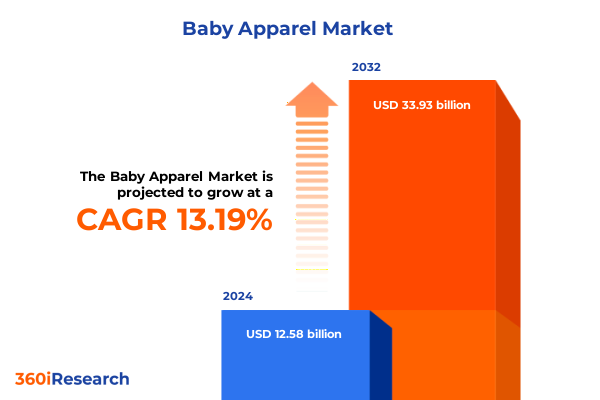

The Baby Apparel Market size was estimated at USD 14.28 billion in 2025 and expected to reach USD 15.87 billion in 2026, at a CAGR of 13.15% to reach USD 33.93 billion by 2032.

Exploring the convergence of digital innovation eco-conscious consumer values and infant apparel design that is redefining market expectations

In an era defined by rapid technological advancements and heightened environmental awareness, the baby apparel industry stands at the intersection of innovation and responsibility. As parents increasingly seek products that combine safety, style, and sustainability, brands are compelled to adapt their offerings to meet these evolving expectations. Digital platforms have become essential touchpoints, enabling brands to engage directly with consumers through personalized experiences and community-driven content, setting the stage for a new paradigm in infant fashion and care.

Meanwhile, a growing emphasis on eco-friendly materials and ethical sourcing has reshaped product development priorities, with organic fabrics and transparent supply chain practices emerging as critical differentiators in a crowded marketplace. This multifaceted landscape underscores the importance of an integrated approach that balances consumer-centric digital engagement with measurable commitments to social and environmental stewardship.

Uncovering the pivotal role of omnichannel digital experiences and ethical material choices in shaping the future of baby apparel

The baby apparel landscape is undergoing transformative shifts driven by a blend of digital engagement and ethical consumption imperatives. Parents now prioritize seamless omnichannel experiences, turning to mobile apps and social media to discover new products, compare pricing, and access peer recommendations in real time. This trend has prompted retailers to invest in augmented reality features and AI-driven personalization tools that guide purchase decisions and reinforce brand loyalty.

At the same time, sustainability has transitioned from a niche concern to a mainstream expectation. Brands are responding by integrating organic cotton, bamboo, and recycled polyester into their core fabric portfolios, reflecting the preference of modern parents for products that minimize environmental impact. Transparency in material sourcing and manufacturing processes has become a hallmark of industry leaders, who leverage certifications and eco-labels to communicate their commitment to sustainability and ethical labor practices.

Examining how 2025’s elevated import tariffs have reshaped sourcing strategies pricing dynamics and supply chain resilience in the baby apparel sector

The introduction of a series of tariffs on imported baby products in August 2025 has led to material cost pressures and pricing adjustments across the industry. With average import levies reaching double-digit levels, many manufacturers and retailers have had to reassess sourcing strategies and pass a portion of increased costs onto consumers. Essential items such as bodysuits, sleepwear, and outerwear have seen price upticks, prompting some brands to seek offsets through streamlined operations and alternative supply networks.

In response to these headwinds, several companies are diversifying production footprints beyond traditional hubs, exploring markets in Southeast Asia and Latin America to mitigate exposure to future tariff fluctuations. While these adjustments may incur short-term logistical complexity, they are crucial for maintaining cost competitiveness and ensuring consistent product availability in the face of evolving trade policies.

Delving into the multidimensional segmentation of the baby apparel market by product distribution age gender material and aesthetic design preferences

Market segmentation within baby apparel spans multiple dimensions, each offering unique insights into consumer preferences and purchasing behaviors. Product type delineations range from essential sleepwear and cozy outerwear to versatile bodysuits, functional footwear, and complementary accessories, reflecting varying levels of investment and style priorities among parents. Distribution channels are equally multifaceted, encompassing traditional offline retail formats-such as department stores, specialty boutiques, and mass-market supermarkets and hypermarkets-and a robust e-commerce ecosystem that includes both brand-operated websites and digital marketplaces, which themselves branch into horizontal and vertical platforms tailored to distinct shopper needs.

Further granularity emerges when considering age group preferences, as infants aged zero to six months may gravitate toward soft, stretchable garments, while toddlers older than a year often prioritize durability and ease of wear. Gender-based segments highlight differentiated color palettes and design elements for boys, girls, and unisex offerings, whereas material-focused classification underscores parent priorities around cotton’s breathability, synthetic blends’ resilience, and wool and knit fabrics’ warmth. Design aesthetics-from minimalist plain solids to embroidered motifs, graphic prints, and patterned fabrics-serve to capture the emotional and stylistic aspirations that drive repeat purchases and brand affinity.

This comprehensive research report categorizes the Baby Apparel market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Gender

- Material

- Design

- Distribution Channel

Analyzing how distinct economic social and regulatory landscapes across the Americas EMEA and AsiaPacific regions influence baby apparel production and consumer demand

Regional dynamics within the baby apparel industry reveal divergent growth drivers and operational considerations across key geographies. In the Americas, robust digital infrastructure and high consumer spending power underpin a mature market where premium organic and tech-enabled products command significant attention. E-commerce penetration is particularly pronounced, encouraging brands to optimize mobile and social commerce channels to capture tech-savvy parents seeking convenience and value.

The Europe, Middle East, and Africa region presents a complex tapestry of regulatory frameworks and consumer values, with stringent environmental standards driving demand for certified sustainable materials. Growth opportunities in emerging Middle Eastern markets coexist alongside established Western European hubs, necessitating agile supply chain strategies to navigate localized preferences and varying import regulations.

Meanwhile, Asia-Pacific continues to serve as both a manufacturing cornerstone and a burgeoning consumer base. Rapid urbanization and rising disposable incomes in markets such as China and India have spurred demand for higher-quality baby apparel, while leading production centers in Vietnam, Bangladesh, and Indonesia face the dual imperatives of cost efficiency and adherence to evolving social and environmental compliance requirements.

This comprehensive research report examines key regions that drive the evolution of the Baby Apparel market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting how premier apparel brands leverage sustainability platforms digital initiatives and innovation funds to define leadership in the babywear category

Leading companies in the baby apparel sector are differentiating through targeted sustainability initiatives, digital transformation, and strategic partnerships. Carter’s has solidified its position in North America by embedding stringent product safety standards and elevating sustainable materials usage through its Raise the Future platform, achieving 99% OEKO-TEX® certification and setting a 2030 target for 100% sustainable cotton fibers.

H&M’s baby wear line exemplifies circularity at scale, sourcing all cotton from organic, recycled, or Better Cotton Initiative streams and introducing Cradle to Cradle Gold-certified compostable garments that align with consumer expectations for end-of-life recyclability. Its ongoing investment in biodegradable packaging and in-store takeback programs underscores a comprehensive approach to reducing environmental impact across the product lifecycle.

Inditex’s Zara brand further advances industry innovation by launching a €50 million textile innovation fund to support start-ups developing low-impact fibers and processing technologies. This fund not only accelerates the adoption of recycled and bio-based materials but also reinforces Zara’s commitment to halving supply chain emissions by 2030, demonstrating how investment in research and collaboration can yield long-term competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Apparel market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adidas AG

- American Apparel Inc.

- Burberry Group plc

- Carter's Inc.

- Cotton On Group

- Fruit of the Loom Inc.

- Gap Inc.

- Gerber Childrenswear LLC

- Gymboree Group Inc.

- Hanesbrands Inc.

- Hennes & Mauritz AB

- J.C. Penney Company Inc.

- Kering SA

- Li & Fung Limited

- Mamas & Papas

- Mothercare plc

- Nike Inc.

- OshKosh B'gosh Inc.

- Primark Stores Limited

- Puma SE

- Ralph Lauren Corporation

- The Children's Place Inc.

- VF Corporation

Strategies for embedding personalization sustainability diversified sourcing and collaborative innovation into the DNA of baby apparel organizations

To navigate the shifting terrain of baby apparel, industry leaders should embrace a series of proactive strategies. First, integrating advanced analytics and AI-driven personalization into e-commerce and CRM systems will enable brands to deliver relevant product recommendations and dynamic pricing promotions that resonate with individual parent profiles. Second, expanding sustainable material portfolios-anchored by third-party certifications-will strengthen consumer trust and pre-empt tightening regulatory requirements, particularly in markets with stringent eco-label mandates.

Third, diversifying production and sourcing hubs beyond traditional regions can mitigate exposure to escalating tariff regimes and geopolitical uncertainties, ensuring continuity of supply and cost stability. Fourth, fostering cross-sector partnerships-such as collaborations with material science start-ups, logistics innovators, and digital platform providers-can accelerate the development of breakthrough textiles and streamline omnichannel fulfillment capabilities. By adopting these recommendations, leaders can not only shield margins but also capture emerging growth opportunities in a rapidly evolving marketplace.

Overview of a robust mixedmethod research approach combining executive interviews consumer focus groups and rigorous data triangulation

This analysis is grounded in a rigorous research framework encompassing both primary and secondary methodologies. Primary data was collected through in-depth interviews with senior executives across brands, retailers, and supply chain partners, complemented by consumer focus groups to surface real-time preferences and purchasing drivers. Secondary research incorporated peer-reviewed journals, industry association reports, regulatory filings, and reputable news outlets, ensuring a comprehensive panorama of market dynamics.

Data triangulation techniques were applied to validate findings, cross-referencing qualitative insights with quantitative trade statistics, customs data, and published corporate disclosures. A multi-stage vendor assessment process evaluated the robustness of each data source, while quality assurance protocols-including peer reviews and iterative stakeholder validation sessions-reinforced the accuracy and relevance of conclusions. This blended approach delivers a balanced, fact-based foundation for the strategic recommendations and sector insights presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Apparel market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Apparel Market, by Product Type

- Baby Apparel Market, by Age Group

- Baby Apparel Market, by Gender

- Baby Apparel Market, by Material

- Baby Apparel Market, by Design

- Baby Apparel Market, by Distribution Channel

- Baby Apparel Market, by Region

- Baby Apparel Market, by Group

- Baby Apparel Market, by Country

- United States Baby Apparel Market

- China Baby Apparel Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Summarizing the critical interplay of digital sustainability tariffs and segmentation in charting resilient growth trajectories for baby apparel

In summary, the baby apparel industry is at a pivotal inflection point where consumer expectations for digital convenience and sustainable responsibility converge. Tariff-driven cost adjustments and evolving regional dynamics necessitate agile operational models and diversified sourcing strategies to maintain competitive advantage. Detailed segmentation by product type, distribution channel, age, gender, material, and design reveals nuanced pathways for targeted growth and brand differentiation.

Industry leaders who invest in personalization technology, reinforce eco-credentials through certified materials, and champion collaborative innovation will be well-positioned to thrive in an increasingly complex global marketplace. By leveraging the insights and recommendations outlined herein, stakeholders can craft resilient business models that cater to modern parents’ demands while safeguarding profitability and brand equity.

Contact the Associate Director of Sales & Marketing to acquire the full baby apparel market research report and leverage strategic insights immediately

To secure comprehensive insights and actionable intelligence on the evolving baby apparel sector, contact Ketan Rohom, Associate Director of Sales & Marketing. Engage directly to explore detailed analyses on consumer behavior shifts, tariff impacts, segmentation drivers, regional dynamics, and competitive strategies. Connect to obtain a tailored discussion on how your organization can leverage this research to inform product innovation, optimize distribution channels, and fortify supply chain resilience in the face of regulatory changes. Reach out today to access the full report and unlock strategic guidance designed to empower decision-making and catalyze growth in the baby apparel market.

- How big is the Baby Apparel Market?

- What is the Baby Apparel Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?