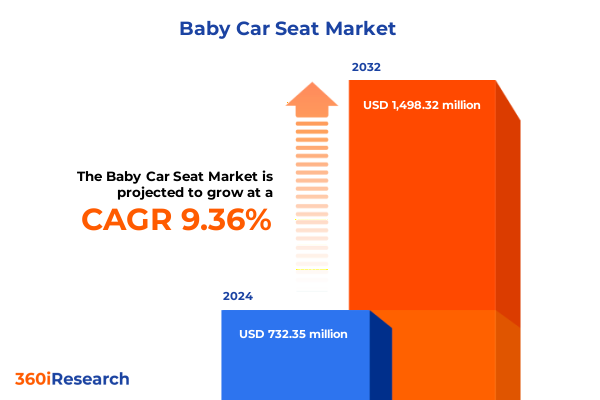

The Baby Car Seat Market size was estimated at USD 784.20 million in 2025 and expected to reach USD 844.52 million in 2026, at a CAGR of 9.69% to reach USD 1,498.32 million by 2032.

Setting the Stage for Revolutionary Improvements in Child Safety and Comfort Through Next Generation Baby Car Seat Technologies

As parents and caregivers worldwide place increasing emphasis on safety, comfort, and convenience, the baby car seat sector has evolved into a battleground of innovation and regulation. Escalating concerns over road safety statistics have driven a relentless push for improved crash protection standards. Regulatory bodies across major markets continue to raise the bar on testing protocols and mandatory features, compelling manufacturers to adopt more rigorous design, testing, and quality assurance processes. At the same time, heightened awareness of child ergonomics has led to an elevated focus on user experience, with comfort features emerging as key differentiators in a crowded landscape.

Amidst this heightened scrutiny and consumer demand, the industry is witnessing a transformation driven by technological breakthroughs in materials science and vehicle integration. Today’s new generation of baby car seats leverages advanced energy-absorbing foams, intuitive installation indicators, and modular designs that accommodate a child’s growth trajectory. Moreover, partnerships between seat producers and vehicle OEMs have begun to unlock seamless connectivity features, enabling real-time feedback on seat positioning and locking status. The confluence of safety imperatives and technological enabling is laying the groundwork for an entirely new paradigm in child restraint systems, one that balances uncompromising protection with a superior user journey.

Uncovering Major Transformative Shifts Driving Disruption and Innovation Across the Global Baby Car Seat Market Landscape

The baby car seat landscape is being reshaped by a set of powerful forces that extend well beyond traditional engineering advances. Digitalization has emerged as a catalyst for change, with brands harnessing e-commerce platforms to engage directly with end-users and gather real-time feedback on product performance. This shift has accelerated innovation cycles, allowing manufacturers to refine prototypes in weeks rather than quarters. At the same time, the rising importance of environmental responsibility has ushered in a wave of sustainable materials initiatives. Biodegradable foams and recycled polymer composites are now being incorporated into structural components, aligning safety standards with broader corporate sustainability commitments.

Another pivotal evolution is the integration of smart sensors and connected-device capabilities. These embedded systems not only monitor installation integrity but also offer predictive analytics on wear-and-tear, empowering parents with alerts when critical components reach end-of-life thresholds. In parallel, advanced manufacturing techniques-like additive printing of complex geometries-are enabling customized seating profiles that deliver ergonomic precision. Together, these transformative shifts are charting a course toward a future where baby car seats are not only passive safety devices but intelligent guardians that adapt and respond to both vehicle dynamics and child physiology.

Analyzing the Cumulative Impact of 2025 United States Tariffs on Supply Chain Dynamics Cost Structures and Consumer Pricing Trends

Recent changes in United States trade policy have introduced a set of tariffs that, collectively, have begun to reverberate through the baby car seat supply chain. Imported raw materials, notably specialized energy-absorption foams and high-grade webbing, are now subject to elevated duties. As a result, upstream producers are experiencing a compression of margins, prompting many to reevaluate procurement strategies and seek alternative suppliers in regions not covered by new tariff measures. These sourcing shifts have led to a rebalancing of logistics networks, with some manufacturers opting for nearshoring tactics to reduce exposure to cross-border cost volatility.

On the downstream side, the tariff-induced cost increases have exerted upward pressure on retail price structures. While consumer willingness to pay for premium safety features remains strong, price-sensitive segments have shown signs of resistance, driving an uptick in demand for value-oriented models that minimize tariff impacts through simplified designs and localized component content. At the same time, distributors and retailers are adapting their promotional strategies, leveraging bundled packages and loyalty incentives to offset higher sticker prices. Collectively, these adjustments underscore the broad cumulative impact of 2025 United States tariffs on manufacturing economics, channel strategies, and end-user purchasing behavior.

Deriving Strategic Insights from Complex Segmentation Dimensions Spanning Distribution Channels Installation Methods Price Ranges and Materials

In assessing the market through the lens of distribution channel segmentation, there is a clear dichotomy between brick-and-mortar and digital storefront environments. Brick-and-mortar continues to thrive in high-traffic hypermarkets and specialty stores that offer hands-on demonstrations and in-person fitting services, yet it faces mounting pressure from manufacturer websites and third-party ecommerce marketplaces that provide unparalleled convenience, user reviews, and direct-to-consumer pricing. Transitioning to installation method segmentation, the dichotomy between LATCH and seat belt systems reveals nuanced preferences: enhanced LATCH variants are gaining traction in premium models, whereas standard LATCH remains prevalent in mid-range offerings, and the choice between three-point belt and five-point belt options is frequently determined by parent demographics and vehicle compatibility.

From a price perspective, economy tier seats-subdivided into budget and value categories-are capturing price-conscious buyers in emerging urban markets, while mid-range segments composed of mid-economy and mid-plus products balance feature sets against affordability. At the pinnacle, luxury and ultra-premium seats incorporate digital sensors and customizable design elements, appealing to affluent consumers prioritizing cutting-edge safety. Meanwhile, the material dimension further differentiates offerings: aluminum and steel alloys provide structural resilience in high-end lines, whereas composite and polypropylene plastics are engineered for cost efficiency and weight reduction in entry- and mid-level models. This multifaceted segmentation framework underscores the strategic imperative for manufacturers to tailor their portfolios to the distinct needs of each subsegment with surgical precision.

This comprehensive research report categorizes the Baby Car Seat market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Installation Method

- Price Range

- Material

Gaining Critical Regional Perspectives Highlighting Key Drivers and Barriers Across Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics continue to exert a profound influence on the trajectory of the baby car seat market. In the Americas, stringent federal and state-level safety regulations have established a high baseline for mandatory crash testing and labeling requirements, fostering consumer confidence yet elevating the cost of market entry. Demographic shifts and rising dual-income households in North America have fueled demand for advanced safety features, while in Latin America, improving retail infrastructure is expanding access to mid-range and premium seats.

In Europe, the Middle East and Africa region, harmonized European safety standards have long set the global benchmark, driving continuous product refinements and reinforcing the importance of third-party certification. Within the Middle East, young families are demonstrating growing interest in luxury seat options, whereas African markets remain price-sensitive but are gradually embracing premium safety solutions as disposable incomes rise. Across Asia-Pacific, rapid urbanization, surging birth rates, and an increasingly sophisticated retail ecosystem are converging to create robust appetite for both economy and premium segments. Government-led safety campaigns in major Asia-Pacific markets are also accelerating consumer education and adoption of advanced restraint systems, positioning the region as a pivotal growth engine.

This comprehensive research report examines key regions that drive the evolution of the Baby Car Seat market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Core Strengths of Leading Manufacturers Driving Innovation Growth and Market Positioning in the Baby Car Seat Sector

A review of leading manufacturers reveals a competitive landscape defined by relentless innovation and strategic alliances. Legacy brands with deep engineering heritage are investing heavily in research partnerships to pioneer next-generation energy management systems, often collaborating with university research centers and materials innovators. Simultaneously, newer entrants are leveraging agile development models and digital marketing tactics to capture niche segments, focusing on modular seat designs that allow for aftermarket upgrades and customization.

Beyond product innovation, industry leaders are forging distribution partnerships with national retailers and premium ecommerce platforms to optimize reach and accelerate time to market. Warranty extensions and subscription-based inspection programs have emerged as differentiators, enhancing post-sale engagement and building loyalty. Companies are also emphasizing sustainability roadmaps, committing to recycled materials targets and transparent supply chain disclosures. Together, these strategic initiatives are shaping a competitive hierarchy in which the ability to blend breakthrough safety technologies with compelling business models and green credentials determines market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Car Seat market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Britax Child Safety, Inc.

- Chicco USA, Inc.

- Cybex GmbH

- Dorel Juvenile Group, Inc.

- Evenflo Company, Inc.

- Graco Children's Products Inc.

- Newell Brands Inc.

- Nuna International B.V.

- Peg Perego S.p.A.

- UPPAbaby, LLC

Delivering Actionable Recommendations for Industry Leaders to Enhance Innovation Operational Efficiency and Competitive Advantage in Car Seat Manufacturing

Industry leaders should prioritize direct engagement with end-users through integrated digital platforms that capture usage data and deliver personalized product recommendations. By analyzing real-world insights, manufacturers can iterate more responsively on safety features and ergonomics. It is also critical to fortify supply chain resilience by diversifying procurement locations and negotiating flexible terms with key raw material suppliers to hedge against future tariff or geopolitical shocks.

Investment in sustainable materials should advance beyond pilot programs, scaling biodegradable composites and recycled plastics across product lines to meet rising consumer demand for eco-friendly solutions. In parallel, expanding smart sensor integration will unlock subscription-based service models for wear monitoring and proactive maintenance alerts. Collaboration with vehicle OEMs and ride-sharing fleets can create new distribution channels and embed safety expertise at the point of sale. Finally, aligning product roadmaps with evolving safety regulations and participating actively in standards-setting committees will ensure that organizations remain at the forefront of compliance and innovation.

Illuminating Rigorous Research Methodology Combining Primary Interviews Secondary Sources and Robust Data Triangulation for Informed Market Insights

This market analysis is grounded in a rigorous multi-phase research process designed to deliver depth and accuracy. Primary research included in-depth interviews with senior product engineers, regulatory experts, retail buyers, and caregivers across major markets. These qualitative insights were triangulated with extensive secondary research, encompassing industry publications, safety standard documentation, and financial disclosures from leading public companies.

Quantitative data was collected from proprietary shipment databases, regional customs records, and retailer POS systems to map distribution footprints and price trends. Advanced analytics methodologies, including scenario modeling and sensitivity analysis, were employed to stress-test key assumptions. A comprehensive validation phase integrated feedback from an expert advisory board comprising academic researchers, policy analysts, and veteran industry consultants. The result is a robust, transparent methodology that underpins every insight and recommendation presented in this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Car Seat market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Car Seat Market, by Distribution Channel

- Baby Car Seat Market, by Installation Method

- Baby Car Seat Market, by Price Range

- Baby Car Seat Market, by Material

- Baby Car Seat Market, by Region

- Baby Car Seat Market, by Group

- Baby Car Seat Market, by Country

- United States Baby Car Seat Market

- China Baby Car Seat Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2226 ]

Drawing Strategic Conclusions Emphasizing Critical Takeaways and Implications for Stakeholders Across the Baby Car Seat Ecosystem

The evolution of the baby car seat market has been defined by a convergence of safety imperatives, regulatory pressures, and technological breakthroughs. Manufacturers that excel in marrying advanced materials science with connected-device capabilities are poised to set new industry benchmarks. Meanwhile, strategic agility in distribution and supply chain management remains critical to withstand macroeconomic instabilities, including the ripple effects of tariff realignments.

Segmentation analysis illustrates the necessity of differentiated value propositions across channels, installation methods, price points, and material choices. Regional perspectives underscore the varied pace of adoption and the importance of local regulatory landscapes in shaping consumer demand. Together, these factors coalesce into a decisive moment for stakeholders: those who capitalize on data-driven innovation, sustainable sourcing, and adaptive market strategies will emerge as the undisputed leaders in safeguarding the next generation of travelers.

Compelling Call To Action Encouraging Engagement with Associate Director of Sales and Marketing to Secure Comprehensive Market Research Insights

It’s time to empower your next strategic decision with unparalleled market intelligence and customized insights tailored for your unique organizational needs. Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, stands ready to guide your procurement process and ensure you obtain a solution that offers deep competitive differentiation and precision in execution. Reach out to discover how this comprehensive research report can illuminate unseen opportunities, mitigate emerging risks, and equip your team with the confidence to act decisively. Seize this opportunity to secure a vital analytical asset that will drive growth, optimize strategic investments, and propel your business ahead of the curve.

- How big is the Baby Car Seat Market?

- What is the Baby Car Seat Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?