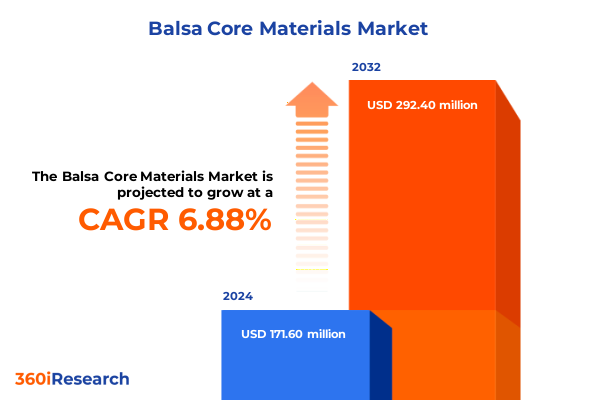

The Balsa Core Materials Market size was estimated at USD 180.22 million in 2025 and expected to reach USD 190.93 million in 2026, at a CAGR of 7.15% to reach USD 292.40 million by 2032.

Exploring the Unique Strength-to-Weight Virtues and Sustainability Benefits of Balsa Core Materials in High-Performance Composite Applications

Balsa core materials harness the end-grain structure of balsa wood to deliver exceptional shear strength and compressive performance while maintaining minimal weight. This unique combination of mechanical properties has positioned balsa cores as indispensable components in advanced composite structures spanning wind turbine blades, marine vessels, and aerospace applications.

Beyond mechanical excellence, balsa wood serves as a renewable resource with cultivation cycles as short as five to seven years, offering a sustainable alternative to synthetic core materials. The growing emphasis on responsible sourcing has led to widespread adoption of forest stewardship certifications, with certain markets willing to absorb a cost premium of up to 18 percent to ensure environmental compliance and traceability.

In the pursuit of lightweight design and carbon footprint reduction, manufacturers are increasingly integrating balsa core materials into next-generation composite architectures. This trend is driven by the material’s capacity to support complex geometries while reducing overall structural mass, thereby enhancing fuel efficiency in transportation and extending service life in construction and industrial applications.

Identifying Pivotal Transformative Shifts Reshaping the Balsa Core Materials Market Across Supply Chains and End-Use Industries

Over the past decade, technological advancements have transformed the processing and customization of balsa core materials, enabling unprecedented quality control and performance consistency. Industry leaders have pioneered digital density grading systems that facilitate real-time monitoring of core uniformity, dramatically reducing waste and variability in high-stakes applications like aerospace interiors and wind energy nacelles.

Simultaneously, enhanced treatment techniques have broadened balsa’s application horizon by addressing moisture ingress and durability concerns that once hindered marine and outdoor deployments. Proprietary resin infusion processes and hybrid core formulations now afford composite designers the flexibility to optimize stiffness-to-weight ratios without compromising long-term resilience, ushering in new possibilities for automotive, construction, and renewable energy sectors.

Assessing the Far-Reaching Cumulative Impact of Newly Enacted 2025 U.S. Tariffs on Global Balsa Core Material Supply and Pricing

In early 2025, the U.S. government implemented a series of tariffs on imported balsa wood specifically targeting major producing regions, introducing levies of up to eight percent on non–free-trade–partner origins. These measures have directly influenced landed costs for balsa core processors and composite manufacturers, creating margin pressures that reverberate throughout the supply chain.

As a direct response to tariff complexities, many end users are exploring alternative sourcing strategies, including long-term contracts with certified plantations in Ecuador and the development of domestic cultivation partnerships. At the same time, duty drawback mechanisms and customs optimization efforts are gaining traction as companies seek to mitigate the financial impact of import levies and preserve competitive pricing structures.

Tariff-induced cost escalation has also accelerated trials of substitute core materials such as PET and PVC foams, while niche applications continue to rely on balsa’s unmatched balance of light weight and mechanical integrity. This evolving landscape is prompting composite developers to reevaluate design parameters and material selection, ensuring that performance and affordability remain aligned under new trade policy realities.

Uncovering Key Segmentation Insights Revealing How Product Types and Applications Drive Diverse Opportunities for Balsa Core Materials

The balsa core materials market is categorized by product type into blocks, sheets, engineered core panels, and raw wood lumber, each serving distinct roles within the composite manufacturing ecosystem. Blocks offer prototyping flexibility for model builders and research applications, sheets provide the basis for laminates in structural skins, engineered panels deliver tailored densities and bonding characteristics for high-volume production, and raw lumber caters to craft and specialty use cases within niche segments.

Application-driven segmentation reveals a multifaceted demand landscape: aerospace and defense sectors leverage balsa cores for aircraft flooring assemblies and interior panels requiring rigorous certification standards; the automotive industry seeks lightweighting gains for electric and performance vehicles; construction utilizes balsa-infused sandwich elements in façade and roofing systems; marine applications incorporate cores in boat hulls, decks, and bulkheads for enhanced buoyancy and rigidity; sports and leisure products exploit balsa’s vibration damping for equipment; and the wind energy sector remains the predominant consumer, applying end-grain balsa within turbine blades to optimize aerodynamic efficiency.

This comprehensive research report categorizes the Balsa Core Materials market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

Highlighting Key Regional Insights That Illuminate Growth Drivers and Dynamics Across Americas, EMEA, and Asia-Pacific for Balsa Cores

In the Americas, balsa core consumption is driven by robust aerospace and renewable energy initiatives along with established marine craft traditions. The regional supply chain, though resilient, remains sensitive to fluctuations in South American harvests and logistic costs, spurring investment in traceable plantation partnerships and onshore processing capabilities to bolster material availability and reduce lead times.

Europe, Middle East, and Africa present a complex regulatory and end-use mosaic that heavily favors certified balsa cores compliant with deforestation-free mandates across the EU. This region prioritizes sustainability credentials, leading to dual pricing models that distinguish eco-certified grades from cost-sensitive imports. At the same time, expanding wind power installations in Northern and Southern Europe bolster demand for structurally optimized balsa cores designed to meet stringent industry certifications.

Asia-Pacific reflects a rapidly evolving paradigm in which domestic balsa cultivation initiatives in China have reduced import dependency while new processing hubs in Southeast Asia advance engineered core production. Local manufacturers benefit from government-supported forestry programs that encourage sustainable expansion, creating competitive alternatives for global users and reshaping trade flows within the region.

This comprehensive research report examines key regions that drive the evolution of the Balsa Core Materials market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Mapping Key Company Insights to Showcase Strategic Competitive Positioning and Innovations Driving the Balsa Core Materials Marketplace

Gurit Holding AG, through its Baltek division, has established leadership by integrating advanced moisture-resistant resin systems and end-grain balsa formulations that meet DNV and Lloyd’s certifications for maritime and offshore deployments. The company’s global distribution network and rigorous quality management protocols underpin a broad portfolio that spans wind energy, marine, transportation, and industrial sectors.

Switzerland’s 3A Composites delivers a diverse range of both pure balsa and hybrid core solutions, leveraging its century-long composite heritage to serve high-end luxury yacht builders and aerospace component manufacturers. Its efforts in engineered panel production and custom fabrication enable tailored density profiles and optimized structural performance for complex design requirements.

DIAB Group, a subsidiary of Ratos AB, and CoreLite Technology, Inc. have carved competitive positions through proprietary processing technologies and digital quality controls, catering specifically to aerospace and wind energy applications where precision grading and repeatable performance are paramount. Both firms have invested in automated machining centers and adhesive systems that streamline integration with advanced composite layup processes.

Hexcel Corporation and Nord Compensati S.p.A. further exemplify market diversification: Hexcel integrates balsa cores within hybrid carbon fiber composites for defense and civil aviation OEMs, while Nord Compensati capitalizes on sustainable forestry certifications to access premium European markets. These approaches highlight the dual imperatives of innovation and environmental stewardship shaping competitive strategies within the sector.

This comprehensive research report delivers an in-depth overview of the principal market players in the Balsa Core Materials market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3A Composites GmbH

- Adhesive Technologies NZ Ltd.

- Airex AG

- Balsasud S.A.

- Bcomp Ltd.

- Bodotex A/S

- Bondi Environmental Material Co., Ltd.

- Carbon-Core Corporation

- Core Materials, Inc.

- CoreLite, Inc.

- DIAB International AB

- Evonik Industries AG

- Guangzhou Sinokiko Balsa Co., Ltd.

- Gurit AG

- I-Core Composites LLC

- Link Composites Pvt. Ltd.

- Nord Compensati S.p.A.

- Plascore Incorporated

- Sicomin Epoxy Systems

- Sky Composite

- The Gill Corporation

Delivering Actionable Recommendations to Help Industry Leaders Optimize Sourcing, Sustainability, and Innovation in Balsa Core Materials Strategy

To navigate evolving trade policies and maintain supply resilience, industry leaders should pursue diversified sourcing strategies that encompass long-term agreements with certified plantation partners in South America, strategic alliances with emerging Asia-Pacific producers, and exploration of domestic cultivation initiatives. By proactively hedging import exposure and implementing duty mitigation frameworks, companies can safeguard cost structures and ensure uninterrupted core availability.

Embracing sustainability imperatives demands a rigorous commitment to forest stewardship certifications and circular economy principles. Organizations can enhance market positioning by integrating recycled balsa initiatives, supporting reforestation programs, and advancing lifecycle assessment methodologies, thereby meeting stakeholder expectations while commanding premium pricing tiers in eco-conscious regions.

Investing in next-generation core processing technologies and digital quality control systems will be critical for achieving consistency in core density and mechanical performance. Collaborative development with resin infusion and automation specialists can unlock efficiencies in panel fabrication, reduce scrap rates, and accelerate time to market for complex composite structures.

Describing the Rigorous Research Methodology That Underpins Data Collection, Validation, and Analysis for Balsa Core Materials Insights

The research methodology underpinning this analysis encompasses a blend of primary interviews with industry stakeholders-ranging from plantation managers and core producers to composite fabricators and end users-and secondary research drawing on technical literature, trade publications, and customs data. This dual approach ensures a comprehensive understanding of supply dynamics and material performance parameters.

Data triangulation techniques were applied to reconcile insights from proprietary supply chain datasets with field observations and expert consultations. Rigorous quality checks and validation protocols, including cross-industry peer reviews and certification assessments, underpin the reliability of the conclusions presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Balsa Core Materials market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Balsa Core Materials Market, by Product Type

- Balsa Core Materials Market, by Application

- Balsa Core Materials Market, by End User

- Balsa Core Materials Market, by Region

- Balsa Core Materials Market, by Group

- Balsa Core Materials Market, by Country

- United States Balsa Core Materials Market

- China Balsa Core Materials Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Insights Summarizing the Strategic Imperatives and Future Outlook for Balsa Core Materials in Evolving Industrial Landscapes

The balsa core materials market stands at the intersection of performance-driven innovation and sustainability imperatives, characterized by material science advancements and evolving trade landscapes. Stakeholders that adeptly integrate improved processing technologies, strategic sourcing frameworks, and environmental stewardship are well positioned to capitalize on emerging opportunities across aerospace, marine, wind energy, and beyond.

As the industry navigates the challenges of trade policy volatility and competitive pressures from alternative core materials, the enduring appeal of balsa’s exceptional strength-to-weight attributes underscores its continued relevance. Strategic investments in certification, technology adoption, and collaborative partnerships will define the next phase of market leadership and value creation.

Connect Directly with Ketan Rohom to Secure Your Comprehensive Balsa Core Materials Market Research Report Tailored for Strategic Advantage

For tailored insights and a comprehensive market research report on balsa core materials, connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to secure the data-driven analysis your strategic initiatives demand.

- How big is the Balsa Core Materials Market?

- What is the Balsa Core Materials Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?