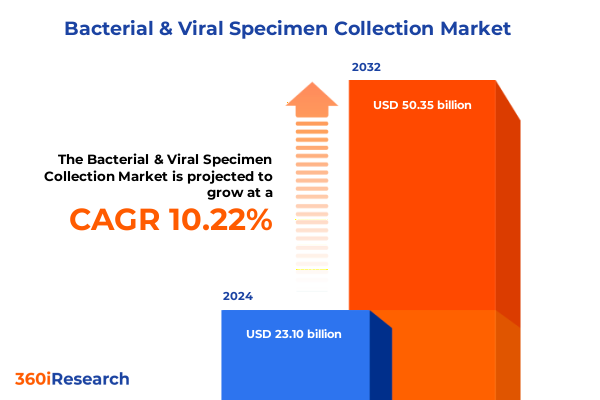

The Bacterial & Viral Specimen Collection Market size was estimated at USD 17.54 billion in 2025 and expected to reach USD 19.63 billion in 2026, at a CAGR of 12.40% to reach USD 39.76 billion by 2032.

Pioneering the Diagnostic Frontier with Enhanced Specimen Collection in Response to Evolving Healthcare Challenges and Technological Progress

The science of specimen collection forms the backbone of accurate diagnostics and effective patient care. In today’s healthcare environment, the precision with which bacterial and viral samples are obtained, preserved, and transported directly influences laboratory reliability and downstream analysis. As diagnostic platforms evolve, the demand for high-quality specimens has intensified, prompting stakeholders to reevaluate collection workflows and supply chain resilience.

Moreover, the escalating threat of antimicrobial resistance underscores the critical role of robust bacterial sampling in both clinical and research settings. In 2019, drug-resistant infections led directly to over 1.27 million global deaths and contributed to nearly 5 million fatalities overall, highlighting an urgent need for reliable pathogen detection and surveillance. According to a recent UK-funded study, unchecked resistance may cost the world economy nearly $2 trillion annually by 2050, further incentivizing investments in precise specimen handling and early diagnostics.

As a result, healthcare and laboratory leaders are prioritizing standardized collection methods, strict chain-of-custody protocols, and device innovations designed to protect sample integrity. This introduction sets the stage for a closer examination of the transformative forces, regulatory impacts, and strategic segmentation insights shaping the next era of bacterial and viral specimen collection.

Unveiling Transformative Shifts Driving Specimen Collection with Automation, Decentralization, Digital Integration and Sustainable Material Adoption

A convergence of technological innovation and shifting healthcare priorities is reshaping specimen collection practices on a global scale. Automation platforms are streamlining laboratory workflows by minimizing manual intervention, accelerating sample processing, and reducing contamination risks. Alongside this, regulatory bodies are moving toward more harmonized validation standards, encouraging device manufacturers to pursue unified approval strategies and bolster cross-regional integration.

Furthermore, the rise of self-collection kits for at-home use reflects a growing emphasis on patient-centric diagnostics and decentralized care. The COVID-19 pandemic catalyzed widespread adoption of remote testing solutions, paving the way for at-home kits tailored to sexually transmitted infections, chronic conditions, and early cancer screenings. Such kits now integrate sample stabilizers, clear user instructions, and pre-labeled packaging that ease the transition from home to lab.

In parallel, smart specimen collection devices embedded with IoT sensors and RFID chips enable real-time monitoring of environmental conditions, thereby enhancing traceability and compliance. These data-driven systems empower laboratories to maintain rigorous chain-of-custody records, ensure temperature control, and respond proactively to deviations during transit.

Lastly, sustainability considerations are driving the adoption of biodegradable polymers and eco-friendly materials for swabs, containers, and packaging. Developers are engineering devices optimized for molecular applications, such as next-generation sequencing and CRISPR-based assays, ensuring that collected samples retain nucleic acid integrity for advanced diagnostic workflows.

Examining the Cumulative Toll of 2025 U.S. Tariff Measures on the Cost Structure and Supply Chain Dynamics for Collection Consumables

In April 2025, the U.S. government introduced a universal 10% tariff on most imported goods, followed by country-specific adjustments that significantly affect laboratory consumables. While Canada and Mexico are exempt from the universal levy, non-USMCA goods from these partners now incur a 25% duty. The result is a more complex cost structure for diagnostic materials that laboratories must navigate to maintain operational efficiency.

Notably, China now faces a cumulative 145% tariff on lab-related imports, combining the universal rate with sector-specific duties. This has prompted many institutions to reevaluate procurement strategies, prioritize local suppliers, and explore domestic manufacturing options for swabs, tubes, and transport media. Such shifts aim to mitigate supply chain bottlenecks and contain rising import expenses.

Academic and commercial research laboratories are experiencing what industry experts describe as “sticker shock,” with increased costs reverberating across project budgets and operational plans. Instruments and consumables vital to bacterial and viral specimen collection-such as flocked swabs and stabilized transport media-are among the hardest hit, driving stakeholders to reassess vendor agreements and volume commitments.

Furthermore, tariffs on steel and aluminum derivatives are amplifying cost pressures for devices containing metal components, including vacutainer tubes and certain tube rack designs. In response, laboratories are advised to conduct comprehensive supplier audits, map out country-of-origin exposures, and strengthen partnerships with U.S.-based distributors to stabilize supply chains and control escalating expenses.

Revealing Strategic Segmentation Insights to Navigate Product, Specimen Type, Technology, End User and Distribution Channel Complexities

The landscape of bacterial and viral specimen collection can be understood by examining the market across multiple dimensions. Specimen types span a continuum from bacterial sources-such as blood, urine, and wound samples-to viral matrices including blood, nasopharyngeal swabs, and saliva. Each category presents unique preservation requirements and handling protocols, influencing device design and regulatory compliance.

In parallel, the product portfolio encompasses collection kits, tubes, swabs, and transport media. Collection tubes bifurcate into vacuum and nonvacuum variants, while swab technologies range from traditional cotton to advanced flocked and foam designs. Transport media formulations are differentiated into bacterial and viral compositions, each calibrated to maintain pathogen viability and analytic fidelity during transit.

Technology segmentation further distinguishes between automated platforms and manual workflows. Automated systems deliver consistency and throughput gains for high-volume settings, whereas manual devices continue to play a crucial role in point-of-care and resource-constrained environments. This division underscores the importance of flexible solutions that adapt to diverse operational contexts.

End-user segmentation reveals distinct demand profiles across clinics, diagnostic centers, hospitals, and laboratories. Each setting prioritizes factors such as ease of use, safety features, and integration with existing diagnostic infrastructure. Finally, distribution channels encompass direct sales, distributor networks, and digital storefronts, reflecting the evolving interplay between traditional procurement models and online marketplaces.

This comprehensive research report categorizes the Bacterial & Viral Specimen Collection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Specimen Type

- Product

- Technology

- End User

- Distribution Channel

Highlighting Vital Regional Dynamics and Growth Opportunities Across the Americas, Europe Middle East and Africa, and Asia Pacific Markets

The Americas benefit from a robust healthcare infrastructure, underpinned by leading academic institutions and a mature regulatory framework that drives early adoption of advanced specimen collection technologies. This region’s emphasis on research and development fosters close collaboration between device manufacturers and end users, accelerating innovation in swab design, transport media composition, and sample stabilization techniques.

Europe, the Middle East, and Africa present a mosaic of markets defined by harmonized regulatory initiatives and diverse healthcare challenges. In Europe, stringent in vitro diagnostic regulations compel manufacturers to pursue unified approval pathways, while investments in digital health platforms are enabling remote monitoring of sample integrity. Across the Middle East and Africa, public-private partnerships and donor-funded programs are expanding access to reliable diagnostics, particularly in regions susceptible to infectious disease outbreaks.

Asia Pacific stands out as the fastest-growing regional market, propelled by significant improvements in healthcare infrastructure and heightened awareness of viral infections’ impact on public health. Governments across the region are prioritizing self-collection kits and point-of-care solutions to address gaps in laboratory access, driving demand for devices that combine simplicity with analytical precision.

Collectively, these regional dynamics underscore the importance of localized strategies that account for regulatory environments, infrastructure maturity, and public health priorities.

This comprehensive research report examines key regions that drive the evolution of the Bacterial & Viral Specimen Collection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Industry Players and Their Strategic Roles Shaping the Specimen Collection Ecosystem and Competitive Landscape

Thermo Fisher Scientific Inc. remains at the forefront of the specimen collection market, leveraging its extensive product portfolio and strategic acquisitions to address diverse diagnostic needs. The company’s investments in research and development underscore a commitment to next-generation collection devices that integrate seamlessly with molecular and immunoassay platforms.

Copan Diagnostics Inc. has established a strong reputation for its advanced flocked swabs and viral transport media. By forging partnerships with leading healthcare providers and research institutions, the company continually refines collection technologies that optimize sample yield and pathogen preservation for both bacterial and viral analyses.

Becton, Dickinson and Company offers a comprehensive suite of blood and fluid collection systems designed to meet global safety standards. Their vacutainer blood tubes and specialized collection sets emphasize user safety, ease of handling, and compatibility with automated laboratory instruments, supporting efficient workflows in high-throughput settings.

Puritan Medical Products Co. LLC, Greiner Bio-One International GmbH, Quidel Corporation, and Hain Lifescience GmbH round out the competitive landscape. Puritan’s reliable swabs and cost-effective media formulations cater to a broad range of end users, while Greiner Bio-One focuses on patient safety through innovative container designs. Quidel delivers rapid point-of-care diagnostic kits, and Hain Lifescience specializes in integrated collection systems optimized for molecular pathogen detection.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bacterial & Viral Specimen Collection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avantor, Inc.

- Becton, Dickinson, and Company

- bioMérieux S.A.

- Cardinal Health

- Copan Group

- DiaSorin S.p.A.

- Dynarex Corporation

- Greiner Bio-One International GmbH

- Hardy Diagnostics

- HiMedia Laboratories Pvt. Ltd

- Longhorn Vaccines and Diagnostics, LLC

- Lucence Diagnostics Pte Ltd

- Medical Wire & Equipment

- Medline Industries, LP.

- Meridian Bioscience, Inc

- Miraclean Technology Co., Ltd

- Pretium Packaging

- Puritan Medical Products

- QuidelOrtho Corporation

- Stellar Scientific

- Thermo Fisher Scientific, Inc.

- Titan Biotech Ltd.

- Trinity Biotech PLC

- Vircell, S.L.

- Wuxi Nest Biotechnology Co., Ltd.

Empowering Industry Leaders with Actionable Strategies to Enhance Resilience, Innovation and Supply Chain Agility in Specimen Collection

To navigate the evolving specimen collection landscape, industry leaders should diversify supply chains by forging partnerships with both domestic manufacturers and global distributors. This approach mitigates tariff-related disruptions and ensures uninterrupted access to critical consumables, such as swabs, tubes, and transport media.

Moreover, investing in automation and digital tracking solutions can significantly enhance operational resilience. Automated collection platforms paired with IoT-enabled sensors enable real-time visibility into sample location, temperature, and condition, empowering laboratories to respond swiftly to deviations and uphold analytic quality.

Embracing sustainable materials and modular kit architectures will not only reduce environmental impact but also align with emerging regulatory and institutional sustainability mandates. Biodegradable swabs and eco-friendly packaging contribute to circular supply chain models without compromising specimen integrity.

Finally, fostering regulatory harmonization and workforce training is essential. By engaging in industry consortia and supporting standardized validation protocols, organizations can streamline market entry and improve cross-border compliance. Concurrently, targeted training programs equip healthcare professionals with the expertise needed to leverage advanced collection technologies effectively.

Outlining Comprehensive Research Methodology Ensuring Rigorous Data Collection, Analysis and Validation for Reliable Insights

This research adopted a robust primary data collection methodology, conducting in-depth interviews with industry executives, laboratory directors, and clinical specialists. These expert insights provided nuanced perspectives on current challenges, adoption barriers, and emerging opportunities in specimen collection.

Complementary secondary research encompassed a comprehensive review of regulatory filings, guidelines issued by health authorities, peer-reviewed publications, and reputable industry reports. Trade publications and technical white papers were analyzed to capture historical trends and forecast potential shifts.

The study’s analytical framework integrated both qualitative and quantitative data through a triangulation process that validated key findings against multiple sources. Comparative analyses, trend mapping, and sensitivity assessments were employed to ensure the rigor of insights and identify critical inflection points.

Quality assurance measures, including peer reviews by external subject matter experts and consecutive validation rounds, reinforced the credibility of conclusions. Clear documentation of research assumptions and methodologies ensures transparency and allows for reproducibility of the study’s outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bacterial & Viral Specimen Collection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bacterial & Viral Specimen Collection Market, by Specimen Type

- Bacterial & Viral Specimen Collection Market, by Product

- Bacterial & Viral Specimen Collection Market, by Technology

- Bacterial & Viral Specimen Collection Market, by End User

- Bacterial & Viral Specimen Collection Market, by Distribution Channel

- Bacterial & Viral Specimen Collection Market, by Region

- Bacterial & Viral Specimen Collection Market, by Group

- Bacterial & Viral Specimen Collection Market, by Country

- United States Bacterial & Viral Specimen Collection Market

- China Bacterial & Viral Specimen Collection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Perspectives Emphasizing Strategic Imperatives for Advancing Excellence in Bacterial and Viral Specimen Collection Practices

The intersection of technological innovation, shifting regulatory landscapes, and evolving public health imperatives is redefining bacterial and viral specimen collection. From automated high-throughput platforms to patient-driven at-home kits, the market is characterized by a relentless pursuit of precision, efficiency, and scalability.

Strategic imperatives include the adoption of resilient supply chain models, the integration of digital monitoring systems, and a commitment to sustainable materials. Stakeholders who embrace these priorities will be better positioned to deliver timely diagnostics, support outbreak response, and drive research breakthroughs.

Looking forward, collaboration between device manufacturers, healthcare providers, and regulatory authorities will be paramount. Harmonized standards and shared best practices will accelerate technology adoption, improve global surveillance capabilities, and fortify preparedness against emerging pathogens.

In essence, the future of specimen collection rests on a balance between innovation and practicality, ensuring that every sample collected yields actionable insights while upholding the highest standards of safety and reliability.

Take the Next Step Toward Optimizing Your Diagnostic Operations by Securing an In-Depth Market Research Report Through Engagement with Our Associate Director

For organizations poised to harness the full potential of these findings, reaching out to Ketan Rohom, Associate Director, Sales & Marketing, will facilitate acquisition of the detailed market research report. Engaging with this resource will equip decision-makers with the intelligence necessary to navigate emerging challenges and capitalize on new opportunities.

- How big is the Bacterial & Viral Specimen Collection Market?

- What is the Bacterial & Viral Specimen Collection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?