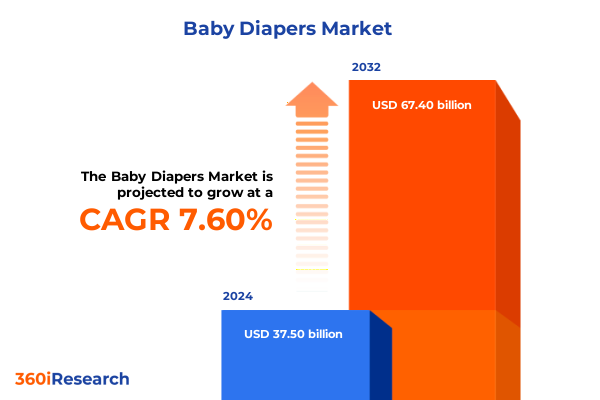

The Baby Diapers Market size was estimated at USD 40.16 billion in 2025 and expected to reach USD 43.02 billion in 2026, at a CAGR of 7.67% to reach USD 67.40 billion by 2032.

Setting the Stage for the Modern Baby Diaper Landscape by Illuminating Key Demographic and Consumer Insights That Propel Market Evolution

Over the past decade, the baby diaper market has undergone a profound metamorphosis driven by shifting demographics, evolving lifestyles, and heightened consumer awareness of health and sustainability. At its core, this segment remains anchored in the fundamental need for infant care, yet it now intersects with broader societal trends such as dual-income households, delayed childbearing, and the quest for eco-friendly alternatives. As birth rates stabilize in developed regions and continue to rise in emerging markets, manufacturers are compelled to align product innovation with the nuanced demands of diverse consumer cohorts.

Moreover, the advent of digital commerce has accelerated the velocity of product adoption, enabling parents to access a broader range of diaper options with unparalleled convenience. Subscription models and direct-to-consumer platforms have reshaped traditional distribution channels, creating new competitive imperatives for legacy players and nimble startups alike. In parallel, regulatory frameworks across major markets increasingly emphasize safety standards and environmental compliance, catalyzing investments in biodegradable materials and recyclable packaging. Consequently, stakeholders must navigate a landscape defined by both robust growth potential and intricate compliance challenges, underscoring the necessity of a strategic, data-driven approach to market entry and expansion.

Unveiling Pivotal Innovations and Market Forces That Are Revolutionizing the Baby Diaper Industry’s Competitive Landscape

In recent years, the baby diaper sector has witnessed transformative shifts fueled by breakthroughs in material science and digital integration. Manufacturers have progressively incorporated super absorbent polymers alongside polyethylene films to enhance leak protection while reducing bulk, responding to parental demands for thinner, more comfortable designs. Simultaneously, the emergence of biodegradable raw components such as plant-derived fibers and hybrid materials underscores an industry pivot toward sustainability. These greener alternatives are not only meeting stringent environmental regulations but also resonating with eco-conscious consumers willing to pay a premium for reduced ecological footprints.

Simultaneously, the incorporation of smart sensors capable of detecting moisture levels and communicating with caregiver devices heralds a new era of connected infant care. Technology partnerships and patent filings have surged, reflecting an appetite for diaper products that transcend basic functionality to offer real-time monitoring and predictive change alerts. Alongside these advances, the retail landscape itself has been reconfigured by omnichannel strategies that unify physical and digital touchpoints. Brands are now leveraging data analytics to personalize marketing outreach, optimize inventory, and tailor subscription offerings, thereby enhancing customer retention and elevating brand loyalty. Collectively, these shifts signal a competitive battlefield where innovation agility and digital fluency are paramount.

Assessing How United States Tariffs Enacted in 2025 Have Reshaped Supply Chains Cost Structures and Competitive Dynamics Across the Industry

The imposition of new tariffs by the United States in early 2025 has produced a cascade of effects across the baby diaper supply chain, from raw material procurement to final retail pricing. Tariffs levied on imported super absorbent polymers and polyethylene resin have elevated production costs for manufacturers reliant on international suppliers. In response, several leading producers have undertaken strategic sourcing initiatives, forging partnerships with domestic resin manufacturers to mitigate exposure to tariff volatility. Concurrently, this shift has intensified competition among resin producers, driving modest innovation in high-performance polymer blends tailored to domestic production needs.

At the retail level, the cumulative pass-through of these added costs has nudged average selling prices upward. However, price elasticity in the diaper segment remains relatively inelastic among core demographic groups, enabling brands to retain margins while exploring targeted promotions to offset consumer sensitivity. Conversely, smaller regional players lacking hedging mechanisms or local supply agreements have experienced margin compression, prompting consolidation activity as they seek economies of scale. Looking ahead, the interplay between tariff policy and bilateral trade negotiations will remain a critical factor shaping cost structures, making it imperative for industry leaders to monitor legislative developments and adapt sourcing strategies in near real time.

Decoding Comprehensive Segmentation Trends That Reveal Consumer Preferences and Strategic Opportunities Across All Diaper Categories and Formats

Insights derived from a meticulous segmentation analysis reveal distinct consumption patterns across every facet of the diaper market. When viewed through the lens of product type, disposable diaper offerings continue to capture dominant mindshare, driven by their convenience and wide availability, whereas non-disposable cloth variants have secured a foothold among eco-driven consumers valuing long-term cost savings. Examining individual product categories, all-in-one diaper configurations maintain broad appeal for everyday use, while swim diapers address niche recreational needs and training diapers support the transitional stages of toddler development. Materials segmentation highlights the escalating importance of biodegradable inputs, which are frequently blended with cotton cloth in hybrid constructs to balance performance with environmental credentials, even as polyethylene films and super absorbent polymers remain indispensable for high-leak protection sectors.

Size differentiation underscores a predictable progression from newborn to double extra large (XXL), aligning with infant growth trajectories and reinforcing the need for size-specific design optimizations. Packaging size preferences range from single packs suited for trial use to jumbo and multiple pack offerings favored by value-seeking households. A further distinction emerges between closed and open diaper formats, with open designs often preferred in clinical and hospital settings for rapid changing, and closed diapers dominating home use due to their ease of disposal. From an end-user perspective, clinics and hospitals maintain rigorous performance and compliance standards, daycare centers prioritize bulk affordability, and home usage balances convenience and cost. Distribution channels reflect a bifurcation between offline retail, where brand sampling and in-store promotions drive trial, and online channels, where subscription models and dynamic pricing enhance customer lifetime value.

This comprehensive research report categorizes the Baby Diapers market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Product

- Material

- Size

- Packaging Size

- Type

- End-User

- Distribution Channel

Analyzing Regional Dynamics in the Americas EMEA and Asia-Pacific to Unearth Growth Hotspots Regulatory Drivers and Consumer Behavior Patterns

Regional dynamics exert a profound influence on demand trajectories, regulatory requirements, and competitive strategies across the baby diaper market. In the Americas, the United States and Canada continue to endorse high-value, premium diaper formats, with sustainability claims and performance benchmarks serving as critical purchase drivers. Latin American markets, by contrast, exhibit sensitivity to price and package size, prompting brands to introduce economically priced multi-packs alongside targeted promotions in emerging urban centers.

Across Europe, Middle East, and Africa, stringent environmental regulations in Western Europe accelerate the adoption of biodegradable materials and recyclable packaging, whereas Middle Eastern markets balance rapid urbanization with a preference for established global brands. In sub-Saharan Africa, penetration rates remain comparatively low, creating a substantial runway for disposable diaper uptake as incomes rise. Moving to Asia-Pacific, China’s urban middle class propels demand for premium, maternal-approved diaper formats, while e-commerce platforms like leading online marketplaces catalyze growth through flash sales and influencer-driven campaigns. India and Southeast Asian economies register the fastest expansion, driven by rising birth rates, improving healthcare access, and increasing brand awareness, setting the stage for fierce competition among both local and international players.

This comprehensive research report examines key regions that drive the evolution of the Baby Diapers market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Global Diaper Manufacturers and Emerging Innovators Driving Market Leadership Through Brand Equity and Technological Advancements

Leading multinational corporations have cemented their positions through extensive distribution networks and sustained investment in research and development. One major player leverages its legacy brand equity to introduce premium eco-friendly lines, integrating advanced moisture management technologies and soft-touch materials. Another global manufacturer has prioritized capacity expansion and backward integration for raw polymer production, securing cost advantages that underpin aggressive pricing strategies in value segments.

Japanese and Korean entrants stand out for their emphasis on dermatological testing and hypoallergenic formulations, catering to region-specific consumer sensitivities and often commanding higher price points. Meanwhile, European specialty firms have differentiated through pioneering compostable diaper innovations, forging collaborations with waste management providers to streamline end-of-life processing. Emerging domestic brands in Asia-Pacific leverage digital marketing prowess, deploying social media influencers and direct-to-consumer subscription bundles to capture urban, tech-savvy parents. This diverse competitive ecosystem underscores the necessity for continuous innovation in product attributes, supply chain resilience, and omnichannel market execution.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Diapers market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abena A/S

- Attends Healthcare Products, Inc.

- Chiaus (Fujian) Industrial Development Co., Ltd.

- Daio Paper Corporation

- Domtar Corporation

- Drylock Technologies

- DSG International Limited

- Essity AB

- First Quality Enterprises, Inc.

- Hengan International Group Company Limited

- Humble Group AB

- Johnson & Johnson

- Kao Corporation

- Kimberly-Clark Corporation

- Medline Industries, Inc.

- Ontex Group NV

- Pigeon Corporation

- Procter & Gamble Co.

- The Honest Company

- The SCA Group

- Unicharm Corporation

- Unilever PLC

Delivering Strategic Imperatives for Industry Stakeholders to Capitalize on Sustainability Innovation and Channel Optimization in the Evolving Baby Diaper Market

Industry leaders seeking to fortify their market positions should prioritize sustainable innovation by expanding R&D into next-generation biodegradable polymers and closed-loop packaging systems that facilitate recycling. Equally important is the optimization of digital sales channels through partnerships with e-commerce platforms and the deployment of advanced analytics to forecast demand at the micro market level. To counteract cost pressures introduced by tariff fluctuations, companies should diversify their supplier base and explore regional manufacturing hubs that offer preferential trade agreements.

Moreover, forging strategic alliances with healthcare institutions-ranging from hospitals to pediatric clinics-can create opportunities for co-developed product lines and seal brand credibility through professional endorsement. Companies should also segment marketing strategies by end-user to tailor messaging, emphasizing sterility and ease of use for clinical customers while highlighting cost efficiency and convenience for home users. Finally, investing in localized consumer research will enable faster response to emerging trends, ensuring that new product rollouts and promotional campaigns resonate with specific regional and demographic nuances.

Explaining the Rigorous Research Framework Employed to Ensure Data Integrity Comprehensive Analysis and Actionable Insights in the Baby Diaper Market

This research synthesis draws upon an integrated methodology that combines comprehensive secondary data analysis with proprietary primary research. Secondary sources include industry publications, regulatory filings, and company annual reports, which have been triangulated to map competitive landscapes and material cost trends. Primary inputs were solicited through structured interviews with supply chain executives, R&D specialists, and procurement managers across leading manufacturers, as well as surveys administered to caregivers and institutional buyers to gauge usage patterns and price sensitivities.

Quantitative data was subjected to rigorous statistical validation, employing both descriptive and inferential techniques to ensure the robustness of segmentation insights and regional comparisons. Qualitative findings were corroborated through thematic analysis to refine understanding of consumer motivations and regulatory impacts. The resulting framework offers both breadth, via macroeconomic and tariff analyses, and depth, through micro-level segmentation and channel performance metrics. While every effort has been made to ensure accuracy and relevance, readers are advised to consider ongoing market dynamics and supplement this report with the latest regulatory updates and company disclosures where appropriate.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Diapers market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Diapers Market, by Type

- Baby Diapers Market, by Product

- Baby Diapers Market, by Material

- Baby Diapers Market, by Size

- Baby Diapers Market, by Packaging Size

- Baby Diapers Market, by Type

- Baby Diapers Market, by End-User

- Baby Diapers Market, by Distribution Channel

- Baby Diapers Market, by Region

- Baby Diapers Market, by Group

- Baby Diapers Market, by Country

- United States Baby Diapers Market

- China Baby Diapers Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings to Illustrate the Future Trajectory of the Baby Diaper Market Amidst Innovation Sustainability and Geopolitical Challenges

In conclusion, the baby diaper market stands at the intersection of innovation, sustainability, and geopolitical complexity. Technological advancements in materials and digital integration offer fertile ground for product differentiation, while shifting consumer values propel demand for eco-friendly alternatives. The introduction of United States tariffs in 2025 has underscored the importance of resilient supply chain structures and adaptive sourcing strategies, even as core demographic trends continue to sustain baseline growth.

Segmentation analysis reveals nuanced opportunities across product types, materials, sizes, and end-use scenarios, while regional variations highlight the need for tailored approaches to pricing, distribution, and regulatory compliance. As competitive pressures intensify, companies that harness rigorous data analytics, embrace strategic partnerships, and invest in localized innovation will be best positioned to capture emerging market share. Looking ahead, aligning growth strategies with sustainability imperatives and consumer convenience preferences will be critical to securing long-term success in this dynamic landscape.

Engaging Directly with Leadership to Unlock Tailored Market Intelligence and Drive Growth Through In-Depth Baby Diaper Industry Analysis and Custom Solutions

To explore the full breadth of market trends and gain a competitive edge in the rapidly evolving baby diaper market, connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engaging directly with Ketan offers the opportunity to receive personalized briefings on emerging consumer priorities, regulatory impacts, and advanced materials innovation. By leveraging his expertise, decision-makers will access exclusive data breakdowns spanning tariff sensitivity, channel performance, and region-specific growth drivers. Don’t miss the chance to transform insights into actionable growth strategies and secure a leading position in this dynamic sector. Contact Ketan today to purchase the comprehensive market research report and unlock critical intelligence that will fuel your strategic initiatives and enhance your market responsiveness

- How big is the Baby Diapers Market?

- What is the Baby Diapers Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?