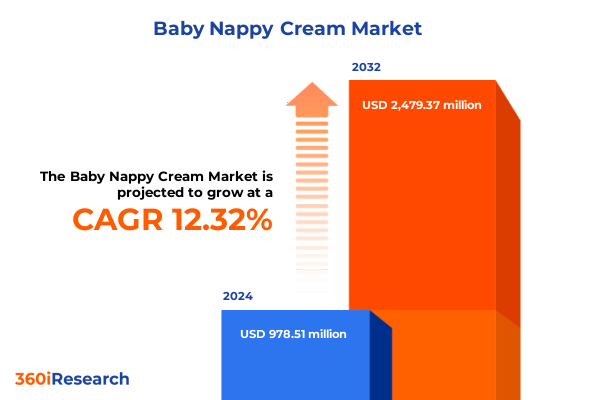

The Baby Nappy Cream Market size was estimated at USD 1.08 billion in 2025 and expected to reach USD 1.20 billion in 2026, at a CAGR of 12.57% to reach USD 2.47 billion by 2032.

Unveiling the Rapid Evolution of the Baby Nappy Cream Marketplace in Response to Shifting Consumer Preferences and Technological Innovations

Increasingly recognized as a cornerstone of infant skincare, baby nappy cream plays an essential role in preventing and alleviating diaper rash, safeguarding delicate skin, and promoting overall comfort for newborns and toddlers. Over the last decade, the category has evolved from a simple zinc oxide paste to sophisticated formulations that incorporate plant-based extracts, probiotics, moisturizers, and barrier-enhancing polymers. As parents become more informed and proactive about early childhood wellness, their expectations for product efficacy, safety, and transparency continue to rise.

Furthermore, demographic shifts such as the growing millennial parent population, combined with heightened awareness of skin sensitivity issues, have spurred demand for gentle yet performance-driven creams. These drivers have fostered innovation across raw material sourcing, manufacturing practices, and formula differentiation. Meanwhile, regulatory frameworks governing ingredient safety and labeling requirements are adapting to new scientific findings, compelling manufacturers to maintain rigorous testing protocols and transparent communication strategies.

With these dynamics in mind, this executive summary delves into the forces shaping the baby nappy cream market, examines the implications of recent tariff changes in the United States, and highlights key segmentation and regional patterns. It also offers insights into leading industry players, actionable recommendations for market participants, and an overview of the methodological rigor underpinning the research, equipping stakeholders to make informed strategic decisions.

Analyzing the Transformational Forces Reshaping the Baby Nappy Cream Sector Amid Rising Eco-Conscious Consumer Demand and Digital Commerce Growth

The baby nappy cream landscape is undergoing a profound transformation driven by an unprecedented convergence of consumer values and technological advances. Rising environmental consciousness among caregivers has shifted the focus toward eco-certified ingredients, biodegradable packaging, and carbon-neutral production processes. This movement is complemented by the mainstreaming of digital platforms, which enable direct engagement with end users through social media, subscription models, and customized online offerings.

Moreover, the proliferation of advanced ingredient technologies-ranging from micro-encapsulated botanicals to microbiome-friendly prebiotics-illustrates how product formulation strategies have become more sophisticated. Regulatory bodies are also responding to consumer demands for transparency by enforcing stricter oversight of claim substantiation, driving brands to invest in clinical trials and third-party certifications. As a result, the market is shifting from mass-market, one-size-fits-all solutions to niche, targeted formulations tailored to specific skin types and sensitivities.

In parallel, omnichannel distribution strategies are reshaping competitive dynamics. Brick-and-mortar retailers are enhancing in-store educational experiences, while direct-to-consumer models leverage data analytics to personalize product recommendations and loyalty programs. Together, these transformative shifts underscore a repositioning of baby nappy cream from a commodity category to a high-value segment that blends science, sustainability, and seamless consumer engagement.

Examining the Comprehensive Impact of United States Tariff Adjustments in 2025 on the Baby Nappy Cream Supply Chain and Pricing Dynamics

The imposition of revised tariff measures on key raw materials and packaging components in the United States during 2025 has exerted a cumulative impact on the baby nappy cream value chain. Duties on imported petrochemical derivatives, critical for barrier agent manufacture, have increased production costs and compelled formulators to seek alternative or higher-cost sourcing options. Concurrently, levies on specialized botanical extracts sourced from overseas have added pressure on natural organic product lines, prompting some manufacturers to reassess global supplier networks.

Consequently, manufacturers have responded by diversifying procurement strategies-establishing regional partnerships for plant extract cultivation and investing in domestic polymer research to offset synthetic material constraints. This recalibration of supply chains has, in many instances, led to modest lead-time extensions and incremental price adjustments that echo through retail and e-commerce channels. Nevertheless, proactive players have leveraged the situation to articulate value-added messaging around supply chain resilience and ingredient traceability.

Looking ahead, continued engagement with trade policymakers and participation in industry coalitions will be essential for navigating evolving tariff frameworks. By adopting flexible sourcing models and fostering closer collaboration with raw material developers, market participants can mitigate cost volatility and preserve margins, thereby safeguarding consumer trust and maintaining competitive positioning in a tariff-sensitive environment.

Revealing Strategic Segmentation Insights to Unlock Growth Opportunities Across Distribution, Product Variants, Materials, Pack Formats and Infant Age Profiles

A nuanced understanding of market segmentation reveals the strategic opportunities inherent across multiple vectors of the baby nappy cream industry. When considering distribution, offline channels continue to command significant shelf space through pharmacies, mass merchandising, and specialty baby boutiques, whereas online platforms are driving accelerated adoption via subscription models and targeted promotions to digitally engaged parents. Product diversity further underlines consumer demand for choice, ranging from traditional cream formulations and concentrated ointments to innovative powders designed for rapid moisture absorption and versatile sprays that allow sanitary application without skin contact.

Raw material selection emerges as another pivotal segmentation dimension, where the natural organic cohort-comprising mineral-based actives such as zinc oxide and plant extract derivatives like chamomile and calendula-resonates strongly with caregivers seeking clean-label assurances. Conversely, the synthetic category, underpinned by chemical-based emollients and petroleum-derived barrier agents, maintains relevance for formulations prioritizing high-performance moisture-lock mechanisms. Packaging preferences also delineate consumer usage patterns, with jars offering substantial volume options in both glass and plastic formats, airless pump dispensers and standard pumps delivering controlled dosing, and adaptable tube designs in aluminum or plastic that cater to portability and hygiene.

Age group considerations add further granularity, as devoted formulas for newborns aged 0 to 6 months emphasize ultra-gentle, fragrance-free profiles, while products targeting infants from 6 to 12 months and toddlers between one and three years incorporate enhanced moisturizers and soothing complexes to address evolving skin resilience. Taken together, these segmentation insights equip market participants to refine portfolio decisions, optimize channel strategies, and tailor messaging to specific caregiver priorities across the value chain.

This comprehensive research report categorizes the Baby Nappy Cream market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Distribution Channel

- Product Type

- Raw Material

- Packaging Type

- Age Group

Uncovering Critical Regional Dynamics Driving Baby Nappy Cream Adoption Across the Americas, EMEA Territories and Asia-Pacific Markets Today

Regional dynamics underscore varying trajectories and consumer preferences within the global baby nappy cream market. In the Americas, robust retail infrastructure and expanding e-commerce penetration have fostered a competitive landscape characterized by rapid product turnover and seasonal promotional cycles. Buyers in this region exhibit a strong preference for certified organic and dermatologist-endorsed formulations, supported by established distribution networks spanning national chains and independent pharmacies.

Across Europe, the Middle East and Africa, regulatory rigor around cosmetic and topical drug approvals drives product innovation, with an emphasis on clinical efficacy and allergen screening. European consumers, in particular, demonstrate cautious adoption patterns, leaning toward hypoallergenic, fragrance-free offerings from brands with verifiable ethical sourcing credentials. In contrast, emerging markets in the Middle East and Africa are witnessing heightened demand due to rising disposable incomes and growing awareness of infant skincare best practices.

Meanwhile, the Asia-Pacific region remains the fastest-growing territory, propelled by urbanization, increasing digital literacy, and a rising birth rate in select markets. High-growth economies within this region are characterized by thriving local manufacturers that blend traditional herbal remedies with modern formulation science. The result is a diverse mosaic where multinational corporations and regional champions coexist, leveraging localized product development and e-tail partnerships to capture the attention of tech-savvy millennial parents.

This comprehensive research report examines key regions that drive the evolution of the Baby Nappy Cream market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling the Dominant and Emerging Players Shaping Competition in the Global Baby Nappy Cream Industry Through Innovation and Strategic Partnerships

Competitive dynamics in the baby nappy cream sector are shaped by a blend of legacy multinationals and agile niche innovators. Established players with extensive R&D resources have the advantage of global manufacturing footprints, allowing them to optimize cost structures and secure priority access to emerging raw material technologies. These companies often leverage broad distribution agreements and co-branding partnerships to reinforce market leadership and sustain consumer trust through consistent product performance and rigorous safety testing.

At the same time, a wave of entrepreneurial brands is capturing market share by championing hyper-focused value propositions-whether through regionally sourced organic extracts, cruelty-free credentials, or eco-friendly refill systems. Such players excel at creating direct emotional connections with caregivers via influencer collaborations, brand storytelling, and community-driven social media campaigns. Their lean structures enable rapid iteration of product lines in response to consumer feedback, setting a benchmark for responsiveness.

Additionally, private label initiatives from major retailers have intensified competitive pressures, introducing price-sensitive alternatives that often mimic the sensory attributes and ingredient profiles of premium formulations. To remain differentiated, leading companies are forging strategic alliances with ingredient innovators, investing in clinical studies, and expanding into adjacent skin care categories, thereby creating synergistic portfolios that reinforce brand equity and foster cross-selling opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Nappy Cream market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Artsana S.p.A.

- Bayer AG

- Beiersdorf AG

- Johnson & Johnson

- Kao Corporation

- Karo Pharma AB

- Laboratoires Expanscience SA

- Pigeon Corporation

- Unilever PLC

- Weleda AG

Empowering Industry Leaders with Strategic Recommendations to Drive Market Penetration Growth Through Innovation, Sustainability and Omnichannel Excellence

Industry leaders seeking to capitalize on market momentum should adopt a multi-pronged strategy that aligns product innovation with operational excellence and consumer engagement. First, prioritizing investment in natural organic segments-particularly plant extract derivatives and mineral-based barrier agents-can enhance brand authenticity while meeting growing demand for clean-label formulations. Simultaneously, integrating adaptive pricing models that account for regional tariff variations will help preserve margin integrity and avoid abrupt cost pass-throughs.

Second, expanding omnichannel capabilities through partnerships with e-tailers, subscription services, and experiential retail outlets will allow brands to engage caregivers at every touchpoint. Leveraging data analytics to drive personalized marketing communications and targeted promotions can significantly boost conversion rates and foster long-term loyalty. Third, optimizing sustainable packaging solutions-such as airless pump dispensers made from recycled materials or refillable tube systems-will resonate with environmentally conscious consumers and reduce supply chain inefficiencies.

Finally, fostering collaboration with dermatological experts and pediatric specialists to support clinical validation and thought leadership initiatives will reinforce product credibility and differentiate brands in a crowded marketplace. By executing these recommendations in concert, market participants can strengthen their competitive positioning and unlock new avenues for growth.

Detailing a Rigorous Research Methodology Integrating Primary Surveys, Expert Interviews and Comprehensive Secondary Data Synthesis to Ensure Robust Market Insights

This research employs a rigorous methodology that synthesizes primary and secondary data streams to deliver robust market insights. Primary research encompassed in-depth interviews with senior executives at leading manufacturers, input from pediatric dermatologists, and qualitative surveys of caregivers across key regions. This firsthand engagement provided direct visibility into formulation priorities, distribution strategies, and emerging consumer behaviors.

Secondary research involved comprehensive analysis of industry publications, regulatory filings, patent databases, and academic journals to map ingredient innovations and technological trends. Trade association reports and customs data were also examined to quantify tariff impacts and supply chain shifts. Data triangulation was applied to reconcile disparate sources, while a structured validation process ensured consistency and accuracy.

Segment-level analysis was conducted using a combination of bottom-up and top-down approaches, enabling the disaggregation of market trends by distribution channel, product type, raw material, packaging format and end-user age group. The research team maintained stringent quality control protocols throughout the project, including iterative peer reviews and expert workshops, to guarantee methodological integrity and actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Nappy Cream market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Nappy Cream Market, by Distribution Channel

- Baby Nappy Cream Market, by Product Type

- Baby Nappy Cream Market, by Raw Material

- Baby Nappy Cream Market, by Packaging Type

- Baby Nappy Cream Market, by Age Group

- Baby Nappy Cream Market, by Region

- Baby Nappy Cream Market, by Group

- Baby Nappy Cream Market, by Country

- United States Baby Nappy Cream Market

- China Baby Nappy Cream Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Synthesizing Key Insights into the Baby Nappy Cream Market to Guide Strategic Decisions and Maximize Competitive Advantage in a Rapidly Evolving Landscape

In conclusion, the baby nappy cream market stands at a pivotal juncture defined by heightened consumer sophistication, evolving regulatory landscapes, and shifting trade policies. The convergence of eco-conscious preferences, digital commerce expansion, and ingredient innovation has transformed what was once a commoditized category into a dynamic arena for strategic differentiation. By understanding the nuanced segmentation patterns across channels, product types, raw materials, packaging formats and age cohorts, stakeholders can tailor their portfolios to meet distinct caregiver needs.

Moreover, the 2025 tariff adjustments in the United States underscore the importance of agile supply chain design and proactive stakeholder collaboration to mitigate cost pressures. Regional analyses further illuminate the varied growth trajectories in the Americas, EMEA and Asia-Pacific, highlighting the need for localized strategies that fuse global best practices with cultural insights. Competitive benchmarking reveals opportunities for both established players and disruptors to carve out meaningful positions through innovation, partnerships and consumer education.

As market dynamics continue to evolve, the insights and recommendations outlined in this summary offer a strategic blueprint for decision-makers aiming to navigate complexity and drive sustainable growth. Embracing a holistic approach that combines product innovation, channel optimization, and data-driven engagement will be critical to securing a competitive edge in this fast-moving industry.

Unlock In-Depth Market Intelligence Today by Connecting with Associate Director Sales & Marketing Ketan Rohom to Secure Your Comprehensive Baby Nappy Cream Report

Reach out today to secure the most comprehensive and up-to-date market research report on the Baby Nappy Cream industry by connecting directly with Ketan Rohom, Associate Director of Sales & Marketing. He stands ready to provide detailed insights, answer your specific queries, and guide you through the purchasing process to ensure you receive the exact level of analysis and support you require. Don’t miss this opportunity to equip your organization with the strategic intelligence needed to excel in a highly competitive landscape-contact Ketan Rohom now to unlock your full market potential.

- How big is the Baby Nappy Cream Market?

- What is the Baby Nappy Cream Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?