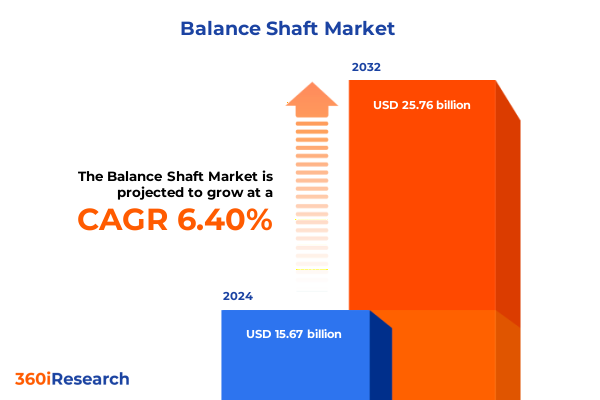

The Balance Shaft Market size was estimated at USD 16.54 billion in 2025 and expected to reach USD 17.46 billion in 2026, at a CAGR of 6.53% to reach USD 25.76 billion by 2032.

Understanding the Evolution, Engineering Principles, and Critical Importance of Balance Shafts in Enhancing Engine Performance and Vehicle Refinement

Balance shafts are a pivotal engineering solution devised to mitigate the inherent vibratory forces of reciprocating engines, elevating both performance and comfort in modern vehicles. Originating from a 1912 patent by Frederick William Lanchester, these counter-rotating shafts carry eccentric weights that nullify secondary inertia forces at twice engine speed, thus reducing vertical vibration in inline-four and V6 configurations. Over a half century later, Mitsubishi refined this concept in the Astron 80 engine with the “Silent Shaft” design, positioning twin shafts at staggered heights to counteract rolling couples and deliver unprecedented smoothness in mass-produced passenger cars.

Today, the balance shaft remains a cornerstone of powertrain refinement in downsized turbocharged engines, where the combination of high compression ratios and compact displacement amplifies vibratory imbalances. As manufacturers strive to meet stringent emissions and efficiency standards, these components are integral to managing noise, vibration, and harshness (NVH) without sacrificing engine responsiveness. While emerging propulsion technologies challenge their traditional use, the balance shaft’s evolution continues alongside hybrid integration and advanced materials, underscoring its enduring relevance in powertrain innovation.

How Electrification, Hybridization, and Supply Chain Dynamics are Reshaping the Global Balance Shaft Landscape with New Technical Demands

The balance shaft landscape is experiencing rapid transformation driven by the global shift toward electrification and hybrid powertrains, compelling suppliers to adapt legacy designs for new technical demands. As electric vehicles (EVs) inherently lack the secondary vibrations addressed by balance shafts, demand for these components in pure EV platforms is diminishing. However, the rise of hybrid and range-extended systems has created a vital niche, where balance shafts must seamlessly engage during internal combustion operation and disengage in electric mode. Research into NVH optimization for plug-in hybrids highlights the complex interplay of electric machine tonal noise and engine vibration, urging engineers to devise adaptive control algorithms and novel decoupling mechanisms to maintain cabin serenity.

Meanwhile, the semiconductor shortage and geopolitical tensions have exposed vulnerabilities in global supply chains, prompting manufacturers to localize sourcing and rethink modular engine platforms. Suppliers such as Schaeffler have warned of persistently negative operating margins in electric mobility units, forecasting a 0.5% contraction in global automobile production for 2025 amid restructuring efforts to mitigate rising costs and intensifying competition from Asia. Furthermore, slowing growth in battery electric vehicle sales has forced automakers and tier-one suppliers to implement cost-cutting measures, including workforce reductions north of 50,000 jobs across companies like Bosch, Continental, Forvia, Michelin, Schaeffler, Valeo, and ZF, underscoring the urgency of operational agility in the face of policy and market uncertainties.

As the industry pivots, advanced materials and lightweighting initiatives present opportunities to reengineer balance shafts with hollow forged steel, composite alloys, and even additive-manufactured structures. These innovations not only reduce rotational inertia and part mass but also facilitate integration within tighter engine bays. In tandem, predictive analytics and real-time NVH monitoring, enabled by IoT-equipped sensors, are emerging as critical tools for proactive quality control and dynamic balancing, ensuring that the balance shaft remains a versatile solution in an ever-evolving propulsion landscape.

Examining the Comprehensive Effects of Section 232 and Section 301 Tariff Measures on Balance Shaft Imports and Domestic Manufacturing Costs in 2025

In March 2025, the U.S. administration invoked Section 232 of the Trade Expansion Act to impose a 25 percent tariff on imported automobiles and key automobile parts, including powertrain components, citing national security concerns and the need to bolster domestic manufacturing capacity. This measure, effective April 3 for vehicles and May 3 for parts, applies to passenger cars and light trucks, with provisions allowing USMCA-compliant importers to certify U.S. content and limit duties to non-U.S. value. These tariffs have directly increased input costs for engine modules, leading to elevated prices for imported balance shafts and incentivizing OEMs to expand in-country assembly to reclaim offset credits.

Subsequent amendments in April introduced a declining duty offset schedule for manufacturers assembling vehicles domestically, starting with a 3.75 percent offset of aggregated MSRP from April 3, 2025 to April 30, 2026, and tapering to 2.5 percent through April 30, 2027, designed to accelerate investment in U.S. production facilities. Meanwhile, differential tariff treatments under new bilateral agreements-such as the U.S.-Japan trade deal that lowers the rate on Japanese autos and parts to 15 percent-have complicated cross-border supply chain economics and shifted competitive dynamics. American automakers have reported combined losses exceeding $2 billion due to these asymmetric levies, underscoring the challenge of maintaining margin integrity in a segmented tariff environment.

Together, these cumulative policy changes have prompted a strategic realignment of sourcing strategies, with many powertrain integrators accelerating plans to localize balance shaft manufacturing and partner with domestic foundries. The introduction of certification processes for non-U.S. content has also refined material selection and traceability protocols, ensuring compliance while optimizing cost recovery. Ultimately, the 2025 tariff framework has spurred a decisive shift toward nearshoring and value-chain resilience in the balance shaft sector.

Deep Dive into Balance Shaft Demand Patterns Across End Use Applications, Distribution Channels, Materials, Types, and Mounting Configurations

Balance shaft demand varies significantly across end use applications, from heavy commercial vehicles to passenger cars and off-highway machinery, each segment presenting distinct engineering requirements. In heavy commercial vehicles, robustness and high torque handling are essential, whereas in light commercial and passenger sedans or SUVs, NVH performance drives the selection of refined shaft profiles and damping strategies. For agricultural and construction off-highway machinery, durability under high-load cycles is prioritized, demanding specialized materials and heat treatments to withstand abrasive environments.

Distribution channels further shape market dynamics, with OEMs integrating balance shafts during initial assembly and aftermarket providers focusing on replacement and retrofitting across aging fleets. Material considerations range from traditional cast iron, prized for cost-effectiveness, to high-strength steel and emerging composites that reduce overall mass and rotational inertia. The choice between multi-piece and single-piece shaft designs reflects a balance between manufacturing complexity and serviceability, as multi-piece variants offer modular repair options while single-piece shafts deliver structural integrity. Mounting configurations, whether block-mounted or crankshaft-mounted, influence engine block design and lubrication pathways, requiring precise alignment and sealing solutions to maintain performance over vehicle lifecycles.

This comprehensive research report categorizes the Balance Shaft market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Type

- Mounting

- End Use

- Distribution Channel

Regional Dynamics Driving Balance Shaft Market Trends Across the Americas, Europe Middle East & Africa, and Asia Pacific Powertrain Sectors

The Americas region, anchored by the United States, Mexico, and Canada, has witnessed a resurgence in domestic engine production fueled by nearshoring incentives and tariff-induced cost shifts. U.S. OEMs are expanding local foundry and machining capabilities to secure tariff offsets and ensure supply chain continuity, while Mexican facilities benefit from labor cost advantages and preferential USMCA content rules. Canada’s automotive clusters in Ontario maintain robust balance shaft machining activities to support both domestic assembly and aftermarket demand.

In Europe, the Middle East, and Africa, legacy manufacturing hubs in Germany, France, and the UK continue to lead in precision engine component design, driven by stringent emissions and NVH standards. Investment flows from the European Green Deal and Middle East diversification initiatives have bolstered regional capacity for advanced balance shaft production, particularly in lightweight alloys and dual-shaft systems for inline-four engines. African markets, though nascent in powertrain manufacturing, present growth opportunities as automotive hubs emerge in South Africa and North Africa’s export corridors develop.

Asia-Pacific remains the largest global production center, with China and Japan at the forefront of high-volume manufacturing. China’s rapid engine production expansion, supported by government-backed industrial policies, has positioned it as a major exporter of cast iron and forged steel balance shaft modules. Japan continues to pioneer hybrid-optimized shaft technologies, while emerging markets in India and Southeast Asia attract capacity investments for both OEM and aftermarket segments. Across the region, evolving vehicle ownership models and regulatory pressure on local assembly content drive continued growth in balance shaft production and innovation.

This comprehensive research report examines key regions that drive the evolution of the Balance Shaft market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players Advancing Balance Shaft Innovation Through Strategic Acquisitions, Cost Management, and Diversified Powertrain Solutions

Schaeffler, encompassing the INA and LuK brands, remains a leading innovator in balance shaft technology, leveraging its heritage in precision bearing and powertrain components. Despite projecting a negative e-mobility operating margin of 14–17 percent in 2025, the company has committed to restructuring initiatives aimed at integrating electric powertrain specialist Vitesco and optimizing cross-platform production for hybrid-enabled balance shafts. These efforts underscore its strategy to diversify revenue streams and mitigate the long-term decline in pure-ICE component demand.

American Axle & Manufacturing reinforced its position in balance shaft module production through the 2017 acquisition of Metaldyne Performance Group, merging capabilities in powder metal connecting rods, crankshaft dampers, and balance shaft assemblies under a unified tier-one platform. This strategic move broadened its product portfolio and global footprint, enabling the company to deliver integrated driveline and engine balancing solutions across light and commercial vehicle segments.

Meanwhile, broader supplier challenges have galvanized the industry to pursue cost rationalization and technology partnerships. Major suppliers including Bosch, Continental, Forvia, Michelin, Schaeffler, Valeo, and ZF have collectively announced workforce reductions exceeding 50,000 jobs in response to slower-than-expected electrification ramps and volatile BEV subsidies, highlighting the critical interplay between policy shifts and supply chain resilience in the component sector. These companies continue to invest in additive manufacturing, advanced forging techniques, and NVH-optimized alloys to sustain balance shaft relevance across ICE, hybrid, and auxiliary applications.

This comprehensive research report delivers an in-depth overview of the principal market players in the Balance Shaft market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Axle & Manufacturing, Inc.

- Dana Incorporated

- Engine Power Components, Inc.

- Farinia Group

- Hirschvogel Group

- Linamar Corporation

- Mahle GmbH

- MAT Foundry Group Ltd.

- Metaldyne Performance Group, Inc.

- Musashi Seimitsu Industry Co., Ltd.

- Otics Corporation

- Sansera Engineering Limited

- SHW AG

- SKF Group AB

- TFO Corporation

Strategic Recommendations for Industry Leaders to Navigate Technological Disruption, Policy Shifts, and Evolving Consumer Expectations in the Balance Shaft Sector

Industry leaders should prioritize modular manufacturing strategies to accommodate both ICE and hybrid balance shaft requirements, enabling rapid reconfiguration of production lines as electrification trends accelerate. By investing in flexible forging and machining cells, companies can scale output seamlessly for varying shaft geometries, reducing changeover times and inventory costs. Moreover, partnerships with advanced material suppliers will be crucial to develop next-generation composite alloys and hollow designs that meet stringent NVH and lightweighting targets without compromising durability.

Simultaneously, engaging proactively with regulatory authorities to shape certification processes for non-domestic content and tariff compliance will yield competitive advantages. Collaborative working groups between OEMs, tier-one suppliers, and trade representatives can harmonize technical standards and streamline offset documentation, mitigating disruptions from shifting trade policies. Additionally, leveraging real-time performance data through digital twins and IoT-enabled balance shafts will support predictive maintenance models, unlocking aftermarket service revenue and fostering deeper customer integrations.

Finally, fostering a culture of continuous learning and design thinking will empower engineering teams to anticipate emerging NVH challenges in hybrid powertrains. Cross-disciplinary research alliances with academic institutions and NVH specialists can accelerate the development of adaptive balancing algorithms and smart control systems, ensuring that balance shafts remain integral to the passenger experience regardless of propulsion technology.

Methodological Framework Integrating Primary Research, Expert Interviews, and Triangulation Techniques to Ensure Rigorous Balance Shaft Market Insights

This research integrates comprehensive primary and secondary methodologies to deliver robust market intelligence. Primary research comprised structured interviews with senior executives at OEMs, tier-one suppliers, and material specialists, supplemented by regional expert consultations to validate regional dynamics and regulatory implications. Secondary research entailed systematic reviews of government proclamations, industry news releases, patent filings, and trade association reports to construct an accurate policy and technological landscape.

Data triangulation was employed to reconcile bottom-up shipment estimates with top-down macroeconomic indicators, including global vehicle production projections and NVH regulation timelines. Market size and growth drivers were cross-verified against third-party trade data and customs import records to ensure consistency. Forecast scenarios incorporated sensitivity analyses around tariff rates, electrification adoption curves, and materials cost fluctuations, enabling stakeholders to evaluate risk-adjusted outcomes.

Quality assurance protocols included iterative peer reviews by domain specialists and statistical validation of survey datasets. The resulting insights reflect the most current industry developments as of Q2 2025, offering decision-grade perspectives to guide strategic planning and operational investments in balance shaft technologies.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Balance Shaft market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Balance Shaft Market, by Material

- Balance Shaft Market, by Type

- Balance Shaft Market, by Mounting

- Balance Shaft Market, by End Use

- Balance Shaft Market, by Distribution Channel

- Balance Shaft Market, by Region

- Balance Shaft Market, by Group

- Balance Shaft Market, by Country

- United States Balance Shaft Market

- China Balance Shaft Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Summarizing the Critical Findings on Technological, Regulatory, and Market Drivers Shaping the Future of Balance Shaft Applications

In summarizing this analysis, balance shafts emerge as a mature yet evolving component, vital for managing engine vibrations in a landscape increasingly defined by hybridization and electrification. The historical progression from Lanchester’s foundational invention to Mitsubishi’s Silent Shaft has set a trajectory of continuous innovation, driving material advancements and modular designs to meet rising NVH expectations. Despite tariff-induced cost pressures and asymmetric trade agreements, the 2025 policy environment has accelerated domestic production investments and refined content compliance mechanisms.

Regions display distinct dynamics, with nearshoring efforts in the Americas, sustainability-driven innovation in EMEA, and scale-oriented manufacturing in Asia-Pacific shaping production footprints and competitive positioning. Key players have navigated these challenges through strategic acquisitions, cost rationalization, and agile supply chain realignments. Looking ahead, the integration of smart balancing systems, real-time performance monitoring, and adaptive control will define the next wave of balance shaft applications, ensuring that this technology retains its relevance in an era of diversified powertrains.

Contact Ketan Rohom to Secure Exclusive Access to the Comprehensive Balance Shaft Market Research Report Tailored for Strategic Decision Making

Take the next step in powering your strategic decisions on balance shafts by engaging directly with Ketan Rohom. As Associate Director, Sales & Marketing, he can provide tailored insights and sample data to demonstrate how this report aligns with your business objectives. Reach out to discuss customized licensing options, enterprise access packages, and value-added services that will enable you to stay ahead of technological advancements and policy changes. Connect today to secure your copy of the full research deliverable and gain the foresight needed to optimize your powertrain strategies and operational investments.

- How big is the Balance Shaft Market?

- What is the Balance Shaft Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?