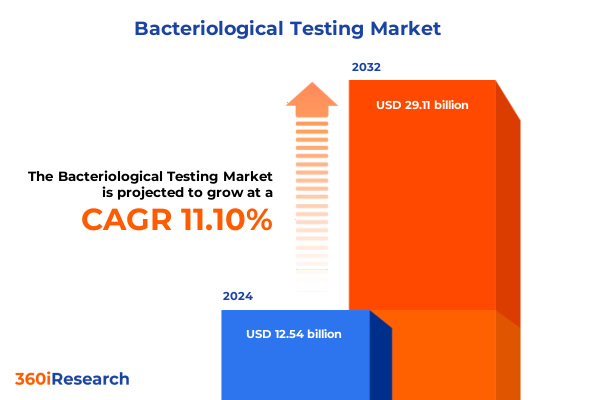

The Bacteriological Testing Market size was estimated at USD 13.63 billion in 2025 and expected to reach USD 14.83 billion in 2026, at a CAGR of 11.44% to reach USD 29.11 billion by 2032.

Setting the Stage for Critical Insights into Bacteriological Testing through Emerging Technologies, Regulatory Evolution, and Market Dynamics

Bacteriological testing stands at the forefront of global efforts to ensure public health, environmental safety, and product integrity across a spectrum of industries. This executive summary introduces the multifaceted landscape of bacteriological diagnostics, detailing how advancements in analytical methods and regulatory expectations have converged to reshape traditional testing paradigms. Readers will gain an informed perspective on the drivers that have accelerated the adoption of sophisticated testing solutions in clinical diagnostics, food and beverage safety, water quality monitoring, pharmaceutical manufacturing, and more.

In recent years, the emergence of novel molecular techniques and digital platforms has created an inflection point for bacteriological testing, fostering a more proactive approach to pathogen surveillance and risk mitigation. With mounting concerns over antimicrobial resistance, contamination events, and outbreak preparedness, stakeholders demand enhanced sensitivity, rapid turnaround, and comprehensive pathogen profiling. Consequently, this report sets the stage for an in-depth exploration of the market’s transformative shifts, regulatory influences, tariff implications, segment-specific insights, and regional nuances that collectively define the current and future trajectory of bacteriological testing.

Uncovering Transformational Forces Redefining Bacteriological Testing from Automation to Digital Integration across Diverse Industry Applications

Across clinical, environmental, industrial, and research domains, the bacteriological testing landscape has undergone transformative changes driven by automation, digital integration, and real-time data analytics. Laboratory workflows have evolved from labor-intensive culture procedures to high-throughput sequencing platforms and point-of-care molecular assays. As a result, laboratories and field teams are now equipped to detect pathogens with unprecedented speed and precision, fostering more timely interventions and risk assessments.

Moreover, the integration of artificial intelligence and machine learning into diagnostic pipelines has enhanced pattern recognition and outbreak forecasting, creating a data-driven paradigm for pathogen surveillance. Decentralized testing models, powered by portable devices and cloud-linked dashboards, have further democratized access to critical diagnostics beyond centralized laboratories. Consequently, industry players and end users alike must adapt to these ecosystem shifts by reevaluating technology investments, skill requirements, and collaborative frameworks to remain at the vanguard of bacteriological testing innovation.

Evaluating the Comprehensive Ramifications of Recent United States Tariff Measures on Bacteriological Testing Supply Chains and Cost Structures

In 2025, the United States implemented revised tariff measures on a range of imported laboratory equipment and consumables pertinent to bacteriological testing, particularly affecting products originating from non-domestic manufacturers. These tariff adjustments have elevated the landed cost of culture media, molecular reagents, and rapid detection kits, prompting procurement teams to reassess supplier portfolios. As a result, organizations are balancing the need for cost containment with the imperative to maintain testing quality and compliance.

Furthermore, increased import duties have triggered a strategic response among domestic instrument developers and reagent suppliers, who are accelerating initiatives to localize production and optimize supply chain resilience. This shift not only mitigates tariff exposure but also shortens lead times and enhances regulatory alignment. Going forward, stakeholders will need to maintain agility in sourcing strategies and consider long-term partnerships that offset tariff volatility while ensuring uninterrupted access to critical testing resources.

In-Depth Exploration of Application, Technology, End User, Sample, and Organism Segmentation Revealing Core Market Drivers and Innovation Trajectories

Segmentation analysis reveals distinct dynamics across application categories, where clinical diagnostics benefits from growing demand for in vitro assays and point-of-care molecular testing, while environmental monitoring is bolstered by advanced sampling techniques for air quality and soil analysis. Food and beverage safety segments are adapting to stricter contamination thresholds in dairy, meat, and ready-to-eat products, reinforcing the need for rapid detection and confirmatory culture testing. Simultaneously, pharmaceutical and biotech players prioritize the rigorous screening of raw materials and final products to comply with evolving quality standards. In water testing, municipalities and industrial plants seek robust protocols for both drinking water safety and wastewater surveillance to safeguard public health and environmental integrity.

When viewed through the lens of technology, culture-based systems-ranging from automated incubation platforms to selective growth media-remain a baseline requirement, complemented by the rapid uptake of immunoassays such as ELISA and lateral flow formats. Molecular diagnostics, including real-time and digital PCR, along with targeted and whole genome sequencing, are increasingly integral to comprehensive pathogen profiling. The rise of rapid immunoassay and molecular kits underscores an industry pivot toward near-instantaneous results, especially in high-stakes settings where time-critical decision-making is paramount.

This comprehensive research report categorizes the Bacteriological Testing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology

- Sample Type

- Organism Type

- Application

- End User

Unraveling Regional Dynamics to Illuminate How the Americas, EMEA, and Asia-Pacific Regions Shape Bacteriological Testing Trends

Regional dynamics significantly influence the strategic landscape of bacteriological testing. In the Americas, robust healthcare infrastructures and extensive food and beverage industries drive uptake of advanced diagnostics and automation. Regulatory rigor and public awareness in North America reinforce the adoption of next-generation sequencing for outbreak investigation and clinical stewardship, while Latin American markets show growing interest in cost-effective rapid detection solutions to address endemic pathogens.

In the Europe, Middle East & Africa region, stringent regulatory frameworks and high public health expenditure underpin demand for comprehensive quality assurance testing across pharmaceuticals, food safety, and water monitoring. Emerging economies within the region are investing in laboratory modernization to enhance disease surveillance capabilities. In Asia-Pacific, rapid urbanization and expanding industrial activities are catalyzing investments in environmental monitoring and food safety testing, with major economies prioritizing point-of-use diagnostics to manage public health risks and supply chain quality.

This comprehensive research report examines key regions that drive the evolution of the Bacteriological Testing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Major Industry Players Driving Technological Advancements and Strategic Partnerships in the Bacteriological Testing Ecosystem Worldwide

Leading players are advancing product portfolios through innovative reagents, integrated instrumentation, and digital service platforms. Key manufacturers are partnering with academic institutions and healthcare providers to validate novel assays and expand clinical utility. Strategic collaborations with software developers have led to the deployment of AI-enabled diagnostic solutions that streamline data interpretation and regulatory reporting.

Industry consolidation through targeted mergers and acquisitions continues to shape the competitive terrain, with companies seeking to broaden technology offerings and geographic reach. Investment in scalable manufacturing facilities has become central to meeting fluctuating demand while ensuring quality compliance. Moreover, an emphasis on customer support and training services is fostering deeper engagement with end users, reinforcing vendor lock-in and facilitating the adoption of advanced bacteriological testing workflows.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bacteriological Testing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Danaher Corporation

- F. Hoffmann-La Roche AG

- Merck KGaA

- QIAGEN N.V.

- Siemens Healthineers AG

- Thermo Fisher Scientific, Inc.

Actionable Strategies for Industry Leaders to Capitalize on Emerging Molecular Diagnostics, Optimize Supply Chains, and Enhance Market Positioning

Industry leaders should prioritize the integration of advanced molecular technologies, such as digital PCR and targeted sequencing, into core testing portfolios to deliver high-definition pathogen profiles and actionable insights. By establishing cross-functional teams that include regulatory, technical, and commercial experts, organizations can expedite product development cycles and secure faster market approvals. Furthermore, forging alliances with regional reference laboratories and academic centers will enhance validation pathways and broaden application scope.

To mitigate supply chain disruptions and tariff impacts, businesses are encouraged to diversify manufacturing footprints, localize critical reagent production, and implement dual-sourcing strategies for key consumables. Investing in cloud-based data platforms and AI-driven analytics will not only optimize laboratory operations but also enable predictive maintenance and capacity planning. By adopting these strategic imperatives, stakeholders can solidify market leadership, improve operational resilience, and deliver enhanced value to customers across end-user segments.

Methodological Rigor Employed in Synthesizing Primary and Secondary Intelligence to Support Comprehensive Bacteriological Testing Insights

This report’s insights are grounded in a rigorous blend of primary and secondary research methodologies. Secondary research encompassed extensive analysis of peer-reviewed journals, patent filings, regulatory guidelines, and proprietary data repositories to establish a foundational understanding of market dynamics and technology trajectories. Concurrently, primary research involved in-depth interviews with industry veterans, laboratory directors, regulatory officers, and procurement specialists to capture firsthand perspectives on emerging challenges and opportunities.

Data triangulation ensured the validation of quantitative and qualitative inputs, while expert panel discussions provided interpretive depth and trend forecasting guidance. The methodology also incorporated continuous monitoring of policy updates, tariff announcements, and supply chain shifts to maintain the currency of findings. Through iterative review and cross-functional collaboration, the research team delivered a comprehensive framework for dissecting the bacteriological testing landscape with precision and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bacteriological Testing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bacteriological Testing Market, by Technology

- Bacteriological Testing Market, by Sample Type

- Bacteriological Testing Market, by Organism Type

- Bacteriological Testing Market, by Application

- Bacteriological Testing Market, by End User

- Bacteriological Testing Market, by Region

- Bacteriological Testing Market, by Group

- Bacteriological Testing Market, by Country

- United States Bacteriological Testing Market

- China Bacteriological Testing Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Concluding Synthesis Highlighting Critical Trends, Stakeholder Imperatives, and Future Trajectories in Bacteriological Testing Markets

In summary, the bacteriological testing market is characterized by rapid technological evolution, heightened regulatory scrutiny, and complex supply chain considerations. Stakeholders must navigate a dynamic environment where precision diagnostics, accelerated time-to-result, and data integration converge to meet public health and safety imperatives. The interplay of regional regulatory policies, tariff regimes, and strategic partnerships will define competitive advantage in the coming years.

Ultimately, success in this evolving market hinges on the ability to align technology investments with end-user needs, sustain operational resilience, and foster collaborative ecosystems. By leveraging the insights and recommendations detailed in this report, decision makers can confidently chart a course toward sustainable growth and enhanced public health impact.

Empowering Decision Makers with Tailored Insights and Direct Access to Purchase the Definitive Bacteriological Testing Market Report Today

Our comprehensive research has synthesized critical bacteriological testing market insights and packaged them into a robust report tailored to guide strategic decision-making across diverse applications and technologies. Leveraging evidence-based analysis, actionable recommendations, and granular segmentation, this report equips stakeholders with a definitive resource to navigate evolving regulatory frameworks, supply chain challenges, and technological disruptors.

To purchase the full report and unlock the depth of our findings, please reach out to Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage directly with our team to secure enterprise licensing, customizable data modules, and expert consultation designed to accelerate your market entry or expansion plans.

- How big is the Bacteriological Testing Market?

- What is the Bacteriological Testing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?