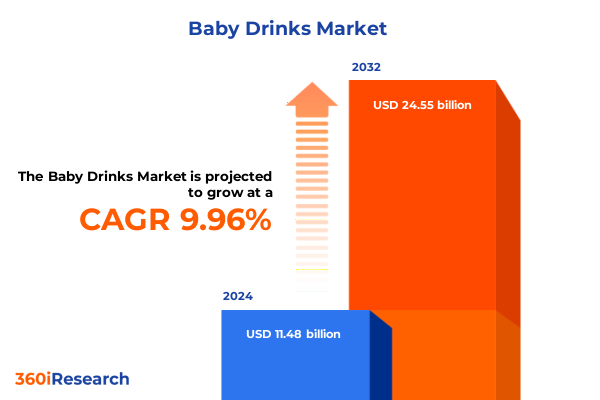

The Baby Drinks Market size was estimated at USD 12.42 billion in 2025 and expected to reach USD 13.43 billion in 2026, at a CAGR of 10.22% to reach USD 24.55 billion by 2032.

Unveiling the Next Generation of Baby Beverages: A Comprehensive Overview of Market Dynamics, Emerging Trends, and Consumer Demands

In an era defined by heightened nutritional awareness and evolving consumer preferences, the baby drinks sector stands at the forefront of innovation and transformation. Growing emphasis on digestive health and immune support has spurred manufacturers to reimagine traditional formulations, elevating them beyond basic hydration to multifunctional beverages that cater to the nuanced needs of infants and young children. Concurrently, demographic trends such as delayed parenting and rising dual-income households have reshaped purchasing behaviors, with caregivers seeking premium, convenient solutions that integrate seamlessly into busy lifestyles. These shifts have cultivated an environment where product developers are challenged to balance efficacy, safety, and convenience in equal measure.

Innovation in ingredient sourcing and formulation has become a critical differentiator, as companies explore opportunities in prebiotics, probiotics, and plant-derived nutraceuticals. Such functional ingredients are increasingly viewed not only as value-adds but as market essentials, reflecting a broader consumer trajectory toward proactive health management from the earliest stages of life. This evolution dovetails with the expanding influence of digital commerce, where online platforms enable parents to access a wider array of specialized products with ease and transparency. The surge of direct-to-consumer channels has also increased scrutiny of brand authenticity and traceability, prompting a deeper dialogue about sourcing standards and production ethics.

Moreover, regulatory frameworks and quality assurance protocols are intensifying, driving manufacturers to adopt rigorous testing and certification practices. Together with sustainability commitments around packaging and carbon footprint reduction, these developments underscore a holistic approach to product development. As the industry moves forward, the intersection of science-driven innovation, consumer empowerment, and regulatory rigor will continue to define the trajectory of baby beverages, setting the stage for new growth opportunities and competitive dynamics.

Navigating Critical Transformations Shaping the Baby Drinks Sector Driven by Health Consciousness, Digital Innovation, Sustainability, and Personalized Nutrition

The baby drinks category is undergoing a profound transformation fueled by interrelated forces that are reshaping product development, distribution, and consumer engagement. Health consciousness has evolved from a peripheral concern to the central pillar of purchasing decisions, with caregivers prioritizing scientifically validated claims around gut health and immune support. In response, manufacturers are investing in advanced research collaborations and clinical trials to substantiate their functional beverage offerings, thereby elevating the overall credibility of the category.

Simultaneously, the digital revolution is redefining how parents discover, evaluate, and purchase baby beverages. E-commerce platforms and mobile applications now serve as vital touchpoints, providing personalized recommendations and subscription models that encourage repeat purchases. This shift to digital has been further accelerated by strategic partnerships between established brands and innovative technology firms, enabling enhanced transparency through blockchain-enabled traceability and interactive QR code integrations.

Sustainability is another pivotal change agent driving product and packaging innovations. Brands are exploring alternatives to traditional plastic, embracing recyclable cartons and plant-based materials to reduce environmental impact and appeal to eco-minded consumers. These sustainability efforts extend beyond packaging, influencing ingredient sourcing and manufacturing processes to minimize carbon emissions. Moreover, personalization has emerged as a powerful trend, with bespoke nutrient profiles and flavor options tailored to regional taste preferences and specific developmental needs. Altogether, these transformative shifts underscore an industry in dynamic flux, where agility and forward-thinking strategies are imperative for success.

Assessing the Far Reaching Consequences of 2025 United States Tariffs on Precursor Ingredients, Supply Chains, Pricing Structures, and Industry Resilience

United States tariffs implemented in early 2025 have introduced a series of operational challenges and strategic pivots across the baby drinks supply chain. Tariffs on essential dairy components and plant-derived ingredients have elevated procurement costs, compelling manufacturers to reassess sourcing strategies and engage in deeper negotiations with suppliers. These added expenses have exerted pressure on production budgets, prompting an industry-wide emphasis on process optimization and cost containment to safeguard profit margins without undermining product quality.

Moreover, the ripple effects of tariff measures have extended to logistics and distribution frameworks. Freight rates have experienced upward pressure amid reconfigured trade flows, as importers explore alternative routes and port pairs to mitigate duty impacts. Consequently, lead times have become less predictable, necessitating more robust inventory management practices and contingency planning. Organizations have responded by diversifying their supplier base, leveraging nearshore partnerships, and exploring domestic ingredient alternatives to bolster supply chain resilience.

Despite these headwinds, many players are seizing the opportunity to reinforce their value proposition through premiumization strategies. By highlighting ingredient provenance and manufacturing certifications, brands can justify incremental price adjustments and maintain consumer trust. At the same time, a growing focus on research-driven formulation improvements supports the advancement of next-generation offerings, ensuring that product portfolios remain compelling even in a higher-cost environment. As the industry continues to adapt, the interplay between policy-driven cost pressures and strategic innovation will shape the competitive landscape for baby beverages.

Unlocking Market Potential Through In Depth Segmentation by Product Innovations, Diverse Distribution Channels, and Versatile Packaging Formats

Analyzing the baby drinks sector through a segmentation lens reveals distinct pathways for value creation and product differentiation. In terms of product type, the market spans functional beverages enriched with prebiotic and probiotic blends, traditional juice drinks including fruit and mixed vegetable-fruit variants alongside pure vegetable extracts, and diverse milk-derived formulas encompassing follow-on, infant, toddler, and growing up milk formulations. Plant-based options such as almond, oat, and soy drinks have emerged to cater to allergic predispositions and lifestyle choices, while water-based formats range from simply flavored compositions to mineral-rich offerings designed for gentle hydration.

From the perspective of distribution channels, offline retail remains anchored by specialty nutrition stores and mainstream supermarkets and hypermarkets that offer direct shelf visibility and experiential purchase opportunities. Online retail is evolving rapidly, split between direct-to-consumer subscription models that foster brand loyalty and expansive e-commerce platforms offering extensive assortments with rapid delivery options. These dual channels exhibit complementary strengths, with digital ecosystems driving repeat engagement and brick-and-mortar outlets reinforcing brand credibility.

Packaging formats also play a pivotal role in consumer perception and convenience. Bottles provide familiarity and portability, cartons offer aseptic protection and sustainability narratives, while pouches and sachets introduce on-the-go solutions favored by busy caregivers. As packaging innovation continues to accelerate, the interplay between product safety, user experience, and environmental stewardship becomes central to segmentation strategies, ensuring that each format addresses unique consumer pain points and aligns with broader brand objectives.

This comprehensive research report categorizes the Baby Drinks market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Packaging

Exploring Regional Dynamics and Growth Drivers Across the Americas, Europe Middle East Africa, and Asia Pacific Baby Beverage Markets

Regional dynamics in the baby drinks market illustrate diverse growth drivers and consumer priorities across global territories. Within the Americas, demand is buoyed by premiumization trends and a surge in organic and clean-label preferences, with North American parents displaying a willingness to invest in specialized formulations that support holistic wellness. Latin American markets are characterized by emerging middle classes and expanding modern retail channels, enhancing accessibility to international brands and niche domestic innovators.

Across Europe, Middle East, and Africa, regulatory frameworks and cultural considerations intersect to influence market development. European markets are defined by stringent labeling requirements and proactive health claims regulations, prompting manufacturers to pursue rigorous clinical validations. Meanwhile, the Middle East and Africa region exhibits rapidly urbanizing populations and rising health awareness, creating fertile ground for products that fuse nutritional efficacy with regional taste profiles and climate-responsive hydration solutions.

Asia-Pacific represents a dynamic and varied landscape, where digital adoption and traditional caregiving principles converge. In China and India, e-commerce proliferation and mobile payment infrastructures have accelerated online penetration, while local taste preferences drive the customization of flavor profiles and ingredient blends. Southeast Asian markets showcase a blend of imported premium products and locally sourced formulations, reflecting a balance between aspirational consumption and cost sensitivity. Consequently, regional strategies must navigate regulatory heterogeneity, cultural nuances, and distribution complexities to capture the full spectrum of growth opportunities.

This comprehensive research report examines key regions that drive the evolution of the Baby Drinks market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves and Competitive Positioning of Leading Baby Beverage Manufacturers and Emerging Innovators Redefining Industry Standards

Leading companies in the baby drinks arena are redefining competitive benchmarks through a combination of product innovation, strategic alliances, and portfolio diversification. Multinational manufacturers are intensifying research collaborations with academic institutions and biotech firms to pioneer proprietary functional blends that address emerging health concerns, such as cognitive development and allergy management. These partnerships facilitate accelerated go-to-market timelines while enhancing scientific credibility.

At the same time, specialized regional players are leveraging localized expertise to craft formulations tailored to cultural taste preferences and regulatory standards. By focusing on clean-label credentials and sustainable sourcing narratives, these organizations differentiate themselves in crowded markets and foster deeper connections with health-conscious consumers. Moreover, recent mergers and acquisitions have consolidated capabilities across manufacturing, distribution, and R&D, enabling companies to achieve economies of scale and broaden their global footprint.

Start-ups and challenger brands are also making notable inroads by employing agile marketing approaches and direct-to-consumer models. Through data-driven personalization and social media engagement, these emerging innovators captivate new parent communities and accelerate trial adoption. Their success underscores the importance of consumer engagement strategies that fuse educational content with authentic brand storytelling, ensuring that products resonate with both pragmatic needs and emotional aspirations.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Drinks market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Arla Foods amba

- Ausnutria Dairy Corporation Ltd

- Danone S.A.

- HiPP GmbH & Co. Vertrieb KG

- Inner Mongolia Yili Industrial Group Co., Ltd.

- Nestlé S.A.

- Reckitt Benckiser Group plc

- Royal FrieslandCampina N.V.

- The Perrigo Company plc

Delivering Targeted Recommendations to Capitalize on Health Trends, Supply Chain Resilience, and Consumer Engagement in the Baby Drinks Industry

To thrive amid evolving consumer expectations and supply chain complexities, industry leaders must pursue a multi-faceted strategic agenda. First, prioritizing research and development in functional nutrition and clean-label formulations will enable companies to maintain a competitive edge. By investing in clinical partnerships and advanced ingredient technologies, organizations can substantiate product benefits and command premium positioning in health-driven segments.

In parallel, strengthening supply chain resilience is imperative to mitigate external shocks such as tariff adjustments and logistics constraints. Implementing dual sourcing strategies, fostering nearshore supplier relationships, and embracing digital supply chain platforms can enhance visibility and responsiveness. These measures will not only secure ingredient availability but also facilitate agile adaptations to unforeseen disruptions.

Finally, cultivating omnichannel engagement models will be essential for nurturing consumer loyalty. Integrating direct-to-consumer subscription offerings with brick-and-mortar experiential activations can deliver seamless brand experiences, while data analytics should underpin personalized marketing initiatives. Furthermore, adopting sustainable packaging innovations and transparent labeling practices will resonate with environmentally conscious caregivers, reinforcing trust and driving long-term brand affinity.

Detailing Methodological Framework Integrating Quantitative Surveys, Qualitative Interviews, and Data Triangulation to Ensure Robust Market Insights

This research framework combined comprehensive primary and secondary methodologies to ensure robust market insights and actionable recommendations. Primary data collection encompassed in-depth interviews with senior executives across ingredient suppliers, beverage manufacturers, and retail partners, complemented by qualitative focus groups with parents and caregivers to capture evolving consumer preferences. Quantitative online surveys provided statistically significant validation of purchasing behaviors, product attribute prioritization, and channel preferences.

Secondary research drew upon industry publications, regulatory filings, and trade association reports to contextualize historical developments and current market structures. Publicly available financial statements and corporate presentations were analyzed to map competitive dynamics, while patent databases and scientific journals were reviewed to track innovation trajectories. All data sources were triangulated to reconcile discrepancies and reinforce the validity of findings.

Analytical techniques included thematic content analysis for qualitative inputs and advanced statistical modeling for quantitative data, ensuring that segmentation schemas and trend forecasts were grounded in empirical evidence. The entire process was overseen by a dedicated quality assurance team, which conducted peer reviews and methodological audits to uphold the highest standards of research integrity and reliability.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Drinks market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Drinks Market, by Product Type

- Baby Drinks Market, by Distribution Channel

- Baby Drinks Market, by Packaging

- Baby Drinks Market, by Region

- Baby Drinks Market, by Group

- Baby Drinks Market, by Country

- United States Baby Drinks Market

- China Baby Drinks Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1749 ]

Concluding Insights Emphasizing Strategic Imperatives, Consumer Centricity, and Innovation as Pillars for Sustainable Growth in the Baby Beverages Landscape

In summary, the baby drinks landscape is poised at a critical inflection point where consumer demands, regulatory intricacies, and supply chain variables converge to redefine competitive advantage. The rise of functional formulations, driven by prebiotic and probiotic innovations, underscores the sector’s commitment to health and wellness. Concurrently, the effects of 2025 United States tariffs have spotlighted the importance of supply chain resilience and cost management while reinforcing the value of premiumization and ingredient transparency.

Segmentation insights reveal opportunities across product categories, distribution channels, and packaging formats, each demanding tailored strategies to capture distinct consumer segments. Regional dynamics further highlight the necessity of localized approaches that account for regulatory frameworks, cultural preferences, and digital infrastructure. Within this context, industry leaders and emerging challengers alike must harness strategic collaborations, sustainable practices, and dynamic marketing models to thrive.

As the industry continues to evolve, the integration of scientific rigor, operational agility, and compelling brand narratives will serve as the cornerstones of sustainable growth. Organizations that embrace innovation, foster consumer trust, and anticipate external disruptions will be best positioned to navigate this complex ecosystem and deliver lasting value to caregivers and their families.

Take Action Today to Secure Comprehensive Baby Drinks Market Insights and Propel Your Strategy with Ketan Rohom’s Expert Guidance

Elevate your decision making and unlock critical insights that will shape the future of your baby drinks portfolio by partnering with Ketan Rohom, whose in-depth understanding of market dynamics and strategic acumen can help you navigate this rapidly evolving landscape. Reach out to secure comprehensive analysis and receive tailored recommendations that align with your organization’s objectives, ensuring your innovations resonate with today’s discerning parents and caregivers.

Don’t miss the opportunity to harness exclusive data and expert guidance that will give you a competitive edge. Connect with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this market research report can empower your team with actionable intelligence and foster sustainable growth in the baby beverages category.

- How big is the Baby Drinks Market?

- What is the Baby Drinks Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?