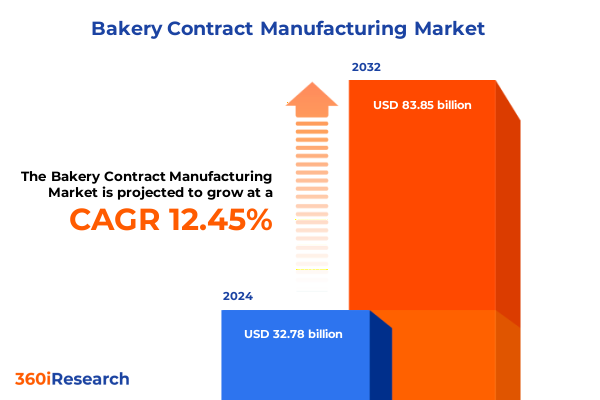

The Bakery Contract Manufacturing Market size was estimated at USD 36.79 billion in 2025 and expected to reach USD 41.28 billion in 2026, at a CAGR of 12.49% to reach USD 83.85 billion by 2032.

Exploring the Evolving Foundations of Bakery Contract Manufacturing and Its Integral Role in Accelerating Client Success and Innovation

Embarking on an exploration of the bakery contract manufacturing domain reveals a landscape shaped by innovation, strategic partnerships, and evolving consumer priorities. This introduction sets out the critical context for understanding how third-party producers collaborate with brands to deliver baked goods at scale. As end consumers demand both classic favorites and novel experiences, contract manufacturers have emerged as indispensable allies for companies aiming to adapt swiftly and efficiently. The mosaic of product types-from artisan breads to granola bars-serves as a testament to the industry’s capacity for versatility.

Within this framework, the interplay of operational excellence, stringent quality control, and flexible manufacturing processes underpins competitive advantage. Early chapters of this report illuminate the core drivers propelling the sector’s development, including shifting retail dynamics, heightened regulatory scrutiny, and the ascent of digital supply chain solutions. By laying a solid foundation, this section primes decision-makers to appreciate the deeper analytical insights that follow, fostering an informed approach to strategic planning and resource allocation.

Uncovering Pivotal Shifts Redefining Bakery Contract Manufacturing with Emerging Technologies and Changing Consumer Expectations

The bakery contract manufacturing arena is undergoing transformative shifts driven by technological integration and changing customer habits. Automation and robotics have transcended pilot installations to become foundational elements within high-throughput lines, enabling producers to maintain consistent quality across batches and scale operations with greater agility. At the same time, advanced analytics platforms are providing real-time visibility into equipment performance and ingredient flow, empowering manufacturers to anticipate maintenance needs and optimize yield.

Parallel to technological advancements, consumer expectations have steered manufacturers toward more agile product development cycles. The clean-label revolution demands ingredient transparency and minimal processing, prompting a rise in collaborations with ingredient innovators that can supply organic, whole grain, and low-sugar formulations. Meanwhile, the surge in direct-to-consumer and digital retail channels has compelled contract manufacturers to refine packaging logistics and shorten lead times. Taken together, these shifts signal a decisive move toward an ecosystem where speed, customization, and sustainability coalesce to redefine competitive boundaries in baked goods production.

Assessing the Comprehensive Ramifications of 2025 United States Tariffs on Operational Costs, Supply Chain Dynamics, and Strategic Resilience in the Bakery Sector

The cumulative impact of the United States’ tariff measures enacted in early 2025 has reverberated across the bakery manufacturing supply chain, reshaping cost structures and procurement strategies. Manufacturers reliant on imported wheat, specialty flours, and equipment components have encountered elevated input prices, which in turn have led to margin compression and upward pricing pressure on finished goods. To counteract these effects, many producers have explored nearshoring alternatives and forged strategic alliances with domestic grain suppliers to stabilize raw material availability and mitigate currency volatility.

Beyond cost implications, the tariffs have acted as an accelerant for diversification within sourcing networks. Firms with established capabilities in both fully baked and par-baked lines have gained a competitive edge by flexibly allocating production based on regional ingredient tariffs and logistical considerations. Concurrently, supply chain leaders have reinforced their resilience by investing in dual-sourcing frameworks and by expanding inventory buffers for critical components. These tactics, while adding layers of operational complexity, serve to protect production continuity and uphold delivery commitments in a climate of regulatory uncertainty.

Unlocking Market Potential through Detailed Segmentation Analysis across Products, Forms, End Uses, Distribution, Ingredients, and Processes

A granular understanding of segmentation reveals the multifaceted nature of the bakery contract manufacturing market. When products are categorized by type, the spectrum spans traditional breads-comprising artisan loaves, sandwich offerings, and mass-market formats-to cakes and pastries, where both cake and delicate pastry formats demand distinct process controls. The cookies and biscuits category covers everything from crisp, shelf-stable biscuits to tender cookies, while the snack bars segment captures energy and granola bar formulations tailored to on-the-go consumption.

Complementing this view, product form segmentation differentiates between fully baked, par-baked, and ready-to-bake goods, reflecting diverse requirements around shelf life and point-of-sale preparation. End-use segmentation further segments demand into foodservice venues such as cafes, hotels, and restaurants, institutional environments including corporate canteens, hospitals, and schools, and retail outlets ranging from convenience and grocery stores to online platforms. Layered on top of these dimensions, distribution channel analysis encompasses convenience stores, foodservice outlets, online deliveries, specialty retailers, and large supermarket and hypermarket chains-each channel driving unique packaging and logistical criteria.

Crucially, ingredient type segmentation spotlights trending health priorities by isolating gluten-free, low-sugar, organic, and whole grain variants, while distinctions in manufacturing process illuminate the technical divide between large-batch and pilot-scale operations and the deployment of semi-automated versus fully automated continuous lines. Collectively, these segmentation lenses enable stakeholders to identify niche opportunities and to tailor product innovation, supply chain design, and marketing approaches for maximum relevance across target end markets.

This comprehensive research report categorizes the Bakery Contract Manufacturing market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Product Form

- Ingredient Type

- Manufacturing Process

- End Use

- Distribution Channel

Examining Evolving Regional Nuances Shaping Bakery Contract Manufacturing Trends in the Americas, EMEA, and Asia-Pacific Markets

Diverse regional dynamics underscore the complexity of serving the global bakery contract manufacturing market. In the Americas, consumer affinity for convenience products and premium, health-focused baked goods has accelerated demand for gluten-free and organic lines, driving producers to refine their clean-label credentials while optimizing cold-chain and frozen distribution practices. North American manufacturers have also leveraged robust domestic grain supplies to offer stable pricing and rapid turnaround, reinforcing the region’s leadership in high-volume bakery production.

Shifting to Europe, the Middle East, and Africa, regulatory pressures around labeling, food safety, and environmental compliance have compelled contract manufacturers to invest heavily in traceability systems and to adopt renewable energy for plant operations. In Western Europe, artisanal and heritage breads coexist alongside fortified products tailored to local taste profiles. Meanwhile, emerging markets in the Middle East and North Africa are witnessing a growing appetite for fortified and fortified-plus products, reflecting public health initiatives and consumer willingness to pay a premium for added nutritional value.

In the Asia-Pacific region, urbanization and rising disposable incomes are fueling rapid expansion in ready-to-eat and snack bar formats, especially within high-density cities where on-the-move consumption is paramount. Local producers are forging joint ventures with multinational brands to accelerate technology transfer and to navigate intricate regulatory landscapes, while also adapting ingredient formulations to regional flavor preferences. These distinct regional drivers demand bespoke operational models and targeted product development roadmaps.

This comprehensive research report examines key regions that drive the evolution of the Bakery Contract Manufacturing market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Contract Bakery Manufacturers Driving Innovation, Efficiency, and Strategic Partnerships across the Global Value Chain

A cadre of leading players has emerged at the forefront of the bakery contract manufacturing sector, setting benchmarks in scale, innovation, and integrated service offerings. Global behemoths have expanded their footprints through strategic acquisitions, forging capacities that span multiple continents and enabling end-to-end solutions from formulation through to packaging. These firms have prioritized investments in automated lines and digital quality assurance systems to support ultra-high throughput while maintaining compliance with stringent food safety standards.

Equally, specialist mid-tier manufacturers have carved out competitive positions by offering bespoke pilot-scale operations and rapid prototyping services, catering to smaller brands and start-ups that require nimble, low-volume production runs. By combining artisanal baking expertise with scalable infrastructure, these providers deliver a unique value proposition that bridges the gap between concept and commercialization.

Across the value chain, select contract manufacturers have also differentiated through vertically integrated ingredient sourcing-particularly for organic, whole grain, and gluten-free raw materials-ensuring traceable supply and consistent quality. Meanwhile, collaborations with packaging innovators and logistics partners have further enhanced the ability to fulfill diverse distribution requirements, from retail ready to foodservice bulk formats. This constellation of capabilities underscores the competitive imperative to blend operational efficiency with specialized know-how.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bakery Contract Manufacturing market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Adventure Bakery LLC by Xami-Inc

- Aryzta AG

- Bake Works, Inc.

- BakeMark USA

- Blackfriars Bakery Limited

- Cibus Nexum B.V.

- Dawn Food Products, Inc.

- Flowers Foods, Inc.

- General Mills, Inc.

- Hearthside Food Solutions

- Hearthside Food Solutions LLC

- Hostess Brands, Inc.

- J&J Snack Foods Corp.

- Kellogg Company

- Lantmannen Unibake USA

- Mondelēz International, Inc.

- Oakhouse Bakery

- Otis Spunkmeyer

- Pacmoore Products Inc.

- Perfection Foods Ltd.

- Richmond Baking

- Stephano Group Ltd.

- Tradition Fine Foods Ltd.

Formulating Actionable Strategies for Industry Leaders to Capitalize on Evolving Consumer Preferences and Technological Advancements in Bakery Manufacturing

Industry leaders seeking sustainable growth must embrace a multifaceted strategy that harmonizes operational excellence with market responsiveness. Prioritizing investment in flexible automation solutions can deliver the dual benefits of high throughput and rapid product changeovers, critical for meeting the demands of dynamic consumer tastes. Simultaneously, establishing collaborative development agreements with ingredient suppliers will accelerate clean-label and functional product launches, capitalizing on health-driven trends without compromising production efficiency.

Supply chain diversification remains a cornerstone of risk mitigation. By adopting dual-sourcing models and forging strategic alliances with both domestic and international suppliers, firms can buffer exposure to tariff fluctuations and raw material shortages. Further, embedding digital supply chain platforms enhances end-to-end visibility, enabling proactive management of inventory levels and transportation disruptions.

Finally, fostering an organizational culture that values continuous improvement and cross-functional collaboration will empower teams to swiftly translate market insights into actionable production roadmaps. Investing in ongoing employee training on new processing techniques and quality management protocols will ensure that talent remains aligned with evolving regulatory and consumer requirements, driving both product excellence and market agility.

Unveiling the Rigorous Research Methodology Underpinning Comprehensive Bakery Contract Manufacturing Insights and Analysis Processes

The research underpinning this report draws on a rigorous combination of secondary and primary methodologies to ensure comprehensive and reliable insights. Secondary research involved the systematic review of trade publications, industry journals, and publicly available corporate disclosures, providing context on regulatory developments, competitive actions, and emerging consumer patterns. Concurrently, proprietary databases were leveraged to map global production footprints, track technology adoption curves, and analyze ingredient sourcing trends.

Primary research entailed structured interviews with senior executives at contract manufacturing firms, ingredient innovators, and channel partners across key regions. These conversations yielded qualitative perspectives on strategic priorities, operational challenges, and innovation roadmaps. Survey instruments distributed to brand managers and procurement leaders further quantified preferences related to product forms, ingredient attributes, and service expectations.

Data triangulation protocols were applied to cross-verify findings from multiple sources, ensuring consistency and robustness. Statistical analyses mapped correlation between operational investments-such as automation or traceability systems-and reported performance outcomes. The final report was subjected to expert panel review, including external consultants with deep knowledge of bakery technology and global supply chain dynamics, guaranteeing the highest degree of accuracy and relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bakery Contract Manufacturing market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bakery Contract Manufacturing Market, by Product Type

- Bakery Contract Manufacturing Market, by Product Form

- Bakery Contract Manufacturing Market, by Ingredient Type

- Bakery Contract Manufacturing Market, by Manufacturing Process

- Bakery Contract Manufacturing Market, by End Use

- Bakery Contract Manufacturing Market, by Distribution Channel

- Bakery Contract Manufacturing Market, by Region

- Bakery Contract Manufacturing Market, by Group

- Bakery Contract Manufacturing Market, by Country

- United States Bakery Contract Manufacturing Market

- China Bakery Contract Manufacturing Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2703 ]

Synthesizing Key Findings to Illuminate Strategic Pathways and Future Opportunities in the Expanding Bakery Contract Manufacturing Arena

In synthesizing the analysis presented throughout this executive summary, several imperatives become clear. First, technological modernization and digital integration are no longer optional enhancements but fundamental requirements for achieving scalability and maintaining quality in high-volume bakery operations. Second, consumer expectations around health, sustainability, and convenience are driving segmentation complexity, necessitating granular product and process differentiation strategies.

Additionally, evolving trade policies-exemplified by the recent tariff shifts in the United States-underscore the importance of supply chain resilience, prompting manufacturers to diversify sourcing and reinforce strategic partnerships across regions. The converging forces of regional consumer preferences and regulatory landscapes further highlight the need for localized operational models that balance global best practices with regional customization.

Ultimately, the competitive edge in bakery contract manufacturing will belong to those organizations that can integrate precise market intelligence with agile execution capabilities. By aligning strategic planning with real-time data and cross-functional collaboration, businesses can seize emerging opportunities, navigate systemic disruptions, and secure lasting differentiation in the ever-evolving baked goods marketplace.

Take the Next Step Toward Growth and Innovation in Bakery Contract Manufacturing with Expert Guidance from Ketan Rohom, Associate Director Sales & Marketing

Engage with Ketan Rohom, Associate Director, Sales & Marketing, to gain unparalleled access to comprehensive bakery contract manufacturing insights and strategic foresight that can power your organization’s next phase of growth. Whether you are looking to deepen your understanding of emerging consumer demands, optimize complex supply chains, or integrate cutting-edge production technologies, personalized guidance ensures your team is equipped with the nuanced intelligence required to outperform competitors.

Reach out to explore tailored service options, secure detailed market intelligence, and collaborate on solutions that align precisely with your operational objectives. The depth of industry expertise on offer will empower your stakeholders to make confident, data-driven decisions-transforming market challenges into opportunities for innovation and differentiation. Start your journey toward enhanced efficiency, profitability, and sustainable competitive advantage by contacting Ketan Rohom today

- How big is the Bakery Contract Manufacturing Market?

- What is the Bakery Contract Manufacturing Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?