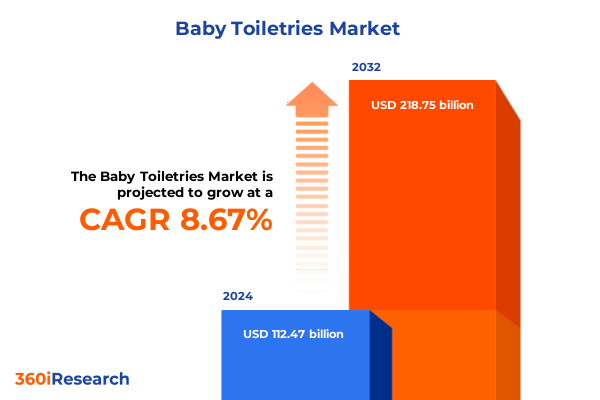

The Baby Toiletries Market size was estimated at USD 121.96 billion in 2025 and expected to reach USD 132.26 billion in 2026, at a CAGR of 8.70% to reach USD 218.75 billion by 2032.

Unveiling the intricate dynamics of the baby toiletries market landscape to set the stage for informed strategic decision-making

The baby toiletries sector has rapidly evolved into a dynamic marketplace where innovation, safety, and consumer trust intersect. Fueled by heightened parental awareness of ingredient safety and a growing emphasis on gentle formulations, this segment now demands nuanced strategies that address both functional efficacy and emotional reassurance. Against this backdrop, industry stakeholders must navigate an intricate network of regulatory guidelines, raw material sourcing challenges, and shifting retail paradigms to maintain relevance and profitability.

This executive summary synthesizes critical insights across product innovation, consumer segmentation, distribution strategies, and geopolitical influences shaping the United States baby toiletries market. By distilling the complex interplay of emerging trends, tariff impacts, and competitive maneuvers, the following analysis equips decision-makers with a clear roadmap to refine product portfolios, optimize supply chains, and capitalize on growth vectors. Through a structured exploration of transformative forces, segmentation dynamics, and regional specificities, this overview lays the groundwork for strategic actions that align with evolving parental expectations and regulatory landscapes.

Exploring the profound transformative shifts reshaping consumer expectations regulatory frameworks and sustainability paradigms in baby care toiletries

Over the past several years, the baby toiletries industry has undergone transformative shifts driven by mounting consumer expectations around safety, sustainability, and transparency. Parents increasingly demand formulations free from sulfates, parabens, and synthetic fragrances, prompting brands to accelerate research into clean-label alternatives and botanical extracts. As a result, natural and organic offerings have moved from niche to mainstream, reshaping product development pipelines and branding narratives.

Parallel to ingredient transparency, digitization of the purchase journey has redefined distribution channels. E-commerce platforms and social commerce avenues now play a pivotal role, allowing brands to engage directly with caregivers through rich storytelling and personalized bundles. At the same time, brick-and-mortar outlets are evolving, integrating experiential displays and educational kiosks to articulate product benefits and sourcing stories. This omnichannel interplay not only broadens reach but also reinforces trust through seamless and informative brand experiences.

Furthermore, sustainability has become a cornerstone of competitive differentiation. Innovations in recyclable packaging, water-efficient formulations, and zero-waste manufacturing processes underscore a collective industry push towards reduced environmental footprints. Regulatory frameworks, including stricter labeling requirements and expanded safety testing protocols, have further elevated the bar for compliance, compelling manufacturers to revisit legacy processes and forge partnerships with specialized testing laboratories. In essence, the convergence of consumer advocacy, digital outreach, and eco-conscious design has set a new paradigm for baby toiletries innovation.

Assessing the multifaceted implications of new United States tariff adjustments on supply chain resilience cost structures and sourcing strategies in 2025

In 2025, revisions to United States tariff policies introduced new complexities to the importation of key raw materials and packaging components used in baby toiletries. Tariffs on certain botanical extracts and plastic resin inputs have elevated landed costs, prompting manufacturers to reexamine supplier relationships and consider nearshoring options. This recalibration has intensified negotiations with domestic producers while accelerating qualification processes to ensure uninterrupted production.

The ripple effects extend beyond raw inputs to finished goods logistics. Heightened duties on cross-border shipments have disrupted established freight contracts and induced many stakeholders to diversify shipping corridors. Forward-thinking companies have adopted dual-sourcing strategies and leveraged bonded warehouses to mitigate the financial burden of tariffs. Simultaneously, inventory management systems have been upgraded with advanced forecasting modules to balance the costs of carrying surplus stock against potential production delays, thereby preserving both margin integrity and market responsiveness.

Unlocking essential insights into consumer and product segmentation dimensions that drive purchasing behaviors and channel preferences in the baby toiletries arena

A nuanced understanding of consumer and product segmentation constitutes the backbone of effective market positioning in the baby toiletries domain. By product type, offerings span from baby lotion formulations to oils, powders, shampoos, soaps, and wipes. Within the baby lotion category, consumers encounter specialized textures such as cream-based, gel-based, milk-infused, and oil-based variations tailored to diverse skincare needs, while baby shampoos range from moisturizing blends to organic compositions and tear-free formulas designed for sensitive eyes.

Distribution channel segmentation further refines go-to-market architectures, covering convenience stores, pharmacy beauty establishments, supermarkets and hypermarkets, alongside a robust constellation of online outlets. The online retail ecosystem itself bifurcates into traditional e-commerce portals, mobile application storefronts, and emerging social commerce environments, whereas pharmacy beauty offerings are delivered through both traditional pharmacy counters and dedicated specialty beauty boutiques. Supermarket and hypermarket scenarios encompass both large-scale hypermarket environments and neighborhood supermarket formats, each with distinct merchandising configurations.

Price tier segmentation delineates clear pathways for mass market, premium, and value-oriented propositions, enabling brands to align formulation complexity and ingredient pedigree with consumer willingness to pay. Age group classifications segment users into newborn, infant, and toddler categories, informing both product claims and packaging ergonomics. Packaging types span bottles, jars, pump dispensers, sachets, and tubes, each influencing consumer convenience perceptions, shelf appeal, and sustainability benchmarks. By overlaying these segmentation layers, stakeholders can craft precisely targeted offerings that resonate with defined caregiver cohorts.

This comprehensive research report categorizes the Baby Toiletries market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Age Group

- Packaging Type

- Distribution Channel

Illuminating regional dynamics across the Americas Europe Middle East Africa and Asia-Pacific to reveal divergent growth drivers and market opportunities

Regional dynamics present divergent narratives that inform global strategies for baby toiletries players. In the Americas, robust brand loyalty and high per capita spend on infant care products underscore the importance of premium positioning and targeted marketing campaigns. North American markets emphasize product efficacy and safety certifications, while Latin American markets prize affordability combined with appealing sensory attributes.

Europe, Middle East and Africa demonstrate a mosaic of regulatory landscapes and consumer sensibilities. Western European buyers gravitate towards eco-credentials and transparent supply chains, whereas emerging economies in Eastern Europe and the Middle East exhibit rising appetite for international brands coupled with localized formulations. In Africa, distribution challenges persist, but rapid urbanization in key metros has engendered pockets of high-growth channels anchored by modern trade partners.

Asia-Pacific emerges as the most dynamic theatre, led by a growing middle class in Southeast Asia and premium-driven markets in Japan and South Korea. Regulatory scrutiny around traceability and allergen warnings remains intense, driving manufacturers to invest in specialized testing and certification pathways. The proliferation of super apps and mobile wallets has also accelerated digital penetration, leading to innovative direct-to-consumer models and influencer-led commerce strategies that redefine engagement metrics.

This comprehensive research report examines key regions that drive the evolution of the Baby Toiletries market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting leading industry players collaboration strategies and innovation pipelines shaping competitive landscapes in the baby toiletries domain

Leading corporations have fortified their market positions through multifaceted innovation pipelines and strategic alliances. Global conglomerates are expanding R&D collaborations with biotech startups to explore probiotic-infused baby shampoos and lotion formulations, while simultaneously co-developing biodegradable packaging solutions with material science partners. Such ventures not only advance product differentiation but also mitigate sustainability risks embedded in conventional plastic packaging.

Collaboration strategies extend to retail partnerships and cross-industry alliances, where beauty brands team up with pediatric healthcare providers to enhance credibility and gain direct access to caregiver networks. At the same time, private label manufacturers are forging distribution agreements with national supermarket chains to offer value-tier alternatives that leverage large-scale production efficiencies. Competitive landscapes thus hinge on the ability to orchestrate an ecosystem of ingredient innovators, regulatory consultants, retail anchors, and digital marketing experts to deliver holistic and differentiated value propositions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baby Toiletries market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AMR Labs.

- Arogya Formulations (P) Ltd.

- Artsana S.p.A.

- Ausmetics Daily Chemicals(Guangzhou) Co., Ltd.

- Avon Cosmetics, Inc.

- Beiersdorf AG

- California Baby

- CITTA (Lexicon Lifestyle Pvt Ltd)

- Colgate-Palmolive Company

- Cotton Babies, Inc.

- Dabur India Limited

- Honasa Consumer Pvt Ltd (Mamaearth)

- Johnson & Johnson Consumer Inc.

- KAO Corporation

- Kimberly-Clark Corporation.

- Laboratoires Expanscience, Inc.

- L’Oréal S.A.

- Max Private Label.

- Pipette by Amyris Clean Beauty, Inc.

- Procter & Gamble Company.

- PROUDLY Baby, Inc.

- Reckitt Benckiser Group PLC

- S. C. Johnson & Son, Inc.

- Sebapharma GmbH & Co. KG

- The Himalaya Drug Company

- The Honest Company

- The Natural Baby Company

- The Procter & Gamble Company

- TIGER BABY LLC.

- Tropical Products, Inc.

- Unilever PLC

- Vasa Cosmetics Private Limited

Actionable strategic recommendations empower industry leaders to capitalize on trends optimize operations and achieve product differentiation

Actionable strategic recommendations empower industry leaders to capitalize on evolving trends, optimize operational workflows, and achieve product differentiation. First, brands should deepen investment in ingredient transparency by implementing blockchain-enabled traceability frameworks that allow caregivers to verify sourcing details from farm to shelf. This approach enhances trust and provides a defensible positioning against regulatory scrutiny.

Second, companies must embrace omnichannel commerce strategies that blend immersive in-store experiences with personalized digital touchpoints. By integrating augmented reality tools in retail outlets and leveraging AI-driven recommendations on e-commerce platforms, stakeholders can foster higher engagement and conversion rates. Third, supply chain resilience should be elevated through dynamic dual-sourcing policies and predictive analytics that preempt disruptions stemming from tariff volatility or logistics bottlenecks.

Moreover, targeted product line expansions based on refined segmentation insights will yield stronger market resonance. Tailored formulations for newborns, infants, and toddlers that align with specific skin profiles-delivered in user-friendly packaging formats such as pump dispensers and sachets-will drive both loyalty and word-of-mouth advocacy. Finally, forging cross-sector alliances in sustainability ventures and pediatric healthcare partnerships will amplify brand equity while generating co-marketing synergies that extend reach and credibility.

Outlining rigorous research methodologies data collection approaches and analytical frameworks that underpin the comprehensive baby toiletries market insights

This analysis draws on a blend of primary and secondary research methodologies to ensure robustness and validity. Primary intelligence was garnered through structured interviews with senior executives across manufacturing, retail and regulatory bodies, complemented by expert panels comprising pediatric dermatologists and supply chain specialists. Concurrently, consumer sentiment was assessed via targeted surveys and digital listening posts that captured real-time feedback on product attributes and purchase motivations.

Secondary research encompassed an extensive review of trade publications, regulatory filings, and patent databases to map innovation trajectories and compliance milestones. Retail audit data and point-of-sale analytics provided granular visibility into channel performance and pricing dynamics. All datasets underwent triangulation through cross-validation techniques, ensuring consistency across multiple intelligence sources. Analytical frameworks such as Porter’s Five Forces and the Value Chain model were employed to distill strategic implications and competitive positioning insights from the aggregated findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baby Toiletries market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baby Toiletries Market, by Product Type

- Baby Toiletries Market, by Age Group

- Baby Toiletries Market, by Packaging Type

- Baby Toiletries Market, by Distribution Channel

- Baby Toiletries Market, by Region

- Baby Toiletries Market, by Group

- Baby Toiletries Market, by Country

- United States Baby Toiletries Market

- China Baby Toiletries Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Summarizing key takeaways to highlight the strategic significance of the baby toiletries market analysis for informed decision-making

In summary, the baby toiletries market is being redefined by a confluence of ingredient transparency demands, digital commerce evolution, tariff-induced supply chain realignments, and region-specific consumer preferences. Segmentation across product type, distribution channel, price tier, age group, and packaging format reveals critical pathways for tailored offerings. Regionally, mature markets emphasize premium credentials and safety certifications, while dynamic economies present opportunities for value-driven innovations and digital-first engagement models.

Leading players are securing competitive advantages by forging strategic collaborations with biotech pioneers, retail giants, and healthcare authorities, thereby accelerating product differentiation and credibility. The actionable recommendations outlined herein provide a clear blueprint for optimizing sourcing strategies, enhancing consumer trust through traceability, and leveraging omnichannel experiences to bolster market share. As industry leaders implement these measures, they will be better positioned to navigate regulatory complexities, outpace competitors, and meet the nuanced needs of modern caregivers.

Adherence to rigorous research methodology underpins the validity of these insights, ensuring that strategic decisions are grounded in comprehensive, multi-source data analysis. Ultimately, the consolidated findings and recommendations in this executive summary offer an authoritative foundation for stakeholders seeking to drive sustainable growth and innovation within the baby toiletries sector.

Driving immediate engagement with a direct call to action inviting collaboration with Ketan Rohom to secure complete baby toiletries market intelligence report

In today’s hypercompetitive landscape, access to precise and actionable market intelligence can spell the difference between capturing emerging opportunities and lagging behind rivals. By collaborating directly with Ketan Rohom, you gain a strategic partner equipped to guide you through the nuances of consumer behavior, supply chain complexities, and product innovation trends specific to the baby toiletries segment.

Secure your complete market research report today to unlock granular insights, validate strategic pivots, and position your organization at the forefront of growth. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore tailored licensing options and embrace the next wave of market leadership.

- How big is the Baby Toiletries Market?

- What is the Baby Toiletries Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?