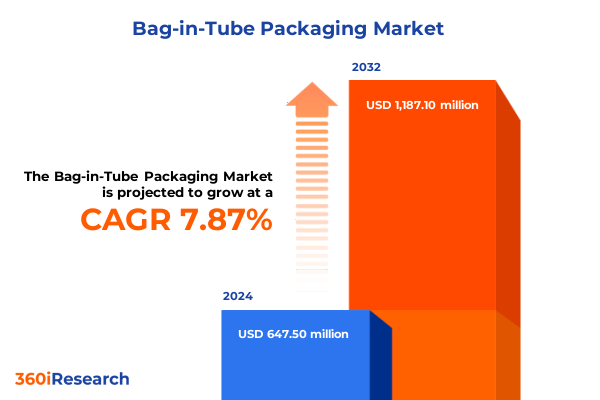

The Bag-in-Tube Packaging Market size was estimated at USD 689.58 million in 2025 and expected to reach USD 740.22 million in 2026, at a CAGR of 8.06% to reach USD 1,187.09 million by 2032.

Unveiling the Strategic Importance and Growth Drivers of Bag-in-Tube Packaging in Transforming Consumer and Industrial Markets

Bag-in-tube packaging has swiftly emerged as a pivotal solution for brands seeking to combine functionality, sustainability, and consumer appeal in a single format. Offering superior barrier protection, reduced material usage, and enhanced convenience, this versatile packaging style caters to a wide array of industries from personal care to food and beverage. As environmental concerns push manufacturers toward more eco-conscious alternatives and consumers demand premium convenience, bag-in-tube systems bridge these needs with lightweight, flexible constructions that accommodate both cold and hot filling.

Moreover, technological advances in materials science have expanded the performance envelope of bag-in-tube formats. High-barrier laminated structures now rival rigid containers in preserving product integrity, while innovative closure types-from dispensing nozzles to resealable laminates-enhance user experience and extend product shelf life. In parallel, the rise of direct-to-consumer channels and e-commerce platforms amplifies the appeal of compact, lightweight packaging forms that promise reduced shipping costs and superior shelf presence.

Consequently, understanding the strategic significance, core drivers, and emerging innovations within the bag-in-tube packaging domain is essential for decision-makers aiming to navigate an increasingly complex market. This executive summary offers a concise yet comprehensive overview of the industry’s transformative trends, regulatory influences, segmentation dynamics, and regional nuances shaping the trajectory of bag-in-tube solutions today.

Exploring Revolutionary Technological Innovations and Sustainability Initiatives Redefining the Global Bag-in-Tube Packaging Landscape

In recent years, the bag-in-tube packaging landscape has undergone transformative shifts driven by a convergence of technological breakthroughs, sustainability mandates, and evolving consumer behaviors. Digital printing technologies, for instance, have enabled brands to achieve high-resolution graphics and variable labeling, fostering greater personalization and small-batch agility. Simultaneously, the adoption of bio-based polymers and next-generation barrier coatings underscores the industry’s commitment to reducing carbon footprints and enhancing recyclability without compromising performance.

Furthermore, manufacturing innovations such as co-extrusion and extrusion lamination processes have lowered production costs while delivering multi-layer structures customized to specific oxygen and moisture sensitivity requirements. Industry-wide collaborations between resin suppliers, packaging converters, and brand owners are now accelerating the development of hybrid solutions that integrate metal foils, paper substrates, and plastic barriers in ever-more efficient architectures.

As supply chains globalize and e-commerce channels expand, logistic optimizations have gained prominence, prompting manufacturers to prioritize lighter weight solutions and modular packaging designs. These cumulative shifts not only redefine operational best practices but also herald a new era of flexibility and responsiveness, positioning bag-in-tube systems as indispensable assets in a competitive marketplace.

Analyzing the Comprehensive Effects of 2025 United States Tariffs on Material Costs Supply Chains and Competitive Dynamics in Tube Packaging

The imposition of United States tariffs in 2025 has exerted a pronounced influence on the cost structure and supply chain dynamics of bag-in-tube packaging. Tariffs targeting aluminum and steel under longstanding Section 232 measures-set at 10% for aluminum and 25% for steel-have elevated the expense of metal barrier components, forcing converters to reassess material blends and negotiate longer-term contracts to hedge against volatility.

Concurrently, duties levied on certain imported laminated substrates and resin imports in response to trade policy realignments have contributed to upstream price pressures. As a direct consequence, manufacturers have intensified efforts to localize sourcing strategies and partner with domestic suppliers capable of balancing cost efficiency with stringent performance requirements. This pivot has, in turn, catalyzed investment in regional converter capacities and spurred research into substitutive plastic barrier technologies that mitigate exposure to fluctuating tariff regimes.

Moreover, these policy shifts have underscored the importance of supply chain resilience, prompting stakeholders to diversify their supplier portfolios across Asia-Pacific and European markets. By leveraging alternative production bases, industry leaders are cushioning the impact of punitive duties while maintaining continuity of supply. In essence, the tariff landscape of 2025 has become both a challenge and an impetus for innovation, compelling the bag-in-tube sector to evolve more robust, cost-effective, and agile sourcing frameworks.

Uncovering Critical Segmentation Perspectives Across Material Types End Use Applications Distribution Channels and Design Variants for Informed Decision Making

A nuanced understanding of market segmentation reveals pivotal insights that inform product development and strategic positioning within the bag-in-tube packaging arena. When examining material categories, laminated structures-encompassing aluminum barrier laminates, paper-based laminates, and plastic barrier laminates-remain the standard-bearers for high-barrier applications. In contrast, mono-material aluminum and steel tubes offer recyclability advantages and premium appeal, while plastic tubes produced via co-extrusion, extrusion lamination, or injection molding deliver lightweight versatility and cost efficiency.

Transitioning to end-use industries, the food and beverage sector, with its stringent safety requirements and branding imperatives, frequently leverages bag-in-tube formats for condiments, sauces, and beverage concentrates. Industrial applications valorize the durability and dosing accuracy of multi-chamber and dual-chamber designs, particularly in adhesives and sealants. Meanwhile, personal care and pharmaceutical segments capitalize on precise dispensing closures-such as flip-top caps and screw caps-to ensure user convenience and product integrity.

Distribution channel dynamics further shape packaging choices. Institutional sales environments demand bulk handling features and cost-optimized closures, whereas modern trade, online retail, and traditional trade channels drive distinct demands for promotional embellishments, tamper-evident seals, and temperature-controlled filling options, be it hot-fill lines for sterile products or cold-fill operations for sensitive formulas. These multifaceted segmentation insights underscore the importance of tailoring tube architectures, closure systems, and filling processes to the precise requirements of each market slice.

This comprehensive research report categorizes the Bag-in-Tube Packaging market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Product Type

- Closure Type

- Filling Temperature

- Distribution Channel

- End Use Industry

Mapping Regional Dynamics Shaping the Adoption Demand and Strategic Growth Opportunities for Bag-in-Tube Packaging Across Major Global Markets

Regional nuances profoundly influence the adoption and success of bag-in-tube packaging solutions. In the Americas, where an emphasis on sustainability and lightweight logistics prevails, brands are increasingly deploying mono-material tubes and promoting recyclability credentials to resonate with environmentally conscious consumers. Substantial investments in domestic converting capacity and local resin production further reinforce supply chain stability while aligning with North American trade policy frameworks.

Across Europe, the Middle East, and Africa, regulatory incentives and stringent circular economy targets are accelerating the transition to bio-based laminates and fully recyclable tube formats. Meanwhile, EMEA’s diverse consumer preferences and retail structures are driving manufacturers to adopt flexible production systems capable of accommodating small lot sizes, multilingual labeling, and rapid color changeovers. This agility supports both luxury personal care brands and emerging direct-to-consumer ventures seeking distinctive shelf presence.

In the Asia-Pacific region, rapid urbanization and growing disposable incomes are fueling robust demand for both premium and value-oriented bag-in-tube solutions. Plastic-based tubes dominate due to cost advantages and established filling infrastructures, yet there is an uptick in laminated hybrids as premium dairy, sauce, and cosmetic segments expand. Furthermore, growing e-commerce penetration in APAC underscores the importance of compact tube geometries and optimized packing configurations to reduce freight costs and minimize environmental impact.

This comprehensive research report examines key regions that drive the evolution of the Bag-in-Tube Packaging market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players Innovation Strategies Collaborative Partnerships and Competitive Edge within the Bag-in-Tube Packaging Sector Ecosystem

The competitive terrain of bag-in-tube packaging is shaped by a cadre of industry leaders whose innovation strategies and collaborative initiatives set benchmarks for performance and sustainability. Amcor’s pioneering work in recyclable barrier laminates has redefined the environmental credentials of flexible tubes, while Berry Global’s investments in digital printing capabilities enable brands to launch personalized packaging campaigns with greater speed and precision.

Essel Propack’s focus on expanding its manufacturing footprint in Asia has bolstered supply availability for global consumers, and its development of co-extruded tubes tailored to cold-fill processes has resonated in food service and industrial markets alike. In Europe, Albea’s strategic joint ventures have amplified its R&D pipeline, driving advancements in lightweight aluminum tube designs and tamper-evident closures that meet stringent regulatory requirements.

Silgan Holdings distinguishes itself through portfolio diversification, offering end-to-end solutions that span material sourcing, tube extrusion, and closure manufacturing. This vertically integrated approach enhances cost control and accelerates time-to-market. Collectively, these companies illustrate how a blend of technological leadership, regional agility, and sustainable innovation propels competitive advantage in the bag-in-tube segment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bag-in-Tube Packaging market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albéa Group

- Amcor plc

- Aran Group

- Berry Global Group, Inc.

- CDF Corporation

- Constantia Flexibles Group GmbH

- Cosmo Films Limited

- DS Smith plc

- EPL Limited

- Goglio S.p.A.

- Hoffmann Neopac AG

- Huhtamäki Oyj

- Liquibox Corporation

- Mondi plc

- ProAmpac LLC

- Scholle IPN

- Sealed Air Corporation

- Smurfit Kappa Group plc

- Sonoco Products Company

- Uflex Limited

- Winpak Ltd.

Delivering Pragmatic Strategic Actions and Operational Roadmaps for Industry Leaders to Enhance Resilience Efficiency and Innovation in Bag-in-Tube Packaging

Industry leaders can derive substantial benefits by adopting a series of targeted initiatives designed to strengthen their market position and operational resilience. First, cultivating strategic partnerships with material innovators and resin suppliers can unlock access to next-generation barrier technologies while providing negotiation leverage against raw material price fluctuations. By establishing collaborative R&D consortia, companies can co-develop bio-based laminates and mono-material tubes that align with global recyclability mandates.

In parallel, operational excellence programs focused on lean manufacturing, changeover optimization, and digital monitoring will elevate throughput and reduce waste. Implementing advanced analytics platforms to track key performance indicators-such as yield rates and downtime metrics-enables continuous improvement and informed capacity planning. Moreover, piloting modular production cells equipped for rapid tooling changes can facilitate small-batch customization and support omnichannel distribution requirements.

Finally, creating cross-functional teams that unify marketing, supply chain, and technical specialists fosters more holistic decision-making. This integrated approach ensures that product design choices, tariff mitigation strategies, and sustainability targets converge seamlessly, delivering differentiated solutions that resonate with end-users while safeguarding profitability in a dynamic policy environment.

Outlining Robust Multimodal Research Approaches Integrated Data Sources and Analytical Techniques Underpinning the Bag-in-Tube Packaging Analysis Framework

The findings presented herein are underpinned by a robust multimodal research methodology that integrates primary and secondary sources to ensure comprehensive coverage and analytical rigor. Primary research involved in-depth interviews with key stakeholders, including packaging engineers, procurement directors, and sustainability officers, providing high-fidelity insights into material selection criteria, regional supply chain challenges, and emerging performance requirements.

Secondary research encompassed a thorough review of industry publications, customs data, regulatory filings, and patent databases, offering contextual background on trade policy changes, technological advancements, and competitor activities. This was complemented by rigorous data triangulation, wherein multiple data points were cross-referenced to validate trends and eliminate biases.

Analytical techniques such as SWOT analysis, scenario planning, and supply chain mapping were employed to distill strategic implications and forecast potential disruption pathways. Collectively, this methodological framework ensures that the analysis is both empirically grounded and strategically relevant for decision-makers navigating the evolving bag-in-tube packaging landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bag-in-Tube Packaging market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bag-in-Tube Packaging Market, by Material Type

- Bag-in-Tube Packaging Market, by Product Type

- Bag-in-Tube Packaging Market, by Closure Type

- Bag-in-Tube Packaging Market, by Filling Temperature

- Bag-in-Tube Packaging Market, by Distribution Channel

- Bag-in-Tube Packaging Market, by End Use Industry

- Bag-in-Tube Packaging Market, by Region

- Bag-in-Tube Packaging Market, by Group

- Bag-in-Tube Packaging Market, by Country

- United States Bag-in-Tube Packaging Market

- China Bag-in-Tube Packaging Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Summarizing Key Insights Strategic Implications and Future Outlook for Bag-in-Tube Packaging to Guide Informed Decisions and Forward-Looking Planning

This executive summary consolidates critical insights into the evolving dynamics of bag-in-tube packaging, highlighting how technological innovation, regulatory shifts, and segmentation strategies jointly shape industry trajectories. The 2025 tariff landscape underscores the imperative of supply chain diversification and proactive cost management, while advanced material developments and digital printing capabilities offer pathways to differentiation and sustainability.

Segmentation analysis reveals that success hinges on tailoring tube architectures and closure systems to distinct end-use requirements across food and beverage, industrial, personal care, and pharmaceutical applications. Regional nuances further dictate strategic priorities-from recyclability mandates in EMEA to rapid e-commerce growth in Asia-Pacific and sustainability-driven investments in the Americas.

Ultimately, a cohesive strategy that integrates collaborative R&D, lean operational frameworks, and cross-functional alignment will empower industry leaders to navigate volatility, seize innovation opportunities, and deliver compelling value to both consumers and corporate stakeholders. By leveraging these insights, organizations can chart a forward-looking course that balances performance, profitability, and purpose.

Contact Ketan Rohom Today to Unlock Exclusive Market Intelligence Insights and Strategic Recommendations Tailored for Your Bag-in-Tube Packaging Success

Harness the power of deep industry analysis and gain a competitive advantage by securing the comprehensive bag-in-tube packaging report. Ketan Rohom, a seasoned Associate Director in Sales & Marketing, is ready to guide you through the key takeaways, strategic recommendations, and actionable insights tailored to your organization’s unique challenges and objectives. By partnering with Ketan, you’ll unlock exclusive perspectives on material innovations, tariff implications, and market segmentation that will inform your next steps and solidify your position in an evolving landscape. Reach out today to discuss customization options, access sample chapters, and explore pricing plans designed to deliver maximum return on investment. Take the decisive step toward future-proofing your operations and driving sustainable growth by contacting Ketan Rohom now.

- How big is the Bag-in-Tube Packaging Market?

- What is the Bag-in-Tube Packaging Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?