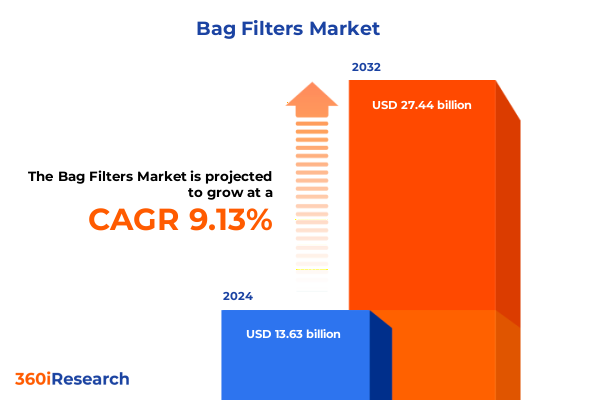

The Bag Filters Market size was estimated at USD 8.83 billion in 2025 and expected to reach USD 9.36 billion in 2026, at a CAGR of 6.21% to reach USD 13.47 billion by 2032.

Unlocking the Crucial Role of Bag Filters Across Industrial Landscapes to Enhance Air Quality Control and Operational Efficiency

The intricacies of industrial air pollution control technologies converge in the unassuming yet critical component of bag filters. Serving as the frontline defense against particulate emissions, these filtration systems capture dust, fibers, and fine particulates that would otherwise compromise environmental standards and operational reliability. As regulatory agencies worldwide tighten permissible emission thresholds, the imperative for advanced bag filter solutions has never been greater. Operators across diverse sectors must not only contend with increasingly stringent air quality mandates but also balance the dual objectives of minimizing downtime and managing lifecycle costs.

In this context, bag filters perform a dual role: they safeguard public health by ensuring cleaner emissions and they enhance productivity by protecting downstream equipment from particulate-induced wear. Their versatile design accommodates an array of operational environments, ranging from high-temperature cement kilns to corrosive chemical processing units. However, the evolving landscape of raw material costs, supply chain constraints, and competitive pressures underscores the need for stakeholders to adopt a strategic perspective on filtration investments. By exploring the technological, regulatory, and economic drivers that shape the bag filter market, decision-makers can align procurement, maintenance, and innovation initiatives with broader corporate sustainability and efficiency goals.

Exploring How Technological Advances and Regulatory Imperatives Are Reshaping Filtration Processes and Performance Standards in the Bag Filter Market

Recent years have witnessed a rapid convergence of digital innovation and environmental regulation that is fundamentally reshaping how bag filter solutions are developed and deployed. The integration of IoT sensors into filtration housings now enables real-time monitoring of pressure differentials, differential flow rates, and particulate loading, empowering operators to anticipate maintenance needs and optimize cleaning cycles, thereby extending filter lifespans and reducing unplanned downtime, according to industry analyses. Simultaneously, advancements in edge computing architectures have brought data processing closer to the point of collection, reducing latency, enhancing cybersecurity, and supporting instantaneous decision-making, which accelerates response times in critical operations.

At the same time, mounting sustainability imperatives are driving the adoption of reusable and recyclable filter media. Bio-based polymers and chemically robust PTFE coatings are gaining traction as manufacturers respond to circular economy initiatives that prioritize waste minimization and resource efficiency. Regulators are also harmonizing air emission standards across major markets, streamlining certification pathways and facilitating the cross-border transfer of best practices. In this new paradigm, product innovation is increasingly characterized by modular designs that allow for rapid media swaps and scalable filter banks, enabling plant operators to tailor filtration capacity to fluctuating production demands.

Furthermore, the rise of service-based commercial models reflects a shift from one-off hardware sales to subscription-style maintenance programs that bundle performance guarantees with data analytics platforms. By aligning capital expenditures with predictable operating costs, these models enhance budgetary clarity and incentivize providers to continuously improve filter efficiency and reliability. Collectively, these transformative shifts are redefining competitive dynamics and charting the course for the next generation of bag filter technologies.

Analyzing the Compound Effects of Multiple U.S. Tariff Actions in 2025 on Raw Material Costs Supply Chain Dynamics and Global Sourcing Strategies

Throughout 2025, the United States has enacted multiple tariff measures that cumulatively influence the cost and sourcing strategies for bag filter components. Initially, an executive order under IEEPA imposed a blanket 10 percent ad valorem tariff on goods originating from China, including Hong Kong, aimed at addressing synthetic opioid supply chain concerns. However, this measure more than doubled to a 20 percent surcharge effective March 4, 2025, as the administration intensified its response, thereby substantially increasing landed costs for polymeric filter media and associated hardware.

In parallel, a separate executive order introduced 25 percent additional duties on imports from Canada and Mexico, effective March 4, further complicating North American supply chains. This tariff escalation eliminated previous de minimis thresholds for duty-free shipments under $800, exposing smaller transaction values to the full rate and prompting importers to reassess their logistics and consolidation strategies. Then, recognizing potential supply disruptions, a temporary suspension order reinstated a uniform 10 percent additional ad valorem rate on all goods imported from select trading partners from April 10 through July 9, 2025, creating a narrow window during which costs temporarily moderated before the resumption of higher duties.

The aggregate effect of these successive tariff actions has been to elevate procurement expenses for key inputs-such as nonwoven polyester, polypropylene, and PTFE media-and to incentivize a shift toward local sourcing or regional manufacturing partnerships. Many stakeholders are exploring near-shore production and dual-sourcing agreements to mitigate the risk of further trade actions. In addition, end users are increasingly collaborating with filter OEMs to lock in forward pricing and secure supply commitments, reflecting a broader strategic emphasis on supply chain resilience in an environment of sustained trade policy volatility.

Unveiling Critical End-Use Application Medium and Shape Segments That Drive Diverse Industrial Demand Profiles for Bag Filter Solutions

The bag filter market’s complexity is underscored by its multi-dimensional segmentation, reflecting diverse requirements across industry verticals, application contexts, material preferences, and physical configurations. End-use industries range from the high-temperature environment of cement manufacturing-where rotary kiln and vertical shaft processes demand thermally robust media-to the stringent purity standards in chemical and petrochemical operations, which encompass pharmaceutical manufacturing, polymer production, and refinery applications. In addition, sectors such as food and beverage, mining and minerals, and power generation-including coal-fired, gas-fired, and nuclear plants-require tailored filtration solutions that address unique particulate profiles and regulatory constraints.

At the application level, bag filters serve distinct functions such as dust control, gas filtration, and oil mist removal. Dust control systems employ either large-scale baghouse collectors for bulk particulate capture or compact dust collectors when floor space is constrained. Gas filtration applications leverage activated carbon filters to adsorb volatile compounds and HEPA filters to capture ultrafine particles. Meanwhile, oil mist removal solutions utilize centrifugal separators to leverage inertia for droplet separation and electrostatic precipitators to negate particle charge and extract submicron oil aerosols.

Material selection is another critical dimension. Polyester media strikes a balance between affordability and performance in general industrial applications, while polypropylene offers enhanced chemical resistance. PTFE, with its superior hydrophobic and thermal properties, addresses the most demanding environments. Finally, filter shape-whether cartridge, envelope, or tube-dictates the packing density, pressure drop characteristics, and serviceability, allowing end users to align system footprint and maintenance workflows with their operational objectives.

This granular segmentation framework enables manufacturers and end users to pinpoint the optimal combination of features, ensuring both regulatory compliance and cost-effective performance across an extensive variety of industrial contexts.

This comprehensive research report categorizes the Bag Filters market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Bag Filters Type

- Filter Media

- Bag Type

- Application

- End-Use Industry

Discerning Regional Adoption Trends and Strategic Market Drivers Across the Americas Europe Middle East Africa and Asia-Pacific Zones

Geographically, the bag filter market exhibits distinct adoption patterns shaped by regulatory stringency, industrial growth trajectories, and infrastructure investments. In the Americas, mature regulatory frameworks and strong environmental enforcement in the United States and Canada drive demand for advanced filtration solutions, particularly in sectors such as power generation and cement. Conversely, Latin American markets prioritize cost-effective retrofit projects and modular dust control units to upgrade aging facilities.

In Europe, Middle East, and Africa, the landscape is equally varied. Western Europe’s rigorous emissions standards and carbon pricing mechanisms incentivize investments in high-performance PTFE-based media and digital monitoring platforms. Meanwhile, the Middle East’s petrochemical hubs emphasize gas filtration applications, leveraging activated carbon beds to manage volatile organic compounds. In Africa, burgeoning mining and minerals activities underpin demand for robust dust control systems, often supplied through strategic partnerships that bundle local manufacturing with service support.

The Asia-Pacific region represents a dynamic mix of emerging economies and established industrial centers. China’s focus on air quality reform has accelerated the deployment of baghouse collectors in cement and power plants, while Southeast Asia’s expanding chemical and food processing industries continue to drive gas filtration and oil mist removal solutions. Japan and South Korea maintain their lead in adopting integrated IoT-enabled filtration platforms, integrating edge analytics and predictive maintenance to optimize uptime. Across these regions, stakeholders are increasingly aligning procurement strategies with long-term emissions reduction goals, fostering cross-border technology transfers and joint ventures to scale best practices and innovations.

This comprehensive research report examines key regions that drive the evolution of the Bag Filters market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating the Competitive Landscape Through Comparative Profiles of Leading Manufacturers Innovators and Strategic Partners in Bag Filter Technology

The competitive landscape in bag filter technology is defined by a mix of global conglomerates and specialized innovators. Leading manufacturers have leveraged decades of expertise to expand their product portfolios and enhance service capabilities. For instance, companies with heritage in air filtration have introduced modular baghouse designs that can be rapidly tailored to diverse plant configurations, while others with polymer expertise have advanced PTFE membrane laminates optimized for corrosive environments.

Strategic partnerships have also emerged as a key differentiator. Some firms collaborate with instrumentation providers to embed differential pressure and particulate sensors directly within filter housings, offering turnkey access to performance dashboards and maintenance alerts. Others have forged alliances with raw material suppliers to co-develop next-generation synthetic fibers that deliver improved particle capture efficiency without sacrificing airflow.

In addition, forward-looking players are investing in localized production facilities and digital service centers to reduce lead times and support regional compliance requirements. By establishing dual-technology labs, these companies accelerate product validation across varying ambient conditions and chemical exposures. Moreover, leading filter OEMs now bundle their hardware offerings with subscription-based service agreements, guaranteeing minimum performance metrics and aligning cost structures with operational budgets.

Collectively, these differentiated strategies-spanning product innovation, strategic alliances, and service model evolution-are elevating the competitive stakes and redefining how value is delivered to end users in a market marked by escalating environmental imperatives and complex industrial requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bag Filters market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Donaldson Company, Inc.

- Camfil Group

- Mann+Hummel Group

- Eaton Corporation PLC

- Babcock & Wilcox Enterprises, Inc.

- Thermax Limited

- FLSmidth & Co. A/S

- BWF Offermann, Waldenfels & Co. KG

- 3M Company

- AGET Manufacturing Company

- Danaher Corporation

- Electrolux AB

- Filter Concept Pvt. Ltd.

- Freudenberg Filtration Technologies SE & Co. KG

- Kavon Filter Products Co.

- Koch Filter

- Lenntech B.V.

- Lydall Industrial Filtration

- Mitsubishi Heavy Industries, Ltd.

- Moldow A/S

- Parker-Hannifin Corporation

- Rosedale Products Inc.

- Shanghai Sffiltech Co., Ltd.

- U.S. Air Filtration, Inc.

- W.L. Gore & Associates Inc.

Strategic Imperatives and Practical Actions to Strengthen Supply Resilience Enhance Filter Performance and Capitalize on Emerging Opportunities

To navigate the multi-faceted challenges in the bag filter ecosystem, industry leaders should prioritize supply chain diversification by establishing regional sourcing partnerships and dual-manufacturer agreements. This approach mitigates exposure to unilateral trade measures and raw material price volatility, ensuring consistent availability of critical media such as polyester, polypropylene, and PTFE.

At the same time, organizations must accelerate the adoption of smart filtration platforms that integrate IoT sensors, edge computing, and machine learning. By leveraging real-time diagnostics and predictive maintenance algorithms, operators can reduce unplanned outages, optimize cleaning cycles, and unlock higher throughput. Piloting these systems in high-value applications-such as petrochemical or pharmaceutical environments-can demonstrate return on investment and build confidence for broader rollout.

Furthermore, embracing circular economy principles through media recycling programs and chemical cleaning protocols can lower disposal costs and align with corporate sustainability targets. Collaboration with material science partners to develop bio-based or regenerated fiber blends will position companies at the forefront of green innovation. Concurrently, engaging proactively with regulatory bodies to align on evolving emissions standards can streamline compliance pathways and foster early access to incentive programs.

Finally, stakeholders should explore service-based commercial models that shift capital expenditures to operating budgets. By negotiating performance-based contracts with OEMs, end users can secure guaranteed filter efficiency and lifecycle support, freeing internal resources to focus on core production objectives while maintaining predictable cost structures.

Detailing the Robust Multi-Method Research Approach Employed to Ensure Data Integrity Insightful Analysis and Industry-Relevant Findings

This research leverages a mixed-methods framework designed to ensure rigorous analysis and actionable insights. Primary data was gathered through in-depth interviews with industry experts, including filtration system engineers, plant maintenance managers, and regulatory consultants. These qualitative discussions uncovered frontline challenges, technology evaluation criteria, and emerging use cases across key end-use sectors.

Secondary research drew upon an extensive review of trade publications, regulatory filings, patent databases, and corporate financial disclosures. This desk-based analysis provided a comprehensive view of market dynamics, including competitive developments, material innovations, and policy trajectories. Both qualitative and quantitative data streams were triangulated to validate findings and reconcile discrepancies.

To enrich the assessment of segmentation trends, data points on end-use volumes, application-specific media performance, and regional deployment were synthesized into an integrated analytics model. This model facilitated cross-comparison of segment growth vectors and stress-tested the impact of external factors such as trade policies and input cost fluctuations.

The methodology emphasizes transparency and replicability. Detailed documentation of data sources, interview protocols, and analytical assumptions is provided in the appendix. This rigorous approach ensures that conclusions are grounded in empirical evidence and deliver strategic relevance for stakeholders seeking to optimize filtration investments and drive operational excellence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bag Filters market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bag Filters Market, by Bag Filters Type

- Bag Filters Market, by Filter Media

- Bag Filters Market, by Bag Type

- Bag Filters Market, by Application

- Bag Filters Market, by End-Use Industry

- Bag Filters Market, by Region

- Bag Filters Market, by Group

- Bag Filters Market, by Country

- United States Bag Filters Market

- China Bag Filters Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Synthesis of Key Insights and Implications for Stakeholders Navigating the Evolving Technological and Regulatory Environment Surrounding Bag Filtration Solutions

The evolution of the bag filter market reflects a confluence of technological innovation, environmental regulation, and supply chain complexity. Advanced materials and digital monitoring tools are transforming traditional filtration into a proactive service, while sustainability mandates and global harmonization of emission standards are elevating performance requirements across regions. Concurrently, successive tariff actions in 2025 have underscored the imperative for resilient sourcing strategies and localized production capabilities.

Segmentation insights reveal that no single solution fits all: the optimal combination of end-use industry focus, application design, filter medium, and physical configuration must be carefully aligned to operational objectives and cost constraints. Regional deployment patterns further highlight the importance of tailoring approaches to local regulatory regimes and infrastructural maturity. Against this backdrop, leading companies are differentiating through strategic alliances, modular product architectures, and subscription-based maintenance offerings.

Looking ahead, the competitive advantage will accrue to stakeholders who can integrate sustainability principles, digital intelligence, and supply resilience into cohesive filtration strategies. By proactively engaging with regulatory shifts, investing in circular economy practices, and adopting data-driven service models, industry participants can both meet stringent air quality targets and unlock new opportunities for operational optimization.

Contact Associate Director Ketan Rohom to Secure Exclusive Access to In-Depth Bag Filter Market Intelligence and Propel Your Strategic Decision-Making Forward

For unparalleled insights into bag filter technologies and their market implications, reach out to Ketan Rohom, our Associate Director, Sales & Marketing, who can provide you with tailored information and exclusive access to the full research report. Engage today to elevate your strategic planning with data-driven recommendations and leverage cutting-edge analysis to make informed decisions that drive growth and innovation in your operations.

- How big is the Bag Filters Market?

- What is the Bag Filters Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?