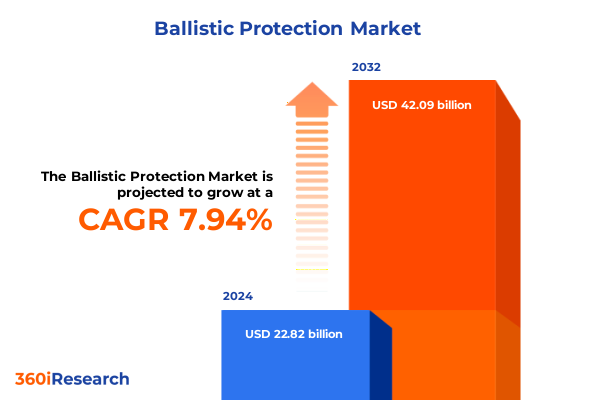

The Ballistic Protection Market size was estimated at USD 24.55 billion in 2025 and expected to reach USD 26.41 billion in 2026, at a CAGR of 8.00% to reach USD 42.09 billion by 2032.

Pioneering the Future of Ballistic Protection with Advanced Materials and Strategic Innovations to Safeguard Lives in Complex Threat Environments

The field of ballistic protection has evolved into an intricate tapestry of material science, engineering innovation and strategic imperatives, demanding a unified framework of understanding and action. As threats proliferate across diverse operational environments-from urban security theaters to high-intensity conflict zones-organizations must navigate an increasingly complex matrix of performance parameters, compliance requirements and technological breakthroughs. An authoritative executive summary serves as a critical guidepost, distilling multifaceted insights into clear pathways for decision-makers tasked with safeguarding personnel, assets and reputations.

In today’s landscape, ballistic protection extends beyond rudimentary armor to encompass integrated systems designed for adaptability, human factors and digital interoperability. This report synthesizes the essential dynamics shaping the industry, highlighting transformative shifts, policy impacts, market segmentation nuances and regional variations. By framing these developments within a concise, strategic context, stakeholders gain a pragmatic blueprint that balances immediate operational needs with long-term innovation roadmaps. Ultimately, this introduction sets the stage for an in-depth exploration of the forces driving the ballistic protection domain and the strategic choices available to industry leaders.

Revolutionary Transformations Redefining Ballistic Defense through Material Breakthroughs, Smart Technologies and New Manufacturing Paradigms for Enhanced Survivability

Recent years have witnessed disruptive breakthroughs that are redefining the fundamentals of ballistic defense, shifting the industry’s paradigm towards lighter, smarter and more sustainable solutions. Among the most significant advancements is the integration of nanotechnology-based armor platforms, which leverage ultra-fine material architectures to optimize strength-to-weight ratios while enhancing multi-hit resilience. Emerging polymer matrix sand composites exemplify this trend, demonstrating how graded inclusion of particulate matter can simultaneously attenuate impact energy and preserve structural integrity under high-velocity threats.

Concurrently, additive manufacturing techniques are facilitating the creation of complex lattice structures and hybrid meta-materials that were previously unattainable through conventional processes. These innovations enable designers to tailor protective systems at the microstructural level, ensuring an optimal distribution of stress and minimizing material usage. Moreover, the convergence of smart sensors and embedded electronics is transforming ballistic platforms into active defense systems capable of real-time impact analysis and health monitoring-ushering in an era where protection transcends passive resistance to become a dynamic, data-driven proposition.

Such transformative shifts are bolstered by progress in high-performance fibers, including ultra-high-molecular-weight polyethylene and advanced aramid variants, which continue to push the envelope of flexibility, durability and environmental resilience. Complementing these material strides, adaptive manufacturing models and digital supply chain architectures are fostering unprecedented levels of customization and responsiveness, ensuring that end users receive purpose-built solutions aligned with evolving threat profiles. Taken together, these converging innovations underscore a pivotal moment in ballistic protection, one defined by a relentless pursuit of lighter, smarter and more integrated defense capabilities.

Assessing the Comprehensive Consequences of 2025 United States Tariff Measures on Ballistic Protection Supply Chains, Costs and Industry Competitiveness

The year 2025 has introduced a confluence of U.S. tariff measures that collectively reshape the economics and logistics of ballistic protection manufacturing. In March, the administration enacted uniform 25% duties on steel and aluminum imports to fortify domestic production under Section 232, with no exemptions for previously favored partners beyond limited carve-outs for certain derivative products. Shortly thereafter, automotive imports faced a parallel 25% levy, implicating a broad range of vehicle armor components and their subassemblies.

In early March, an executive order invoked the International Emergency Economic Powers Act to impose additional tariffs on Canadian, Mexican and Chinese goods, expanding the scope of fiscal pressure across multiple categories and signaling a broader strategic posture on trade policy. These overlapping measures have produced a cumulative duty burden, compelling manufacturers to reassess sourcing strategies, absorb incremental costs or transfer expenses downstream to end users. The combined effect of these actions has introduced volatility into pricing models and created pronounced supply chain realignments as companies seek tariff-efficient routes and domestic alternatives.

Looking ahead, the layered tariff environment is stimulating investment in near-shoring and vertical integration initiatives designed to mitigate ongoing risks. Concurrently, industry participants are accelerating negotiations with material suppliers to secure fixed-price contracts and exploring tariff relief mechanisms through duty drawback programs and Free Trade Zone provisions. While these adaptations can preserve competitiveness, they also underscore the urgency of comprehensive scenario planning and agile procurement processes to navigate an increasingly protectionist landscape.

Uncovering Crucial Market Segmentation Patterns Across Product Types, Materials, Applications, Protection Levels and Distribution Channels to Drive Strategic Insights

Understanding the ballistic protection ecosystem requires a nuanced appreciation of the product spectrum, material innovations, application domains, protection standards and sales channels that collectively define market dynamics. Armor plates anchor this landscape, offering scalable defense through ceramic-reinforced composites, steel alloys and hybrid configurations, while armored vehicles occupy a critical segment subdivided into heavy, medium and light platforms designed to counter varied threat sets. At the personal level, body armor balances hard and soft solutions to deliver mobility and ballistic performance, and shields-ranging from ballistic glass to tactical models-provide protective barriers for both law enforcement and military missions.

Material selection is equally pivotal, encompassing ceramics that shatter projectiles on impact, composites that fuse fibers for multi-hit resistance, polyethylene variants renowned for weight savings, glass systems optimized for clarity and steel grades tailored for high-velocity encounters. Application sectors further refine this tapestry; correctional facilities deploy specialized security measures for detention centers and guard personnel, industrial environments integrate ballistic safety into construction, manufacturing and oil and gas operations, and law enforcement agencies-spanning police, homeland security and special operations-rely on calibrated protection solutions. Military end uses extend across air, land and naval forces, each demanding tailored vehicular and personal armor, while civilian protection needs have fostered personal kits and body armor designed for private security and high-risk professional contexts.

Protection levels serve as a standardized measure of performance, with NIJ ratings from II through IV ensuring clarity on threat negotiation capabilities and enabling transparent procurement. Distribution pathways-direct sales, distributor networks and online platforms-round out the segmentation picture, offering diverse access points for end customers, whether they require bespoke project support or rapid, off-the-shelf fulfillment. Collectively, these segmentation dimensions form the foundational structure for targeted strategy development and competitive positioning.

This comprehensive research report categorizes the Ballistic Protection market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material

- Level Of Protection

- Application

- Distribution Channel

Examining Diverse Regional Dynamics Shaping Ballistic Protection Demand across the Americas, Europe Middle East Africa and Asia Pacific Environments

Regional dynamics play a defining role in shaping the adoption and evolution of ballistic protection solutions across the globe. In the Americas, North American defense modernization programs and law enforcement procurement cycles drive steady demand, supported by robust domestic manufacturing capabilities and established supply chains. Meanwhile, Latin American markets are increasingly focused on private security investments, with geopolitical instability spurring localized demand for personal and facility protection systems.

Across Europe, the Middle East and Africa, a diverse array of factors influences market trajectories. Western Europe’s emphasis on interoperability and standards compliance under NATO frameworks underscores a sophisticated procurement environment, while Eastern European nations are rapidly upgrading vehicle armor and personal gear in response to regional security tensions. In the Middle East, expansive defense budgets have catalyzed large-scale acquisitions of armored vehicles and protective infrastructure, and North African markets are progressively exploring cost-effective solutions to address both civil unrest and counter-terrorism operations.

The Asia-Pacific region presents a mosaic of mature and emerging markets. Established powers like Japan, South Korea and Australia invest heavily in next-generation armor technologies for joint force interoperability, while Southeast Asian nations and India prioritize affordability and domestic production partnerships to bolster national capabilities. Across all APAC markets, industrial expansion and maritime security concerns have spurred demand for vessel armor and port facility protection, illustrating the region’s diverse security imperatives.

This comprehensive research report examines key regions that drive the evolution of the Ballistic Protection market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Exploring the Strategic Initiatives and Technological Milestones of Leading Ballistic Protection Companies Driving Innovation and Market Evolution Globally

Leading companies in the ballistic protection sector are distinguishing themselves through strategic investments in R&D, partnerships and tailored offerings that address the full spectrum of defense and security needs. BAE Systems has recently demonstrated agility by integrating weaponized drone capabilities with its ballistic solutions, thereby enhancing force protection against unmanned aerial threats while localizing critical production components. Rheinmetall AG continues to advance active protection systems for combat vehicles, leveraging its expertise in sensor fusion and reactive armor modules to deliver holistic battlefield survivability.

Innovators in personal protection are equally impactful. DuPont’s introduction of Kevlar EXO underscores the pursuit of next-generation aramid fibers that elevate comfort without sacrificing ballistic performance, catering to both military and law enforcement end users. TenCate Advanced Armor is forging collaborations to integrate ceramic matrix composites with additive manufacturing, achieving bespoke armor geometries that optimize threat mitigation. Meanwhile, Avon Protection is expanding its chemical, biological, radiological and nuclear filtration solutions within ballistic helmets, creating multi-hazard protection systems aligned with evolving security protocols.

Collectively, these companies are forging a path forward through co-development agreements, technology licensing and vertical integration strategies designed to accelerate time-to-market and deepen customer collaborations. Their focused initiatives highlight a shared commitment to innovation, performance excellence and comprehensive support services that underpin long-term partner value.

This comprehensive research report delivers an in-depth overview of the principal market players in the Ballistic Protection market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Avon Polymer Products Limited

- BAE Systems plc

- Craig International Ballistics Pty Ltd

- DuPont de Nemours, Inc.

- Honeywell International Inc.

- Morgan Advanced Materials plc

- Northrop Grumman Corporation

- Rafael Advanced Defense Systems Ltd.

- Rheinmetall AG

- Safariland LLC

- Teijin Limited

Formulating Actionable Strategic Recommendations for Industry Leaders to Optimize Innovation, Supply Chain Resilience and Market Expansion in Ballistic Protection

Industry leaders must embrace a multifaceted strategy that prioritizes both technological advancement and supply chain resilience in order to thrive amid evolving threats and policy uncertainties. First, a concentrated investment in modular, scalable armor architectures will facilitate rapid configuration adjustments for diverse mission profiles, enhancing customer responsiveness and reducing inventory overhead. Concurrently, forging strategic partnerships with raw material providers and adjacent technology firms can secure access to emerging composites and sensor platforms, fostering co-innovation and shared risk mitigation.

To navigate tariff volatility, organizations should pursue a balanced approach of near-shoring and duty optimization, leveraging designated trade zones and proactive engagement with policymakers to explore relief mechanisms and exemptions. Digital transformation initiatives, including blockchain-enabled supply chain tracking and AI-driven demand forecasting, will amplify operational agility and ensure timely response to shifting regulatory and threat environments. Additionally, embedding sustainability criteria into material selection and manufacturing processes can unlock cost savings, mitigate environmental risks and resonate with an expanding set of socially conscious end users.

Finally, cultivating a robust aftermarket ecosystem-encompassing training, maintenance and upgrade pathways-will extend product lifecycles and reinforce customer loyalty. By aligning these recommendations with organizational priorities, industry stakeholders can establish a resilient, innovation-centric foundation poised for sustained growth and strategic leadership in ballistic protection.

Detailing the Rigorous Research Methodology Employed for Unmatched Data Integrity, Expert Validation and Comprehensive Analysis of Ballistic Protection Trends

This analysis is grounded in a rigorous, multi-phase research methodology designed to ensure comprehensive insights and data integrity. The process commenced with extensive secondary research, encompassing industry publications, policy documents and publicly available corporate disclosures to map the macroeconomic, regulatory and technological landscape. Data sources were critically evaluated for credibility and relevance, with an emphasis on peer-reviewed studies, official government releases and authoritative technical journals.

To complement secondary findings, primary research was conducted through structured interviews with senior executives, materials scientists, procurement specialists and end-user representatives across military, law enforcement and civilian security sectors. These discussions facilitated validation of emerging trends, material performance criteria and regional demand drivers. Triangulation techniques were applied throughout, reconciling divergent perspectives and ensuring that insights reflect a balanced consensus.

Quantitative data sets-spanning trade flows, production capacities and patent filings-were systematically analyzed using advanced analytics tools, enabling identification of correlation patterns and growth enablers without breaching proprietary confidentiality. Throughout the research lifecycle, iterative reviews were undertaken by an internal panel of domain experts who provided benchmarking feedback and refined the analytical framework. The result is a robust, transparent methodology tailored to equip decision-makers with actionable intelligence and strategic clarity.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Ballistic Protection market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Ballistic Protection Market, by Product Type

- Ballistic Protection Market, by Material

- Ballistic Protection Market, by Level Of Protection

- Ballistic Protection Market, by Application

- Ballistic Protection Market, by Distribution Channel

- Ballistic Protection Market, by Region

- Ballistic Protection Market, by Group

- Ballistic Protection Market, by Country

- United States Ballistic Protection Market

- China Ballistic Protection Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2226 ]

Concluding Strategic Reflections on Innovation Imperatives, Supply Chain Adaptation and Regional Strategies for Sustaining Leadership in Ballistic Protection

The executive summary underscores a pivotal juncture in ballistic protection, where converging innovations, shifting policy landscapes and regional demand variations require nuanced strategic responses. Advanced materials and smart technologies are redefining performance benchmarks, enabling lighter and more adaptive defense solutions that address a broad spectrum of threat environments. As these technologies mature, the industry’s capacity for rapid customization and real-time threat analysis will emerge as critical differentiators.

Concurrently, the cumulative impact of 2025 tariff measures has introduced heightened complexity to supply chain management, underscoring the importance of diversified sourcing and agile procurement strategies. Regional disparities in defense budgets, regulatory frameworks and security priorities further highlight the need for tailored market approaches that leverage local partnerships and compliance expertise. Through targeted segmentation insights, stakeholders can align product portfolios with specific user requirements-from correctional facility security to high-end military applications.

Ultimately, sustaining leadership in ballistic protection hinges on a balanced commitment to continuous innovation, operational resilience and customer-centric service models. By integrating the actionable recommendations and regional insights presented herein, industry practitioners will be well positioned to navigate emerging challenges, capitalize on growth avenues and fortify protective capabilities that safeguard lives and critical assets.

Engage with Ketan Rohom to Access the Definitive Ballistic Protection Market Research Report and Empower Your Strategic Decisions for Competitive Advantage

Partnering with Ketan Rohom offers an unmatched opportunity to access comprehensive insights and strategic guidance tailored to your organizational goals. His expertise in sales and marketing will ensure you understand all facets of the ballistic protection market, from emerging material breakthroughs to evolving regulatory landscapes. By engaging with Ketan, you gain timely support in interpreting data, customizing recommendations and implementing actionable strategies that enhance decision-making and competitive positioning. Reach out to explore how this report can empower your leadership team and catalyze growth in an ever-changing defense and security environment

- How big is the Ballistic Protection Market?

- What is the Ballistic Protection Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?