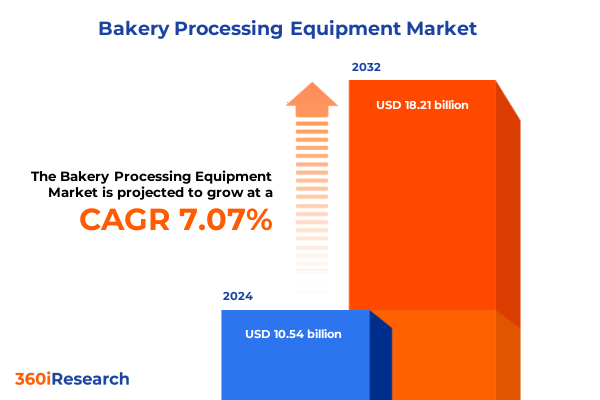

The Bakery Processing Equipment Market size was estimated at USD 11.08 billion in 2025 and expected to reach USD 11.65 billion in 2026, at a CAGR of 7.35% to reach USD 18.21 billion by 2032.

Discover the Evolving Dynamics of Bakery Processing Equipment and Unveil Strategic Opportunities That Drive Innovation and Efficiency Across Production

In today’s dynamic food manufacturing environment, bakery processing equipment has emerged as a cornerstone for delivering consistent product quality and responding to consumer demands for artisanal and specialty baked goods. Equipment ranges from mixers and ovens to advanced proofing and packaging systems, all integrated with digital controls to streamline operations and ensure food safety compliance. As bakery producers face pressures to innovate flavor profiles, expand product lines, and optimize throughput, investment decisions in these critical assets can define market competitiveness and operational resilience.

This report provides a comprehensive exploration of the strategic imperatives driving the bakery processing equipment landscape, focusing on core themes of technological advancement, regulatory catalysts, and evolving customer preferences. Through an authoritative synthesis of industry developments, we aim to equip decision makers with a clear understanding of the forces shaping production capabilities and supply chain dynamics. Moreover, this introduction sets the stage for deeper analysis on transformative shifts, trade policy impacts, segmentation insights, and regional considerations that inform capital allocation and growth strategies

Exploring the Technological Disruptions and Operational Shifts Reshaping the Bakery Processing Equipment Market for Enhanced Productivity Efficiency

The bakery processing equipment sector is undergoing a profound technological metamorphosis driven by Industry 4.0 principles. Advanced automation solutions now enable real-time monitoring of dough rheology, temperature uniformity, and baking cycles, while cloud-based analytics aggregate performance data across multiple facilities. Intelligent robotics handle repetitive tasks such as sheeting and packaging, reducing labor costs and minimizing contamination risks. Furthermore, the integration of predictive maintenance algorithms leverages sensor feeds to forecast equipment servicing needs, thereby preventing unplanned downtime and enhancing overall line efficiency.

Operationally, manufacturers are adopting modular production architectures that can be swiftly reconfigured to accommodate shifting product mixes and seasonal demand fluctuations. Sustainable engineering practices are increasingly embedded into equipment design, with energy-efficient heating systems, water-recycling proofers, and recyclable construction materials mitigating environmental impact. Digital twin simulations allow producers to model throughput scenarios and optimize layouts before committing to capital expenditures. Collectively, these shifts are redefining the bakery equipment landscape by prioritizing agility, scalability, and resource stewardship in pursuit of both profitability and ecological responsibility

Analyzing the Far Reaching Impact of United States Tariffs on Equipment Imports and Evolving Domestic Production Landscape and Supply Chain Adaptations in 2025

In early 2025, the United States enacted a targeted tariff regime on imported bakery processing equipment, imposing a standardized duty rate that significantly altered cost structures for mixers, ovens, and moulding machines. These measures were introduced to bolster domestic manufacturing capacity and safeguard strategic supply chains amid rising global trade tensions. Consequently, importers have encountered up to 25% additional levies on equipment sourced from key manufacturing hubs, prompting many end users to re-evaluate sourcing strategies and consider localized production partnerships.

These tariff adjustments have catalyzed a shift toward nearshoring and diversification of vendor portfolios. While the immediate effect has been an increase in upfront capital expenditure for imported assets, domestic original equipment manufacturers have seized the opportunity to expand production lines and invest in innovation. Supply chain lead times have been extended by procedural customs inspections, yet some industry players report improved reliability by consolidating shipments through vetted domestic channels. Evolving compliance requirements and anti-dumping verifications further underscore the necessity for comprehensive trade-policy intelligence when planning capital investments in bakery processing equipment

Unveiling Critical Insights From Product Type to End Use Segmentation to Drive Strategic Decisions in Bakery Processing Equipment Investments

Understanding the intricacies of bakery processing equipment necessitates a deep dive into segmentation frameworks that guide purchasing decisions and operational strategies. Product type segmentation reveals divergent equipment requirements: bread production lines demand robust, continuous mixers and tunnel ovens, whereas cake manufacturing benefits from precision deck ovens and gentle planetary mixers. In cookie applications-encompassing delicate biscotti and sandwich cookie formats-dividers and moulders must deliver consistent portioning, followed by specialized ovens catering to unique thermal profiles. Pastry operations, whether crafting flaky Danish pastry or buttery puff pastry, rely on high-precision sheeters and spiral mixers to achieve the desired lamination and texture.

Equipment type segmentation further nuances this landscape. Dividers and moulders range from high-capacity round moulder machines to versatile divider moulder solutions, while mixers encompass both spiral and planetary configurations suited to variable batch sizes. Oven architectures include deck, rack, and tunnel variants, each optimized for specific throughput and product characteristics. Packaging equipment leverages weighing machines and automated wrapping solutions, and proofers come in cabinet and rack styles for flexible fermentation control. Sheeter offerings span horizontal and vertical designs, aligning with spatial constraints and process workflows. Additionally, capacity tiers-low, medium, and high-intersect with technology levels from manual to semi-automatic and fully automated systems. Distribution channels, whether through aftermarket maintenance service providers, ecommerce platforms and manufacturer portals, or direct built-to-order and standard models from original manufacturers, shape post-purchase support and upgrade pathways. Finally, end-use segmentation spans foodservice outlets-from hotel bakeries and restaurants to cafeteria operations-to large-scale industrial facilities and retail bakery points of sale, each presenting distinct throughput and customization demands

This comprehensive research report categorizes the Bakery Processing Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Equipment Type

- Capacity

- Technology

- Distribution Channel

- End Use

Assessing How Regional Dynamics Across the Americas Europe Middle East and Africa and Asia Pacific Drive Distinct Trends in Bakery Processing Equipment Demand

Regional variations exert a profound influence on the adoption and evolution of bakery processing equipment. In the Americas, producers benefit from a mature supply chain ecosystem and access to both high-capacity tunnel ovens and artisanal deck ovens for specialized applications. Regulatory standards and sustainability mandates are driving investment in energy-efficient heating technologies and closed-loop water systems. Meanwhile, Latin American markets exhibit growing demand for modular equipment that can serve both urban and emerging rural bakeries, facilitating decentralized production models.

Across Europe, the Middle East, and Africa, a tapestry of regulatory frameworks and cultural traditions shapes equipment preferences. European manufacturers lead in advanced automation integration, while Middle Eastern artisan bakeries continue to rely on manual and semi-automatic proofers optimized for regional breads. In Africa, large-scale development projects are spurring demand for medium-capacity continuous mixers and mobile proofing units. Asia Pacific markets remain the fastest growing segment, with China and India investing heavily in industrial bakery lines and Southeast Asian nations prioritizing flexible production cells for local snack and pastry varieties. Across all regions, sustainability and digital connectivity emerge as common themes, influencing the selection and upgrade cycles for processing equipment

This comprehensive research report examines key regions that drive the evolution of the Bakery Processing Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Industry Players and Strategic Partnerships That Are Shaping Innovation and Competition in Bakery Processing Equipment Sector

Leading industry players are driving innovation and competitive differentiation through strategic partnerships, targeted acquisitions, and robust after-sales service networks. Global engineering firms specializing in thermal processing systems have expanded their portfolios with turnkey bakery lines that integrate mixing, proofing, baking, and packaging into seamless workflows. Collaborative initiatives between original equipment manufacturers and software providers have yielded advanced control platforms capable of orchestrating entire production cells via single-pane-of-glass dashboards.

Competition is further intensified by regional and niche suppliers who excel in customization and rapid delivery for emerging markets. Some enterprises have embraced joint ventures with local fabricators to secure market access while adhering to domestic content requirements. Moreover, aftermarket suppliers that offer comprehensive maintenance services and dedicated spare parts programs are solidifying customer loyalty and recurring revenue streams. Through a combination of R&D alliances, digital service offerings, and global service footprints, these key companies continue to shape the future of bakery processing equipment and set benchmarks for reliability, precision, and sustainability

This comprehensive research report delivers an in-depth overview of the principal market players in the Bakery Processing Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ali Group S.r.l.

- Anko Food Machine Co., Ltd.

- Baker Perkins Ltd.

- Bühler Holding AG

- DIOSNA Dierks & Söhne GmbH

- FRITSCH GmbH

- GEA Group AG

- Gemini Bakery Equipment Company

- Global Bakery Solutions Ltd.

- Heat and Control, Inc.

- JBT Corporation

- Koenig Maschinen GmbH

- Markel Food Group

- Rademaker B.V.

- Reading Bakery Systems, Inc.

- Rheon Automatic Machinery Co., Ltd.

- Tartler GmbH & Co. KG

- The Middleby Corporation

- TNA Australia Pty Ltd.

- VMI Group B.V.

Empowering Industry Leaders With Targeted Strategies to Enhance Operational Efficiency Profitability and Sustainable Growth Within Bakery Processing Equipment

Industry leaders seeking to enhance operational efficiency and sustainable growth should prioritize the adoption of modular automated lines that facilitate rapid changeovers and scalable throughput. Investing in digital twins for process simulation can accelerate time to market for new product variants while minimizing trial-and-error costs. Furthermore, forging alliances with ingredients suppliers and technology vendors can unlock co-innovation opportunities, enabling the development of equipment optimized for emerging specialty segments such as plant-based and gluten-free baked goods.

To mitigate supply chain risks and regulatory volatility, executives should develop diversified procurement strategies that incorporate multiple sourcing partners across geographies. Implementing predictive maintenance frameworks using machine-learning analytics will minimize unplanned downtime and optimize total cost of ownership. In parallel, organizations must invest in workforce training programs to upskill technicians on digital control systems and sustainability protocols. By embedding circular economy principles-such as recyclable equipment components and energy-recovery systems-into capital planning, industry leaders can achieve both environmental and financial performance targets

Explaining the Rigorous Research Design Data Collection and Analytical Techniques Underpinning the Insights in the Bakery Processing Equipment Study

The insights presented in this report derive from a rigorous, multi-phase research methodology designed to ensure both depth and validity. Secondary research included a comprehensive review of industry publications, regulatory filings, and technology white papers to map historical trends and emerging patterns. Primary research was conducted through structured interviews with senior executives at equipment manufacturers, procurement specialists at leading bakery operations, and independent service providers. A series of expert panels and in-field site visits across key production facilities provided empirical validation of equipment performance and adoption barriers.

Analytical rigor was maintained through the application of established frameworks, including SWOT evaluations, PESTEL analysis, and Porter’s Five Forces, to contextualize competitive dynamics and regulatory influences. Data triangulation methods were employed to reconcile findings from diverse sources, ensuring reliability and consistency. Quantitative and qualitative insights were synthesized to identify critical inflection points in technology uptake, tariff impacts, and regional market trajectories. The resulting narrative offers an authoritative foundation for strategic decision making, grounded in transparent research protocols and continuous data verification

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bakery Processing Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bakery Processing Equipment Market, by Product Type

- Bakery Processing Equipment Market, by Equipment Type

- Bakery Processing Equipment Market, by Capacity

- Bakery Processing Equipment Market, by Technology

- Bakery Processing Equipment Market, by Distribution Channel

- Bakery Processing Equipment Market, by End Use

- Bakery Processing Equipment Market, by Region

- Bakery Processing Equipment Market, by Group

- Bakery Processing Equipment Market, by Country

- United States Bakery Processing Equipment Market

- China Bakery Processing Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 3021 ]

Summarizing the Key Findings and Implications for Stakeholders to Navigate Challenges and Leverage Opportunities in the Bakery Processing Equipment Industry

The bakery processing equipment sector is poised at the intersection of technological innovation, regulatory transformation, and evolving consumer preferences. Key findings highlight the accelerating shift toward fully automated, data-driven production systems, the significant effects of 2025 tariff measures on supply chain strategies, and the nuanced segmentation dynamics that influence equipment selection from mixers to packaging solutions. Regional analysis underscores the importance of tailoring approaches to local regulatory landscapes and cultural baking traditions while capitalizing on global best practices in sustainability and digital integration.

These insights have profound implications for stakeholders across the value chain. Manufacturers must align product portfolios with emerging specialty bakery trends and strengthen service ecosystems to drive customer retention. Processors should leverage modular equipment configurations and predictive maintenance to optimize operational agility. Investors and policymakers will benefit from an informed perspective on trade policies and infrastructure investments that shape domestic production capabilities. As the industry navigates these complex variables, proactive adaptation and collaborative innovation will determine which organizations excel in delivering quality, consistency, and profitability

Contact Ketan Rohom Associate Director Sales and Marketing to Secure Your Access to Comprehensive Bakery Processing Equipment Market Research Report Today

Secure your strategic advantage in the evolving bakery processing equipment landscape by engaging directly with Ketan Rohom Associate Director Sales and Marketing. Gain personalized guidance on leveraging deep-dive research insights to inform your procurement, investment, and innovation roadmaps. Ketan Rohom will work closely with you to identify the most relevant findings tailored to your organization’s unique requirements and growth ambitions, ensuring you capitalize on emerging opportunities and mitigate potential disruptions.

Reach out today to initiate a confidential consultation and secure your access to the full market research report. Empower your leadership team with authoritative analysis, actionable recommendations, and competitive intelligence that drive sustainable performance and market leadership. Don’t miss the chance to align your strategic initiatives with the most current trends and data in bakery processing equipment-partner with an expert who understands your challenges and is dedicated to your success

- How big is the Bakery Processing Equipment Market?

- What is the Bakery Processing Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?