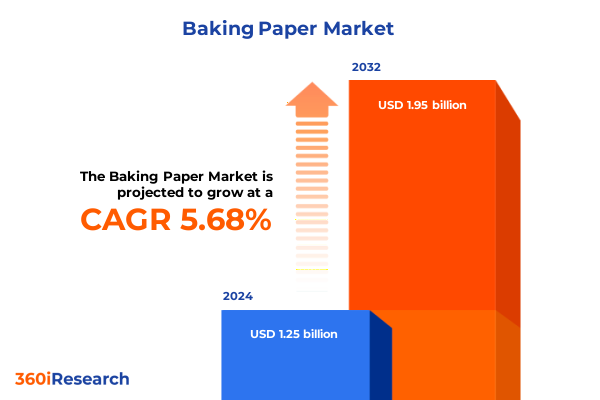

The Baking Paper Market size was estimated at USD 1.25 billion in 2024 and expected to reach USD 1.32 billion in 2025, at a CAGR of 5.68% to reach USD 1.95 billion by 2032.

Unveiling the Essential Function and Market Relevance of Non-Stick Baking Paper in Modern Culinary Practices and Packaging Applications

Over the past decade, the baking paper market has emerged as a cornerstone of modern culinary and packaging processes, driven by evolving consumer preferences for convenience, safety, and environmental responsibility. Non-stick baking paper has transcended its traditional role as a simple liner to become a versatile tool embraced by home bakers, commercial kitchens, and food packaging enterprises alike. This growing adoption is underpinned by the material’s ability to reduce cleanup time, enhance product quality through consistent heat distribution, and minimize reliance on chemical coatings or greases.

As urbanization accelerates and consumers seek out at-home dining experiences that rival professional standards, the demand for reliable culinary aids continues to climb. Concurrently, heightened scrutiny on single-use plastics and a broader push towards circular economy principles have intensified attention on paper-based solutions that can offer post-use recyclability and compostability. These converging dynamics underscore the rising strategic importance of baking paper, positioning it at the intersection of performance, safety, and sustainability. Consequently, stakeholders across the value chain-from raw material suppliers to retail distributors-are recalibrating their offerings and investment priorities to capitalize on this expanding market landscape.

How Innovations in Materials, Digital Retail, and Regulatory Pressures Are Redefining the Baking Paper Industry Landscape

The baking paper industry is in the midst of profound transformation, propelled by technological breakthroughs, evolving regulatory frameworks, and shifting consumer behaviors. Advancements in material science have yielded next-generation coatings that enhance the non-stick properties of parchment while reducing reliance on PFAS compounds, reflecting a broader industry commitment to safer chemical profiles. In parallel, digital printing innovations allow for premium surface graphics, enabling branded packaging solutions that double as marketing touchpoints.

Beyond product innovation, the retail landscape itself has shifted dramatically. E-commerce platforms are now integral to consumer purchasing journeys, with tailored subscription models and direct-to-consumer fulfillment options reshaping traditional supply routes. This digital momentum is complemented by the emergence of small-format specialty stores and curated gourmet outlets, where artisanal and eco-certified baking paper offerings command premium price points. Regulatory developments, including stricter food contact safety standards and waste management mandates, are compelling manufacturers to accelerate sustainable sourcing initiatives and invest in closed-loop recovery programs, further redefining competitiveness across the value chain.

Assessing the Far-Reaching Consequences of 2025 United States Tariffs on Supply Chains, Input Costs, and Innovation Pathways

In 2025, United States tariffs on paper-based products have created a ripple effect across the baking paper market, influencing raw material costs and supply chain configurations. Increased duties on imported pulp and specialty coating components have encouraged manufacturers to reassess their sourcing strategies, with many pivoting towards domestic suppliers or nearshoring operations to mitigate duty exposure. This strategic realignment has contributed to more resilient supply chains but has also introduced cost variability as domestic pulp production grapples with capacity constraints and fluctuating raw wood pulp prices.

Furthermore, tariffs have spurred investment in alternative feedstocks, such as agricultural residues and recycled pulp, as companies seek to insulate themselves from trade uncertainties. While the transition to recycled content aligns with consumer sustainability demands, it presents technical challenges in maintaining sheet strength and uniform heat resistance. As a result, research and development efforts have intensified to optimize fiber blends and enhance coating adhesion. Collectively, these tariff-driven dynamics are reshaping cost structures, innovation pipelines, and supplier partnerships, compelling industry players to adopt agile procurement frameworks and pursue collaborative risk-sharing agreements.

Deep Dive into Market Differentiation Based on Product, Material, Coating, Packaging, Application, and Distribution Channels

The baking paper market exhibits multifaceted segmentation that underpins product differentiation and tailored market strategies. Product type segmentation distinguishes parchment paper, known for its superior heat tolerance and non-stick surface, from wax paper, which is prized for moisture resistance and is predominantly deployed in short-term food wrapping applications. Material type segmentation contrasts recycled pulp, which resonates with eco-conscious end users, against virgin pulp, which offers consistent fiber quality and performance predictability across high-temperature applications.

Coating type segmentation further refines market positioning by separating coated paper variants-enhanced with silicone or alternative release agents-from non-coated papers that cater to minimalist or food-safe purist requirements. Packaging type segmentation delineates between pre-cut sheets that facilitate precise kitchen workflows and rolls that provide flexibility for large-scale commercial and industrial operations. Application segmentation spans baking, cooking and roasting, food packaging, grilling and roasting, and pastry and confectionery, highlighting how functional requirements drive choice. Finally, distribution channel segmentation captures the duality of offline outlets spanning convenience stores, specialty stores, and supermarkets as well as online sales channels that deliver convenience and subscription-based buying experiences.

This comprehensive research report categorizes the Baking Paper market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Coating Type

- Packaging Type

- Application

- Distribution Channel

Exploring How Regional Consumers, Regulations, and Retail Structures Shape Baking Paper Demand across Americas, EMEA, and Asia-Pacific

Regional dynamics in the baking paper market vary significantly, reflecting distinct consumption patterns, regulatory landscapes, and supply chain architectures. In the Americas, mature retail infrastructures and high penetration of at-home cooking appliances sustain steady demand, while the onset of private-label baking paper offerings intensifies competition on quality and price. North American initiatives on sustainable forestry practices and waste recovery systems further influence supplier commitments and product ecolabeling.

In Europe, Middle East and Africa, stringent food contact regulations and progressive single-use waste directives drive innovation in recyclable and compostable baking paper variants, with leading manufacturers establishing localized production hubs to comply with regional standards. Middle Eastern and African markets show nascent growth potential, fueled by rising disposable incomes and an expanding quick-service restaurant sector. The Asia-Pacific region demonstrates the fastest growth trajectory, propelled by burgeoning urban populations, the proliferation of online grocery platforms, and cultural affinity for home baking. Regional policy shifts toward circular economy frameworks and rapid expansion of industrial bakery operations underscore the strategic importance of local partnerships and capacity enhancements.

This comprehensive research report examines key regions that drive the evolution of the Baking Paper market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining How Leading Integrated Producers and Specialty Converters Are Innovating, Collaborating, and Scaling Differentiated Solutions

Key participants in the baking paper market are leveraging strategic investments, mergers, and product innovations to consolidate their market positions. Industry incumbents renowned for their scale leverage integrated supply chains that span forestry management, pulp production, and paper conversion, enabling optimized cost efficiencies and tighter quality controls. Meanwhile, nimble specialty paper converters focus on premium or niche segments, emphasizing attributes such as compostability, chemical-free coatings, and custom print capabilities tailored to bespoke culinary and packaging applications.

Collaborations between raw material producers and coating technology firms are becoming increasingly common, as participants seek to co-develop proprietary release agents that meet evolving safety regulations. At the distribution level, alliances with leading e-commerce platforms and food service conglomerates facilitate direct access to end users and institutional buyers. By investing in sustainability certifications, end-to-end traceability solutions, and digital marketing initiatives, these companies aim to foster brand loyalty and differentiate their offerings in a crowded marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Baking Paper market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ahlstrom Oyj

- AmerCareRoyal, LLC

- Amol Paper Mills Pvt. Ltd.

- Chevler Ltd.

- Cosmoplast UAE

- delfortgroup AG

- Derun Green Building (Shandong) Composite Material Co., Ltd.

- Dispapali S.L.

- Domtar Corporation by Paper Excellence Canada Holdings Corporation

- Fredman Group Oy

- Fujian Naoshan Paper Industry Group Co., Ltd.

- Georgia-Pacific LLC by Koch, Inc.

- Green Woods Paper & Stationery Co., Ltd.

- Griff Paper and Film

- Hangzhou Guanglian Complex Paper Co., Ltd

- Hangzhou Weshare Import & Export Co., Ltd.

- Hoffmaster Group, Inc.

- Hongchang

- KRPA Holding CZ

- Linwood Raker Ltd

- Metsä Group

- Nordic Paper

- Orient Co. Pte Ltd.

- Pudumjee Paper Products Limited

- Reynolds Consumer Products LLC

- Shandong Runjia New Material Co., Ltd.

- SHREE PRAGYA FLEXIFILM INDUSTRIES

- thermohauser GmbH

- Yiwu Natural Paper Products Co., Ltd.

- Zhengzhou Eming Aluminium Industry Co., Ltd.

Strategic Blueprint for Leaders to Fortify Supply Resilience, Accelerate Sustainable Innovation, and Amplify Digital Customer Engagement

To navigate the current market challenges and capitalize on emerging opportunities, industry leaders should prioritize three strategic imperatives. First, securing flexible raw material supply agreements with both domestic and nearshore pulp suppliers will help mitigate tariff volatility and enable rapid response to fluctuating demand patterns. Strengthening supplier relationships through joint-venture networking and risk-sharing frameworks can also foster stability across the value chain.

Second, companies should accelerate the development of next-generation products that blend recycled content with advanced non-PFAS release technologies, catering to both regulatory pressures and sustainability-driven consumer preferences. Co-innovation partnerships with material science research institutions can fast-track formulation optimization and shorten time-to-market. Lastly, enhancing digital engagement strategies-ranging from tailored subscription services to targeted social media campaigns-will allow brands to build deeper customer relationships, expand into underserved demographics, and harness data insights for precision marketing and product development.

Comprehensive Multi-Stage Research Approach Combining Secondary Data, Primary Interviews, and Data Triangulation for Unbiased Insights

This research employed a rigorous, multi-stage methodology to ensure comprehensive analysis and factual accuracy. The study began with an extensive secondary research phase, drawing from reputable global trade associations, industry white papers, and publicly available regulatory filings to map the competitive landscape and regulatory environment. Concurrently, primary interviews were conducted with senior executives, procurement managers, and technical specialists across the upstream pulp, coating, and paper conversion sectors to validate key findings and uncover emerging trends.

Subsequently, data triangulation techniques were applied to reconcile quantitative insights with qualitative observations, ensuring consistency and reliability. Detailed case studies and supplier audits provided granular perspectives on operational best practices and cost structures. The final report integrates these multiple data streams, supplemented by scenario analyses that stress-test potential market disruptions, thereby offering stakeholders an authoritative, actionable foundation for decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Baking Paper market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Baking Paper Market, by Product Type

- Baking Paper Market, by Material Type

- Baking Paper Market, by Coating Type

- Baking Paper Market, by Packaging Type

- Baking Paper Market, by Application

- Baking Paper Market, by Distribution Channel

- Baking Paper Market, by Region

- Baking Paper Market, by Group

- Baking Paper Market, by Country

- United States Baking Paper Market

- China Baking Paper Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1272 ]

Concise Synthesis of Major Market Drivers, Regional Nuances, and Strategic Imperatives Guiding Future Growth Trajectories

In summary, the baking paper market is undergoing significant evolution driven by technological advancements, tariff-induced supply chain shifts, and escalating sustainability imperatives. Product innovation in coatings and recycled materials is reshaping performance benchmarks, while distribution channels continue to balance the growth of e-commerce with traditional retail reach. Regional markets present distinct strategic priorities, from regulatory compliance in EMEA to rapid capacity build-out in Asia-Pacific. For companies committed to long-term success, integrating flexible sourcing strategies, pioneering eco-certified product lines, and deepening digital engagement will be paramount. This executive summary serves as a blueprint for navigating these complex dynamics and unlocking value in a competitive landscape characterized by both challenges and transformative opportunities.

Take Immediate Strategic Advantage by Partnering with Ketan Rohom to Unlock Comprehensive Baking Paper Market Intelligence

With in-depth insights now at your fingertips, connect today with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full spectrum of actionable intelligence and strategic guidance on the baking paper market. Engage directly to customize an acquisition package that aligns with your organization’s unique objectives and gain immediate entry to proprietary data tailored to fuel your competitive positioning. Don’t miss this opportunity to leverage comprehensive research that will underpin critical decision-making, accelerate market penetration, and sharpen your value proposition. Reach out now to initiate your partnership and confirm your access to this indispensable resource.

- How big is the Baking Paper Market?

- What is the Baking Paper Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?