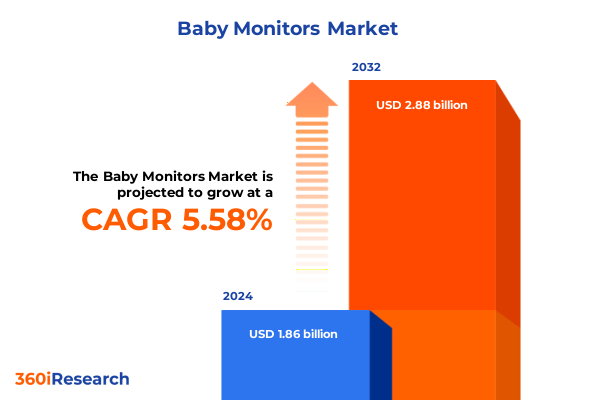

The Baby Monitors Market size was estimated at USD 1.97 billion in 2025 and expected to reach USD 2.07 billion in 2026, at a CAGR of 5.60% to reach USD 2.88 billion by 2032.

Unveiling the Evolution and Importance of Modern Baby Monitors in Delivering Safety, Connectivity, and Peace of Mind for New Generation Caregivers

In recent years, the baby monitor market has transcended its traditional role as a niche convenience tool to become a cornerstone of modern child safety and parental well-being. Innovations in wireless connectivity, digital video streaming, and artificial intelligence have transformed how caregivers interact with their infants and toddlers. No longer confined to simple audio feeds, today’s monitors provide high-definition video, real-time movement detection, and seamless integration with smart home ecosystems. This evolution reflects a broader societal trend toward proactive health and safety measures that empower busy families to maintain constant vigilance without sacrificing flexibility.

The convergence of technology and childcare has also driven significant enhancements in battery life, range, and portability, enabling greater peace of mind whether at home or on the go. As connectivity standards like DECT and Wi-Fi become more robust, families are demanding devices that harmonize with mobile applications and cloud platforms for instantaneous alerts and long-term data analysis. In turn, manufacturers are prioritizing user-friendly interfaces, encrypted data streams, and firmware updates that address emerging security threats. Consequently, this market continues to attract established electronics giants alongside agile startups, each vying to redefine the caregiver experience through next-generation functionality.

Moreover, the shift toward a more connected lifestyle extends beyond the nursery, with monitors now serving as multipurpose hubs for environmental sensors, two-way communication, and even wearable integration for biometric monitoring. As a result, companies must navigate a complex ecosystem of hardware innovation, software development, and regulatory compliance, all while retaining a keen focus on usability and trust. This introduction sets the stage for a deep dive into the dynamic forces shaping the future of baby monitoring solutions.

Navigating the Technological and Regulatory Transformations Redefining the Baby Monitor Industry’s Next-Generation Capabilities

The landscape of baby monitoring has undergone several transformative shifts driven by technological breakthroughs and changing consumer expectations. Once dominated by analog audio receivers, the space has rapidly embraced digital platforms capable of delivering crisp video streams and AI-driven insights. This transition from basic sound detection to sophisticated data analytics underscores a major shift in how safety and convenience interplay, giving rise to devices that can distinguish between ambient noise and a genuine cry for attention. Efficiency in power consumption and wireless protocols has further enhanced the reliability and range of these systems, making them indispensable components of the modern nursery.

Beyond pure functionality, market players have reconfigured their value propositions to emphasize ecosystem compatibility. Connectivity standards such as Bluetooth and Wi-Fi have become baseline requirements, while proprietary apps now form the primary user interface, offering customizable alerts and historical trend analysis. As parents increasingly treat baby monitors as extensions of their smart home environment, interoperability with popular voice assistants and home security platforms has shifted from optional to mandatory.

Furthermore, heightened awareness around digital privacy has compelled manufacturers to implement end-to-end encryption and promote transparent data-usage policies. This focus on cybersecurity not only addresses parental concerns about unauthorized access but also anticipates forthcoming EU and U.S. regulatory requirements. Collectively, these transformative shifts have reshaped market dynamics, elevating the role of research and development and propelling the industry toward a future defined by convergence of connectivity, intelligence, and security.

Assessing the Layered Consequences of United States Electronics Tariffs on Supply Chain Strategies and Cost Competitiveness in 2025

In 2025, the cumulative impact of United States tariffs on imported electronics continues to influence the cost structure and sourcing strategies of baby monitor manufacturers. Section 301 duties imposed on Chinese-origin goods in recent years remain in effect, leading many companies to reassess their supply chains to mitigate elevated landed costs. In response, several players have diversified procurement to include Southeast Asian and Latin American contract manufacturers, seeking tariff‐free or lower‐tariff alternatives under various trade agreements.

This strategic pivot has not been without challenges. Variations in manufacturing expertise, quality control processes, and lead times have introduced complexities into production planning. While some firms have successfully established dual‐sourcing models to balance cost and reliability, others have invested in incremental automation and local partnerships to offset tariff burdens. These efforts are essential to maintaining price competitiveness in a market where consumers weigh advanced features against affordability.

Moreover, evolving tariff schedules and periodic trade negotiations continue to inject uncertainty into capital expenditure decisions. Companies that invest in new domestic assembly lines or near-shoring arrangements must factor in the potential for tariff rollbacks or additional levies, emphasizing the importance of real-time customs analytics and scenario planning. As a result, supply chain resilience and agility have emerged as critical differentiators, compelling industry leaders to integrate trade policy intelligence into their long-term strategic roadmaps.

Leveraging Multi-Dimensional Segment Analysis to Illuminate Consumer Behaviors and Technological Preferences Across Baby Monitor Categories

Analyzing the global baby monitor market through multiple segmentation lenses provides nuanced insights into consumer preferences and technological adoption trends. Product type distinctions reveal that video monitors, with their live streaming capabilities and high‐resolution displays, drive innovation while audio and movement monitors continue to serve as accessible entry points for price-sensitive buyers seeking core functionality. Smart monitors, which blend environmental sensing with data analytics, are capturing the interest of tech‐savvy parents who prioritize comprehensive visibility into nursery conditions.

From a technology standpoint, RF‐based devices remain valued for their interference-resistant communication, while DECT solutions offer enhanced privacy and range-features critical to larger homes. Bluetooth has emerged as a complementary protocol, facilitating direct pairing with mobile devices for short-range notifications, whereas Wi-Fi connectivity underpins cloud‐based services and remote access, becoming a near-universal expectation among premium tier consumers.

Channel dynamics further illustrate divergent purchasing behaviors. Online platforms, including both e-commerce marketplaces and manufacturer direct sites, have surged as the primary avenue for research and purchase, buoyed by expansive product assortments and user reviews. Specialty stores continue to differentiate through experiential showrooms and expert consultations, while supermarkets and hypermarkets drive volume through strategic promotions that position monitors alongside complementary baby care essentials. End use segmentation highlights the bifurcation between residential buyers, focused on ease of installation and portability, and commercial clients-such as day-care centers-that emphasize scalability and multi-unit management.

This comprehensive research report categorizes the Baby Monitors market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Distribution Channel

- End User

Comparative Regional Dynamics Shaping Adoption Rates, Regulatory Compliance, and Innovation Trends in Key Global Markets

Regional market dynamics demonstrate considerable variance in adoption patterns and regulatory environments across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, strong consumer confidence and widespread digital literacy underpin robust demand for advanced video and smart monitoring systems. North America, in particular, exhibits a willingness to invest in high-end features like AI-enabled sleep coaching and cloud storage subscriptions. Meanwhile, Latin American markets show burgeoning interest driven by rising internet penetration and growing middle-class spending power, albeit moderated by sensitivity to price and import duties.

In the Europe, Middle East & Africa zone, regulatory frameworks concerning radio frequency usage and data privacy impose high design standards. Manufacturers targeting these markets often develop region-specific firmware and comply with GDPR mandates, reinforcing consumer trust. Demand in Western Europe is shaped by eco-friendly product certifications and integration with established home automation platforms. Conversely, in parts of the Middle East and Africa, network reliability and power infrastructure can constrain uptake of bandwidth-intensive video monitoring, leading to sustained preference for audio or movement-only solutions.

The Asia-Pacific region presents a mosaic of mature markets and nascent opportunities. In countries like Japan and South Korea, consumer appetite for connectivity and innovative features is exceptionally high, driving rapid adoption of premium monitors with multi-sensor arrays. Nevertheless, emerging markets such as India and Southeast Asian nations are characterized by affordability pressures and local manufacturing incentives that favor competitive, lower-price models. Cross-regional partnerships and joint ventures are increasingly leveraged to tailor offerings to these diverse economic landscapes.

This comprehensive research report examines key regions that drive the evolution of the Baby Monitors market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Diverse Competitive Ecosystem Driving Innovation, Partnership, and Differentiation Among Baby Monitor Providers

The competitive landscape of the baby monitor industry encompasses established consumer electronics giants, pioneering smart-home specialists, and niche innovators focusing on specific functionality. Legacy players leverage extensive R&D resources to refine hardware performance and distribution networks, ensuring visibility in both online channels and brick-and-mortar retail. Their scale enables investment in global manufacturing footprints, facilitating compliance with complex regional regulations and enabling swift product rollouts.

Conversely, emerging challengers are distinguishing themselves through software-first approaches, embedding AI algorithms that analyze sleep patterns and environmental data to deliver personalized recommendations. Collaborative ecosystems that integrate with third-party health and wellness apps increasingly serve as a battleground for differentiation, with partnerships between monitor manufacturers and pediatric healthcare platforms gaining traction.

Strategic alliances and vertical integration efforts are also reshaping market dynamics. Companies are pursuing end-to-end control by acquiring sensor-development startups and cloud service providers, thereby optimizing data security and user experience. Simultaneously, distribution alliances with major online marketplaces and specialized baby product retailers are enhancing accessibility, particularly in markets with complex import regimes or diverse consumer preferences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Monitors market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Angelcare Monitor Inc.

- Anker Technology (UK) Limited

- Dorel Industries Inc.

- Hanwha Corporation

- iBaby Labs Inc.

- Infant Optics, Inc.

- Kids2, Inc.

- Koninklijke Philips N.V.

- Lenovo Group Limited

- Lorex Technology Inc.

- Motorola Solutions Inc.

- Netgear Inc.

- Panasonic Holdings Corporation

- Safety 1st

- Samsung Electronics Co. Ltd.

- Summer Infant Inc.

- VTech Communications Inc.

Aligning Technological Innovation, Supply Chain Agility, and Data Privacy Commitments to Propel Market Leadership

Industry leaders seeking to strengthen their market position should prioritize investments in advanced sensor fusion and AI-driven analytics. By enriching product roadmaps with contextual insights-such as integrating sleep-stage detection or air-quality indexing-companies can deliver heightened value that resonates with digitally connected parents. Furthermore, optimizing firmware update mechanisms and remote diagnostic tools will foster long-term customer loyalty and streamline support operations.

Operational resilience demands a dual-track approach to supply chain design: maintain relationships with incumbent manufacturers in traditional hubs while progressively onboarding partners in tariff-advantaged regions. Implementing real-time trade compliance monitoring tools will reduce exposure to sudden policy shifts, preserving margin stability. Marketing strategies should be refined to showcase data privacy commitments and regional certifications, directly addressing consumer concerns and regulatory requirements.

Finally, strengthening go-to-market agility through modular platform architectures will facilitate localization, enabling rapid customization of user interfaces, languages, and compliance features. Cross-functional collaboration between R&D, legal, and marketing teams will be essential to synchronize product launches with region-specific demand drivers and communication channels.

Detailing a Rigorous Hybrid Methodology of Executive Interviews, Digital Analytics, and Regulatory Review to Ensure Robust Market Insights

This research integrates a hybrid methodology combining extensive primary interviews with executives from leading manufacturers, distributors, and regulatory bodies alongside secondary analysis of trade publications, patent filings, and regulatory databases. Primary data collection included in-depth discussions with product development engineers to understand emerging sensor technologies, conversations with logistics experts on tariff impacts, and consultations with privacy law specialists to assess compliance trajectories.

Secondary research was conducted by systematically reviewing industry white papers, technical standards documentation, and publicly available filings with governmental trade agencies. Market intelligence was enriched through examination of online consumer reviews, e-commerce platform analytics, and social media sentiment analysis to capture evolving preferences in real time. Quantitative insights were validated through triangulation across multiple data points, ensuring robustness and reliability.

Finally, an expert panel comprising pediatric healthcare practitioners and IoT security analysts provided qualitative validation of the key findings, offering perspectives on clinical relevance and cybersecurity best practices. This iterative validation process ensured the study’s conclusions are both pragmatic and forward-looking, equipping stakeholders with actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Monitors market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Monitors Market, by Product Type

- Baby Monitors Market, by Technology

- Baby Monitors Market, by Distribution Channel

- Baby Monitors Market, by End User

- Baby Monitors Market, by Region

- Baby Monitors Market, by Group

- Baby Monitors Market, by Country

- United States Baby Monitors Market

- China Baby Monitors Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesizing Technological, Operational, and Market Dynamics to Chart the Course for Future Success in the Baby Monitor Industry

As the baby monitor industry continues its rapid evolution, stakeholders must remain attuned to the intersection of technological innovation, regulatory complexity, and shifting consumer expectations. The convergence of AI, IoT, and data privacy imperatives is reshaping product roadmaps, while evolving tariff landscapes demand strategic supply chain repositioning. These converging forces create both challenges and opportunities for companies seeking to differentiate their offerings in a highly competitive environment.

Ultimately, success in this market will hinge on the ability to deliver seamless user experiences that integrate advanced analytics without compromising on security or affordability. By leveraging multi-segmentation insights, regional dynamics, and competitive intelligence, industry participants can craft strategies that align technological capabilities with consumer needs. Embracing flexible manufacturing and distribution networks will mitigate external shocks, while proactive engagement with regulatory developments will bolster brand trust across diverse markets.

In summary, the current landscape underscores the imperative for holistic, data-driven decision making that bridges product innovation, operational resilience, and market responsiveness. Companies that excel at orchestrating these elements will not only meet the demands of today’s parents but also anticipate the needs of future generations.

Unlock Strategic Advantages in the Baby Monitor Market Through Personalized Insights with Our Expert Associate Director

To learn how to leverage the latest insights into product innovation, supply chain resilience, and consumer preferences in the baby monitor market, connect with Ketan Rohom, who can guide you through the strategic value and detailed findings of this comprehensive analysis. Engage directly with Ketan’s expertise to uncover tailored solutions that will empower your organization to stay ahead of regulatory changes, anticipate shifting consumer demands, and capitalize on emerging technologies. By purchasing the full market research report, you’ll gain access to in-depth competitive intelligence, granular segmentation breakdowns, and actionable roadmaps that inform sustainable growth strategies. Reach out today to secure your copy of the definitive baby monitor market study and position your business at the forefront of this dynamic, fast-evolving industry landscape.

- How big is the Baby Monitors Market?

- What is the Baby Monitors Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?