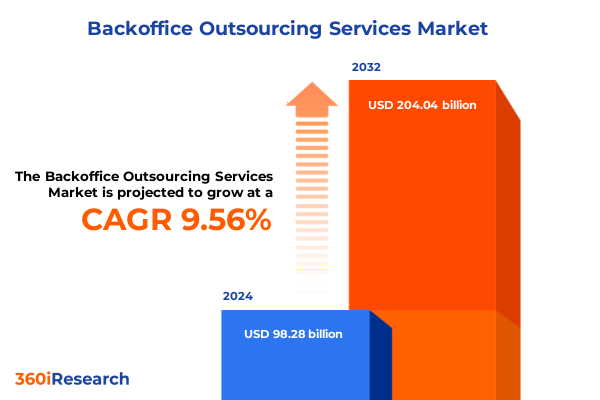

The Backoffice Outsourcing Services Market size was estimated at USD 13.01 billion in 2025 and expected to reach USD 13.54 billion in 2026, at a CAGR of 5.21% to reach USD 18.57 billion by 2032.

Setting the Stage for a New Era of Backoffice Outsourcing Services Driven by Innovation, Efficiency, and Strategic Partnerships

In an era defined by digital transformation and heightened global interconnectedness, backoffice outsourcing services have become integral to organizational success. These services span a wide spectrum of functions, including customer support operations, financial and accounting processing, human resources administration, data management and analytics, IT support, legal services, and procurement and supply chain management. By partnering with specialized providers, enterprises can redirect focus and resources toward core activities, while benefiting from operational scalability, access to skilled talent pools, and enhanced service quality.

As businesses face increasing pressure to adapt to dynamic market conditions, outsourcing offers not only cost efficiencies but also strategic value through process automation, advanced analytics, and cybersecurity frameworks. Leading service models now integrate robotic process automation and AI-driven insights to streamline workflows and drive faster decision-making. This executive summary offers a panoramic view of the evolving backoffice outsourcing landscape, examining technological trends, regulatory shifts, and competitive strategies to inform decision-making.

Furthermore, this report leverages a robust research methodology that combines primary interviews with industry stakeholders, expert surveys, and quantitative data analysis to deliver actionable intelligence. Subsequent sections explore transformative shifts, the ramifications of new trade policies, segmentation insights across service types, business sizes, and industries, regional dynamics, and profiles of key market participants. Together, these insights furnish a comprehensive foundation for stakeholders seeking to navigate the complexities of modern backoffice outsourcing and capitalize on emerging growth opportunities.

Exploring How Technological Advancements, Regulatory Dynamics, and Business Models Are Reshaping the Outsourcing Landscape for Sustainable Growth

The backoffice outsourcing landscape is undergoing transformative change as organizations embrace cloud computing, artificial intelligence, and automation to enhance operational efficiency. Cloud-native architectures now support seamless integration across global delivery centers, enabling real-time collaboration and rapid scaling of resources. AI-powered tools, including chatbots for customer queries, predictive analytics for financial forecasting, and intelligent document processing, are dramatically reducing cycle times and error rates. These innovations are complemented by robotic process automation, which handles repetitive tasks with precision and consistency, freeing human resources for higher-value activities.

Alongside technological innovation, regulatory requirements and data privacy mandates are driving the adoption of robust governance frameworks. Service providers are investing heavily in compliance capabilities to meet standards such as GDPR, CCPA, and industry-specific regulations in banking, healthcare, and pharmaceuticals. At the same time, sustainability and environmental, social, and governance criteria are influencing outsourcing decisions, prompting providers to demonstrate their commitments to ethical sourcing and carbon footprint reduction.

The convergence of these factors is fostering a shift from transactional outsourcing models to partnerships centered on strategic value creation. Providers are offering integrated platforms that combine multiple backoffice functions under unified service level agreements, enabling clients to achieve holistic process standardization. As agility and resilience become paramount, organizations that align with partners capable of rapid innovation and end-to-end service delivery are poised to gain a competitive edge in an increasingly complex operating environment.

Examining the Far-Reaching Consequences of the 2025 United States Tariff Adjustments on Global Backoffice Outsourcing Strategies and Cost Structures

In early 2025, the United States implemented sweeping tariff reforms, introducing a 10% baseline duty on most imported goods and elevated rates targeting critical sectors, including semiconductors, technology hardware, and clean energy components. This policy aimed to strengthen domestic manufacturing and address national security concerns. While traditional tariffs target physical goods, the ripple effects on service-driven industries, notably backoffice outsourcing, have been profound. Rising input costs for hardware and software systems, coupled with customs and classification complexities, have prompted organizations to reassess offshore service arrangements and explore alternative service hubs to mitigate exposure to increased duties.

As tariff uncertainty persisted, service providers and their clients reported tightening budgets and lengthening procurement cycles. Companies across sectors, from automotive to consumer electronics, began stockpiling essential hardware and software licenses ahead of potential tariff escalations, resulting in immediate cash flow constraints and shifting outsourcing timelines. These pressures catalyzed a strategic pivot toward onshore and nearshore service delivery models, as firms sought greater control over supply chains and regulatory compliance. In parallel, leading outsourcing hubs in Asia and Eastern Europe accelerated diversification efforts, investing in tariff-neutral regions to preserve cost competitiveness and maintain service continuity.

Unpacking the Diverse Service Type, Business Size, and Industry Segmentation That Inform Strategic Positioning in Backoffice Outsourcing Markets

A nuanced understanding of market segmentation is essential for providers and buyers seeking to optimize backoffice outsourcing strategies. Service type segmentation reveals distinct value propositions across functions such as customer support-encompassing call center and help desk services-financial operations like accounts payable, receivables, billing, and tax preparation, data management and analytics platforms that unlock insights from unstructured information, and human resources services including payroll, benefits administration, recruitment, and training. IT support functions span network management, data security, and helpdesk operations, while legal services offer contract drafting, intellectual property counsel, and litigation support. Procurement and supply chain services deliver inventory management, order processing, and supplier relationship management, enabling clients to streamline procurement workflows and reduce logistics costs.

Business size segmentation further shapes service delivery models, as large enterprises demand global delivery networks and bespoke service level agreements to align with complex organizational structures, while small and medium enterprises prioritize modular solutions that offer rapid deployment and flexible pricing. End-use industry segmentation underscores differential requirements and compliance needs, with sectors such as banking, financial services, and insurance mandating stringent security and audit capabilities; healthcare and life sciences focusing on data integrity and regulatory adherence; manufacturing seeking integration with production planning; retail and e-commerce emphasizing customer experience and peak‐season scalability; telecommunications requiring high‐availability networks; and transportation and logistics valuing real‐time tracking and supply chain transparency.

This comprehensive research report categorizes the Backoffice Outsourcing Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Types

- Business Size

- End-Use Industries

Analyzing Regional Variations in Demand, Compliance Requirements, and Innovation Hubs That Drive Backoffice Outsourcing Opportunities Worldwide

In the Americas, North American markets benefit from strong legal frameworks, advanced technological infrastructure, and nearshore delivery advantages that facilitate seamless collaboration across time zones. Mexico and Latin American countries have emerged as cost-effective alternatives for both English‐ and Spanish‐language services, supported by favorable trade agreements and growing talent pools. Compliance with frameworks such as USMCA and industry regulations in healthcare and finance has spurred investments in secure operations and localized centers of excellence.

Europe, the Middle East, and Africa present a complex regulatory mosaic, where compliance with GDPR remains a cornerstone for service providers. Western European nations, particularly the United Kingdom and Germany, emphasize strategic digital transformation initiatives, while Central and Eastern European countries leverage competitive labor costs and multilingual capabilities to attract financial services, legal, and IT outsourcing contracts. In the Gulf region and parts of Africa, governments are actively incentivizing inward investment, driving demand for specialized backoffice support in sectors like energy, telecommunications, and public administration.

Asia-Pacific continues to lead in scale and maturity, with established hubs in India and the Philippines offering deep expertise in customer support, finance, and IT services. Emerging markets such as Vietnam, Malaysia, and Indonesia are rapidly ascending due to competitive cost structures, government support for IT parks, and improved digital connectivity. Regional diversity within Asia-Pacific enables providers to offer tiered delivery models that align with varying complexity levels, allowing clients to calibrate service quality and cost tradeoffs based on project requirements.

This comprehensive research report examines key regions that drive the evolution of the Backoffice Outsourcing Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting the Strategic Moves, Competitive Strengths, and Collaborative Alliances of Leading Backoffice Outsourcing Providers Transforming the Industry

Leading global service providers have bolstered their portfolios through targeted acquisitions, strategic alliances, and the development of proprietary platforms. Major consulting firms have deepened their backoffice capabilities by integrating advanced analytics and intelligent automation into their service suites, while traditional BPO firms have invested in cloud‐native architectures to support real-time data processing and remote workforce management.

Organizations such as those specializing in digital transformation have partnered with niche cybersecurity vendors to deliver end-to-end solutions that encompass both process efficiency and risk mitigation. Similarly, several North American and European companies have established joint ventures in tariff-neutral geographies to maintain uninterrupted service delivery in the face of evolving trade policies. Providers in Asia have diversified beyond labor arbitrage, emphasizing domain expertise in healthcare, legal, and supply chain functions to capture higher-value engagements.

These strategic moves have enabled leading providers to differentiate through sector-specific capabilities, holistic technology integration, and robust governance frameworks. Buyers now have access to a spectrum of partners ranging from large-scale integrators with global footprints to specialized firms offering vertical-specific process expertise, facilitating more tailored outsourcing engagements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Backoffice Outsourcing Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Accenture PLC

- Alorica, Inc.

- Capgemini SE

- CGI Inc.

- Cognizant Technology Solutions Corporation

- Concentrix Corporation

- DXC Technology Company

- ExlService Holdings, Inc.

- Flatworld Solutions Inc.

- Genpact Limited

- HCL Technologies Limited

- Infosys Limited

- International Business Machines Corporation

- Invensis Technologies Pvt Ltd.

- TaskUs

- Tata Consultancy Services Limited

- Tech Mahindra Limited

- Teleperformance SE

- Wipro Limited

- WNS (Holdings) Ltd.

Outlining Targeted Strategies and Operational Tactics That Industry Leaders Can Implement Today to Strengthen Their Backoffice Outsourcing Capabilities

To navigate the evolving outsourcing landscape, industry leaders should prioritize investments in modular digital platforms that enable rapid configuration across multiple functions and geographies. Embedding AI-driven analytics within core backoffice processes empowers real-time performance monitoring, predictive risk management, and continuous process improvement.

Enhancing cybersecurity and compliance frameworks is imperative; practitioners should adopt zero-trust models, implement robust data encryption protocols, and pursue certifications aligned with client industry standards. By establishing a culture of security, providers can assuage buyer concerns and support growth in regulated sectors.

Diversifying delivery footprints across onshore, nearshore, and offshore locations mitigates geopolitical and tariff-related risks. Leaders should develop strategic partnerships in emerging markets and invest in flexible labor models that balance cost efficiency with service quality.

Finally, building an agile talent ecosystem through continuous reskilling programs, cross-functional team rotations, and performance-based incentives fosters innovation and helps retain critical expertise, positioning providers and buyers to capitalize on the next wave of backoffice transformation.

Detailing the Comprehensive Research Framework, Data Sources, and Analytical Techniques Underpinning Rigorous Insights into Backoffice Outsourcing Trends

This analysis is grounded in a hybrid research methodology combining extensive secondary research, primary qualitative interviews with senior executives and service delivery leaders, and large-scale quantitative surveys across geographic regions and industry verticals. Secondary sources include regulatory filings, trade publications, and authoritative white papers, providing contextual understanding of policy shifts and technological innovations.

Primary data collection involved structured interviews with procurement heads, CIOs, and operations leaders, complemented by electronic surveys capturing buyer priorities, investment intents, and satisfaction metrics. Data points were validated through cross-referencing with publicly available company performance reports and independent analyst commentary.

Quantitative analysis employed statistical modelling and scenario planning to assess the impact of tariffs, regulatory changes, and technological adoption on outsourcing cost structures and service levels. Geospatial mapping techniques were applied to illustrate regional delivery footprints and talent distribution. Findings were peer-reviewed by industry experts to ensure accuracy and relevance.

This rigorous approach ensures that the insights presented herein reflect real-world dynamics and provide a robust foundation for strategic decision-making within the backoffice outsourcing ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Backoffice Outsourcing Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Backoffice Outsourcing Services Market, by Service Types

- Backoffice Outsourcing Services Market, by Business Size

- Backoffice Outsourcing Services Market, by End-Use Industries

- Backoffice Outsourcing Services Market, by Region

- Backoffice Outsourcing Services Market, by Group

- Backoffice Outsourcing Services Market, by Country

- United States Backoffice Outsourcing Services Market

- China Backoffice Outsourcing Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1590 ]

Synthesizing Key Insights to Illustrate How Backoffice Outsourcing Is Evolving as a Catalyst for Operational Efficiency, Innovation, and Competitive Advantage

The convergence of digital innovation, regulatory evolution, and shifting geopolitical landscapes has positioned backoffice outsourcing as a critical lever for organizational resilience. Service providers that integrate AI, automation, and advanced analytics are delivering unprecedented levels of efficiency and insight, enabling faster decision cycles and reduced error rates.

Simultaneously, compliance requirements and data privacy mandates have elevated governance as a differentiator, driving providers to adopt rigorous security frameworks and demonstrate adherence to global standards. This focus on risk mitigation has broadened the appeal of outsourcing within heavily regulated sectors.

Moreover, the redistribution of services across onshore, nearshore, and offshore hubs has enhanced supply chain resilience and cost optimization. Firms that proactively adapt their delivery footprints to geopolitical and tariff-related disruptions maintain continuity and preserve competitive positioning.

Overall, the backoffice outsourcing market is transitioning from a cost-centric paradigm to one where strategic value creation, innovation enablement, and agility are paramount. Stakeholders embracing this evolution stand to realize significant performance gains and sustained competitive advantage.

Taking the Next Step in Optimizing Your Backoffice Outsourcing Strategy by Partnering with Ketan Rohom to Access Tailored Market Intelligence and Analysis

For organizations seeking to deepen their understanding of backoffice outsourcing dynamics and identify tailored strategies for growth, an in-depth market research report led by Ketan Rohom provides unparalleled insights. As an Associate Director of Sales & Marketing, he specializes in translating complex market data into actionable strategies that align with corporate objectives and industry best practices.

To explore how this report can inform your decision-making and drive operational excellence, contact Ketan Rohom to schedule a personalized briefing. Gain exclusive access to comprehensive data, detailed vendor profiles, and scenario-based analyses that will empower your organization to lead in a rapidly evolving outsourcing environment.

- How big is the Backoffice Outsourcing Services Market?

- What is the Backoffice Outsourcing Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?