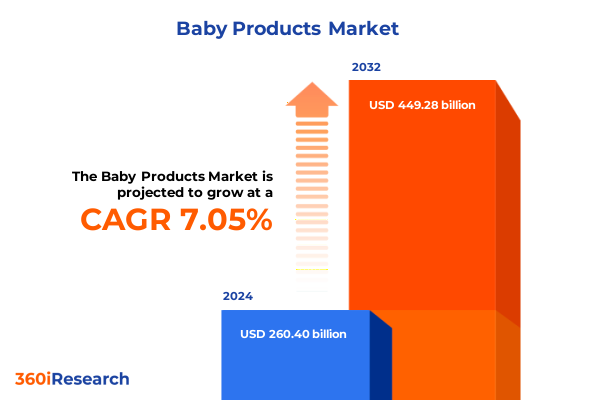

The Baby Products Market size was estimated at USD 277.82 billion in 2025 and expected to reach USD 296.41 billion in 2026, at a CAGR of 7.10% to reach USD 449.28 billion by 2032.

Establishing the Critical Role of This Executive Summary in Outlining Strategic Imperatives Shaping the Global Baby Products Arena

The baby products landscape is undergoing unprecedented evolution as consumer expectations shift toward safety, sustainability, and digital convenience. This executive summary distills the critical strategic imperatives and emerging trends driving industry transformation, equipping decision-makers with the insights needed to navigate a rapidly changing competitive environment. As the convergence of technological innovation, heightened regulatory scrutiny, and generational consumer preferences reshapes product development and distribution models, businesses must align their strategic priorities with these fundamental shifts.

By synthesizing qualitative feedback from caregivers and quantitative data drawn from retail analytics, this summary highlights the pivotal factors influencing purchasing behavior, supply chain resilience, and market differentiation. Transitioning from conventional retail to a digitally empowered ecosystem demands a clear understanding of omnichannel dynamics and the integration of safety-focused features that resonate with today’s parents. Moreover, environmental considerations and ethical sourcing have moved from niche concerns to mainstream expectations, altering value propositions across all product categories.

Ultimately, this introduction sets the stage for a deeper exploration of the transformative shifts, tariff impacts, segmentation insights, regional nuances, competitive strategies, and actionable recommendations shaping the future of baby products. By providing a concise yet comprehensive overview, it empowers leaders to make informed decisions that drive growth and foster consumer trust in an increasingly complex marketplace.

Identifying Pivotal Transformations Redefining Consumer Behavior Technological Innovation and Competitive Dynamics in the Baby Products Sector

Consumer behavior in the baby products sector is being redefined by a series of transformative shifts that span technological advancements, evolving lifestyle preferences, and heightened expectations around sustainability. Parents are increasingly seeking digital touchpoints that offer seamless shopping experiences, from virtual product demonstrations to subscription-based replenishment services, signaling a move toward personalized, convenience-driven commerce. At the same time, smart connected devices-ranging from wearable infant monitors to voice-enabled nurseries-are converging with traditional product categories, creating hybrid solutions that blend physical goods with digital ecosystems.

Simultaneously, environmental consciousness has surged to the forefront of purchasing decisions, prompting manufacturers to explore bio-based materials, waste-reducing packaging, and circular product lifecycles. This trend has persisted alongside intensifying regulatory requirements for chemical safety, labeling transparency, and carbon emissions disclosure, elevating compliance to a core strategic consideration. Technological innovation is also unlocking new avenues for product customization, enabling manufacturers to tailor designs, colors, and functionalities based on real-time consumer insights.

These complementary forces are reshaping supply chain configurations, as brands forge partnerships with eco-certified suppliers and logistics providers committed to decarbonization. In turn, competitive dynamics are shifting, with digitally native startups challenging established multinational corporations on agility, authenticity, and direct-to-consumer engagement. Together, these transformative trends outline a new competitive blueprint for success in the baby products arena, demanding bold strategic alignment and operational adaptability.

Evaluating the Comprehensive Ramifications of New 2025 United States Tariffs on Baby Products Supply Chains Cost Structures and Sourcing Strategies

In 2025, the United States implemented a series of new tariffs targeting imported baby products, including toys, apparel components, and select nursery furniture items. These measures were introduced in response to ongoing trade negotiations and as a means of protecting domestic manufacturing capabilities. The resulting cost pressures have reverberated across product portfolios, prompting pricing recalibrations and supplier diversification efforts among industry participants. As average landed costs increased, manufacturers began exploring alternative sourcing hubs beyond traditional bases, accelerating shifts toward Southeast Asia, South America, and select Nearshore locations.

Simultaneously, tier-one baby gear companies have intensified collaboration with logistics partners to optimize freight consolidation and leverage free-trade zone advantages. This operational pivot has not only helped mitigate the direct impact of import duties but also strengthened supply chain resilience against future trade disruptions. Within this context, private-label and value-segment players have gained traction by capitalizing on cost-efficient production models, while premium brands have sought to preserve margin integrity through increased automation and vertical integration.

Ultimately, the cumulative effect of the 2025 tariff regime has underscored the critical importance of agile sourcing strategies and dynamic cost management. Industry leaders are now focused on building end-to-end visibility, investing in digital procurement platforms and predictive analytics to forecast duty exposures. This heightened focus on tariff mitigation is redefining competitive positioning and reshaping long-term strategic roadmaps for baby product innovators and distributors alike.

Uncovering In Depth Segmentation Insights That Illuminate Product Preferences Age Based Usage Patterns End User Dynamics and Distribution Channel Trajectories

A granular understanding of consumer demand within the baby products arena requires careful examination of the distinct product categories and the nuanced subsegments that comprise them. Apparel, for instance, is bifurcated into bottom-wear and top-wear, each influenced by seasonality, material innovation, and branding relevance. Food and feeding products are shaped by safety regulations and ergonomic design trends that emphasize ease of use for both infants and caregivers. Furniture encompasses dressers and high chairs, with consumer preferences gravitating toward multifunctional designs and space-saving form factors. In parallel, personal care divides into cosmetics and toiletries, where ingredient transparency and hypoallergenic formulations are non-negotiable attributes. Toys and play equipment continue to evolve from traditional constructs to educational, STEM-focused modules, while travel gear leverages lightweight materials and compact portability to meet on-the-go family lifestyles.

Age segmentation further illuminates distinct user requirements, with infants aged zero to one demonstrating high demand for health and comfort-oriented innovations, toddlers between one and three gravitating toward developmentally enriching play patterns, and preschoolers from three to five seeking interactive learning experiences. End-user contexts also diverge, encompassing households that prioritize convenience and style, hospitals and maternity clinics that demand rigorous quality assurances, and daycare centers that require durable, scalable solutions. Distribution channels bifurcate into offline networks-where experiential retail and expert consultations drive trust-and online platforms that offer subscription services, user reviews, and data-driven personalization.

These segmentation layers underscore the imperative for companies to tailor product roadmaps and communication strategies to specific consumer cohorts, aligning value propositions with the unique preferences of each demographic and purchasing channel.

This comprehensive research report categorizes the Baby Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- End User

- Distribution Channel

Illuminating Critical Regional Nuances Highlighting Consumer Behavior Regulatory Environments and Innovation Adoption Patterns across Key Global Geographies

Diverse regional imperatives shape the trajectory of the baby products industry across the globe. In the Americas, stringent safety regulations and a culture of brand loyalty have entailed that manufacturers prioritize rigorous testing protocols and invest heavily in marketing narratives that underscore product reliability. Consumer spending patterns reflect a willingness to pay premiums for eco-certified and pediatrician-endorsed solutions, while e-commerce channels continue to expand their foothold, particularly through mobile commerce innovations and subscription models.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and cultural preferences demands multifaceted strategies. Western European markets emphasize chemical safety compliance and recyclability, whereas Gulf Cooperation Council countries show growing appetite for luxury-oriented baby gear. In parts of Africa, informal retail networks coexist with nascent online marketplaces, creating hybrid distribution ecosystems. Manufacturers entering these regions must navigate varying import regulations, labelling requirements and certification standards, requiring meticulous product adaptation.

In Asia-Pacific, the rapid ascent of digital natives and increasing urbanization have fueled robust demand for smart, connected baby products. Chinese consumers, in particular, demonstrate high receptivity to imported premium brands, while India’s growing middle class is driving volume demand for value-driven innovations. Across Southeast Asia, cross-border e-commerce platforms have reduced entry barriers, enabling both international and local players to scale quickly. As regional players invest in local manufacturing capabilities and forge strategic alliances, the Asia-Pacific landscape is emerging as a crucible for product innovation and supply chain optimization.

This comprehensive research report examines key regions that drive the evolution of the Baby Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Stakeholders Offering Insights into Competitive Strategies Partnerships and Market Positioning in the Baby Products Sector

Leading companies in the baby products domain have adopted a spectrum of strategic initiatives to solidify their market positions and capture evolving consumer preferences. Major personal care brands have bolstered their premium skincare lines by integrating natural, cruelty-free formulations and securing pediatric endorsements. Household product manufacturers have expanded their portfolios through acquisitions of agile startups specializing in digital-enabled devices, thereby accelerating time-to-market for smart monitoring solutions.

In the apparel segment, global textile leaders have invested in sustainable fiber innovation, working directly with cotton cooperatives to trace origin and minimize environmental impact. Simultaneously, toy and play equipment companies have restructured global supply networks to incorporate additive manufacturing capabilities for rapid prototyping and small-batch customization. Travel gear specialists have collaborated with online platforms to offer co-branded limited-edition products, leveraging social media influencers to amplify brand narratives.

These competitive maneuvers underscore the criticality of cross-functional synergies, where R&D, marketing, and supply chain teams converge to deliver holistic value propositions. By investing in digital infrastructure, forging strategic partnerships, and championing product safety and sustainability, top industry players are redefining benchmarks for innovation, quality and consumer trust.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Artsana S.p.A.

- Beiersdorf AG

- Britax Child Safety, Inc.

- CITTA by Lexicon Lifestyle Pvt Ltd

- Cotton Babies, Inc.

- Dabur India Ltd

- Danone S.A.

- Dorel Industries

- Essity AB

- Fujian Hengan Group

- Himalay Wellness Company

- Honasa Consumer Ltd.

- Johnson & Johnson Services Inc.

- KAO Corporation

- Kimberly-Clark Corporation.

- Koninklijke Philips N.V.

- Mattel, Inc.

- Meiji Holdings Co., Ltd.

- Munchkin, Inc.

- Nestlé S.A.

- Prince Lionheart, Inc

- Procter & Gamble Company.

- S. C. Johnson & Son, Inc.

- Sebapharma GmbH & Co. KG

- The Honest Company

- Unicharm Corporation

- Unilever PLC

Delivering Pragmatic Recommendations to Empower Industry Leaders to Drive Innovation Enhance Operational Efficiency and Strengthen Consumer Engagement

Industry leaders can capitalize on emerging opportunities by executing a set of interrelated strategic initiatives that drive innovation, operational excellence, and consumer engagement. First, integrating omnichannel capabilities-such as virtual product try-ons and real-time chat support-will enhance the purchase journey, bridging the gap between digital convenience and in-store expertise. Concurrently, prioritizing sustainable materials and circular economy principles in product design will resonate with eco-conscious parents, strengthening brand loyalty and mitigating regulatory risks.

To bolster supply chain agility, executives should diversify sourcing footprints across multiple low-cost regions, deploy predictive analytics to anticipate duty fluctuations, and establish flexible manufacturing cells that can quickly pivot production based on shifting demand. Complementing these efforts with data-driven personalization platforms will enable tailored product recommendations and subscription offerings, increasing customer lifetime value.

Finally, nurturing ecosystem partnerships with technology providers, healthcare institutions, and parenting communities can accelerate innovation cycles and build social proof. By aligning R&D roadmaps with emerging pediatric health guidelines and collaborating on co-developed solutions, companies will enhance their credibility and unlock new revenue streams. Collectively, these recommendations offer a strategic roadmap for organizations seeking to strengthen their competitive advantage in an increasingly dynamic baby products marketplace.

Detailing a Rigorous Research Methodology Combining Primary and Secondary Data Sources Expert Validation and Robust Analytical Frameworks

The research underpinning this executive summary employs a robust multi-phase methodology designed to ensure rigorous analysis and objective conclusions. The primary phase comprised in-depth interviews with caregivers, pediatricians, and category managers at leading retailers, capturing first-hand insights into purchasing drivers, safety concerns, and usability preferences. Concurrently, structured surveys were distributed to a representative sample of households, daycare operators, and clinical institutions to quantify the relative importance of product attributes and distribution channels.

In the secondary phase, an extensive review of government regulations, industry association guidelines, and scholarly publications provided comprehensive context on compliance standards, ingredient safety thresholds, and environmental certifications. Trade journals and proprietary retail analytics platforms supplemented this review, offering granular data on channel performance, consumer feedback sentiment, and emerging competitive entrants.

All quantitative findings were subjected to triangulation via cross-validation techniques, ensuring consistency between primary feedback and secondary data points. Analytical frameworks such as SWOT analysis, Porter’s Five Forces, and customer journey mapping were applied to synthesize insights and identify strategic imperatives. The result is a cohesive set of observations and recommendations grounded in empirical evidence and industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Products Market, by Product Type

- Baby Products Market, by Age Group

- Baby Products Market, by End User

- Baby Products Market, by Distribution Channel

- Baby Products Market, by Region

- Baby Products Market, by Group

- Baby Products Market, by Country

- United States Baby Products Market

- China Baby Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarizing Key Takeaways That Synthesize Market Dynamics Critical Insights and Strategic Imperatives for Future Growth in Baby Products

This executive summary has distilled the essential dynamics propelling the baby products sector forward, from digital-first consumer expectations and sustainability imperatives to the tangible impacts of new tariff regimes. Through focused segmentation analysis, we have highlighted the unique requirements of different product categories, age groups, end users, and distribution channels, underscoring the importance of tailored strategies. Regional insights emphasize that success hinges on aligning with local regulatory frameworks, consumer behaviors, and supply chain ecosystems. Further, the profiles of leading industry stakeholders illustrate the power of strategic partnerships, portfolio innovation, and brand differentiation in capturing consumer loyalty.

The recommendations outlined herein provide a clear roadmap for optimizing omnichannel engagement, reinforcing supply chain resilience, and championing sustainable and safety-focused solutions. By leveraging rigorous research methodologies and cross-validation of data sources, this analysis ensures that strategic decisions are backed by empirical evidence and industry expertise. As companies navigate the evolving landscape, the integrative approach presented will enable them to anticipate market shifts, mitigate risks, and secure lasting competitive advantage.

Engage Directly with Associate Director for Personalized Consultation to Secure the Comprehensive Baby Products Market Research Report Today

For a deeper dive into the profound insights and actionable strategies distilled from this executive summary, we invite you to connect directly with Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch. By engaging with Ketan, you will gain personalized guidance tailored to your organization’s specific priorities and unlock access to the full comprehensive baby products market research report. Reach out today to secure strategic clarity and position your business for sustained success.

- How big is the Baby Products Market?

- What is the Baby Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?