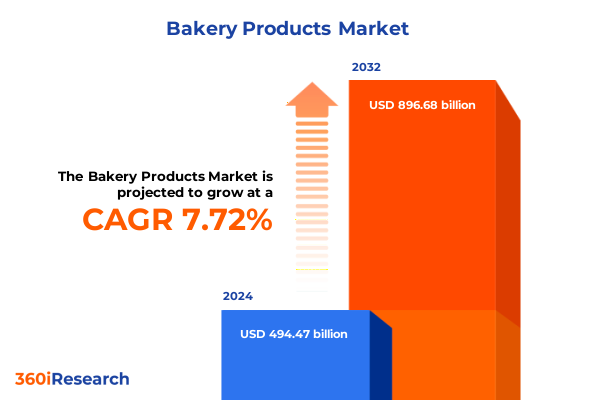

The Bakery Products Market size was estimated at USD 531.31 billion in 2025 and expected to reach USD 571.05 billion in 2026, at a CAGR of 7.76% to reach USD 896.68 billion by 2032.

Unveiling the Bakery Sector’s Multifaceted Transformation Driven by Evolving Consumer Preferences and Technological Advancements in Production

The bakery products sector is at a pivotal moment, shaped by ever-shifting consumer tastes and heightened expectations around quality, health, and convenience. In recent years, a confluence of dietary trends-ranging from clean labels to plant-based ingredients-has challenged traditional formulations and propelled manufacturers to innovate continuously. Simultaneously, digital commerce and omnichannel retailing have altered how end users discover, purchase, and engage with baked goods, demanding a seamless fusion of online and offline experiences.

Against this backdrop of dynamic change, companies are compelled to realign their value propositions, optimize production workflows, and forge strategic partnerships across the supply chain. Raw material suppliers, ingredient formulators, and equipment manufacturers are collaborating more closely with bakery brands to accelerate product development cycles without compromising on authenticity or flavor. At the same time, regulatory scrutiny around nutritional claims, labeling accuracy, and ingredient sourcing has intensified, reinforcing the need for robust compliance frameworks.

This executive summary distills the most salient factors driving evolution in the bakery landscape, from transformative market shifts to the tangible effects of recent tariff policies. Through a comprehensive segmentation lens and rigorous methodological approach, we present actionable insights and recommendations tailored to industry leaders. As consumer expectations continue to evolve, the insights herein offer a strategic foundation for anticipating change, navigating complexities, and capturing new avenues for sustainable growth.

Unmasking the Profound Disruptive Forces and Transformative Shifts Redefining Consumer Engagement and Product Development in Bakery Offerings

Beyond incremental improvements, the bakery sector is experiencing paradigm shifts that touch every facet of the value chain. Clean-label formulations and allergen-free options have accelerated beyond niche applications to become mainstream requirements, prompting ingredient suppliers to offer novel plant-based proteins and ancient grains. Parallel to this nutritional renaissance, sustainability has risen to the forefront, with manufacturers targeting carbon footprint reduction through renewable energy integration, waste valorization initiatives, and eco-conscious packaging solutions.

Digitalization represents another frontier of disruption. From AI-driven demand forecasting to automated recipe batching, cutting-edge technologies are streamlining production, reducing waste, and enhancing consistency. In parallel, direct-to-consumer platforms and subscription models are empowering artisanal and regional bakers to scale while maintaining authenticity. This democratization of distribution channels not only fosters innovation but also compels established brands to differentiate through experiential marketing, provenance storytelling, and hyper-personalization.

Taken together, these transformative forces are redefining competitive dynamics. Firms able to harness data intelligence, embrace sustainable practices, and respond swiftly to evolving consumer sentiment will secure a decisive edge. Conversely, those that rely on legacy processes risk obsolescence in an environment where agility and authenticity are paramount.

Assessing the Far-reaching Repercussions of 2025 United States Tariff Measures on Ingredient Sourcing, Pricing Structures, and Competitive Dynamics in Bakery Markets

In 2025, new tariff measures imposed by the United States government have introduced material complexity into ingredient sourcing and cost structures across the bakery industry. Higher duties on imported wheat and specialty grains have translated into increased procurement costs for artisanal and mass-market bakers alike. Component surcharges on sugar derivatives and certain packaging materials have further strained margins, compelling firms to reassess supplier agreements and explore alternative inputs.

These levies have not only driven up raw material expenses but have also reshaped trade flows. Some manufacturers have pivoted toward domestic milling partners or regional procurement hubs to mitigate exposure; others have engaged in scenario planning to balance cost containment with ingredient authenticity expectations. The ripple effects extend to pricing strategies, as retailers and foodservice operators calibrate their margins and promotional activities in light of altered cost bases.

Amid these challenges, companies demonstrating resilience have adopted multi-sourcing frameworks and leveraged forward purchasing contracts to lock in price certainty. Meanwhile, a subset of innovators is exploring hybrid formulations that blend tariff-impacted imports with local alternatives, ensuring both regulatory compliance and product quality. As the year progresses, the industry’s ability to navigate these tariff headwinds will be a critical determinant of competitive positioning and profitability.

Decoding Consumer Behavior and Market Opportunities Through Detailed Segmentation by Product Type, Form Profile, Distribution Pathways, and End-use Applications

A nuanced understanding of market segmentation unveils the distinct growth narratives within the bakery products domain. When viewed through the lens of product type, the breadth of offerings encompasses staple loaves-where subsegments like multigrain, sourdough, white, and whole wheat each respond to specific nutritional and taste preferences-alongside indulgent categories such as cakes, featuring cheesecakes, layered creations, and classic sponge variants. Cookies, from chocolate chip to oatmeal and sugar compositions, highlight the balance between nostalgia and flavor innovation, while muffins and cupcakes-including blueberry, chocolate, and filled options-cater to on-the-go consumption and premium personalization. Finally, delicate pastries like croissants, Danish, and puff variants underscore the interplay of artisanal craftsmanship and scalable production methods.

Form influences purchasing behavior, as fresh items appeal to immediate consumption and retail freshness guarantees, whereas frozen and part-baked formats support extended shelf life, streamlined logistics, and in-store finishing programs. Distribution channels further diversify reach, with offline outlets-from specialty bakeries to supermarket aisles-complemented by the rapid ascent of digital storefronts. This dual-channel dynamic compels manufacturers to tailor packaging, branding, and promotional strategies to each context. End-use segmentation, spanning commercial venues like cafeterias, foodservice establishments, hotels, and restaurants, alongside household consumption, delineates divergent quality thresholds and volume requirements, necessitating flexible production runs and differentiated service levels.

By integrating these segmentation dimensions, stakeholders can pinpoint white-space opportunities-whether introducing an artisan-style multigrain loaf through subscription services or supplying bulk frozen pastries to hospitality chains-thus aligning product innovation, marketing, and distribution in concert with targeted audience expectations.

This comprehensive research report categorizes the Bakery Products market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Distribution Channel

- End User

Illuminating Regional Variances in Consumption Patterns, Distribution Networks, and Growth Drivers Across Americas, Europe Middle East Africa, and Asia-Pacific

Regional dynamics in the bakery market reveal unique consumption patterns and growth trajectories. In the Americas, traditional bread varieties remain staples, yet there is surging interest in high-value items such as protein-fortified loaves and keto-friendly cakes. North American markets benefit from well-established cold-chain infrastructures that support frozen and part-baked portfolios, while Latin American consumers exhibit a strong cultural affinity for sweet pastries and local flavor infusions, driving regional recipe adaptations.

Europe, the Middle East, and Africa present a tapestry of tastes, from Western European artisanal sourdough movements to Middle Eastern flatbread formats and North African sweet pastries enriched with date and nut blends. Sustainability mandates in EMEA are particularly stringent, spurring innovations in upcycled ingredients and recyclable packaging. These regulatory imperatives shape both ingredient selection and production methodologies, elevating sustainability as a core competitive dimension.

Across Asia-Pacific, rapid urbanization and rising disposable incomes fuel demand for on-the-go bakery formats and premium indulgences. Markets in East Asia emphasize small-batch confectioneries and fusion-style pastries, while Southeast Asian producers incorporate tropical flavors and locally sourced ingredients to cater to regional palates. The diversity of retail landscapes-from bustling markets to digital-first grocery platforms-further underlines the necessity for adaptable distribution models and culturally attuned product development.

This comprehensive research report examines key regions that drive the evolution of the Bakery Products market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Movements, R&D Focus, and Competitive Positioning Among Leading Global and Domestic Bakers and Ingredient Suppliers

The global bakery products arena is characterized by a mix of deeply entrenched multinationals and nimble regional players. Industry leaders continually strive to balance scale with innovation, investing heavily in R&D to create low-sugar, clean-label variants and premium artisan lines. Strategic acquisitions and joint ventures have expedited portfolio diversification, enabling established brands to leverage local expertise and distribution networks in emerging markets.

Ingredient suppliers are equally pivotal, introducing enzyme-based solutions to extend freshness and plant-derived emulsifiers to replace synthetic alternatives. Collaborative partnerships between ingredient innovators and bakery brands are accelerating product development timelines, resulting in seasonal flavor launches, functional bakery snacks, and protein-enriched morning goods. Meanwhile, private-label expansion by major retail groups is intensifying competition, prompting brand-name manufacturers to reinforce differentiation through storytelling, traceability, and limited-edition offerings.

In parallel, packaging technology firms are pioneering compostable materials and smart packaging systems that monitor freshness in real time. These cross-sector alliances underscore the evolving nature of competition, where ingredient invention, brand storytelling, and sustainability credentials converge to shape consumer choice and market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Bakery Products market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpha Baking Company, Inc.

- Arca Continental, S. A. B. de C. V.

- Associated British Foods PLC

- B&G Foods, Inc.

- Bahlsen GmbH & Co. KG

- Bakers Delight Holdings Limited

- Britannia Industries Limited

- Campbell Soup Company

- Conagra Brands, Inc.

- Crazy Snacks Pvt. Ltd.

- Dr. August Oetker KG

- Elliott's Bakery

- Finsbury Food Group PLC

- Flowers Foods, Inc.

- General Mills, Inc.

- Grupo Bimbo, S.A.B. de C.V.

- Hostess Brands, Inc. by The J. M. Smucker Company

- Inspire Brands, Inc.

- ITC Limited

- Kellanova

- Kerry Group PLC

- King's Hawaiian Holding Co, Inc.

- Lantmännen ek för

- Mondelez International, Inc.

- Nestlé S.A.

- PepsiCo, Inc.

- Rich Products Corporation

- The Hershey Company

- TreeHouse Foods, Inc.

- Warburtons Limited

- Yamazaki Baking Co., Ltd.

Formulating Actionable Strategic Imperatives for Industry Leaders to Capitalize on Emerging Trends, Enhance Resilience, and Drive Sustainable Growth

To thrive amid increasing complexity, industry leaders must adopt a multi-pronged strategic approach. First, diversifying sourcing pipelines through alliances with domestic and regional suppliers will hedge against tariff volatility and supply chain disruptions. By integrating locally sourced grains and co-manufactured ingredients, firms can protect margins while appealing to the growing consumer demand for provenance and traceability.

Second, targeted investment in clean-label and functional bakery innovations-leveraging ancient grains, plant proteins, and fiber-rich formulations-will fortify product portfolios against shifting nutritional guidelines. These development efforts should align with consumer-driven health trends, supported by transparent communication on labeling and certifications. Concurrently, scaling digital capabilities-from predictive demand analytics to e-commerce fulfillment-will ensure seamless integration across offline and online touchpoints.

Finally, embedding sustainability across the value chain-through energy-efficient production, waste-to-value programs, and recyclable or compostable packaging-will resonate with eco-conscious consumers and preempt regulatory mandates. By prioritizing these imperatives, industry players can enhance resilience, unlock new growth vectors, and secure enduring competitive advantage.

Outlining a Rigorous Mixed-method Research Framework Combining Quantitative Analysis, Qualitative Insights, and Multi-tier Validation Processes

This research is built upon a robust mixed-method framework designed to ensure depth, accuracy, and strategic relevance. Quantitative analysis draws from a combination of publicly available trade data, proprietary procurement datasets, and point-of-sale information across diverse retail channels. These numerical insights are complemented by qualitative interviews with senior executives at bakery manufacturers, ingredient suppliers, distributors, and leading foodservice operators.

Furthermore, an extensive survey of consumer preferences and purchasing behaviors was administered to a stratified sample of households and commercial buyers, capturing attitudes toward nutrition, sustainability, and convenience. Secondary literature from regulatory bodies, industry associations, and technology providers has been systematically reviewed and triangulated against primary findings. A multi-tier validation process, incorporating peer review by subject-matter experts and cross-functional workshops, has refined the insights to ensure practical applicability and strategic foresight.

Through this meticulous methodology, the report delivers a comprehensive understanding of market dynamics, enabling decision-makers to draw upon both quantitative rigor and qualitative nuance when crafting their strategic roadmaps.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Bakery Products market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Bakery Products Market, by Product Type

- Bakery Products Market, by Form

- Bakery Products Market, by Distribution Channel

- Bakery Products Market, by End User

- Bakery Products Market, by Region

- Bakery Products Market, by Group

- Bakery Products Market, by Country

- United States Bakery Products Market

- China Bakery Products Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Synthesizing Key Learnings and Critical Insights to Offer a Cohesive Perspective on the Future Trajectory of Bakery Product Paradigms

The evolving bakery landscape demands that stakeholders remain vigilant to consumer preferences, regulatory shifts, and supply chain complexities. Key transformative drivers-ranging from health-centric formulations and sustainability mandates to digital retail innovations-are reshaping how baked goods are developed, produced, and delivered. The 2025 tariff adjustments have further underscored the importance of agile sourcing strategies and cost-management disciplines.

Deep segmentation analysis, spanning product types from multigrain breads to gourmet pastries, across fresh and frozen formats, distribution channels, and end-use categories, highlights the untapped potential within targeted niches. Regional insights reveal that while mature markets prioritize premium and clean-label offerings, emerging geographies are fertile grounds for value-added and culturally resonant bakery solutions. Competitive intelligence underscores the crucial role of ingredient partnerships, technological innovation, and brand differentiation in sustaining leadership.

By synthesizing these insights, executives can navigate the intersection of taste, health, and profitability. A proactive stance-characterized by diversified sourcing, strategic R&D, and comprehensive sustainability programs-will be instrumental in capturing growth and fostering long-term resilience. The future of bakery products belongs to those who can seamlessly integrate market understanding with operational excellence and visionary leadership.

Seizing the Opportunity to Secure In-depth Insights and Drive Informed Decisions by Acquiring the Comprehensive Bakery Market Research Report Today

To access the full depth of strategic insights, comprehensive data analyses, and expert commentary that underpin this executive summary, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. He can guide you through the report’s scope and how it addresses your specific business objectives. By partnering with him, you’ll gain immediate access to carefully curated market intelligence that empowers you to make informed decisions, mitigate risks, and capitalize on emerging bakery product opportunities. Don’t miss this chance to elevate your competitive standing-contact Ketan Rohom today to secure your copy of the complete bakery market research report and unlock actionable strategies tailored to your organization’s growth trajectory

- How big is the Bakery Products Market?

- What is the Bakery Products Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?