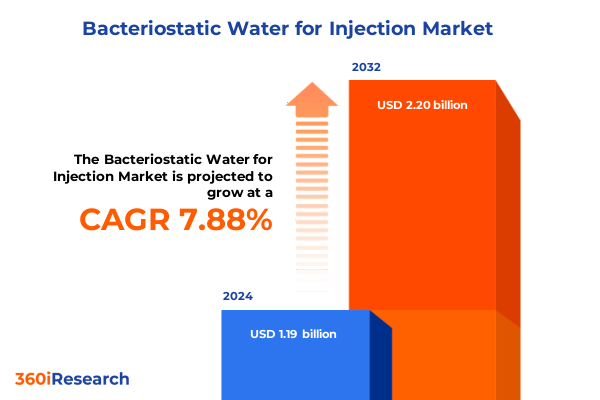

The Bacteriostatic Water for Injection Market size was estimated at USD 1.28 billion in 2025 and expected to reach USD 1.38 billion in 2026, at a CAGR of 7.93% to reach USD 2.20 billion by 2032.

Strategic overview of the evolving bacteriostatic water for injection landscape and its role in modern parenteral therapy ecosystems

Bacteriostatic water for injection occupies a critical yet often underappreciated position in the parenteral therapy ecosystem. It is a sterile, nonpyrogenic water for injection formulation that incorporates benzyl alcohol as a preservative, enabling multiple withdrawals from a single vial when used to reconstitute or dilute injectable drugs before administration. This role as a universal diluent touches a broad range of therapeutic areas, from anesthesia and oncology to infectious disease management and ophthalmology, as well as research and diagnostic workflows in clinical and reference laboratories.

In clinical practice, bacteriostatic water for injection supports efficient preparation of injections while helping to limit microbial proliferation in multi-dose containers between uses, provided aseptic technique is maintained. At the same time, its benzyl alcohol content introduces important safety nuances, particularly for vulnerable populations such as neonates, where preservative-free alternatives are required. For manufacturers, these dual imperatives of convenience and safety translate into strict expectations around formulation integrity, container closure performance, and sterilization robustness.

This executive summary examines the evolving landscape for bacteriostatic water for injection, considering key shifts in clinical practice, manufacturing technology, regulatory oversight, and international trade policy. It also frames how product segmentation by container type, packaging material, volume, sterilization method, application, end user, and distribution channel is reshaping competitive positioning. Finally, it highlights regional differences across the Americas, Europe, the Middle East and Africa, and Asia-Pacific, and synthesizes the implications for companies seeking to build resilient, compliant, and economically sustainable portfolios in this niche but strategically significant segment of the injectable supply chain.

Transformative shifts redefining bacteriostatic water for injection markets amid biologics growth, home care expansion, and digitalized supply chains

The market for bacteriostatic water for injection is being reshaped by fundamental changes in how injectable therapies are developed, delivered, and controlled. The growth of biologics, complex injectables, and multi-dose regimens is intensifying demand for reliable, compatible diluents that support stable reconstitution and precise dosing. As more therapies move toward self-administration or administration in community settings, product developers are rethinking how bacteriostatic water is presented, including an increased focus on smaller-volume vials that align with specific dosing schemes and minimize wastage.

Parallel to clinical trends, long-term shifts in care delivery are expanding the importance of non-hospital settings. Home care and ambulatory care centers are handling a broader range of parenteral treatments, prompting procurement teams to prioritize formats that combine ease of handling with reduced contamination risk. In these settings, user-friendly single-dose configurations and clearly labeled multi-dose bacteriostatic vials both play roles, depending on workflow, training, and local infection-prevention policies. At the same time, laboratories and diagnostic facilities increasingly demand consistent, high-quality bacteriostatic water for standardized sample preparation and test protocols.

Supply chain and quality expectations are evolving just as rapidly. Recent recalls of bacteriostatic water for injection related to sterilization assurance and particulate contamination underscore how intolerant regulators and customers have become of even minor process deviations. Manufacturers are responding by strengthening contamination control strategies, investing in advanced inspection systems, and implementing more rigorous process validation for both autoclave and gamma-based sterilization. These investments are complemented by broader digitalization initiatives, including electronic batch records, real-time release analytics, and integration with hospital or wholesaler inventory systems to improve traceability and reduce the risk of stocking substandard or expired lots.

Finally, sustainability and materials science are beginning to influence purchasing criteria. As health systems assess the environmental impact of single-use plastics and energy-intensive sterilization, producers of bacteriostatic water are experimenting with lighter-weight polymers, optimized secondary packaging, and sterilization cycles that minimize energy consumption without compromising sterility assurance. Together, these transformative shifts are moving the category away from being treated as a generic commodity toward a more differentiated set of solutions tailored to specific clinical contexts and operational constraints.

Assessing the cumulative impact of evolving United States tariff regimes on bacteriostatic water for injection inputs, pricing, and supply security

From 2018 through 2025, successive waves of United States tariffs on medical products, raw materials, and related components have altered the operating environment for bacteriostatic water for injection manufacturers and buyers. Recent policy developments include broad-based baseline tariffs on many imports, sharply elevated duties on selected Chinese goods, and targeted investigations into medical devices, consumables, and pharmaceuticals under Section 232 national security provisions. Although finished pharmaceutical products have often been treated differently from devices, the distinction is less clear for inputs such as benzyl alcohol, glass vials, elastomeric stoppers, plastic resins, and sterile packaging, many of which are sourced from countries now facing higher duties.

In parallel, new tariff measures have been directed at active pharmaceutical ingredients and key intermediates from China and India, as well as sterile packaging materials and analytical equipment from several major exporting economies. For bacteriostatic water, this means that even if the final filling and sterilization step occurs domestically, upstream cost structures are influenced by duties on chemical preservatives, container materials, and the lab and sterilization technologies required to maintain stringent quality standards. Layered on top of tariffs on metals, plastics, and energy-intensive manufacturing equipment, this has created an environment of persistent cost volatility.

Healthcare providers and advocacy organizations have raised concerns that tariffs on medical inputs could compromise access to essential supplies, particularly for safety-critical items such as consumables and basic injectables. While hospital and group purchasing contracts often limit immediate price pass-through, suppliers facing higher landed costs must ultimately adjust pricing, rationalize product portfolios, or reconfigure supply chains. For bacteriostatic water producers, responses include diversifying sourcing away from the most heavily tariffed origins, increasing regionalization or nearshoring of critical production steps, and negotiating longer-term supply agreements that incorporate shared risk mechanisms for tariff-related surcharges.

Taken together, the cumulative impact of United States tariffs through 2025 has been to elevate the strategic importance of supply chain resilience and trade compliance in a category once managed largely on unit price. Companies that proactively map tariff exposure across their bill of materials, establish dual or multi-region sourcing strategies for benzyl alcohol and container materials, and integrate tariff scenarios into capital investment planning are better placed to maintain continuity of supply. Conversely, manufacturers that rely on single-country sourcing or have limited visibility into subcontractor networks face a higher probability of margin compression, stockouts, or delayed product launches when trade policies shift suddenly.

Key segmentation dynamics shaping demand patterns for bacteriostatic water for injection across container types, volumes, materials, and uses

Segmentation reveals how nuanced the demand structure is for bacteriostatic water for injection, and why a one-size-fits-all product approach is increasingly insufficient. Container type is a natural starting point. Multi-dose vials, enabled by the bacteriostatic properties of benzyl alcohol, remain the backbone offering in many institutional settings because they allow repeated withdrawals for drug reconstitution across multiple patients or doses, reducing packaging waste and storage requirements. At the same time, infection prevention policies in high-acuity areas often favor single-dose vials that eliminate the risks associated with multiple entries into the same container, particularly in environments with high staff turnover or limited opportunities for advanced aseptic training.

Packaging material drives a second layer of differentiation. Glass has long been the default for bacteriostatic water, owing to its well-characterized compatibility and low permeability. However, advances in medical-grade polymers have enabled plastic vials that are lightweight, shatter-resistant, and capable of maintaining sterility and volume integrity over the product’s shelf life. For logistics-intensive applications, such as large integrated delivery networks or regional distributors serving smaller clinics and home care providers, the reduced breakage risk and freight weight of plastic formats increasingly justify their adoption, provided extractables and leachables remain within pharmacopeial limits.

Volume segmentation reflects both clinical dosing patterns and operational efficiency. Small-fill presentations up to 10 milliliters support precise reconstitution of high-potency drugs and biologics, limiting overfill and wastage where even minor volume deviations can impact dosing accuracy. Intermediate volumes from 10 to 20 milliliters are frequently used in perioperative settings, anesthesia, and multi-dose therapeutic regimens that require a moderate buffer of diluent without excessive leftover solution. Larger fills above 20 milliliters cater to high-throughput areas such as hospital pharmacies, oncology infusion centers, and busy laboratories where a single container may serve repeated reconstitution or flushing needs before being discarded.

Sterilization method is another critical segmentation axis, closely linked to both regulatory scrutiny and sustainability goals. Moist heat sterilization via autoclaving remains dominant due to its robustness, familiarity, and well-established validation frameworks. However, gamma irradiation plays an important role for certain plastic containers and closure materials that cannot tolerate repeated high-temperature cycles without deforming or compromising barrier properties. Manufacturers must align container selection, line configuration, and sterilization strategy so that the resulting combinations meet global regulatory expectations while optimizing cycle times and operating costs.

Application-based segmentation sharpens this picture further. Drug reconstitution is the primary use case for bacteriostatic water and underpins demand in nearly every clinical setting that administers injectable therapies. Intravenous administration as a diluent, laboratory testing workflows requiring standardized diluent properties, and ophthalmic procedures where controlled volumes and sterility are paramount all contribute to distinct specification and packaging preferences. End-user categories such as hospitals and clinics, ambulatory care centers, diagnostic laboratories, and home care settings each blend these applications differently, leading to varied preferences for single-dose versus multi-dose formats, volume mixes, and packaging materials.

Finally, distribution channel segmentation shapes how products reach these end users. Hospital pharmacies continue to account for a significant share of volumes, supported by direct purchasing agreements with manufacturers or wholesalers. Retail pharmacies increasingly handle smaller quantities for outpatient therapies and home-based care, while online pharmacies are emerging as important channels for licensed professionals and institutions seeking rapid replenishment or specialized formats, particularly in markets with fragmented brick-and-mortar infrastructure. Together, these interlocking segmentation dimensions provide a roadmap for manufacturers and distributors to fine-tune product portfolios, pricing strategies, and service models around clearly defined customer segments rather than treating bacteriostatic water as a homogenous commodity.

This comprehensive research report categorizes the Bacteriostatic Water for Injection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Container Type

- Packaging Material

- Volume

- Sterilization Method

- Application

- End User

- Distribution Channel

Regional performance insights for bacteriostatic water for injection across the Americas, Europe, Middle East, Africa, and Asia-Pacific

Regional dynamics exert a powerful influence on how bacteriostatic water for injection is specified, sourced, and consumed. In the Americas, the United States anchors demand, underpinned by high utilization of injectable therapies, extensive hospital and clinic networks, and a dense ecosystem of wholesalers and group purchasing organizations. Domestic and regional manufacturers play a prominent role in supplying bacteriostatic water, often through vertically integrated sterile injectable platforms. However, many of the key inputs, including active pharmaceutical ingredients, intermediates, and certain packaging components, still originate from global suppliers, notably in Asia. Recent tariff measures affecting APIs, packaging materials, and medical consumables have therefore translated into heightened attention to supply chain mapping, alternative sourcing, and contingency planning.

Elsewhere in the Americas, including Canada and Latin American markets, reliance on imports is stronger and local sterile manufacturing capacity more variable. This increases exposure to currency fluctuations, regulatory delays at borders, and shipping disruptions. In response, some regional players are investing in localized filling and finishing facilities focused on core injectable commodities such as sterile and bacteriostatic water, while still importing benzyl alcohol and specialized container components. Demand is shaped by the growth of public and private hospital infrastructure, expansion of health coverage schemes, and efforts to standardize injectable practices across diverse care settings.

Across Europe, the Middle East, and Africa, regulatory frameworks and healthcare system structures drive a different pattern. In the European Union, harmonized pharmacopoeial standards and robust good manufacturing practice enforcement set a high bar for bacteriostatic water quality and documentation. Hospitals and clinics often specify detailed container, material, and sterilization characteristics in tenders, and there is strong focus on infection prevention, which can favor single-dose presentations in some care areas despite higher packaging intensity. In the Middle East and parts of Africa, rapid investments in hospital capacity and oncology and critical care services are increasing demand for standardized diluents, yet many countries continue to depend heavily on imported supplies, making them vulnerable to global logistics and pricing shifts.

In the Asia-Pacific region, structural growth in healthcare access, demographic trends, and a large base of domestic generic manufacturers collectively expand the role of bacteriostatic water. China and India are both major producers of APIs and finished injectables, making them central nodes in global supply chains for diluents and parenteral therapies. As regulatory agencies in the region strengthen oversight and align more closely with international standards, manufacturers are upgrading facilities and documentation, which supports greater export activity but also increases compliance costs. Within domestic markets, rising incomes, growing private hospital segments, and expanded insurance coverage are broadening access to injectable treatments, thereby increasing demand for both bacteriostatic and preservative-free waters for injection. Differences in pricing controls, public procurement mechanisms, and local content policies across Asia-Pacific markets further diversify how products are positioned and which volumes, materials, and container types gain traction in each country.

Taken together, these regional patterns underscore that strategies successful in the Americas will not automatically translate to Europe, the Middle East and Africa, or Asia-Pacific. Manufacturers and distributors must calibrate offerings, regulatory engagement, and supply-chain footprints to local realities, balancing global standardization with regional customization in order to capture opportunity and manage risk.

This comprehensive research report examines key regions that drive the evolution of the Bacteriostatic Water for Injection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Competitive landscape and strategic positioning of leading bacteriostatic water for injection manufacturers, contract fillers, and brand owners

The competitive landscape for bacteriostatic water for injection blends global pharmaceutical majors, diversified medical product companies, and specialized sterile injectables manufacturers. Large multinational firms that operate extensive parenteral portfolios often position bacteriostatic water as part of integrated offerings that also include sterile water, saline solutions, and a wide range of injectable medications. For example, proprietary bacteriostatic water products supplied in multiple-dose vials with benzyl alcohol preservative illustrate how leading companies leverage established sterile manufacturing capabilities, validated packaging systems, and global distribution networks to support consistent quality and availability.

Mid-sized and regional players frequently emphasize agility and customization. These companies may collaborate closely with hospital systems, contract research organizations, and compounding services to tailor container sizes, materials, or packaging configurations to local preferences and regulatory requirements. Some target niche segments such as specific volume ranges optimized for anesthesia or oncology, or focus on supply to diagnostic laboratories and ophthalmic centers that value precise volume control and stringent particulate specifications. Others differentiate through quality programs that highlight low particulate profiles, enhanced visual inspection regimes, and advanced sterility assurance methodologies.

Contract manufacturers and contract development and manufacturing organizations are gaining importance as innovators of flexible capacity in this space. They allow brand owners to scale production of bacteriostatic water and related diluents without committing to significant greenfield capital projects, while still achieving compliance with advanced regulatory expectations. In turn, these partners invest in multi-purpose filling lines capable of handling both glass and plastic vials, as well as infrastructure for autoclave and gamma-based sterilization to support diverse client needs.

Across the competitive landscape, recent quality events involving bacteriostatic and sterile waters have sharpened the focus on risk management, supplier qualification, and transparency. Companies that proactively communicate about improvements in process control, container closure integrity, and sterility assurance are better positioned to win long-term supply contracts with hospitals, group purchasing organizations, and national procurement agencies. Those that combine robust compliance records with targeted innovation in packaging, sustainability, and digital traceability are emerging as preferred partners in a market where differentiation is increasingly based on reliability, responsiveness, and total value rather than price alone.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bacteriostatic Water for Injection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Canvax Reagents SL

- Cytiva by Danaher Corporation

- EUROCRIT LABS INTERNATIONAL PRIVATE LIMITED

- Farbe Firma Pvt Ltd.

- Geno Technology Inc.

- Merck KGaA

- Pfizer, Inc.

- Sandoz

- Thermo Fisher Scientific, Inc.

Actionable strategic recommendations to help industry leaders fortify bacteriostatic water for injection portfolios, quality systems, and resilience

Industry leaders aiming to strengthen their position in the bacteriostatic water for injection arena must move beyond incremental improvements and adopt a more strategic, system-level perspective. One priority is to embed tariff and supply chain risk assessments directly into product and sourcing strategies. Mapping exposure across benzyl alcohol, glass and plastic containers, closures, and sterilization services allows companies to evaluate the benefits of dual sourcing, regional redundancy, and longer-term contracts that incorporate mechanisms for sharing or smoothing tariff-related cost shocks. Integrating these insights into capital planning helps ensure that new filling lines and sterilization assets are located and configured in ways that reduce vulnerability to trade disruptions.

Enhancing quality and regulatory resilience is equally critical. Companies should expand the use of risk-based quality by design principles for bacteriostatic water, treating container type, packaging material, volume, and sterilization choice as interdependent variables. Strengthening environmental monitoring, adopting advanced inspection technologies, and harmonizing process validation protocols across sites can reduce the likelihood of recalls and enhance confidence among regulators and customers. Investing in clear, accessible documentation and proactive communication with health authorities supports faster resolution of questions and smoother approvals for line changes or site transfers.

On the commercial side, leaders can extract more value from segmentation by aligning product configurations with the evolving needs of specific end users. Hospitals and clinics often prioritize consistent supply, robust quality records, and unit costs optimized through large-volume contracts, while ambulatory care centers and home care providers may place greater weight on ease of handling and smaller, more manageable vial sizes. Diagnostic laboratories and ophthalmic centers, by contrast, tend to emphasize stringent particulate limits and reliable reconstitution characteristics. Tailoring packaging, labelling, and service levels to these distinct priorities creates opportunities to deepen relationships and defend share.

Finally, forward-looking organizations should invest in digital capabilities and sustainability initiatives that resonate with purchasers and regulators alike. Implementing interoperable track-and-trace systems for bacteriostatic water batches enhances transparency and supports recall readiness, while data analytics on consumption patterns help providers optimize inventory. At the same time, exploring lower-impact packaging options, energy-efficient sterilization cycles, and waste reduction initiatives aligns product offerings with broader healthcare sustainability goals. By coordinating these operational, regulatory, commercial, and environmental levers, industry leaders can transform a seemingly simple commodity into a strategically managed asset within their broader injectable portfolios.

Research methodology underpinning the bacteriostatic water for injection market analysis, integrating multi-source validation and expert perspectives

The analysis underpinning this executive summary is grounded in a structured, multi-step research methodology designed to capture both the technical specificities of bacteriostatic water for injection and the broader market and policy forces acting upon it. Secondary research served as the foundation, encompassing regulatory and pharmacopoeial texts, safety and prescribing information for bacteriostatic and sterile water products, official tariff announcements, and communications from healthcare and hospital associations concerning supply chain risk. Publicly available information from manufacturers, healthcare providers, and regulators was systematically reviewed to identify product characteristics, sterilization practices, quality events, and emerging procurement preferences.

This documentary base was supplemented by analysis of policy and trade developments affecting pharmaceutical and medical inputs, including tariffs on active ingredients, packaging materials, and medical products, as well as proposed trade measures under national security and environmental frameworks. These sources informed the assessment of how evolving tariff regimes influence cost structures, sourcing patterns, and risk management strategies for bacteriostatic water producers and buyers, without extrapolating to quantitative forecasts or market size estimates.

Primary insights were then incorporated through discussions with stakeholders across the value chain, including individuals familiar with sterile manufacturing operations, hospital pharmacy management, diagnostic laboratory workflows, and procurement for hospitals, ambulatory centers, and other care settings. These conversations provided context on how segmentation dimensions such as container type, packaging material, volume, and sterilization method translate into real-world preferences and operational constraints, and how clinicians and pharmacists perceive the balance between multi-dose efficiency and infection-prevention imperatives.

Throughout the research process, findings from different sources were cross-validated to reconcile discrepancies and avoid over-reliance on any single viewpoint. Emphasis was placed on triangulating qualitative evidence, checking consistency with regulatory guidance and documented quality events, and ensuring that the narrative reflects conditions and policies current to 2025. The result is a synthesis intended to offer a high-confidence, yet non-forecasting, perspective on the strategic landscape surrounding bacteriostatic water for injection.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bacteriostatic Water for Injection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bacteriostatic Water for Injection Market, by Container Type

- Bacteriostatic Water for Injection Market, by Packaging Material

- Bacteriostatic Water for Injection Market, by Volume

- Bacteriostatic Water for Injection Market, by Sterilization Method

- Bacteriostatic Water for Injection Market, by Application

- Bacteriostatic Water for Injection Market, by End User

- Bacteriostatic Water for Injection Market, by Distribution Channel

- Bacteriostatic Water for Injection Market, by Region

- Bacteriostatic Water for Injection Market, by Group

- Bacteriostatic Water for Injection Market, by Country

- United States Bacteriostatic Water for Injection Market

- China Bacteriostatic Water for Injection Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1272 ]

Integrated conclusions on the strategic outlook for bacteriostatic water for injection amid shifting regulations, technologies, and clinical practices

Viewed holistically, the bacteriostatic water for injection landscape in 2025 is shaped by the intersection of clinical, regulatory, supply chain, and policy dynamics. Clinically, the product remains indispensable as a versatile diluent for a wide spectrum of injectables, but its benzyl alcohol content and multi-dose usage pattern require careful alignment with patient safety priorities and infection-prevention protocols. Regulatory agencies continue to demand rigorous evidence of sterility assurance, container closure integrity, and process control, and recent quality events have underscored the reputational and operational costs of any deficiencies.

At the same time, shifts in care delivery and therapeutic innovation are changing how and where bacteriostatic water is used. The expansion of biologics and complex regimens, the growth of ambulatory and home-based care, and the strengthening of laboratory and diagnostic infrastructures all contribute to a more segmented pattern of demand. Differences in preferred volume ranges, container materials, and sterilization approaches across applications and end users mean that manufacturers who calibrate offerings with precision can create meaningful differentiation, even in a category long perceived as generic.

Overlaying these trends is a trade and tariff environment that has injected additional complexity into sourcing and cost management. The cumulative impact of new duties on medical products, APIs, packaging materials, and related industrial inputs reinforces the need for diversified, regionally resilient supply networks and disciplined trade compliance. Companies that treat bacteriostatic water as a strategic product line, integrating tariff analysis, supply chain resilience planning, and regulatory intelligence into their decision-making, are better placed to maintain continuity of supply and protect margins.

Looking ahead, the convergence of digitalization, sustainability, and quality-by-design methodologies is likely to define the next phase of evolution. Digital traceability and advanced analytics will make it easier to monitor consumption patterns, detect anomalies, and support rapid response to quality or supply disruptions. Sustainability considerations will influence packaging choices and sterilization practices, while ongoing regulatory harmonization will continue to raise expectations for documentation and process robustness. Within this context, bacteriostatic water for injection will remain small in unit price but large in strategic significance, serving as a foundational enabler of safe and effective parenteral therapy across global health systems.

Take the next step with tailored insights on bacteriostatic water for injection by engaging directly with Ketan Rohom to secure full report access

Securing a deeper understanding of the bacteriostatic water for injection landscape is no longer optional for organizations that manufacture, procure, or rely on injectable therapies. As regulatory expectations tighten, tariffs reshape cost structures, and clinical practice evolves, decisions based on partial information translate directly into operational risk and missed opportunity. A comprehensive, independent market study allows stakeholders to benchmark their strategies against current best practices, validate internal assumptions, and identify the combinations of container type, packaging material, volume, and application focus that best align with emerging demand.

To translate this strategic perspective into concrete advantages, engaging directly with Ketan Rohom, Associate Director, Sales and Marketing, is a practical next step. Through a detailed discussion of your specific objectives, Ketan can help you explore report licensing options, review the scope and structure of the analysis, and identify which sections align most closely with your organizational priorities. Whether you are evaluating capital investments in new production lines, rebalancing your supplier base, or refining commercial strategies toward hospitals, ambulatory centers, laboratories, retail pharmacies, or online channels, a tailored walkthrough of the report’s findings will ensure the insights are actionable for your team.

By initiating this dialogue, decision-makers gain guided access to the depth of research underlying this executive summary, including granular segmentation views, regional dynamics, and implications of tariff and regulatory developments. The result is a clearer roadmap for strengthening supply security, optimizing product portfolios, and enhancing competitiveness in a market where sterile quality, cost containment, and clinical reliability converge. Opening a conversation with Ketan positions your organization to convert analytical insight into tangible strategic and operational outcomes.

- How big is the Bacteriostatic Water for Injection Market?

- What is the Bacteriostatic Water for Injection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?