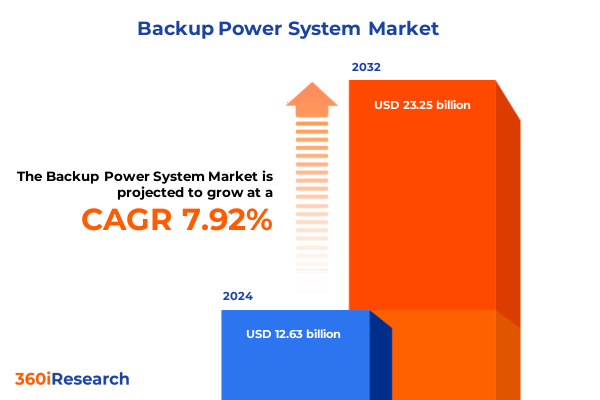

The Backup Power System Market size was estimated at USD 13.63 billion in 2025 and expected to reach USD 14.57 billion in 2026, at a CAGR of 7.91% to reach USD 23.25 billion by 2032.

Navigating the Dynamic World of Backup Power Solutions: Understanding Drivers, Challenges, and Strategic Imperatives for Modern Enterprises

Backup power systems are no longer a contingency plan reserved for critical infrastructure; they have become an essential component of operational resilience for enterprises across all verticals. From high-density data centers driving the digital economy to industrial facilities powering continuous manufacturing lines, the capacity to maintain uninterrupted electricity defines both service reliability and regulatory compliance. Contemporary grid challenges, ranging from extreme weather events to aging transmission networks, have underscored how a momentary outage can cascade into financial losses, data corruption, and reputational damage. Moreover, heightened cybersecurity threats increasingly target control systems, making the integrity of backup power solutions a cornerstone of risk mitigation.

Against this backdrop, the backup power landscape has evolved into a sophisticated ecosystem encompassing diverse technologies and service models. Battery energy storage platforms now complement traditional generator sets, while uninterruptible power supplies deliver seamless switchover to critical loads. Hybrid solutions that integrate renewable sources with energy storage further enhance sustainability profiles and support decarbonization initiatives. As organizations strive to align with environmental, social, and governance goals, these advanced configurations play a dual role, ensuring both operational continuity and carbon footprint reduction. This introduction sets the stage for a comprehensive analysis of emerging trends, regulatory impacts, segmentation nuances, and regional dynamics shaping the future of backup power solutions.

Embracing Disruptive Shifts in Backup Power Systems: The Convergence of Decarbonization, Digitalization, and Decentralized Energy Architectures

The backup power industry is experiencing transformative shifts driven by the convergence of decarbonization imperatives, digital enablement, and decentralized energy architectures. Companies are increasingly adopting battery energy storage systems that leverage advanced lithium-ion chemistries, in part to reduce reliance on diesel generators and in part to integrate with onsite solar or wind assets. This trend aligns with broader corporate sustainability mandates and renewable energy procurement strategies, marking a pivotal departure from purely carbon-intensive standby power configurations.

In parallel, digitalization is redefining performance management and predictive maintenance of backup power assets. Remote monitoring platforms equipped with Internet of Things sensors and analytics engines enable real-time visibility into system health, battery state of charge, and generator readiness. These capabilities not only minimize unplanned downtime but also optimize lifecycle costs by preempting component failures. Furthermore, edge computing deployments are placing localized microgrids at the forefront of resilience strategies, empowering facilities to operate autonomously during grid disruptions and dramatically improving recovery timelines.

This convergence of technology and sustainability is fostering hybrid service models, including as-a-service and pay-per-use agreements, which reduce upfront capital expenditures and shift ownership risk. Energy-as-a-Service providers are bundling hardware, installation, and maintenance with performance guarantees, reflecting a broader shift in procurement philosophies toward outcome-based engagements. Collectively, these disruptive forces are redefining not only how backup power is sourced and delivered but also how value is realized by stakeholders.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Backup Power Components and Supply Chain Resilience

In 2024, the Office of the United States Trade Representative finalized and implemented major adjustments to Section 301 tariffs on a range of Chinese-origin products integral to backup power deployment. In late September 2024, non-lithium battery parts saw their duties rise to 25 percent, and electric vehicle batteries and related components also incurred increased tariffs starting in the same period. These measures were part of a broader effort to counteract what USTR identified as unfair trade practices and state-subsidized oversupply in critical clean energy segments.

Looking ahead to January 1, 2025, tariff rates on semiconductors used in power conversion and control systems doubled from 25 percent to 50 percent, adding cost pressure to manufacturers of smart inverters and digital controllers. The impending hikes underscore the need for importers and system integrators to evaluate domestic sourcing options and to explore tariff exemption processes for specialized equipment. By impacting key components such as power electronics and battery management controllers, the 2025 tariff schedule will influence total cost of ownership and supply chain strategies for backup power solution providers.

Stakeholders must remain vigilant, as these tariffs will apply only to direct imports of affected goods from China, while downstream products under different tariff codes may be exempt. Engaging early with customs authorities and leveraging exclusion mechanisms can mitigate financial risks, but requires robust documentation and strategic planning. In sum, the cumulative impact of these tariff changes will reverberate across procurement, pricing, and competitive positioning, prompting both OEMs and end users to reassess global sourcing footprints.

Unveiling Critical Segmentation Insights for Backup Power Markets Across Types, Applications, and End-User Verticals for Strategic Clarity

Analyzing the backup power market through a type-based lens reveals distinct performance and cost profiles. Battery energy storage systems, encompassing both lead-acid and advanced lithium-ion variants, offer rapid response times and emission-free operation, making them well-suited for critical data centers and healthcare facilities. Fuel cells deliver clean, continuous power by converting chemical energy directly into electricity, though they necessitate dedicated fuel logistics. Generators, whether diesel or gas-fueled, remain indispensable for large-scale standby power, providing high reliability and extended runtime, particularly in remote or heavy industrial settings. Complementing these offerings, uninterruptible power supplies in line-interactive, online, and standby topologies ensure seamless transition to backup reserves, safeguarding delicate electronics against voltage anomalies.

Turning to applications, peak shaving solutions optimize energy costs by reducing demand charges during high-tariff intervals, while prime power configurations serve as the primary source of electricity in off-grid or islanded operations. Standby power installations guarantee uninterrupted service during unexpected outages, underpinning business continuity for financial institutions and critical infrastructure operators. Each application imposes unique design criteria, from energy density and runtime requirements to environmental and noise emissions standards.

End-user segmentation further highlights divergent needs across commercial, industrial, and residential domains. Commercial environments, including data centers and retail outlets, prioritize rapid switchover and modular scalability to accommodate fluctuating load profiles. Industrial sectors, spanning manufacturing, mining, oil & gas, and telecommunications, demand robust solutions capable of withstanding harsh operating conditions and providing long-duration support. Residential consumers increasingly adopt compact, user-friendly battery storage paired with solar arrays to enhance energy independence and hedge against escalating electricity rates. This multi-dimensional segmentation analysis informs tailored product development and targeted go-to-market strategies.

This comprehensive research report categorizes the Backup Power System market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Application

- End-User

Pinpointing Vital Regional Dynamics in Backup Power Markets Across the Americas, EMEA, and Asia-Pacific Growth Hubs for Tailored Strategies

Regional dynamics in backup power investments reflect a complex interplay of infrastructure maturity, regulatory frameworks, and energy security priorities. In the Americas, grid modernization initiatives paired with rising frequency of extreme weather events have accelerated adoption of integrated energy storage and generator packages. Large-scale data center clusters in North America, for instance, increasingly lean on hybrid solutions to meet stringent uptime mandates while aligning with corporate sustainability pledges.

Meanwhile, in Europe, Middle East & Africa, stringent emissions regulations and incentives for low-carbon technologies are catalyzing a shift from diesel-only generators towards battery-based and hydrogen fuel cell systems. Governments across Europe are mandating energy resilience standards for critical infrastructure, while the Middle East is investing in microgrid architectures to support remote oil and gas facilities facing harsh climates. Africa’s expanding telecom footprint and urbanization trends further drive demand for modular backup power systems that can be rapidly deployed in off-grid environments.

Across Asia-Pacific, booming industrial output and manufacturing expansions, particularly in Southeast Asia, are propelling investments in robust standby power solutions. Integration with renewable energy sources is fostering hybrid deployments, as countries seek to balance sustainability goals with reliability. Moreover, residential rooftop solar adoption paired with home battery storage is on the rise in Australia, Japan, and South Korea, driven by policy incentives and consumer preferences for energy autonomy. Each regional cluster presents unique growth levers and challenges, underscoring the need for context-specific go-to-market approaches.

This comprehensive research report examines key regions that drive the evolution of the Backup Power System market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Shaping the Future of Backup Power with Innovation, Partnerships, and Strategic Expansion

Key industry participants are shaping the backup power ecosystem through continuous innovation, strategic alliances, and expansion of service portfolios. Global conglomerates such as Caterpillar leverage decades-old engineering expertise to deliver integrated generator and storage solutions, while power electronics specialists like Schneider Electric and ABB are advancing digital monitoring platforms that optimize system performance and predict maintenance needs.

Meanwhile, manufacturers traditionally rooted in renewable energy, such as Tesla and Siemens Energy, are extending their battery energy storage expertise into backup power segments, offering scalable, software-driven solutions that align with grid defection and microgrid trends. Pure-play fuel cell developers are forging partnerships with end-user enterprises to deploy pilot projects demonstrating hydrogen’s viability for off-grid resilience. Additionally, leading UPS providers such as Eaton and Vertiv are investing in modular architectures and energy management software to address evolving data center and telecommunications requirements.

These firms are also pursuing regional manufacturing footprints to navigate local content regulations and tariff landscapes. Joint ventures and acquisitions remain prevalent strategies for gaining market access and securing supply chains. By prioritizing customer-centric service models and lifecycle management offerings, these leading companies are deepening client relationships and creating recurring revenue streams, reinforcing their competitive positions in a dynamic market.

This comprehensive research report delivers an in-depth overview of the principal market players in the Backup Power System market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABB Limited

- AEG Power Solutions B.V.

- Atlas Copco AB

- Bon Pty Ltd.

- Briggs & Stratton Corporation

- Caterpillar Inc.

- CyberPower Systems, Inc.

- Delta Electronics, Inc.

- Eaton Corporation PLC

- Emerson Electric Co.

- Exide Industries Limited

- Fuji Electric Co., Ltd.

- General Electric Company

- HIMOINSA SL

- Huawei Technologies Co., Ltd.

- Kohler Co.

- Legrand S.A.

- Magellan Power

- Microtek International Pvt Ltd.

- Mitsubishi Electric Corporation

- Schneider Electric SE

- Siemens AG

- Su-Kam Power Systems Ltd.

- Toshiba Corporation

Actionable Strategic Recommendations for Industry Leaders to Optimize Backup Power Investments and Navigate Emerging Market Complexities

Industry leaders must adopt a multifaceted approach to capitalize on evolving market opportunities. First, diversifying sourcing strategies by partnering with multiple component suppliers and engaging in nearshoring can mitigate the impact of import tariffs and supply chain disruptions. Next, embracing digital platforms for asset monitoring and predictive analytics will reduce unplanned downtime and lower total cost of ownership through condition-based maintenance.

Furthermore, investing in modular energy storage solutions that can be co-located with renewable generation assets will enhance both resilience and sustainability. Companies should also explore outcome-based service agreements, which shift the risk associated with performance guarantees onto providers and can unlock new revenue streams. Cultivating relationships with policymakers and participating in tariff exclusion proceedings will ensure timely access to critical imports while shaping favorable regulatory environments.

Finally, fostering cross-industry collaborations-spanning energy, technology, and finance sectors-will accelerate commercialization of emerging technologies such as hydrogen fuel cells and hybrid microgrids. By aligning product roadmaps with customer decarbonization targets and resilience requirements, industry leaders can position themselves as indispensable partners in an era where reliable, clean power is paramount.

Robust Research Methodology: Leveraging Diverse Primary and Secondary Sources to Deliver Reliable Backup Power Market Insights

This market analysis integrates insights derived from a rigorous research framework combining primary and secondary methodologies. Primary research involved in-depth interviews with industry executives, technical experts, and end-user architects to capture firsthand perspectives on technology adoption, deployment challenges, and strategic priorities. These qualitative findings were supplemented by surveys distributed to system integrators and facility managers to validate emerging trends and quantify adoption drivers.

Secondary research sources included regulatory filings, industry white papers, technical journals, and trade association publications, providing context on policy changes, standards evolution, and technology roadmaps. Additionally, proprietary databases tracking equipment shipments and patent filings were analyzed to identify innovation hotspots and competitive movements. Data triangulation ensured that contradictory signals were reconciled and that insights presented are both robust and reflective of real-world conditions.

Through iterative validation cycles with subject-matter experts, the methodology assured comprehensive coverage across technology types, applications, end-user segments, and regions. This approach underpins the reliability of strategic recommendations and lends confidence to stakeholders relying on these insights for investment and deployment decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Backup Power System market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Backup Power System Market, by Type

- Backup Power System Market, by Application

- Backup Power System Market, by End-User

- Backup Power System Market, by Region

- Backup Power System Market, by Group

- Backup Power System Market, by Country

- United States Backup Power System Market

- China Backup Power System Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1431 ]

Synthesis of Key Learnings and Strategic Imperatives for Stakeholders Navigating the Rapidly Evolving Backup Power Ecosystem

The evolving backup power landscape demands integrated strategies that balance resilience, sustainability, and cost-effectiveness. Key insights underscore the imperative to adopt cleaner energy storage technologies alongside traditional generators, leveraging digital tools for maintenance optimization and predictive failure prevention. Meanwhile, segmentation analysis highlights the differentiated needs across commercial, industrial, and residential sectors, reinforcing the importance of bespoke solution architectures.

Regional intelligence reveals that while the Americas prioritize hybrid systems for extreme weather resilience, EMEA is accelerating low-carbon transitions, and Asia-Pacific focuses on industrial scale-up and rural electrification. Concurrently, the 2025 tariff environment necessitates proactive supply chain diversification and engagement with regulatory processes to maintain competitive positioning. Top providers are distinguished by their ability to innovate, form strategic alliances, and deploy outcome-based service models that de-risk client investments.

Looking forward, stakeholders that integrate emerging technologies such as hydrogen fuel cells, advanced battery chemistries, and microgrid orchestration platforms will capture value by delivering holistic resilience solutions. Embracing collaborative partnerships and flexible business models will be crucial in navigating market complexities and steering the industry toward a more reliable and sustainable energy future.

Engage with Our Expert Research Leadership to Secure Comprehensive Backup Power Market Insights and Drive Strategic Growth Today

We invite you to elevate your strategic decision-making and secure a competitive advantage by engaging with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. His deep expertise in energy infrastructure, market dynamics, and client solutions will guide you through the nuances of backup power systems, ensuring your organization is equipped to navigate technological shifts, regulatory changes, and evolving supply chain landscapes. Reach out to Ketan Rohom today to acquire the comprehensive market research report and unlock the data-driven intelligence your leadership team needs to drive growth, optimize deployments, and mitigate risks in an increasingly power-dependent world

- How big is the Backup Power System Market?

- What is the Backup Power System Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?