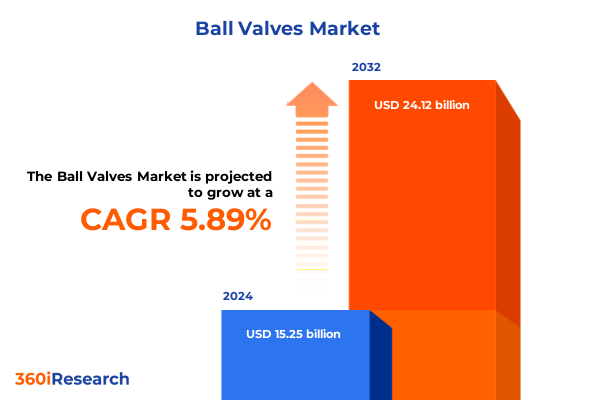

The Ball Valves Market size was estimated at USD 16.10 billion in 2025 and expected to reach USD 17.00 billion in 2026, at a CAGR of 5.94% to reach USD 24.12 billion by 2032.

Overview of the Critical Role and Lifecycle Relevance of Ball Valves in Industrial and Commercial Fluid Control Applications Worldwide

The ball valve has emerged as a cornerstone of modern fluid control regimes, combining simplicity of operation with robust sealing performance across a diverse array of applications. At its core, a ball valve features a spherical closure element with a bore through the center that aligns with the flow path when actuated, delivering minimal pressure drop and exceptional leakage resistance. This fundamental design has experienced iterative refinements that optimize actuation torque, stem sealing, and flow modulation, ensuring that end users from process industries to utilities benefit from reliable shutoff and control functionality.

Beyond its mechanical elegance, the ball valve’s lifecycle affordability and adaptability to varied service conditions underscore its strategic importance. Materials ranging from stainless steel alloys to advanced polymers allow for compatibility with corrosive media, elevated temperatures, and high-cycle environments. As industry demands evolve, the ball valve consistently proves its worth by enabling faster maintenance turnarounds, integrating seamlessly with automation platforms, and supporting modular system architectures that reduce downtime and boost overall operational efficiency.

Identification of Pivotal Technological, Regulatory, and Demand-Driven Transformations Reshaping the Global Ball Valve Market Dynamics

Over the past decade, the global ball valve landscape has been reshaped by an interplay of technological innovation, evolving regulatory frameworks, and shifting demand patterns. Advancements in digital sensing and IIoT connectivity have paved the way for smart ball valve systems that deliver predictive diagnostics and real-time flow analytics. These systems empower operators to transition from reactive maintenance to condition-based strategies, driving down unplanned downtime and extending service intervals.

Concurrently, stringent environmental regulations have catalyzed the adoption of low-emission valve designs and compliance-certified materials. This regulatory thrust, coupled with the growing emphasis on energy efficiency, has encouraged manufacturers to integrate lightweight, high-strength composites that reduce actuation energy requirements. Additive manufacturing techniques are increasingly leveraged for rapid prototyping and production of complex valve components, while AI-driven design tools accelerate development cycles. Together, these forces are converging to redefine performance benchmarks and create new opportunities for differentiation in a competitive market.

Assessment of the Comprehensive Impact of Newly Implemented United States Tariff Measures on Ball Valve Supply Chains and Pricing Structures

In early 2025, the United States implemented a series of tariff adjustments affecting imports of industrial valves, including ball valves, which have introduced notable headwinds for global suppliers. These new duties have elevated landed costs for key raw materials such as stainless steel castings and specialized sealing compounds, compelling original equipment manufacturers and distributors to recalibrate their sourcing strategies. The immediate consequence has been an increase in procurement cycle times, as supply chains adjust to optimize for duty savings and minimize exposure to sudden policy shifts.

The tariff environment has also heightened the importance of onshore manufacturing capabilities, prompting leading suppliers to explore domestic production partnerships and invest in localized fabrication facilities. This pivot not only mitigates tariff pressures but also offers enhanced control over quality assurance and logistical agility. Despite these challenges, the market remains resilient, with cost mitigation tactics such as alternative alloy specifications and cross-border processing arrangements delivering incremental relief to end users amid a dynamic trade policy landscape.

Insights into Ball Valve Market Segmentation by Product Variations, Configurations, Size Specifications, Pressure Thresholds, and Industry End-User Domains

A nuanced understanding of market segmentation provides clarity on how different valve types, configurations, sizes, pressure ratings, and end-user domains drive purchasing decisions. By product type, floating ball valves harness upstream line pressure to seal reliably in low- and moderate-pressure systems, rising stem designs offer external visual indication critical for safety inspections, trunnion mounted valves excel in high-pressure and large-diameter applications, and V-port variants deliver precise flow control for metering and modulation tasks. Each type satisfies distinct performance requirements, from simplistic quarter-turn isolation to complex throttling roles.

Valve configuration further differentiates offerings: single piece bodies optimize functionality in compact installations, split body constructions enable swift inspection and seal replacement, three-piece designs facilitate full in-line servicing, and two-piece options present a cost-effective compromise for general-purpose applications. Size classifications range from sub-inch units suited for instrumentation to extra-large valves for pipeline and process infrastructure. Pressure ranges encompass low-pressure valves built for general utilities, medium-pressure solutions common in process industries, high-pressure gear for energy and petrochemical sectors, and ultra-high-pressure equipment tailored to subsea, power generation, and critical industrial services. End users span automotive and aerospace manufacturing, chemicals, food and beverage processing, specialized glove production, HVAC installations, marine operations, metals and mining, oil and gas, power generation, palm oil extraction, pharmaceutical environments, pulp and paper mills, semiconductor fabrication, textile manufacturing, and water and wastewater treatment ecosystems.

This comprehensive research report categorizes the Ball Valves market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Valve Configuration

- Size

- Pressure Range

- End User

Evaluation of Regional Divergence in Ball Valve Demand and Innovation Trajectories across the Americas, EMEA, and Asia-Pacific Territories

Geographical analysis reveals divergent growth dynamics and focal points for innovation across global regions. In the Americas, robust activity within oil and gas upstream developments, coupled with expanding chemical and water management initiatives, has driven sustained demand for corrosion-resistant and high-pressure ball valve solutions. North American manufacturers have intensively pursued digital integration, while Latin American operations emphasize cost-competitive valve assemblies adapted to local material ecosystems.

Across Europe, the Middle East, and Africa, stringent environmental regulations and the energy transition have accelerated the uptake of low-emission, high-efficiency valve designs. The EMEA region also serves as a hub for specialized applications in petrochemical refining and renewable energy projects, where customization and certification rigor are paramount. Meanwhile, the Asia-Pacific market remains the fastest-growing arena, fueled by large-scale infrastructure projects, petrochemistry expansions, and rising municipal investments in water and wastewater treatment. Asian OEMs leverage scale efficiencies and agile supply chains to offer competitively priced products, increasingly integrating advanced materials and regional servicing capabilities to capture market share.

This comprehensive research report examines key regions that drive the evolution of the Ball Valves market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examination of Strategic Positioning, Product Portfolios, and Innovation Initiatives Among Key Global Ball Valve Manufacturers

Leading global manufacturers have established their market presence through broad product portfolios, strategic acquisitions, and technology partnerships. One major manufacturer differentiates through proprietary sealing systems and extensive instrumentation integration, while a second key player offers a full range of ball valves complemented by aftermarket service networks that ensure rapid parts availability and field support. A third prominent supplier has leveraged digital twins and remote monitoring platforms to offer predictive maintenance packages that reduce lifecycle costs and improve asset reliability.

In parallel, emerging competitors have carved niches by specializing in exotic alloy valves for ultra-corrosive environments and lightweight composite solutions for the aerospace and defense sectors. Collaborations between established and niche players are increasingly common, with joint development agreements focused on hybrid materials and smart actuation systems. This competitive tapestry underscores the importance of innovation agility and end-to-end service capabilities for maintaining differentiation in a market characterized by both commoditization and high-value customization.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ball Valves market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- ABB Ltd.

- Alfa Laval AB

- ASC Engineered Solutions, LLC

- AVK Group A/S

- BELIMO Holding AG

- Bray International, Inc.

- Crane Company

- Curtiss-Wright Corporation

- Danfoss A/S

- Dembla Valves Ltd.

- Emerson Electric Co.

- Festo SE and Co. KG

- Finolex Industries Ltd.

- Flomatic Corporation

- Flowserve Corporation

- Georg Fischer Ltd.

- Hayward Industries, Inc.

- Hitachi Ltd.

- Honeywell International Inc.

- KITZ Corporation

- KLINGER Fluid Control GmbH

- Milwaukee Valve Corporation

- MV Nederland BV

- NIBCO Inc.

- Parker Hannifin Corporation

- Powell Valves

- Schlumberger Limited

- Schneider Electric SE

- Siemens AG

- Simtech Process Systems

- Spirax-Sarco Engineering PLC

- SSP Fittings Corporation

- Sulzer Ltd.

- Swagelok Company

- Trillium Flow Technologies

- Valmet Oyj

- Velan Inc.

Actionable Strategies for Industry Pioneers to Enhance Supply Chain Efficiency, Foster Innovation, and Navigate Emerging Market Complexities

Industry leaders must proactively diversify their supply networks to build resilience against tariff fluctuations and material shortages. Establishing dual-source agreements and nurturing partnerships with regional fabricators can help secure critical components and stabilize lead times. Furthermore, investing in advanced materials research-such as corrosion-resistant alloys and polymer composites-will enable the introduction of valves tailored to evolving environmental and regulatory demands.

Simultaneously, companies should accelerate their digital transformation roadmaps by embedding sensors and connectivity within valve assemblies. This will facilitate condition-based monitoring, predictive maintenance, and seamless integration into enterprise asset management platforms. By harnessing data-driven insights, organizations can optimize performance, reduce unplanned downtime, and offer differentiated service packages. Ultimately, a balanced emphasis on operational agility, product innovation, and customer-centric solutions will define the next generation of market leaders.

Outline of Rigorous Multi-Source Research Methods Employed to Deliver Comprehensive Insight into Ball Valve Industry Trends and Dynamics

This study harnesses an integrated research framework combining exhaustive secondary research with targeted primary data collection. An extensive literature review of industry publications, technical white papers, and regulatory documents forms the foundation, complemented by analysis of public company disclosures and trade association reports. Primary insights were obtained through in-depth interviews with senior executives, product engineers, procurement specialists, and end users, enabling a holistic view of market trends and operational challenges.

To ensure data reliability and perspective breadth, findings were triangulated across multiple sources and validated through expert workshops. Quantitative inputs on technology adoption, material preferences, and regional deployment were cross-referenced against field data and distributor feedback. This rigorous methodology underpins the comprehensive nature of the report, ensuring that strategic conclusions are grounded in robust evidence and reflect the multifaceted realities of the ball valve ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ball Valves market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ball Valves Market, by Product Type

- Ball Valves Market, by Valve Configuration

- Ball Valves Market, by Size

- Ball Valves Market, by Pressure Range

- Ball Valves Market, by End User

- Ball Valves Market, by Region

- Ball Valves Market, by Group

- Ball Valves Market, by Country

- United States Ball Valves Market

- China Ball Valves Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Synthesis of Core Findings, Strategic Implications, and Industry Outlook for Stakeholders Engaged in the Ball Valve Supply Ecosystem

The evidence presented underscores the ball valve’s sustained centrality in fluid control applications while illuminating the transformative impact of digitalization, regulatory mandates, and trade policy adjustments. Segmentation analysis highlights the diversity of product types and configurations that manufacturers must support, and regional perspectives reveal distinct growth opportunities shaped by local industry drivers and compliance regimes.

Strategic implications for stakeholders revolve around fortifying supply chain resilience, advancing material and digital innovation, and aligning product offerings with end-user requirements. By leveraging the detailed segmentation and regional intelligence within this report, decision-makers can pinpoint target markets, refine value propositions, and invest in emerging technologies that deliver competitive advantage. This synthesis serves as a springboard for focused action and long-term enterprise value creation within the dynamic ball valve arena.

Engagement Invitation to Discuss Tailored Ball Valve Market Insights with Associate Director Sales and Marketing for Customized Intelligence Acquisition

We welcome industry stakeholders seeking nuanced understanding of the ball valve landscape to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how this comprehensive study can inform strategic objectives. By collaborating with Ketan, organizations can access tailored insights, including in-depth analyses of market segmentation, regional dynamics, and competitive positioning, all customized to address specific operational challenges and growth targets.

This dialogue transcends a simple transaction; it represents an opportunity to co-create a roadmap for informed decision-making. To arrange a personalized consultation and gain immediate access to the full market research report, please reach out and discover the actionable intelligence that can power your next phase of growth.

- How big is the Ball Valves Market?

- What is the Ball Valves Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?