. Organizations should evaluate dual sourcing models that balance domestic production facilities with international suppliers, while negotiating flexible contract terms to mitigate exposure to sudden policy changes. Vertical integration initiatives-such as in-house manufacturing of key botanical extracts or dairy-derived proteins-can further reinforce margin control and ensure supply security.

Third, aligning product portfolios with sustainability and clean-label mandates will differentiate offerings in an increasingly conscientious marketplace. Collaborations with packaging specialists, as well as certifications for non-GMO, organic, and ethically sourced ingredients, can elevate brand reputation among enterprise buyers. Concurrently, forming strategic alliances with research institutions to validate performance claims through clinical studies will enhance credibility and support premium pricing structures. By implementing these recommendations in a coordinated fashion, industry leaders can navigate regulatory complexities, capitalize on growth trends, and secure a competitive edge in the B2B sports nutrition domain.

Outlining Rigorous Research Methodology Employed to Capture Comprehensive B2B Sports Nutrition Market Perspectives through Data Collection Analysis and Expert Validation

This research employs a multifaceted methodology designed to capture a holistic view of the B2B sports nutrition market. It begins with comprehensive secondary research, drawing on industry journals, trade association publications, and publicly available financial disclosures to map the competitive landscape and identify key market drivers. This is followed by primary data collection through in-depth interviews with executives from leading ingredient suppliers, contract manufacturers, distribution partners, and enterprise end users in fitness centers, healthcare institutions, and sports organizations.

Data triangulation techniques are applied to reconcile findings from secondary sources with insights gleaned from primary interviews, ensuring the validity and reliability of conclusions. Quantitative surveys supplement these qualitative inputs, offering statistical rigor to segmentation analyses across product type, distribution channel, form factor, application, and end-user categories. Expert validation panels-comprising industry veterans, regulatory advisors, and sports science researchers-provide critical review of emerging trends, tariff implications, and regional developments, bolstering the credibility of strategic recommendations.

Throughout the research process, ethical guidelines and data privacy standards are strictly maintained. All proprietary information is anonymized and aggregated, and the methodological framework is designed to be replicable for future updates. This rigorous approach underpins the report’s ability to deliver actionable intelligence and strategic clarity to stakeholders navigating the complex B2B sports nutrition ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our B2B Sports Nutrition market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- B2B Sports Nutrition Market, by Product Type

- B2B Sports Nutrition Market, by Form

- B2B Sports Nutrition Market, by Application

- B2B Sports Nutrition Market, by Distribution Channel

- B2B Sports Nutrition Market, by End User

- B2B Sports Nutrition Market, by Region

- B2B Sports Nutrition Market, by Group

- B2B Sports Nutrition Market, by Country

- United States B2B Sports Nutrition Market

- China B2B Sports Nutrition Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Summarizing Key Takeaways and Strategic Implications of B2B Sports Nutrition Market Trends for Decision Makers Seeking Growth and Competitive Advantage

In summary, the B2B sports nutrition sector stands at a pivotal juncture defined by technological innovation, shifting regulatory landscapes, and complex supply chain dynamics. The emergence of new digital procurement platforms, clean-label formulations, and sustainable packaging solutions is accelerating product development cycles and differentiating market offerings. At the same time, the United States’ 2025 tariff adjustments are incentivizing supply chain realignment and vertical integration strategies, while regional variations in consumption preferences and regulatory frameworks underscore the importance of tailored market entry and distribution plans.

Key segmentation insights reveal that performance supplements, protein formulations, sports drinks, vitamins and minerals, and weight management products each present distinct value propositions for enterprise buyers, necessitating nuanced channel and form strategies. Regional analyses highlight strong growth momentum in the Americas, evolving standards in Europe Middle East & Africa, and rapid expansion across Asia-Pacific driven by localized ingredient innovation and cross-border e-commerce.

Looking ahead, organizations that embrace data-driven decision making, invest in resilient supply networks, and forge strategic partnerships for clinical validation and sustainable practices will be best positioned to capture value in this fast-evolving market. By synthesizing segmentation depth, regional acumen, and competitive intelligence, decision makers can chart a clear course toward sustainable revenue growth and market leadership in B2B sports nutrition.

Encouraging Investment Dialogue with Our Expert Ketan Rohom to Access In-depth B2B Sports Nutrition Insights and Secure Your Comprehensive Market Report Purchase

For decision makers who recognize the critical need for actionable insights into the evolving B2B sports nutrition landscape, engaging directly with Ketan Rohom, Associate Director of Sales & Marketing, offers a strategic advantage. With extensive expertise in market trends, consumption dynamics, and channel innovations, Ketan provides personalized guidance to ensure that your organization secures the most relevant and timely research deliverables. Reach out to discuss bespoke data packages, enterprise licensing options, and tailored consulting services that align with your strategic objectives. By partnering with Ketan, you gain access not only to a comprehensive market research report but also to ongoing advisory support that empowers your leadership team to make informed decisions, mitigate risks associated with regulatory shifts and tariffs, and capitalize on emerging growth opportunities. Don’t miss this chance to strengthen your competitive positioning and accelerate your path to market leadership in sports nutrition; contact Ketan Rohom today to acquire the definitive resource your organization needs.

- How big is the B2B Sports Nutrition Market?

- What is the B2B Sports Nutrition Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?