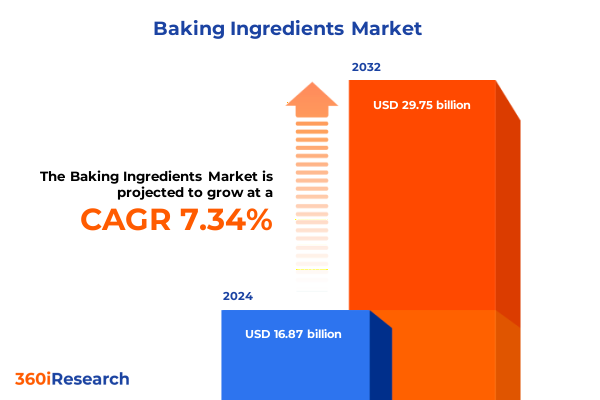

The Baking Ingredients Market size was estimated at USD 18.12 billion in 2025 and expected to reach USD 19.47 billion in 2026, at a CAGR of 8.81% to reach USD 32.75 billion by 2032.

Unveiling the complex interplay of health demands, sustainability priorities, and digital innovation transforming the global baking ingredients landscape

The baking ingredients market is at a pivotal juncture as evolving consumer preferences, technological advances and sustainability imperatives converge to reshape the supply chain and product innovation. In recent years, there has been a clear shift toward clean labels and natural formulations. Major global players have announced plans to eliminate artificial colorings and simplify ingredients lists, reflecting a broader consumer demand for transparency and health-centric products. This movement is underpinned by rising awareness of diet-related health concerns and an appetite for minimally processed foods, which has prompted manufacturers to explore plant-based emulsifiers, enzyme-driven leavening solutions and naturally derived flavorings.

Simultaneously, the rise of online baking communities and social media platforms has democratized recipe sharing and elevated consumer expectations for premium, artisanal experiences. This trend is influencing ingredient portfolios, with bakers seeking specialized flours such as gluten-free and ancient grains, as well as exotic spice blends and functional additives like high-protein powders and prebiotic fibers. As a result, companies are investing in R&D to develop novel ingredient systems that cater to both home enthusiasts and industrial bakers, ensuring consistent performance while delivering on sensory and nutritional targets.

How emerging health trends, technological breakthroughs, and sustainability imperatives are revolutionizing ingredient sourcing and product development

A fundamental transformation in the baking ingredients industry is driven by the pursuit of health and wellness, technological breakthroughs and a commitment to environmental stewardship. The clean-label movement has accelerated reformulations, leading to a surge in demand for ingredients that are free from synthetic additives and verifiable through fully traceable supply chains. Innovations in regenerative agriculture, exemplified by sourdough cultures sourced from whole wheat flour cultivated under sustainable practices, are redefining how raw materials are procured and marketed to discerning consumers.

At the same time, digital technologies are increasingly embedded in ingredient development and distribution. AI-driven analytics enable real-time insights into consumer behavior, while digital platforms provide personalized recipe recommendations and direct feedback loops that inform product roadmaps. This fusion of data science and food technology is yielding functional ingredients tailored to niche dietary needs, such as gluten-free flour blends optimized for texture retention and plant-based emulsifiers engineered for superior mouthfeel. As industry leaders integrate sustainability metrics alongside performance benchmarks, the result is a more resilient, transparent and consumer-centric baking ingredients ecosystem.

Assessing far-reaching financial pressures and supply chain disruptions triggered by U.S. tariff measures on essential baking imports

Recent U.S. trade policies have introduced significant headwinds for the baking ingredients industry, imposing tariffs that threaten to disrupt both cost structures and supply chains. According to the American Bakers Association, levies on imports from Canada, Mexico and China could add approximately $454 million in additional costs over the coming year, with a 25 percent tariff on Canadian and Mexican goods and a ten percent tax on Chinese products exerting particular pressure on key ingredient imports such as specialty flours, packaging materials and flavor extracts. This cost escalation is exacerbated by the recent imposition of higher tariffs on strategic equipment and raw materials, which may ultimately be passed through to consumers or absorbed by manufacturers seeking to maintain competitiveness.

Furthermore, targeted tariffs on refined sugar have led to a surge in wholesale prices, pushing costs upward by more than 15 percent in early 2025. In response, many bakers are exploring alternative sweeteners and investing in strategic sourcing partnerships to mitigate volatility. Despite the potential for tariff relief through diplomatic negotiations, the current landscape demands agile risk management and proactive supply chain diversification to safeguard margins and ensure continuity of supply.

Decoding diverse consumer needs and market opportunities through ingredient types, applications, channels, forms, end users, and nature segmentation

Understanding the baking ingredients market requires a nuanced look at ingredient types, which encompass a broad array of fats and oils, flavor enhancers, flours, leavening agents and sweeteners. Among fats and oils, producers are balancing traditional offerings such as butter and margarine with growing volumes of vegetable oils tailored for specific baking applications. Meanwhile, flour portfolios extend from conventional wheat flour to specialty and gluten-free variants, each formulated to meet unique performance and dietary requirements. Leavening agents range from chemical powders to yeast systems, with chemical subtypes calibrated for instant or delayed gas release and yeast strains engineered for rapid fermentation and flavor development. Sweeteners span conventional sugar alongside syrups and artificial alternatives, offering bakers flexibility in cost, sweetness profile and functional properties.

In terms of application, the market serves core segments including bread products, cakes and pastries-spanning indulgent doughnuts and delicate croissants-as well as confectionery and cookies. Distribution channels have evolved to include traditional supermarkets and hypermarkets alongside specialty baking stores and rapidly expanding online retail platforms, each channel presenting distinct margin and service expectations. Market participants must also address preferences for dry, frozen and liquid forms of ingredients, catering to industrial-scale production or do-it-yourself home baking. Finally, the end-user dimension differentiates commercial bakeries from household consumers, while product nature-conventional versus organic-adds an additional layer of segmentation, reflecting divergent consumer values and regulatory frameworks.

This comprehensive research report categorizes the Baking Ingredients market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Ingredient Type

- Form

- Nature

- Application

- Distribution Channel

- End User

Evaluating the distinct growth trajectories and regulatory landscapes influencing baking ingredient demand across major global regions

Across the Americas, the baking ingredients sector is characterized by robust innovation and acute sensitivity to trade policy shifts. The United States remains a crucial hub for plant-based emulsifier development and enzyme technologies, even as tariff measures challenge traditional supply chains. Emerging markets in Latin America are witnessing a parallel surge in demand for specialty flours and natural sweeteners, driven by growing middle-class consumption and urbanization.

In Europe, the Middle East and Africa, stringent regulatory environments and consumer advocacy for health and sustainability are catalyzing the adoption of clean-label ingredients and regenerative sourcing models. European producers are spearheading initiatives in transparent traceability, while Gulf markets are embracing premium ingredients to serve aspirational coastal urban centers.

The Asia-Pacific landscape is marked by rapid industrialization and a vibrant fusion of local and global baking traditions. Demand for functional and organic baking ingredients is accelerating across East and South Asia, with manufacturers leveraging advanced formulation technologies to deliver gluten-free, high-protein and ancient-grain variants. Supply chain innovation is also evident in the region’s growing network of e-commerce platforms, which connect ingredient suppliers directly with small-scale bakers and emerging food-tech enterprises.

This comprehensive research report examines key regions that drive the evolution of the Baking Ingredients market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling leading ingredient producers and innovators redefining quality, sustainability, and technological advancement in the baking sector

The competitive landscape of baking ingredients is shaped by a mix of multinational conglomerates, specialized ingredient houses and emerging innovators. Global leaders have expanded their portfolios through strategic acquisitions and joint ventures, securing access to plant-based emulsifier lines and enzyme-enhanced leavening systems. Companies traditionally associated with starch and sweetener solutions are investing heavily in functional proteins, while flavor houses are deploying fermentation technology to produce natural extracts and colorants at scale.

Mid-sized regional players are carving out niches in clean-label and organic segments, offering tailored formulations that comply with local regulations and cater to artisanal bakeries. Start-ups with direct-to-consumer platforms are gaining traction by providing curated ingredient kits and personalized recipe services. Collectively, these companies are reshaping competitive dynamics through agile innovation, strategic partnerships and differentiated product offerings that meet evolving consumer preferences and operational demands.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baking Ingredients market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer Daniels Midland Company

- Associated British Foods plc

- Barry Callebaut

- Bunge Limited

- Cargill, Incorporated

- Chr. Hansen Holding A/S

- DSM-Firmenich

- Ingredion

- Ingredion Incorporated

- International Flavors & Fragrances (IFF)

- International Flavors & Fragrances, Inc.

- Kerry Group plc

- Koninklijke DSM N.V.

- Lesaffre

- Puratos Group

- Tate & Lyle PLC

Strategic directives for strengthening resilience, capturing emerging trends, and fostering sustainable growth in the baking ingredient industry

Industry leaders should prioritize the diversification of sourcing strategies by forging partnerships with suppliers practicing regenerative agriculture and robust traceability. Implementing multi-sourcing models, including domestic and near-shore procurement, will reduce exposure to tariff-driven price shocks and logistical disruptions. Simultaneously, investing in digital supply chain platforms will enhance visibility, enabling real-time adjustments to inventory and procurement protocols.

Product innovation must continue to focus on clean-label, functional and plant-based solutions. Cross-functional teams combining food science, consumer insights and digital analytics can accelerate the development of ingredient systems tailored to specific applications, such as gluten-free breads or high-protein snacks. Engaging in co-creation with key customers, including industrial bakers and food-service chains, will deepen collaboration and de-risk new product launches.

Lastly, sustainability should be embedded across all facets of operations. Adopting circular economy principles in packaging and process engineering, securing certifications for organic and fair-trade sourcing, and transparently communicating environmental metrics will strengthen brand equity and meet the expectations of eco-conscious consumers.

Transparent overview of data sources, analytical frameworks, and validation processes underpinning this comprehensive market study

This report integrates a dual research approach combining primary and secondary data collection. Primary insights were gathered through in-depth interviews with executive stakeholders at leading ingredient manufacturers, commercial bakeries and regulatory bodies. These conversations provided qualitative context on supply chain dynamics, product innovation pipelines and the impact of evolving trade policies.

Secondary research encompassed a comprehensive review of industry publications, patent filings, regulatory filings and financial statements. Credible sources included government trade reports, sustainability certifications and technical whitepapers, ensuring a robust foundation of factual data. Quantitative data underwent triangulation using multiple data points, including import-export statistics, industry association cost analyses and macroeconomic indicators, to validate assumptions and strengthen forecast accuracy.

The analytical framework employed a bottom-up segmentation model, cross-referenced with top-down market dynamics to identify growth pockets and risk factors. Sensitivity analyses were conducted to evaluate tariff impact scenarios and raw material price fluctuations. Finally, findings were vetted through peer review by subject-matter experts to guarantee methodological rigor and actionable insights.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baking Ingredients market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baking Ingredients Market, by Ingredient Type

- Baking Ingredients Market, by Form

- Baking Ingredients Market, by Nature

- Baking Ingredients Market, by Application

- Baking Ingredients Market, by Distribution Channel

- Baking Ingredients Market, by End User

- Baking Ingredients Market, by Region

- Baking Ingredients Market, by Group

- Baking Ingredients Market, by Country

- United States Baking Ingredients Market

- China Baking Ingredients Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2067 ]

Synthesis of critical market drivers and future imperatives for stakeholders navigating the evolving baking ingredients landscape

The baking ingredients market is undergoing a profound transformation driven by health-oriented consumer behaviors, regulatory evolution and technological innovation. Clean-label and functional ingredients have moved from niche to mainstream, compelling manufacturers to adapt in near real-time. At the same time, geopolitical factors such as tariffs and trade policy shifts have underscored the importance of supply chain resilience and strategic diversification.

Segmentation analysis reveals distinct opportunities across ingredient types, applications and end users, indicating that tailored product development and channel strategies will be critical for sustained success. Regional variations highlight the need to balance global scale with local relevance, leveraging technological capabilities while maintaining agility in response to policy changes.

As the industry continues to evolve, stakeholders who proactively embrace sustainability, foster collaborative innovation and harness data-driven decision-making will be best positioned to thrive. The convergence of consumer expectations, digitalization and regulatory oversight presents both challenges and unprecedented avenues for value creation in the baking ingredients landscape.

Partner with Ketan Rohom to obtain exclusive market insights and strategic guidance tailored for baking ingredients industry growth

To explore the full depth of market trends, competitive dynamics and tailored growth opportunities in the baking ingredients sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing. He can provide you with an exclusive sample of the comprehensive market research report, detailed data models and strategic insights designed to accelerate your decision-making. Engage with Ketan to secure custom consulting sessions, gain privileged early access to emerging trend analyses and optimize your product roadmaps with data-driven foresight. Contacting Ketan today ensures you stay at the forefront of innovation and maintain a decisive edge in a rapidly evolving landscape.

- How big is the Baking Ingredients Market?

- What is the Baking Ingredients Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?