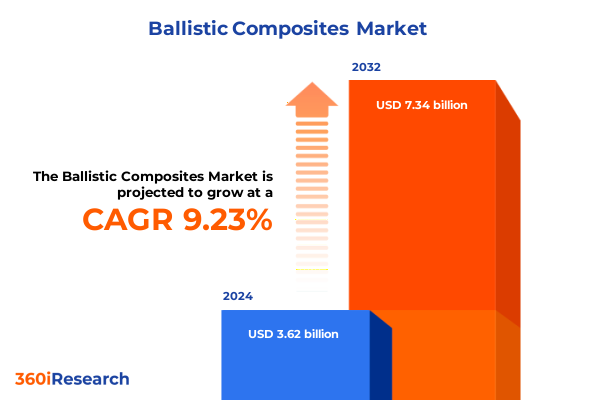

The Ballistic Composites Market size was estimated at USD 3.94 billion in 2025 and expected to reach USD 4.29 billion in 2026, at a CAGR of 9.28% to reach USD 7.34 billion by 2032.

An authoritative orientation to the ballistic composites environment that aligns technological evolution with procurement, resilience, and program-level decision-making

The ballistic composites landscape is entering a strategic inflection: advanced fibers, hybrid matrix architectures, and system-level integration are converging with shifting procurement priorities and trade policy frictions to redefine how organizations source protection solutions. This introduction frames the high-level forces that should guide executive attention-technology differentiation, supply-chain resilience, regulatory and trade dynamics, and cross-domain demand from defense, law enforcement, and personal protection markets.

Over the next investment cycle, leaders must evaluate protection outcomes not as discrete material choices but as engineered systems where fiber type, product form, and integration approach determine weight, multi-threat performance, and lifecycle cost. This systemic mindset reshapes vendor selection, testing regimes, and partnership strategies. In parallel, procurement teams are increasingly required to balance near-term deliverability with strategic assurance: domestic or allied supply options, stockpile strategies for high-value components, and adaptable design rules that permit rapid substitution when a single-supplier risk materializes.

Taken together, these dynamics make it imperative for decision-makers to adopt a layered, evidence-based approach. Executives should prioritize clear success metrics for weight reduction, multi-hit performance, and thermal/environmental stability while embedding contingency and scale-up pathways into procurement contracts. This report’s executive orientation helps translate those priorities into program-level decisions and actionable supplier engagement frameworks.

How convergence of material innovation, scalable manufacturing, modular architectures, and geopolitical sourcing pressures is redefining ballistic protection strategies

The contemporary landscape for ballistic composites is being reshaped by several transformative shifts that go beyond incremental material improvements. First, fiber- and matrix-level innovation is enabling lighter, more conformable protective systems that preserve or improve ballistic performance while lowering physiological and platform burdens. These developments are prompting product designers to rethink protective system architecture and human factors simultaneously, so armor is evaluated as much on ergonomics and mission endurance as on test-stand ballistic metrics.

Second, manufacturing scale and process automation are moving from prototype to production in selected technologies, which shortens development timelines and reduces unit cost for advanced panels and laminates. As manufacturing matures, modular and reconfigurable armor concepts are gaining traction; procurement organizations are beginning to favor architectures that can be upgraded in the field rather than replaced entirely. This shift changes logistics calculus, drives lifecycle savings, and permits faster response to evolving threats.

Third, material supply dynamics and geopolitical policy are directing a rebalancing of international sourcing. Buyers are emphasizing traceability, origin transparency, and alternate sources for critical feedstocks to reduce single-point vulnerabilities. Finally, research and development programs-both public and private-are layering computational design, high‑throughput testing, and multi-scale modeling into the development pipeline, accelerating qualification of hybrid solutions that combine aramid, high-performance glass, carbon reinforcement, and ceramic strike faces into tailored protection packages. Collectively, these shifts require a deliberate integration of R&D, procurement, and program management.

Assessing how cumulative 2025 tariff actions and evolving exclusion policies are materially changing sourcing strategies, landed cost risk, and procurement resilience for armor systems

Tariff and trade developments in the United States through 2025 are an operational reality that has incrementally increased the complexity of sourcing decisions for ballistic composites and their upstream inputs. Policy instruments aimed at protecting critical domestic industries and addressing perceived strategic vulnerabilities have been adjusted and reviewed within the Section 301 framework; certain product exclusions have been extended at intervals while duty rates for specific categories were revised as part of statutory reviews. These ongoing modifications influence supplier selection, landed cost assumptions, and the practical desirability of near-shoring for mission‑critical components.

In practical terms, the cumulative effect of tariff actions is to accelerate the internalization of supply-risk assessment within procurement cycles. If a high‑performance fiber, precursor chemical, or specialized ceramic component becomes subject to higher duties or uncertain exclusion status, buyers often pivot toward manufacturers within allied jurisdictions or toward vertically integrated suppliers who can internalize more of the value chain. This strategic reorientation is not solely a short-term reaction to price change; it reflects an operational preference for lower geopolitical exposure when product performance is critical to soldier or platform survivability.

Because exclusions and duty treatments have been periodically extended and reviewed, procurement teams must monitor regulatory notices and maintain adaptive sourcing clauses in contracts. Contractual flexibility-clauses that allow approved substitutions, temporary dual-sourcing, or advance purchase of critical feedstocks-reduces the chance that sudden policy changes will cause program delays or force last-minute, high-cost procurement decisions. In sum, trade policy in 2025 functions as a persistent factor in program planning rather than a transitory cost note.

Insightful segmentation analysis connecting material types, application architectures, end-use requirements, and product forms to clarify commercialization and procurement pathways

Segmentation provides the analytic scaffolding for precise product and commercial decisions; interpreting each axis-material, application, end use, and product form-reveals distinct competitive and adoption dynamics. Material segmentation separates aramid fibers, carbon fibers, ceramic matrix composites, and S2 glass fiber into divergent performance and supply profiles. Within aramid fibers, the distinction between non-woven and woven constructions changes how a material is used: non-woven architectures dominate flexible soft-armor packages where conformability and multi-layer energy dissipation matter, while woven aramids are preferred when controlled ply architecture and predictable structural behavior are required for rigid or semi-rigid panels.

Application segmentation-spanning body armor, helmets, shields, and vehicle armor-drives differing product priorities. Body armor procurement must weigh comfort and multi-threat capability; within body armor, hard plates emphasize edge-to-edge ceramic strike faces and trauma mitigation, while soft panels prioritize flexibility and blunt-force energy dispersion. Vehicle armor programs need to reconcile platform payload and mobility objectives with threat profiles; aircraft armor emphasizes minimal weight and aerothermal constraints, whereas land vehicle armor focuses on blast, spall, and high-velocity penetration resistance. End-use segmentation further differentiates requirements. Commercial and personal-use buyers emphasize cost, comfort, and discrete aesthetics; defense and law enforcement buyers prioritize certified multi-threat protection, interoperability with existing platforms, and predictable performance under extreme environmental conditions. The defense sub-segmentation into air force, army, and navy introduces platform-specific environmental and integration constraints, while law enforcement sub-segmentation between police and security agencies emphasizes rapid deployability, visibility, and legal compliance.

Product form segmentation-coatings, laminates, panels, and sheets-shapes how materials are engineered into systems, how they are certified, and how they are repaired or upgraded in the field. Coatings and thin laminates enable retrofits and modularity. Panels are the building blocks for plate carriers and vehicle modules, and sheets provide scalable feedstock for custom fabrication. Understanding how these segments intersect informs supplier selection and R&D prioritization: material innovation is valuable only when matched to the application architecture and the end‑use procurement rhythm.

This comprehensive research report categorizes the Ballistic Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material

- Product Form

- Application

- End Use

Regional strategic overview showing how Americas, Europe Middle East & Africa, and Asia-Pacific supply strengths and policy dynamics drive sourcing and deployment choices

Regional dynamics shape industrial capabilities, procurement doctrine, and strategic supply options across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, the concentration of advanced material science, integrated defense prime contractors, and established manufacturing capacity makes the region a preferred source for accelerated qualification and program continuity, particularly for defense end users. North American suppliers often emphasize proven certification pathways, quality management, and rapid logistical support for fielded systems, which favors in-region procurement when operational certainty is paramount.

Europe, the Middle East & Africa present a heterogeneous landscape where advanced research centers and specialist manufacturers coexist with rapidly modernizing defense ministries and regional procurement organizations. European suppliers are often strong on compliance, lifecycle documentation, and sustainability claims, while procurement programs in parts of the Middle East are prioritizing rapid capability upgrades and local industrial partnerships that transfer capability. Africa’s adoption remains uneven, driven primarily by internal security needs and select procurement programs.

Asia-Pacific contains both high-volume manufacturing and leading-edge innovation. Several countries in the region maintain large fabric and composite-processing footprints, giving them advantages in scale; simultaneously, a subset of regional players are investing heavily in advanced fibers and ceramic processing. Export controls, local content rules, and geopolitics increasingly factor into procurement decisions. For multinational programs, these regional contrasts translate into practical sourcing matrices: some components are best procured regionally to meet delivery windows, while others-or higher-risk critical feedstocks-may be sourced from allied supply chains to preserve strategic assurance. Effective regional strategy therefore blends program timelines, supplier capabilities, and geopolitical risk assessment into a coherent sourcing plan.

This comprehensive research report examines key regions that drive the evolution of the Ballistic Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

A synthesis of supplier strategies, vertical integration, product innovation, and organizational restructuring that is reshaping supplier competitiveness and buyer risk assessment

Company activity and strategic moves among specialized fiber producers, hybrid materials makers, and systems integrators are dictating competitive positioning. Some established fiber houses are focusing their investment on next-generation aramids and higher‑performance polyethylene fibers to sustain their legacy positions in personal protection, while other advanced-materials firms are expanding vertically to capture more of the panel lamination and modular armor marketplace. Recent corporate transactions and organizational restructuring in high‑value aramid production have already affected buyer conversations about long-term availability and the need for alternate qualified sources.

Meanwhile, manufacturers of high-performance polyethylene and other high‑specific-strength fibers are releasing new grades that emphasize thinner, lighter systems compatible with lower-profile carriers and helmet shells, allowing product OEMs to push integration boundaries and improve wearer mobility. Equipment and process suppliers are also delivering more automated layup and bonding technologies that reduce unit variability and speed time-to-volume, which benefits defense acquisition programs that require repeatable quality at scale. Major suppliers are supplementing product releases with traceability claims and expanded testing documentation to answer buyer concerns about provenance and certification. These industry moves collectively pressure incumbents to articulate clearer supply assurances, to invest in scalable manufacturing, or to enter partnerships that broaden material portfolios.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ballistic Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avient Corporation

- BAE Systems plc

- Barrday Inc.

- DuPont de Nemours, Inc.

- Gurit Services AG

- Hexcel Corporation

- Honeywell International Inc.

- MKU Limited

- Morgan Advanced Materials plc

- Point Blank Enterprises, Inc.

- Rheinmetall AG

- Royal Ten Cate N.V.

- Solvay S.A.

- Southern States, LLC

- Teijin Limited

Practical, program-level recommendations for leaders to hardwire supply resilience, design modularity, and accelerate deployment of advanced ballistic protection systems

For industry leaders seeking to convert insight into operational advantage, a focused set of actions will be decisive: first, integrate supply‑risk metrics into program milestones and budget reviews so that supplier selection weighs origin, exclusion exposure, and dual‑source feasibility alongside performance and cost. Second, foster modular design rules that permit substitution of woven and non‑woven aramids, glass‑fiber reinforcements, or ceramic strike faces without requalifying an entire platform; this preserves operational continuity if a feedstock or supplier becomes constrained. Third, accelerate pilot adoption of hybrid product forms-thin ceramic laminates with polymeric backings, or UD (unidirectional) fiber laminates paired with conformable non‑woven layers-to capture weight and multi-threat advantages while limiting single-technology exposure.

Leaders should also formalize strategic inventory and forward-purchase policies for critical feedstocks where duty uncertainty or lead-time variability is material to program risk. Investing in local or allied‑jurisdiction manufacturing partnerships can be more cost-effective than pay‑for‑delivery premiums in high‑risk scenarios. Finally, expand engineering-to-manufacturing handoffs with advanced simulation and standardized test protocols; bringing certification design into the earliest phases reduces the chance that an innovative material cannot be practically integrated at scale. Implementing these recommendations will help convert emergent technologies and shifting trade conditions into resilient capability gains.

Transparent, multi-source research methodology combining primary interviews, technical literature, live-fire validation, and policy review to prioritize operationally relevant insights

This research combines multi-channel primary interviews, technical literature synthesis, and targeted policy review to produce defensible, actionable conclusions. Primary engagement included structured interviews with materials engineers, procurement leaders in defense and law enforcement organizations, and manufacturing operations managers to capture operational constraints that do not appear in open literature. Those qualitative inputs were supplemented by technical paper review and validated live‑fire and simulation studies to triangulate material‑level performance observations.

Policy and trade analysis used public notices and regulatory texts to identify tariff actions, exclusion extensions, and review cycles that materially affect sourcing risk. Synthesis techniques emphasized cross-validation: corporate press releases and supplier product literature were treated as statements of intent and capability and were tested against independent academic studies and government reports where available. The methodological objective was to prioritize operational relevance over headline metrics: rather than estimating market size, the work documents where capability gaps exist, how procurement regimes respond to supplier risk, and which material-product matches are most robust under alternate sourcing scenarios. This approach produces insights tailored for program managers and procurement executives who must convert technical performance into fieldable protection.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ballistic Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ballistic Composites Market, by Material

- Ballistic Composites Market, by Product Form

- Ballistic Composites Market, by Application

- Ballistic Composites Market, by End Use

- Ballistic Composites Market, by Region

- Ballistic Composites Market, by Group

- Ballistic Composites Market, by Country

- United States Ballistic Composites Market

- China Ballistic Composites Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Concise conclusion emphasizing the necessity of integrated supply, design, and procurement strategies to realize durable advantages from advanced ballistic composite technologies

In conclusion, the ballistic composites domain is moving from single-material optimization toward systems thinking where fiber type, product form, and supply assurance jointly determine program success. Lightweighting advances and hybrid architectures are creating defensible capability gains, but those gains must be pursued with deliberate supply-chain strategies and contractual flexibility given the evolving tariff and trade environment. Material innovations can deliver immediate operational benefits-reduced wearer burden, modular vehicle protection, and retrofit-friendly panels-but their strategic value depends on predictable supply and robust qualification pathways.

Decision-makers should therefore treat material selection, supplier partnerships, and procurement policy as an integrated program risk to be managed, not a sequence of transactional purchases. Those who embed contingency planning, dual-sourcing where practical, and modular upgrade paths into program designs will reduce schedule risk and maintain field capability even when geopolitical or regulatory shocks occur. The report supports these choices by mapping segment-specific tradeoffs and furnishing procurement-ready recommendations that bridge material science, manufacturing, and policy considerations.

Secure immediate access to the full ballistic composites market report through a confidential briefing with the Associate Director of Sales and Marketing to accelerate procurement and strategy

To move from insight to decision, contact Ketan Rohom, Associate Director, Sales & Marketing, to arrange a tailored briefing and purchase access to the full ballistic composites market research report. A direct briefing with Ketan will enable senior leaders to review the research scope, validate which chapters are most relevant to current procurement or R&D priorities, and negotiate a licensing package that aligns with your internal review cycles and confidentiality requirements.

During the briefing Ketan can walk through the report’s structure, sample datasets, methodology highlights, and ancillary deliverables such as custom slide decks or executive workshops. He will also coordinate any bespoke analysis requests - for example, supplier risk mapping, materials substitution sensitivity, or scenario planning tied to tariff permutations and supply-chain contingencies. These custom options are designed to accelerate procurement decisions and reduce time to implementation.

Requesting a purchase conversation with Ketan is the fastest way to secure controlled access to the full report, obtain rights for enterprise distribution if required, and schedule follow-up advisory sessions for product, procurement, or strategy teams. Reach out to arrange a confidential briefing and begin integrating research-driven actions into your operational roadmap.

- How big is the Ballistic Composites Market?

- What is the Ballistic Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?